For the past four years, Nvidia’s datacenter business, which includes GPUs, networking, and servers, has been hot on the heels of its gaming GPU business. In the first quarter of fiscal 2023 ended in early May, the datacenter division edged out in front of gaming, and thanks to a collapse in gaming GPU sales – which may be as much about the flooding of the market with used GPUs aimed at cryptocurrency mining as it is about demand for shiny new GPUs for video games – the datacenter business is going to by far outpace gaming sales for Nvidia.

We know this a few weeks ahead of schedule as Nvidia took the unusual step of warning Wall Street that sales in its gaming division were going to plummet by 33 percent in the quarter that ended on July 31.

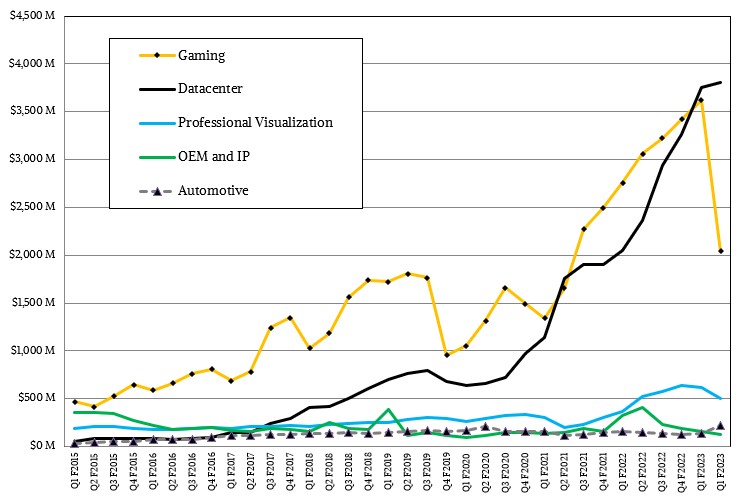

This might feel like a seminal moment, but it is not without precedent, as you can see from the chart below:

The graphics card business for gamers and cryptocurrency miners, which are lumped together by Nvidia because historically it has been difficult to tell what the cards are used for once they are released into the channel, periodically takes a dive. The declines are, however, getting larger as this GPU business keeps growing. Some of that is due to the eccentricities of the GPU market, some of it is due to Nvidia’s product cycles, and some of it is due to competitive pressure from its main rival in discrete GPUs, AMD.

These discrete GPU sales aimed at gamers and cryptocurrency miners took a turn for the worse in Q4 of fiscal 2016, and in Q4 of fiscal 2017, the hit was a bit bigger. A much bigger hit happened in Q4 of fiscal 2019, and another decline of several quarters happened again in Q4 of fiscal 2020. There was no such decline in Q3 of either fiscal 2021 or fiscal 2022, as you can see from the chart above, but the decline that is coming in Q2 of fiscal 2023 is immense.

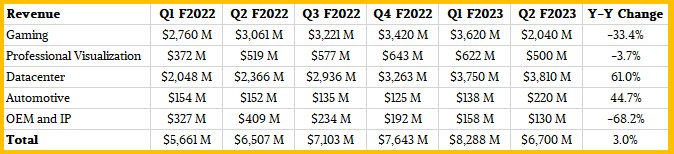

To be specific, Nvidia is now projecting that gaming GPU sales will decline by 33.4 percent to $2.04 billion, and sales of GPUs for high-end workstations used in graphics and engineering design work will also be off in sympathy by 3.7 percent to around $500 million.

“Our gaming product sell-through projections declined significantly as the quarter progressed,” said Jensen Huang, co-founder and chief executive officer at Nvidia, explained in the statement to Wall Street. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.”

Nvidia warned that it will book a $1.32 billion charge against earnings in Q2 of fiscal 2023, and within this figure are writeoffs for gaming GPU inventories and purchase commitments with its GPU foundry partners during the “Ampere” generation, mainly Taiwan Semiconductor Manufacturing Co and with Samsung etching some parts.

We wonder if gamers might be waiting for a “Lovelace” generation of GeForce RTX cards, too. The Lovelace chips are the companion to the Hopper datacenter GPUs, much as the “Turing” chips were the companions to the “Ampere” GPUs in the prior GPU cycle.

Given the sales decline and the writeoff, Nvidia will post a pretty hefty hit to earnings, which we will find out more about when the company posts its final financials for Q2 on August 24.

By contrast, sales in Nvidia’s datacenter division, which is driven largely by AI workloads but also by a fair amount of HPC simulation and modeling and data analytics workloads, are going to rise by 61 percent to around $3.81 billion in fiscal Q2.

However, as you can also see in the chart above, the curve for datacenter revenues is flattening out, and we think this is attributable in part to AMD bringing a more competitive GPU compute offering to market with the “Aldebaran” Instinct MI200 series GPUs. Customers are also waiting to get their hands on Nvidia’s “Hopper” GPU accelerators and DGX-H100 servers as well, which were expected to start shipping in the third quarter of calendar 2022 that started in August and runs through the end of October.

We are confident that Nvidia can ship the Hopper H100 GPUs, but with rumored delays of the “Sapphire Rapids” Xeon SP processor from Intel that Nvidia chose as the host processors for the DGX-H100 systems, Nvidia might not be able to ship DGX-H100 machinery in a timely fashion. It is amazing that Nvidia does not dual-source its processors – perhaps creating a DGE line with AMD Epyc hosts and a DGX line with Intel Xeon hosts, for instance, and maybe even a DGP line with IBM Power hosts given the memory bandwidth and memory capacity advantages the “Cirrus” Power10 chips have over even the most recent Epyc and Xeon SP processors.

Nvidia can afford to do three motherboards and to support three different CPU engines to hedge its bets a bit. And of course, next year Nvidia will without a doubt offer DGX-H100 machines with its own “Grace” Arm CPU.

Nvidia said in a statement released today that its Datacenter division revenues in fiscal Q2 of 2023 would hit a record level but were “somewhat short of the company’s expectations” due to supply chain disruptions. And if Nvidia is indeed relying only on Intel Sapphire Rapids CPUs for its DGX-H100 systems, it could get burned here, too, in calendar Q3. Hopefully, this is not the case, and Nvidia has been able to secure a supply of working Xeon SP chips from Intel and/or will have alternate “Genoa” Epyc 7004 processors available in the DGX-H100 systems.

We shall see soon enough.

In any event, Nvidia had been expecting overall sales to rise by around 25 percent to $8.1 billion in the quarter, and now it is looking at sales only rising by 3 percent to around $6.7 billion, give or take a little. The company had over $20 billion in cash in the bank at the end of the prior quarter, so this contraction has no practical effect on Nvidia’s ability to maneuver in the market. But it will hurt its share price and its pride. It is a reminder that markets are never completely predictable, especially in a wonky economic environment.

Totally agree that NVIDIA should multi-source its CPUs! Already, Summit’s POWER9+V100 hits 1.2 multi-precision ExaFlops/s on HPL-AI (endorsed it seems by Jack Dongarra, at least as an experiment for now) and the A100 gives a 10x speedup on HPL-AI vs HPL. I can’t wait to see Hopper in action (with POWERs, EPYCs, and Xeons, maybe even ARMs)…

Is this just regression to the mean? This quarter’s numbers would have looked great in 2020.

Nvidia enjoyed 2 years in which Crypo values were in an unsustainable bubble, and a captive audience of stuck-at-home gamers were buying large volumes of graphics cards and willing to pay high prices. Is this a short term dip until some inventories are cleared out and a new product line launches? Alternately, was the last two years the aberration, and this is a more normal level of demand? Maybe a little of both.