Customers of Hewlett Packard Enterprise have one foot on the gas and one foot on the brakes at the same time that the company is transitioning from selling gear outright to customers to selling them subscriptions that spread the cost – and therefore HPE’s recognized revenues – out over time.

That’s why the quarter ended in July, the third quarter of HPE’s fiscal 2023 year, had its ups and downs. But on the whole, HPE is managing all these transitions (and several more) even as its core ProLiant server business is in decline. Server buyers are worried about the economy and they are provisioning the capacity they bought last year and even with new processors from AMD and Intel, many are not eager to buy new iron. And shortages of components – namely, GPUs – have flattened revenues in its higher-end HPC and AI systems business, where HPE has had to focus on fulfilling its obligations on pre-exascale and exascale machinery to national labs in the United States and Europe.

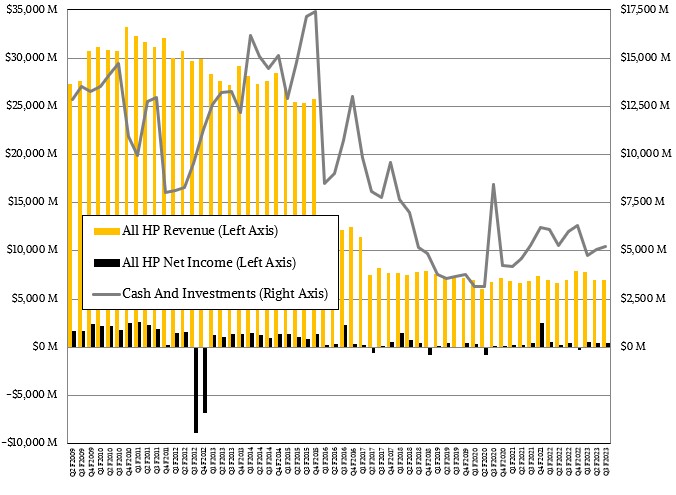

In the July quarter, HPE’s overall revenues were just a tad over $7 billion, an increase of seven-tenths of a point over the year ago period. Earnings from operations were up a smidgen to $471 million, and despite higher research, development, and sales costs, the cost of the goods that HPE peddles went down as did some other extraneous costs relating to a disaster in one of its factories and net income rose by 13.4 percent to $464 million. HPE exited the quarter with $5.21 billion in cash, which is down 13.6 percent year on year but up 3 percent sequentially.

On a sequential basis, HPE’s revenues were up four-tenths of a point and its net income was up 11 percent.

While Hewlett Packard Enterprise might be a lot smaller than the former iteration of Hewlett Packard, it is more tightly focused and it is bringing a bit more to the bottom line as a share of revenue. But don’t get the wrong impression: This ain’t easy. Not with the intense competition among server sellers and the razor thin margins in the HPC business. Like many IT suppliers, HPE is counting on AI to drive sales and profits going forward, and there is every chance that it will do so if supplies of GPUs from AMD, Nvidia, and even Intel can be increased to meet demand.

The Ups And Downs

There are always challenges when running an IT conglomerate, and such has been the case with the many iterations of Hewlett Packard over the decades – and this continues to be true for IBM, Dell, Fujitsu, and Cisco Systems. There is always something going wrong inside of these IT giants, but the good news is that there is always something in transition providing hope and momentum and there is often something going right.

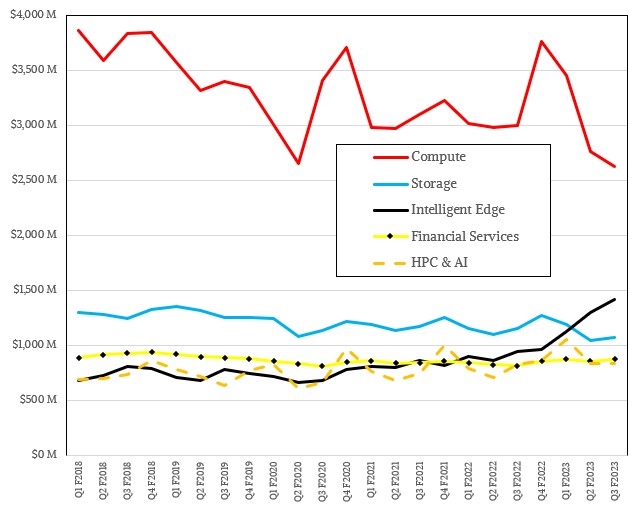

With HPE, the acquisition of Aruba Networks for $3 billion way back in March 2015 is paying off handsomely eight years later, with the Intelligent Edge business up 50.4 percent to $1.42 billion and throwing off operating earnings of $420 million, up by a factor of 2.7X year on year and comprising just about half of HPE’s overall operating profits of $848 million in the quarter. This is a remarkable rise and one that helps HPE deal with issues in its other divisions. On a trailing twelve month basis, Intelligent Edge sales are up 36.5 percent to $4.81 billion and operating income is up 2.25X to $1.15 billion. This Aruba campus networking business, which has just been bolstered by SD-WAN capabilities through the acquisition of Silver Peak and security through the acquisition of Axis Security, is on a hockey stick upwards.

