The hyperscalers and cloud builders are the toughest customers in the IT sector, demanding the highest performance at the lowest price and an ever-improving ratio between the two. They can be as tough as they want, of course, but unless they want to design their own ASICs and compute, storage, and networking gear, they have to eventually buy something from someone.

And when it comes to datacenter switching and increasingly routing, that somebody that two of the big ones – Microsoft and Meta Platforms – are spending a lot of dough with is Arista Networks.

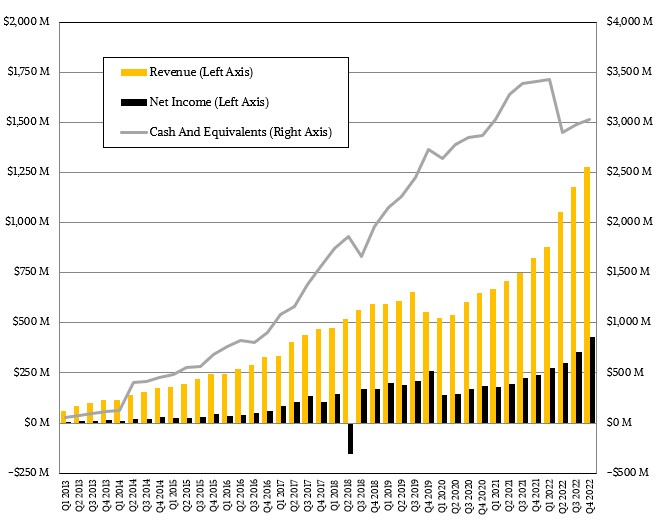

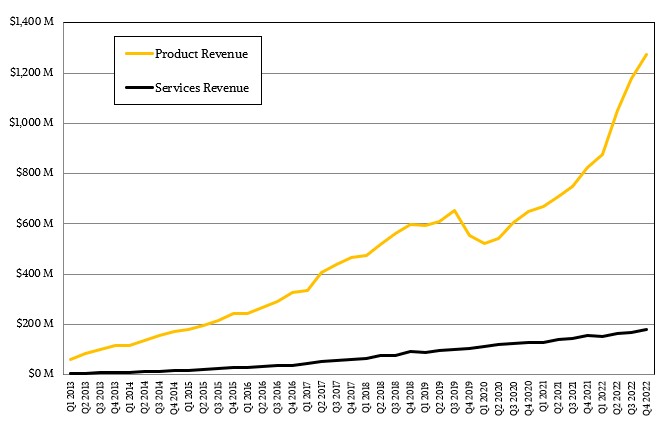

In the quarter ended in December, sales at Arista Networks exploded by 64.2 percent to just a tad under $1.1 billion, the highest level for product sales in the company’s history and the eleventh quarter in a row that this has been the case. Services revenues keep chugging along and rose by 14.2 percent to $178.7 million in the period, and 15.8 percent of revenues, or $201.5 million, were for software subscriptions and services. If you do the math, that means Arista Networks had $22.9 million in software subscription revenues, up 25 percent, driven by the switch from perpetual licenses for its EOS network operating system and other telemetry and analysis software.

Net income grew even faster than product sales, up 78.5 percent to $427.1 million.

Arista Networks exiting the December quarter with just over $3 billion in cash, and thanks to an improving supply chain situation, deferred revenues fell by 32.3 percent sequentially to $637 million in the quarter and customer purchase commitments fell sequentially by 14 percent to $3.7 billion. Add them up and they are just about equivalent to the sales the company had for all of 2022.

For the full year, Arista Networks raked in $4.38 billion in sales, up 48.6 percent, with product sales up 56.3 percent to $3.72 billion and services revenues up 16.6 percent to $665 million. Net income rose by 60.8 percent to $1.35 billion.

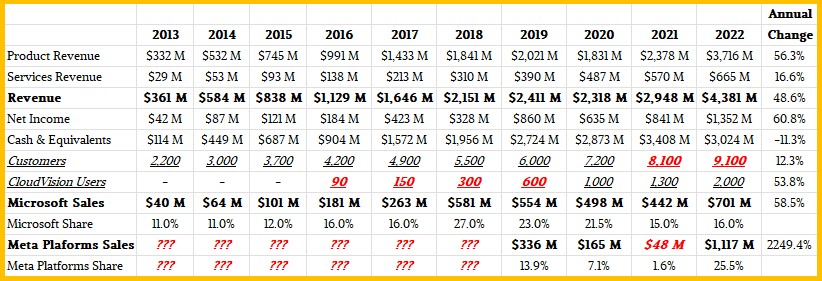

Over the course of the year, Arista Networks added around a thousand new customers, to what we estimate is 9,100, a 12.3 percent increase in the customer base, consistent with the customer expansion that the company has had since 2019. Interestingly, Arista Networks now has over 2,000 users of its CloudVision network operations management tool, and this is one of the big factors driving software subscriptions.

