Supercomputer maker SGI has been going it alone in the upper echelons of the computing arena for decades and has brought much innovation to bear on some of the most intractable simulation, modeling, and analytics problems in the world. But the one thing it could never do was get enough feet on the street to sell its gear.

Now that Hewlett Packard Enterprise has acquired SGI, that will no longer be a problem, but the downside, as far as the variety in the IT ecosystem is concerned, is that yet another independent company will be subsumed into a much larger entity. This will probably not be the last such deal in the HPC and hyperscale markets, where the systems are complex and costly and the customers are among the most demanding in terms of scale and price/performance.

SGI was due to report its financial results today, but in the wake of the announcement of its acquisition by HPE, the company canceled its call with Wall Street. SGI did put out its financial results, which we will review in a minute.

Under the terms of the deal, HPE will pay $7.75 per share for SGI, which is a 30 percent premium over the level that SGI’s shares were trading at during the market close; interestingly, SGI’s shares were up about 10.5 percent on the day ahead of the news of the HPE deal. By our math, SGI shares were trading at $5.41 a share at the market open this morning, ahead of the expected earnings call, so the premium that HPE is paying is more like 43 percent when you do the math. That is a pretty hefty premium to one way of thinking it, but considering the engineering capability and intellectual property that SGI controls, HPE is getting a pretty good deal for SGI.

To another way of looking at it, HPE is acquiring a high-end NUMA system business that, in some important ways, is considerably better than what it has been able to create itself. And by the way, this is not the first time this has happened.

The original Hewlett-Packard acquired a 5 percent stake in supercomputer maker Convex Computer, which made parallel vector systems that rivaled those made by the original Cray (the one that predates its acquisition by Tera Computer). Under that deal, Convex switched to HP’s PA-RISC processors, which were taking on rivals IBM and Sun Microsystems in the commercial Unix arena, for its supers. A little more than three years later, as the dot-com boom was starting to get rolling, HP bought all of Convex for $150 million in stock, and the Convex architecture was used as the foundation of its high-end HP 9000 and later Integrity NUMA systems. That Convex IP still lives on, in a sense, inside the “DragonHawk” Superdome X machines based on Intel’s Xeon E7 processors that HPE is selling today – and interestingly, selling against SGI’s own UV 300 and UV 3000 systems.

Silicon Graphics International, as the company is formally known, is actually the result of the acquisition of the former SGI supercomputer business by hyperscale system maker Rackable Systems, which bought the assets of SGI for $42.5 million in May 2009 and took on many key employees after the latter company emerged from bankruptcy. The Great Recession was not good to any server makers, and Rackable Systems and Silicon Graphics were no exception. (The one exception, of course, was Cisco Systems, which launched its Unified Computing System converged platforms right down the throat of the recession, something you can do when you are sitting on $35 billion in cash as the networking giant was at the time, and has subsequently built a $4 billion server business. But it has its own issues, and recently shuttered its UCS M Series composable systems line, having gotten a little too far in front of the future this time around.)

SGI has two key lines, its UV series of NUMA machines, based on its own NUMALink interconnect that has its heritage in the old SGI, and ICE-X machines that have the origins in the former Rackable Systems and that use normal Ethernet and InfiniBand networks to more loosely couple servers together. The UV line is used in some of the largest systems on the planet, which are used for simulation, modeling, and analytics where a shared memory system is more important than raw compute power. As SGI chief executive officer Jorge Titinger has told The Next Platform in the past, the goal has been to get the UV line to contribute 10 percent of annual revenues in the current fiscal 2016 year that just ended, up from a few percent of revenues in years gone by. The rest of SGI’s revenues come from regular ICE-X clusters, storage, and a smidgen of systems software. That UV revenue growth has not been driven by HPC as we know it, but rather SGI’s expansion into data analytics with the UV 300 line and its partnerships with Dell, HPE, and Cisco Systems, which currently resell UV 300s for analytics workloads like SAP HANA in-memory databases.

