Waferscale compute engine and AI system maker Cerebras Systems has filed with the US Securities and Exchange Commission to sell a chunk of itself to the public, giving we outsiders a view of the past two and a half years of its internal financials.

Those financials reveal how much Cerebras bas become dependent upon AI partner G42 for its recent revenue growth, and how much investing that G42 could possibly do in the coming years to bolster the company further. But what Cerebras really wants to do is expand from AI training to AI inference and take on Nvidia, AMD, and a zillion other startups to bring its systems – or capacity from clouds hosting them – to the corporate masses yearning to add GenAI functions to their applications.

Cerebras was founded in 2015 by Andrew Feldman, Sean Lie, Gary Lauterbach, Michael James, and Jean-Philippe Fricker, all of whom worked at microserver upstart SeaMicro and who made the jump to AMD after the latter company acquired SeaMicro in March 2012 for $334 million. Three years later, the SeaMicro execs and techies were left with nothing to do at AMD when the company his reset on its server CPU business in April 2015 and shut SeaMicro down, exiting the system business that it bought.

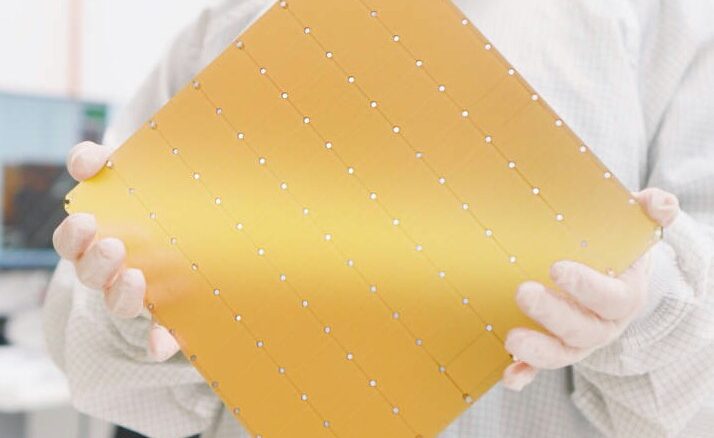

When they looked around for something to do, the commercial AI boom was just getting going as some AI models were doing better on human experts at tasks such as image recognition and language translation. And so they set out to make not only a tensor math engine suitable for the calculations underpinning AI workloads – and as it turns out, some kinds of classical HPC simulations like seismic processing, molecular dynamics, and drug discovery) – and sought to do it at massive scale using an entire silicon wafer as interconnected chip blocks rather than try to make smaller devices and use InfiniBand or Ethernet networking to stitch smaller chips together.

HPC centers like Lawrence Livermore National Laboratory in the US and EPCC in the United Kingdom got early CS-1 waferscale systems, and others have followed suit. But Cerebras, like other AI startups such as Nervana Labs, Habana Labs, Groq, SambaNova Systems, and GraphCore have not been able to break into the commercial bigtime for AI training. And those that are left are pivoting to AI inference as Nvidia has AI training pretty much locked up and the hyperscalers and big clouds are also designing their own AI engines.

It is not for want to trying. First, it has had to raise a lot of money. Cerebras secured its $27 million Series A funding back in May 2016, and reach its $1 billion valuation with its Series D round in November 2018. Over the course of its nine years of existence, it has raised $715 million in funding in six rounds, with the last one at $250 million in November 2021 from Alpha Wave Ventures and the Abu Dhabi Growth Fund. At that time its valuation was at around $4 billion.

Cerebras has launched three generations of wafer-scale compute engines and systems using them,. The CS-1s went into production in August 2019, the CS-2s in April 2021, and the CS-3s in March 2024. The latter machines have a WSE-3 engine that has 4 trillion transistors and 900,000 cores delivering 12.5 petaflops of dense FP16 and 125 petaflops of sparse FP16 performance for AI workloads. Moreover, up to 2,048 of these CS-3 systems, which have one wafer per box, can be lashed together to create a massive AI system capable of running AI training and AI inference workloads at hyperscale.

In July 2023, Cerebras found the deep pockets it needed to push its technology into production at this scale with a partnership with Group 42, or G42 for short, which is a multinational conglomerate formed in 2018 in Abu Dhabi and backed by the government of the United Arab Emirates with over 22,000 employees that build AI models in Arabic and operate datacenters to run those models.

This past April, according to the S-1 document filed by Cerebras with the SEC, G42 agreed to buy $300 million in hardware, software, and services, which is related to its four phase rollout of a cluster of “Condor Galaxy” supercomputers that we reported on here. The initial Condor Galaxy-1 machine installed earlier this year had 576 WSE compute engines, with a total of 489 million cores and 18 exaflops of aggregate FP16 tensor math and 738 TB of SRAM memory, all for around $900 million at list price but we only saw $37 million drawn down from that G42 traunch and the rest is still in $263 million in restricted cash.

