It has been quite a week for Hashi Corp, the company behind the open source Hashi Stack of systems software for creating and running modern, distributed applications.

First, on Monday the company was in the middle of transforming is business model with the Hashi Stack, and had a big event at the NASDAQ stock exchange in New York City. The big news was that HashiCorp would be shifting from pushing licenses and support contracts for its seven core and integrated products – Terraform, Packer, Waypoint, Nomad, Vault, Boundary, and Consul – to a SaaS model where it operates these tools on various public clouds on behalf of customers.

And then on Tuesday, the rumors broke that IBM was going to acquire the upstart, whose Hashi Stack – now formally called HashiCorp Cloud Platform – is an alternative to the OpenStack cloud controller, OpenShift Kubernetes container controller, and Ansible automation tool that are all brought together under IBM’s Red Hat brand.

Both the Red Hat and Hashi stacks are based on open source tools, so it will be hard to argue, on antitrust grounds, that IBM is cornering the market on enterprise distributed computing. But it clearly is trying to do that. And buying HashiCorp is the best way to ensure that whichever stack enterprise customers choose and whatever cloud customers choose, Big Blue wins. (Don’t get to used to the new HashiCorp Cloud Platform, or HCP for short, branding. There is a very good chance it will all have the Red Hat brand slapped on it before too long.)

IBM confirmed the HashiCorp rumors in its conference call on Wednesday to go over its first quarter of fiscal 2024 financial results ending in March. Big Blue is paying $35 a share to acquire HashiCorp, which is a 41.7 percent premium over the company’s stock price before the acquisition rumors hit. HashiCorp which has $1.28 billion in the bank, yielding a net cost of around $6.4 billion when the deal gets done sometime before the end of the year if all goes according to plan. There is a non-zero chance that someone moves in to be a spoiler, but we don’t think the odds are high. Oracle, Amazon, Microsoft, Google, or Elon Musk could make a higher bid to make trouble. Heck, Hock Tan, chief executive officer of Broadcom and relatively new owner of VMware, could swoop in with big bags of cash.

We did a deep dive into the Hashi Stack back in June 2021, before the company went public and when HashiCorp co-founder and chief technology officer Armon Dadgar threw a little bit of shade at Kubernetes and bragged that the Nomad alternative that HashiCorp had created was better. You can run Kubernetes atop the Hashi Stack just like any other application you might imagine – which was also the case with the Mesos controller out of Twitter and the OpenStack controller out of NASA and Rackspace Hosting – but the question is why would you when Nomad is simpler and easier?

We analyzed HashiCorp’s financials in March 2022 the wake of the company going public in December 2021, noting that like many startups HashiCorp was spending money a lot faster than it was making it so it could get larger and reach breakeven. The company’s market capitalization peaked at $17.1 billion just after it went public and was $5.6 billion when we were writing, when HashiCorp’s four core automation products at the time – Terraform for infrastructure provisioning, Vault for security, Consul for networking, and Nomad for workloads and containers – had what the company figured was a $73 billion total addressable market.

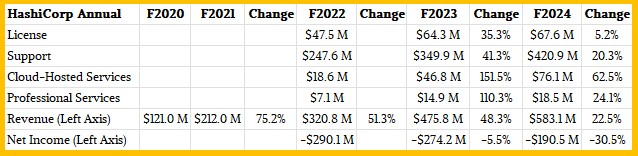

When we drilled down into HashiCorp’s numbers again in March 2023, market capitalization was stable at $5.3 billion, and the company said that it wanted to grow at 30 percent per year and be profitable on a quarterly basis sometime in the second half of fiscal 2025. It doesn’t look like it will happen, with sales growth on an annual basis dropping by half in fiscal 2024 ended in January this year, to 22.5 percent, from the 48.3 percent growth HashiCorp had in fiscal 2023.

The math we did back in March last year, based on the company’s guidance, had HashiCorp breaking $1 billion in sales – and doing so profitably – in fiscal 2026.

In September 2023, HashiCorp switched its code to the Business Source License, which allows people to see the code and make modifications, but absolutely restricts someone from creating a clone of the Hashi Stack and peddling support for it. This created a lot of blowback from open source purists, but with millions of lines of code created from the HashiCorp payroll, you can hardly blame a public company from trying to earn its keep. (There is a reason that Mitchell Hashimoto, the other company co-founder and the one that gave it a name, left HashiCorp in December 2023. Well, there are several.) HashiCorp was literally trying to avoid the CentOS problem that has plagued Red Hat’s enterprise business for decades.

