It’s no secret that the hyperscalers and cloud builders are becoming the biggest drivers of the datacenter hardware portion of the IT market. Given how much scale they have and the utility pricing they offer, it’s no surprise that the cloud also is playing an increasingly prominent role in HPC.

HPC vendor Atos is among the vendors that is going down that path. Its acquisitions last year of Nimbix, Visual BI, and Ideal GRP were key steps in extending its business into the cloud as well as other spaces, including tech services.

Google Cloud this year released an open source toolkit – aptly named the Cloud HPC toolkit – to make it easier for HPC units to build compute clusters for training and modeling.

For its part, Rescale got a $105 million funding boost last year, giving more credence to the idea of cloud HPC.

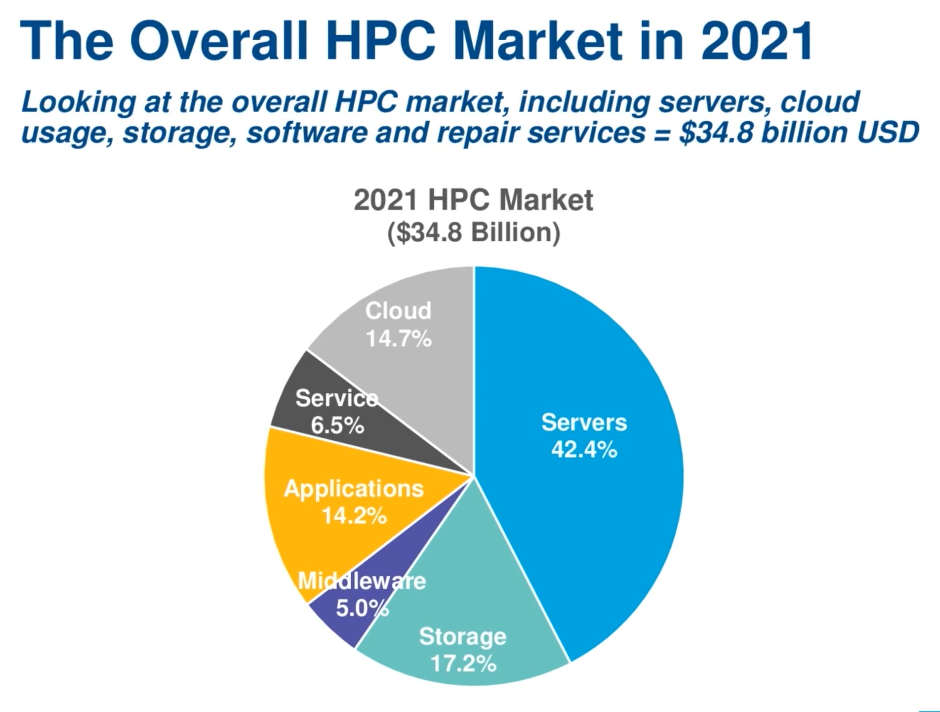

In their latest update on the HPC market, analysts with Hyperion Research said the cloud is still only a relatively small part of a much larger and healthy HPC market that is inching closer to $35 billion in spending. As seen below, servers still constitute more than 42 percent of the spend, followed by storage at 17.2 percent. But next up is the cloud, at 14.7 percent, just ahead of applications.