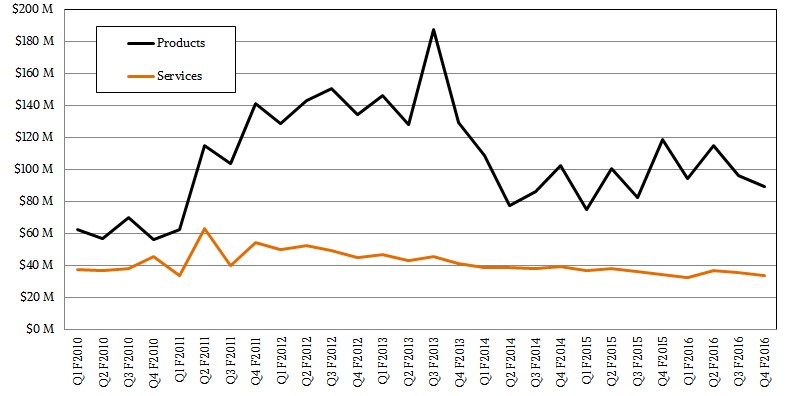

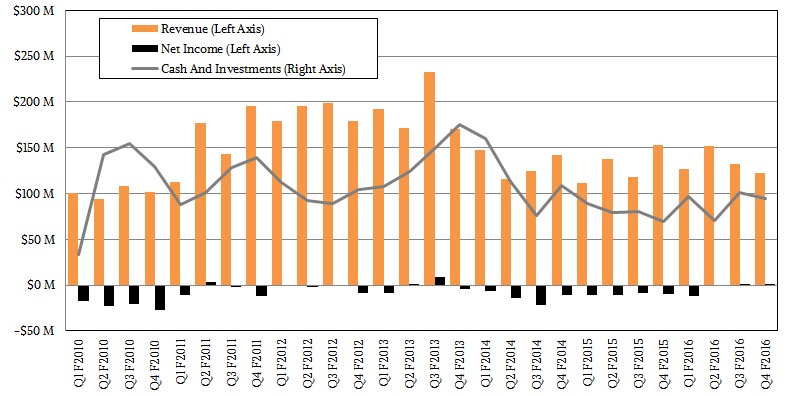

It is a good thing for Rackable Systems that it bought SGI because only a few years later, its business of selling systems to Amazon Web Services and other cloud providers started to come under profit pressure, so much so that four years ago, the new SGI walked away from this business, which was bringing in $139 million a year from Amazon alone. Not coincidentally, Amazon was starting to design its own systems, and Microsoft, another big customer, would follow suit and have their systems built by ODMs in Asia. In the fourth quarter of fiscal 2013, when SGI exited this cloud server business, it generated around $200 million, or a little less than a quarter of revenues, You can see the revenue bump from the cloud buildup, but without a corresponding jump in profits here:

And you can see the downdraft in SGI revenues and its struggles to get profitable. HPC is a cut-throat business, and it is not a high margin business like building a public cloud like AWS is. (That’s not fair, given the importance of HPC, but it is the reality of the situation, as rival Cray knows full well.)

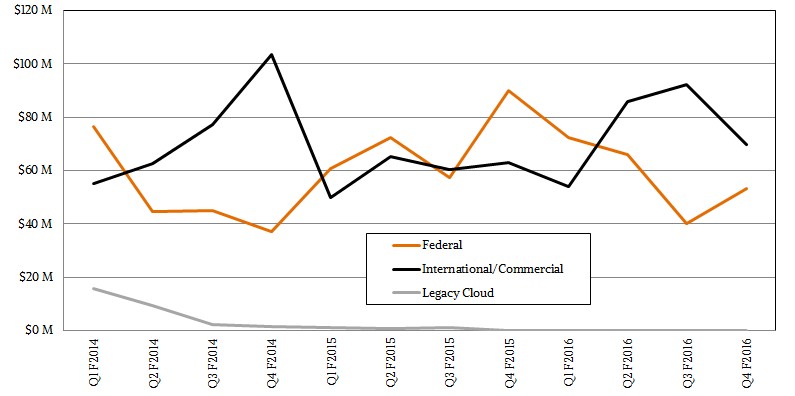

As SGI backed away from that hyperscale system business that was not making it any margin, its core HPC and analytics systems business and their related storage drove somewhere around $400 million in revenues annually, with another $150 million to $175 million in related services. The idea was to grow these businesses as the $200 million hyperscale system business declined and hold the business steady. Growth has proven difficult, and mainly because of spending cuts in the US Federal government. SGI had a tough time in fiscal 2015 with its commercial sales, but it has started to recover.