And so here we are. With the market cap down to $4.74 billion for HashiCorp earlier this week and growth stalled lower than expected in an ebullient cloud market but an IT world shaken up and distracted by generative AI, Big Blue could make HashiCorp shareholders an offer that they wouldn’t refuse. (It is not quite an offer that they couldn’t refuse, but it might be close.)

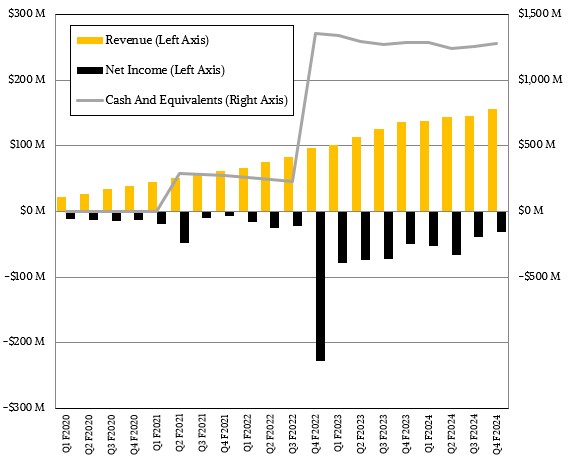

Before we get into IBM’s numbers for the first quarter and how it looks like Red Hat, let’s just get some visuals on HashiCorp’s numbers.

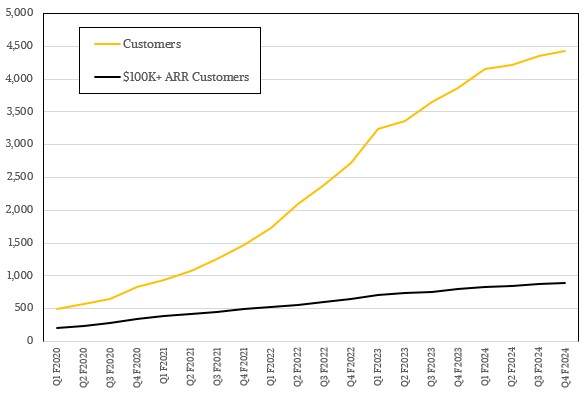

As you can see below, getting new customers is getting harder, not easier, and while the big customers still keep coming, the pace has also slowed here:

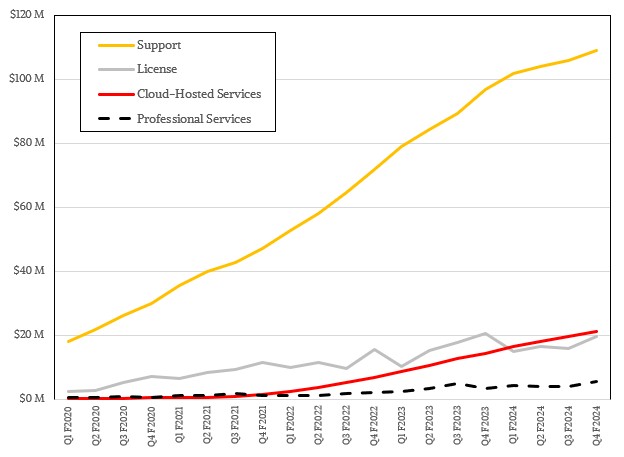

Revenue growth for support contracts hit an inflection point to a slower growth rate a year ago, and even though its cloud-hosted service offering is growing linearly, it is still growing a little bit more slowly than support. Software licensing revenues for stuff that is presumably closed source wiggles up and down here and there and is generally growing.

Professional services putter along, and this is where IBM can not only help, but needs something new around which to wrap consulting services. IBM’s stock took a hit this week precisely because the forecast for its consulting business is not great.

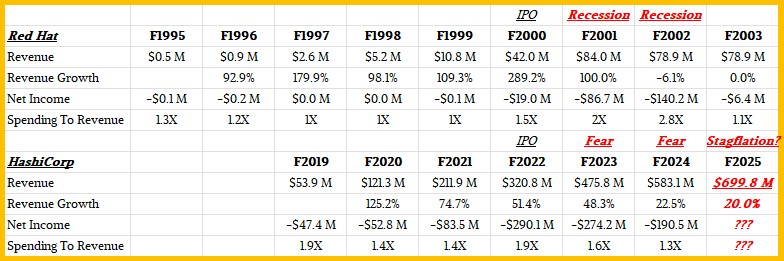

Here is a comparison we did a year ago, and we just updated it, comparing Red Hat and HashiCorp, linking them at the state of their businesses at their IPOs. The parallels are interesting, amusing, and not even remotely causal:

HashiCorp is a bigger and stronger company before and after its IPO than Red Hat was. In the summer of 1999 (which was in fiscal 2000 for Red Hat), when Red Hat made only made tens of millions of dollars a quarter, the company’s market capitalization shot above $20 billion. (That was real irrational exuberance, eh?) In the wake of the Dot-Com Boom, it took until 2017 for Red Hat to build a business that justified a $20 billion market capitalization and thus it could hit it again.