Microsoft is a customer that has represented more than 10 percent of revenues for the past decade – as long as we have been tracking Arista Networks financials closely.

Microsoft represented 27 percent of the company’s overall revenues in 2018, when the 100 Gb/sec Ethernet switching and routing upgrade cycle got underway in earnest at many of the hyperscalers and cloud builders, and that upgrade cycle went into 2019 for Microsoft and Facebook (now Meta Platforms) got in on the 100 Gb/sec action that year, too. Microsoft participated to a much lesser extent in the 200 Gb/sec wave, and Meta Platforms just bowed out of 200 Gb/sec Ethernet, as you can see. This really hurt Arista Networks, and we have the impression that it was something of a surprise when Meta Platforms passed on 200 Gb/sec Ethernet for its switching infrastructure.

But in 2022, both Microsoft and Meta Platforms kicked it up a notching for the 400 Gb/sec Ethernet cycle, as has been anticipated.

Last year, Microsoft spent $701 million at Arista Networks, accounting for 16 percent of the company’s overall sales, and Microsoft, of course, runs its own SONiC network operating system on the high volume parts of its product line and stitch together Azure cloud capacity as well as the iron underpinning the Bing search engine.

Meta Platforms, which has datacenter to run Facebook, Instagram, and other properties, had a serious catchup year and spent a whopping $1.12 billion on stuff made by Arista Networks. You read that right.

Switching gear co-designed by Meta Platforms and Arista Networks – namely the 7368 and 7388 switches – are based on Broadcom’s “Tomahawk 3” StratusXGS switch ASICs launched in January 2018, and interestingly are not based on the “Tomahawk 4” chips unveiled in late 2019. The fact that Arista Networks called these Tomahawk 3 ASICs out does not mean that Meta Platforms will not use the “Tomahawk 5” ASIC revealed in August 2022 and expected in products maybe by this summer. On a conference call with Wall Street analysts going over the numbers, Anshul Sadana, chief operating officer at the networking company, said that Meta Platforms has deployed its 7800 series modular switches, which are based on the “Jericho 2” deep buffer ASIC in the Meta Platforms network backbone and in generative AI and recommendation engines. All of this gear supports the Facebook FBOSS homegrown network operating system.

Jayshree Ullal, chief executive officer at Arista Networks, said on the call that she expected for Microsoft and Meta Platforms to both account for more than 10 percent of revenues in 2023.

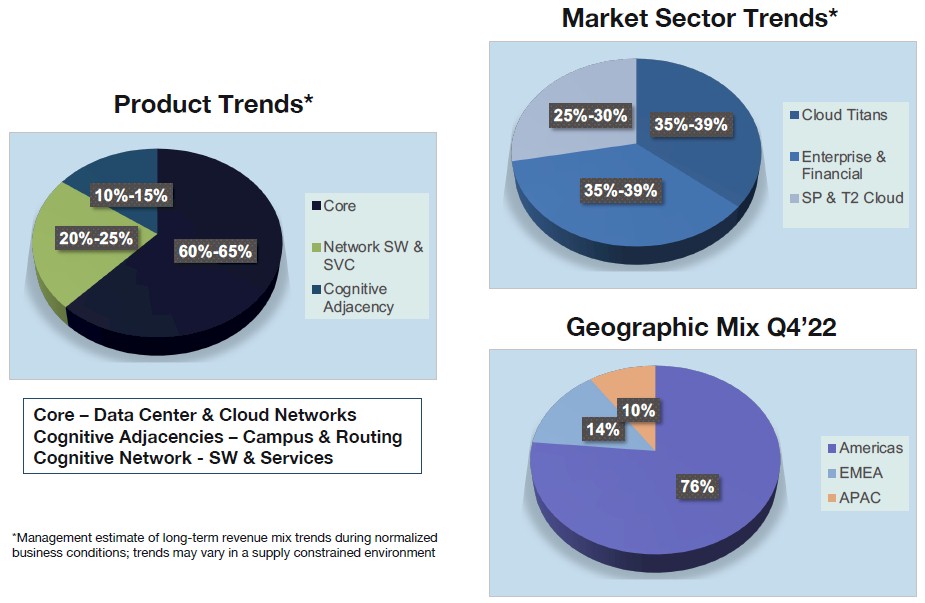

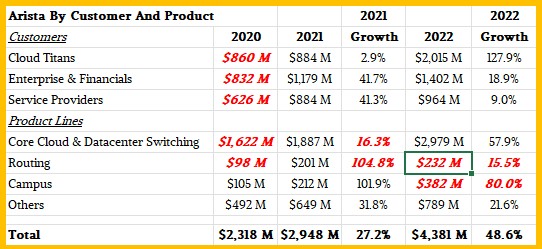

Given that the “cloud titans,” as Arista Networks calls the hyperscalers and cloud builders, represented a total of 46 percent of revenues for all of 2022, that means other clouds and hyperscalers only comprised another 4.5 percent of revenues. (We have no idea who they are, but there are only a handful of other companies it could be.) Revenues from cloud titans was up by a factor of 2.3X in 2022 and account for most of the company’s revenue growth and nearly half of its revenues.