The general trendline for product sales is slightly up over the past two years, with the dip in the current fourth quarter of fiscal 2016 being down when it would normally have been up. This pressure, and the very slim profits that SGI has been able to pull to the bottom line, no doubt made the SGI top brass give serious consideration to being part of a larger organization that can sell on a more global basis. The services business is not growing at SGI, but it is still an appreciable portion of the company. In the current fiscal year, SGI had $532.9 million in revenues, with $394.8 million coming from products and $138.1 million coming from services. Services gross margins are 42.7 percent for the year, compared to 21.7 percent for the products.

That is another way of saying that the services business at SGI has a virtual revenue stream that looks a bit like $280 million in systems sales. This is no doubt one of the reasons HPE wants to buy SGI, and this is precisely the kind of services business that HPE does not want to spin out and surely wants to keep. What is clear is that SGI needed to do something to get its hardware costs down and its margins and revenues up, and now it can leverage the HPE supply chain and sales force to do that. We presume there will be some cost cutting as well as redundant back office functions at SGI are eliminated.

It is not clear what HPE intends to do with the SGI product lines or its 1,100 employees worldwide. Presumably HPE will have to honor SGI’s reseller agreements with Dell and Cisco, but there may be an out there and even if there is, neither company will want to help HPE generate revenue in the same way they were willing to help SGI, which is a much smaller company and no threat to either companies’ core server businesses.

What we can also tell you is that HPE expects for the deal to close before the end of its first quarter of fiscal 2017, which ends in January, and that SGI will be neutral to HPE’s earnings in the first year after the deal is done and add some black ink at the bottom line after that. The two companies will be operating separately until the deal is finalized, and there is just an outside chance that some other company might want to fight for SGI because of its technology portfolio. (Lenovo, Dell, and Cisco could use it.) Nothing would please SGI shareholders more, especially considering they are only getting $275 million net of SGI’s cash and debts for the company.

We will be talking to the folks at HPE and SGI about their integration plans as soon as they are up for a chat. There are a lot of interesting options here.

I originally thought that HPE was buying SGI mainly in order to acquire SGI’s UV technology – but HPE is developing “The Machine”, which should supersede, or at least be comparable to, the UV series. So, now I’m not so sure about HPE’s motivations… maybe they just decided the sum of SGI’s parts was worth the money – plus removing an HPC competitor.

As I understood it, currently “The Machine” is NUMA only to the extent that any processor on any node can access any of the persistent memory. The volatile memory residing on each node is only accessible from the processors local to that node. I further understand that the SGI NUMA is largely if not completely a cache-coherent NUMA, meaning that any processor can access any memory AND any changed data residing in any processor’s cache. That is not the case currently with “The Machine”; although the contents of any persistent memory can be cached, changes to that memory still residing in a processor’s cache is only visible to processors on the same node. That difference has a direct effect on the programming model.

The OS for The machine is largely up in the air and open for development, so purchasing something that has an OS with technologies that have worked in a large scale NUMA environment in the past that may be adaptable to the machine would make sense. Especially where the traditional medium to high latency in the NUMA models are reduced by photonic interconnects, and some of the reasons for NUMA patterns are now slower persistent memory storage which may or may not be in the same city.

Hopefully HPE will be more gentle and tactful in its acquisition of SGI than SGI was in its acquisition of Cray Research, Inc. HPE’s “The Machine “was touted and expected to exceed UV’s technology and design, so now there maybe two similar designs? Seymour Cray said “it does take $300 M to build a truly new architecture and design to market”. $270 M is a bargain.to buy new tech, and to take out a competitor.

As with SGI’s acquisition of CRI, HPE also just bolstered itself with SGI’s Customer list as well as SGI’s Technology.

Bill Mannel no doubt had this in mind when he left SGI for HPE.

Cisco would have been smart to buy SGI and perhaps Mannel and others at HPE saw this as a possible threat.

Now, Dell or Cisco should go buy Cray. More consolidation in HPC is inevitable as margins are getting ultra thin. Dell is investing more in HPC than ever before. Cisco seems to still be dipping their toe in the HPC water and getting Cray now may be a good move for them to get serious about their moves in HPC. I think Cisco and Cray would be a great fit. Cray will be expensive relative to SGI, but then again, Cray has stronger technology and a larger revenue stream.

Lenovo? The US government would absolutely nix any acquisition of Cray or SGI by a Chinese firm.