So how does HashiCorp fit into IBM? Pretty much like a smaller Red Hat, and very likely within Red Hat when all is said and done. (Just like Red Hat absorbed CoreOS Linux and its neat container tools for Kubernetes in 2018 to create the second and better iteration of its OpenShift container controller.)

IBM certainly needs to ride any systems software wave it can find, and if there are customers looking to use Hashi Stack instead of the OpenShift-OpenStack-Ansible combo to create hybrid clouds, then IBM needs to have control of both.

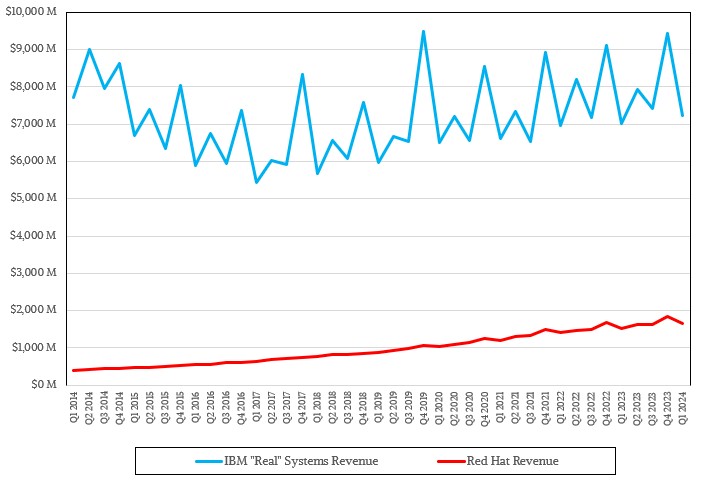

IBM is looking way out into the future with this deal, and it will not have a material impact for a while on Big Blue’s software business. The Red Hat business has an annual run rate in the trailing twelve quarters of $6.7 billion and is 11.5X as large as HashiCorp. But it is only growing at 8 percent or 9 percent per quarter, and when IBM bought it in October 2018 and merged it into its Software group in 2019, it was growing at between 20 percent and 25 percent year on year, depending on the quarter.

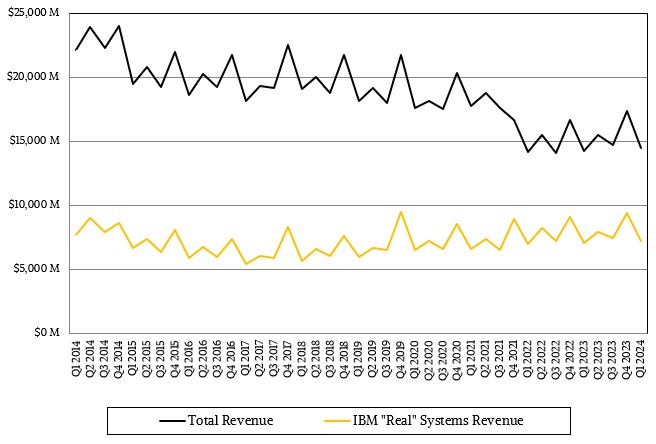

Red Hat has nonetheless – and as we expected – bent the overall IBM core systems business up and to the right, which it most certainly was not doing ahead of the Red Hat acquisition. The systems part of the Red Hat business were added to the core systems business – meaning servers, storage, and operating systems but not all middleware and no databases or application software – in 2019, and you can see it stop the slide and reverse it.

HashiCorp can do the same thing for Red Hat, initially at a smaller scale, and thus also help the overall “real” IBM systems business grow more than it might otherwise. A 20 percent growth rate is a heck of a lot more than the 1.6 percent growth rate IBM’s core systems business had in the trailing twelve months. That said, IBM brought in $32 billion from the combination of its System z mainframe and Power Systems servers and their storage and operating systems in the past four quarters, and of that, $4.7 billion was for systems software from Red Hat for servers from IBM or from others who also use Red Hat software.

Quite a case of IBM going spiritual in the kitchen (IMHO), reinforcing its ghost in the business machine stance with a further Infrastructure as Code master-chef for composition of tentacular spinal-tapped ZettaCthulhus! The so-summoned heterogeneous cephalopods, flexible as they are, should prove to be most tasty concoctions to add to the gastronomist’s menu. Fried, stewed, sautéed, or braised, it’s all good I think (great investment)! 8^b