Not so with the Compute and Storage divisions, which are in a bit of a lull but which are both still generating revenues and operating profits.

In the quarter, the Compute division, which is dominated by sales of rack and tower ProLiant servers generally based on CPUs from Intel and AMD with an occasional Ampere Computing Arm chip in the mix and increasingly loaded with lots of memory, flash, and Nvidia GPUs for AI and sometimes HPC work, posted sales of only $2.62 billion, down 12.6 percent, and operating earnings of $285 million, down 28.8 percent. This is consistent with the server recession we have been talking about outside of AI servers, which we have seen pop up in the numbers of both Intel and AMD. But we also have to remember that an increasing part of the revenue stream for HPE is coming through GreenLake services, which provide cloud-like utility pricing on servers, storage, networking, services, and software and which are amortized over contracts that run for several years. The shift from transactional to subscription revenues makes comparisons difficult, but in the longest of runs, HPE will have what amounts to a rental base and we are fairly certain it will charge a premium given the time value of capital expenses and money, and therefore it will be more profitable as well as more predictable.

“Compute performed well considering the sector ongoing cyclicality,” Antonio Neri, HPE’s chief executive officer, explained in a call with Wall Street analysts. “We saw sequential unit demand increase in the quarter. One area where we anticipate demand picking up in the coming quarters is customers seeking a solution to run AI inference workloads. Our new HPE ProLiant Gen 11 servers optimized for AI workloads are well positioned for this growing customer need. During the third quarter, we started shipping these servers, which boosted AI inference performance by more than 5X over previous models. And just last week, we expanded our portfolio for enterprise tuning and inference solutions with Nvidia and VMware to accelerate their customers’ generative AI deployments.”

HPE said that unit shipments in the Compute division were off “mid-teens” and that average unit prices were flat as some customers bought fatter machines but some component prices also came down.

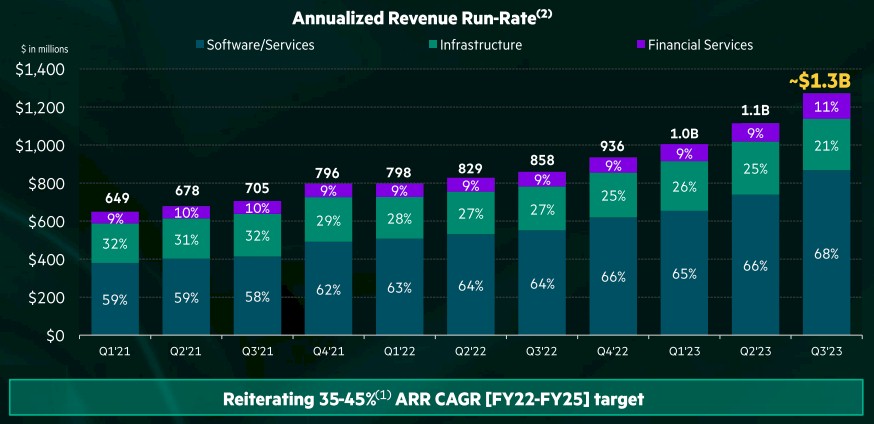

Jeremy Cox, HPE’s new chief financial officer, said on the call that “cycle times remain elongated” and that there is still a digestion of previously installed capacity happening at many of HPE’s customers. We don’t know precisely how much Compute is driving the annualized revenue runrate (ARR) for GreenLake and other SaaS-style services, but we suspect it is a lot, but Cox says that the Edge and Storage divisions were the main drivers of ARR growth in Q2 F2023.

From here on out, we are just going to call them all GreenLake services because HPE should do that and just give us a single number for subscription services versus transactional revenue. In any event, ARR is up 48 percent year on year to $1.3 billion, and HPE exited the quarter with over $12 billion in total contract value for GreenLake services booked going out into the future. On a trailing twelve month basis, GreenLake services order rates have doubled, and the total contract value has tripled in the past two and a half years.

It would be hard to find a company that is doing a better job managing the transition from transactional to subscription sales than HPE is doing.

In Storage, the Alletra line announced last year, which is replacing some fifteen disparate storage products, was a high point, with triple digit growth. Alletra is available as a GreenLake service as well as for purchase and it provides block and file services at scale and will soon have object storage to complete the set. GreenLake sales of Alletra storage was up in the double digits, which means many companies are still acquiring the boxes rather than renting them. (Old habits die hard. But new habits are supposed to be easier to form, right?)

The acquisitions of Silicon Graphics for $275 million in August 2016 and of Cray for $1.3 billion in May 2019 are paying off in terms of driving high-end system sales and, as readers of The Next Platform well know, we never expected these deals to deliver much in the way of profits initially because neither SGI nor Cray were particularly profitable in the HPC patch. But as HPC has morphed into AI and as AI is embraced by enterprises who cannot command the steep discounts that the national HPC labs can get on systems, there is a chance that the HPC & AI division at HPE can make some profits.