In May, G42 upped its acquisition agreement with Cerebras by another $1.43 billion, which it agrees to spend by February 2025 to build out the rest of the Condor Galaxy infrastructure. The S-1 document also shows G42 has agreed to purchase 22.85 million shares of Cerebras stock at a purchase price of $335 million by April 15, 2025. So presumably Cerebras will go public after that time, not before.

By filing for its initial public offering, Cerebras is now looking to Wall Street to give it even more funding to expand its operations and a chance for its employees that have stock options to cash out. Cerebras is not saying how much of its stock it will float to the public or at what price. Presumably G42 is getting a sweet deal on its stock, and the asking price will be higher than the $14.66 per share it has agreed to pay. The word on the street is that Cerebras is looking to raise between $750 million and $1 billion, and that could translate into a valuation of somewhere between $7 billion and $8 billion.

The interesting thing about any S-1 filing is that it gives us a look at the financials of the company going public for the first time. And in this case, as we said above, it shows how much the G42 deal – and therefore AI work in Arab countries – has mattered to Cerebras. And, frankly, how little money government agencies, hyperscalers, and cloud builders have spent thus far on waferscale systems from Cerebras despite the many obvious advantages.

We have aggregated the important data from the S-1 into a simple table. Take a look:

It would be unwise to take the data from the first half of 2024 and just double it to get a sense of what all of 2024 might look like – and we understand the temptation to do this. But Cerebras is a young company that really has only been making money recently, and its revenue streams are still choppy as you might expect. That said, we think there is a high degree of probability that Cerebras will have a very good second half in 2024, and an even better first half of 2025, if G42 buys as much iron as it seems to be inclined to do.

We presume that given the UAE and Abu Dhabi are allies of the United States, there will not be export controls placed on Cerebras Systems iron. A lot depends on who, in turn, will be renting WSE capacity on its clouds and what work they are doing with them. Rest assured, we think Uncle Sam is watching carefully.

The vast majority of the money spent at Cerebras is for research and development, which is exactly what you expect from a startup breaking out of experimental and moving towards mainstream. So those net losses in 2022, 2023, and the first half of 2024 are not surprising. But what really sticks out is how much of the revenue boost for Cerebras has come from G42, and how sales were dipping in 2023 to other customers before G42 stepped in. (This data is shown in blue bold italics in the table above.) That might have been as much a function of the availability of CS-2 systems as it was desire on behalf of other customers.

In any event, G42 accounted for 83 percent of 2023 revenues at Cerebras in 2023, or $65.4 million out of $78.7 million. And in the first six months of 2024, G42 accounted for 87 percent of its $136.4 million in revenues, which works out to $118.7 million from G42. All other customers so far this year only spent $17.7 million. Again, that could be availability of parts, or lack of interest even with the shortages of GPUs. If the former, then Cerebras needs to put some money into stacking up wafers and building systems, and that explains why it wants to sell stock to Wall Street investors.

But still, there is a lot of concentration of financial risk here, with basically only one customer that matters. And we are not sure how Wall Street will like this. Probably not a whole lot. But Cerebras needs to catch the inference wave, and it is going to take a lot of dough and proof of concept iron to do that with the thousands of corporations and government agencies that could be its first wave of commercialization of waferscale computing.

I wish them good luck with a caveat that inference market is (going to be more) brutal and more mainstream. In that context, selling a very specialized product that does not fit into the overall structure of hyperscalers/enterprise data center topology will be super challenging. They need to show an array of advantages for those major inconveniences their customers need to step up for.

Typo. In any event, G42 accounted for 83 percent of 2023 revenues at Cerebras in 2023, or $65.4 billion out of $78.7 billion

Million, not billion.

Yes, thanks for the catch. A little distracted down here in Boone, NC.

Wow! I’m sure glad you weathered this storm and hope that Nicole and the little ones are fine as well!

The USGS raingauge 03479000 at Watauga River Near Sugar Grove, just 10-15 km West of Boone, recorded more than 15 inches of rain from Sept. 25 to when it was overwhelmed by Helene (flooded, Sept. 27) — the area received more than 4 months worth of rain (yearly avg = 52.6 in) in just 2-3 days … and the river responded in kind, beyond the measurable max of 25 ft.

I’m sure I speak for all TNP readers in wishing you and yours the strongest of courage and resilience in all phases of recovery from this record storm.

( USGS rainfall: https://waterdata.usgs.gov/monitoring-location/03479000/#parameterCode=00045&period=P30D&showMedian=false , USGS river data: https://waterdata.usgs.gov/monitoring-location/03479000/#parameterCode=00065&period=P30D&showMedian=false )

Yeah, my rain gauge gave up as well. But we had an inch an hour for a long time and two inches an hour for half of a long time. We had power and cable and Internet outages for days and the house took some damage on the port shields that is pretty serious. But we are all OK, and good heavens, there are so many people down the hill from us and west of us that have had their lives obliterated. People keep using the word decimated wrong. That means one-tenth is destroyed. In many towns, it is ten tenths are destroyed.