Service providers, which includes smaller clouds and webscale companies as well as telcos and other hosters, accounted for 22 percent of overall sales, or $1.4 billion, up 18.9 percent. Large enterprises and financial services firms accounted for 32 percent of the revenue pie in 2022 for Arista Networks, up 18.9 percent year on year.

Arista Networks has changed its customer and product categories a bit this year and we have sussed out, as best we can, what 2022 looked like in the older categories, which we think were useful.

The core cloud and datacenter switching product segment raked in $2.98 billion in sales, up 57.9 percent. Arista Networks had a goal of hitting $400 million in revenues for its campus switching product line (taking a bite out of a new part of rival Cisco Systems), but didn’t make that goal because of supply chain issues even as it did have over $400 million in orders for 2022 for such gear. Our guess is that it came in at $382 million. Given this, we think routing use cases for its gear drove $232 million in sales, up only 15.5 percent after more than doubling in 2021.

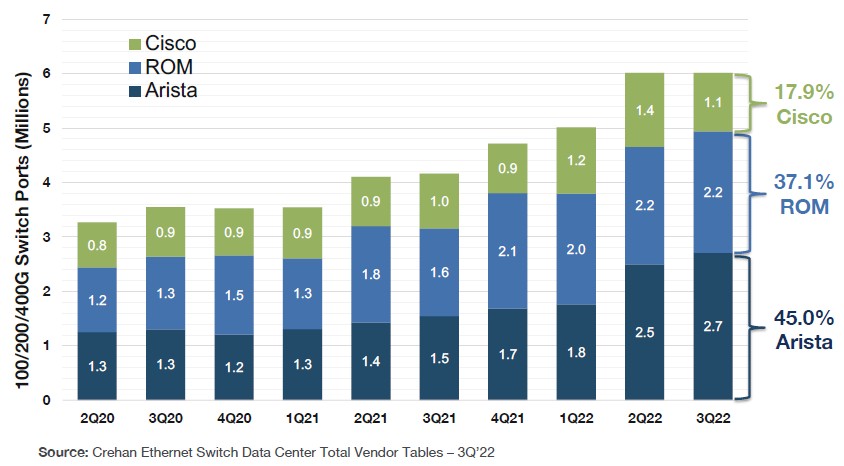

Arista Networks has more than doubled its customer count for its 400 Gb/sec Ethernet gear, from 300 customers in 2021 to over 600 customers as 2022 came to an end. And, as has been the case for a while, Arista Networks is outshipping Cisco Systems when it comes to switches that run at 100 Gb/sec, 200 Gb/sec, or 400 Gb/sec speeds:

Interestingly, the last win for the December quarter was for one outside of the United States in the government sector, where 400 Gb/sec Ethernet gear from Arista Networks was chosen over InfiniBand switch fabrics (presumably from Nvidia) for the deployment of Hadoop analytics clusters, and added that built-in data encryption and real-time telemetry were key differentiating elements to winning this deal.

To which we ask: People are still using Hadoop?

Arista Networks expects for revenues to grow about 25 percent in 2023, to around $5.47 billion, and that obviously represents a deceleration compared to 2022 – and probably as Microsoft and Meta Platforms deploy the gear they have just acquired in their datacenters and allow for the applications to drive the next upgrade cycle.

Oh, so THAT’S why I had a full year lead time on a 100G switch from Arista in October 2022.

Oh it was very interesting! Your article makes me invest to arista networks. Then, I wonder where you got the data from the third table above, because I looked for it a lot, but it didn’t come out. So, could you tell me how you got the data? If you estimated it, how did you estimate it?

I estimated it, as it says. We had some data points, as I explained, and then filled in gaps with what we think are good guesses.

Oh Thanks for letting me know. So are the number of users and sales part actual data or estimate? If you estimated, what data did you use? Actually, I’m a student who’s been studying stocks recently, but I’m not sure how to estimate it. Please, let me know..

Oh Thanks for letting me know. So are the number of users of cloud vision and sales part of microsoft and meta platforms actual data or estimate? If you estimated, what data did you use? Actually, I’m a student who’s been studying stocks recently, but I’m not sure how to estimate it. Please, let me know..

CloudVision user base been reported, and we add in where data is missing. If it is in bold red italics, it is our estimate. If it is in black, it is real data. As for our method, it is informed guessing based on trends.

Let me ask you one last question. Where can I find the cloud vision report? I can’t find it’s in the company’s promotional materials

It is something I have gathered from each quarterly result presentation and call.