The pipeline is certainly strong. As Q2 F2023 ended, HPE said it had a pipeline of $1.6 billion in AI-related sales, which was a mix of transactional and subscription revenue streams, and Neri said on the call that it ended Q3 F2023 with about the same $1.6 billion because a lot of the deals that had been books came through. The order book for the HPC & AI division is at $3 billion, and is 2X that which the company had before the coronavirus pandemic hit. (Which is a natural era marking in IT, just like the Dot Com Boom of 1997, the Dot Com Bust of 2001, and the Great Recession of 2008 are.)

By the way, Neri said that HPE had a big deal with a hyperscaler in the quarter, which has not shipped yet and which we strongly suspect might be for a “Shasta” Cray EX supercomputer. If we were buying, we would want a clone of the “El Capitan” supercomputer going into Lawrence Livermore National Laboratory, including its “Rabbit” storage system.

But profits are hard to come by in the HPC & AI division. In the quarter, sales for HPC & AI mirrored those of HPE overall, up seven-tenths of a point to $836 million; but it had $7 million operating loss. In the trailing twelve months, HPC & AI had sales of $3.59 billion, up 7.9 percent, but operating income was down 82.3 percent to $22 million.

Hope springs eternal in HPC. . . especially when contemplating future profitability. The AI boom in enterprise might help, or it all might move to a big cloud and hurt. We shall have to see.

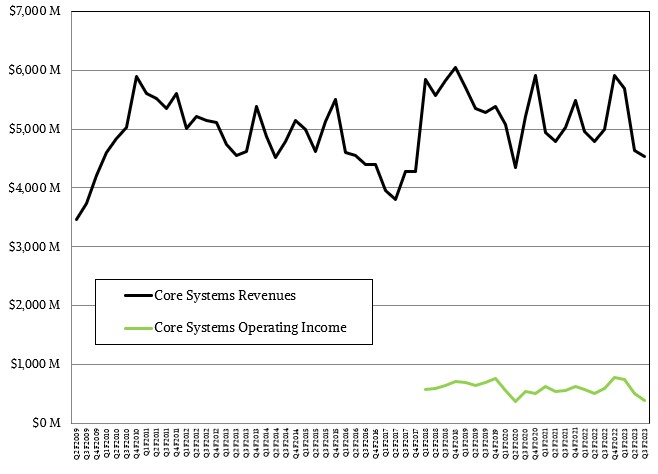

As we have done for decades, we try to figure out what the core datacenter business is in terms of revenues and profits and plot that out over time. Given our model, which takes out edge stuff, we think HPE’s core datacenter systems revenues came in at $4.53 billion, down 9.1 percent, and operating income was $393 million, which represents 8.7 percent of revenues and which was down 34.2 percent year on year.

Looking ahead, HPE thinks Q4 F2023 sales will be somewhere between $7.2 billion and $7.5 billion, which represents a year-on-year decline that will range from down 8.5 percent to down 4.7 percent. Again, some of that is the transition to subscription, but some of it is just lower sales year on year. HPE will not be able to book revenues on the El Capitan system being installed now until it is accepted, probably early next year if all goes well.

It’s funny how 10 years ago (June 2013) HPE+HPE/Cray had more than half of the systems on top500, which gave them 32% “Vendor Performance Share” (VPS). They had the Opteron-based #2 Titan, at 18 PF/s (2.2 GF/W), to the Xeon-based #1 Tianhe-2A, at 34 PF/s (1.9 GF/W). Their VPS went up to 46% in 2015 (around HP/HPE unmerge time), then down to 17% in 2021 (couple years after Cray aquisition) and is now back up to 44% in 2023, with the EPYC-based #1 Frontier, at 1.2 EF/s (52. GF/W). It was a bit of a roller-coasting decade but HPE-Cray seems to have now reached a stable (and impressive) stride. The swashbuckling old-spice stronger swagger of El Capitan should definitely contribute nicely to this (in addition to “Intelligent Edge” products)!

This does however raise the question of the missing Chinese Exafloppers … whatever happened to those?

At the SC23 Denver (Nov.12-17) website (https://sc23.supercomputing.org) they now list the 2023 Gordon Bell Prize Finalists, which include a team from China+UK+US (including National Supercomputing Center in Wuxi and UIUC/NCSA) for their work: “Towards Exascale Computation for Turbomachinery Flows” (available on arxiv.org) — NASA’s grand challenge problem.

They achieved a sustained 116 PF/s (FP64) on their Sunway supercomputer: “The system consists of over 100,000 SW26010 pro chips with a theoretical peak performance of 1.5 EFLOPS.” (page 4). The paper has very nice illustrations of their solution of the Reynolds-Averaged Navier-Stokes (RANS) equations.

So, a nice system, somewhere between #6 Sierra (95 PF/s sustained) and #1 Frontier (1.7 EF/s peak). Schrumour has it the team submitted a HPL-MxP score of 5 EF/s for the November list — in the June ’23 list the top 5 systems had MxPs of 2 to 10 EF/s.

… Woopsy! … they of course used Large Eddy Simulation (LES), not RANS! … and (obviously) TNP detailed the SW26010-Pro chip of the Sunway supercomputer last year (03/11/22) — but maybe the SACA accelerator is a new item added since then.