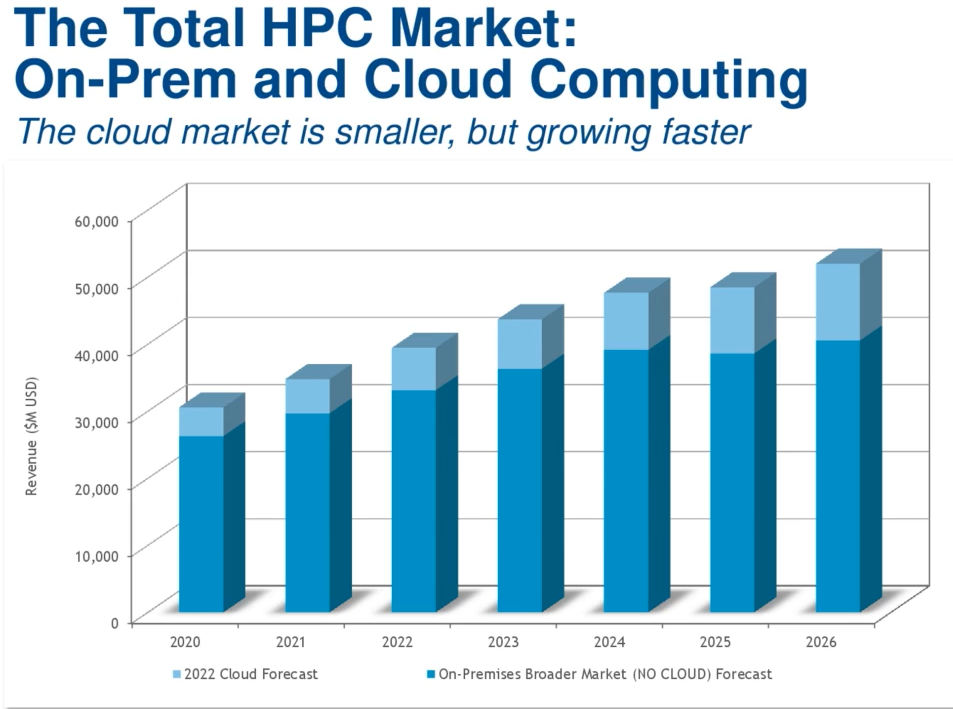

And as they noted, the five-year forecast for cloud spending growth in the HPC space is an average of 17.6 percent a year, hitting more than $11 billion by 2026, still a smaller but a faster growing part of the overall HPC market than on-prem spending.

The accelerated growth comes at a time when there was a major shift in cloud computing and HPC in 2021, according to Hyperion CEO Earl Joseph.

“We were asked by a number of customers for the last decade to watch the market and see when on-prem spending actually has moved to the cloud,” Joseph told journalists during a virtual briefing. “Up until the last year, there were a few one-off examples, but almost all cloud spending was new budget for sites. What we saw last year for the first time was a sizeable number of people decided to move their on-prem spending to the cloud. In most cases, it was delays of purchases or spending slightly less on their current systems or buying something different in the system.”

However, he said, “this is adding to the growth in cloud spending heavily. At the same time, we do expect the on-prem spending to be very strong because the amount of money being moved isn’t a very large amount, but it is the first time where we saw the shift that the on-prem budgets – or portions of that – were moving to the cloud.”

The look at cloud spending in HPC comes in a larger report about the industry as a whole a week before the SC22 supercomputing show in Dallas. The most recent report – Hyperion which is returning to twice-yearly reports from the quarterly ones run during the COVID-19 pandemic – echoes much of what the analyst firm has seen in prior reports. The HPC space appears to be rebounding from the effects of the pandemic, thanks in part to the work of OEMs managing supply chain woes.

They analysts also dove into the exascale market and the ongoing competition between the US and China as well as plans Europe has in place for its exascale future.

With the cloud, compute accounts for roughly 60 percent of the spending, with storage-specific components or aspects of running workloads in the cloud – like persistent storage – comprising about a third of revenue, according to Hyperion Research Director Alex Norton. As far as workloads, Hyperion is seeing high adoption across all different applications, though AI applications are a key growth driver, particularly given the access to public datasets and data aggregations tools available in the cloud.

There also is a shift underway in how organizations are using the cloud, Norton said. About 57 percent of HPC cloud spending is focused on instances, with reserved instances generating slightly more revenue than spot instances. Part of that is because reserved instances are more expensive, but also because organizations are better understanding how the cloud fits in with their overall HPC efforts and are trending more toward reserved instances for specific workloads, Norton said.

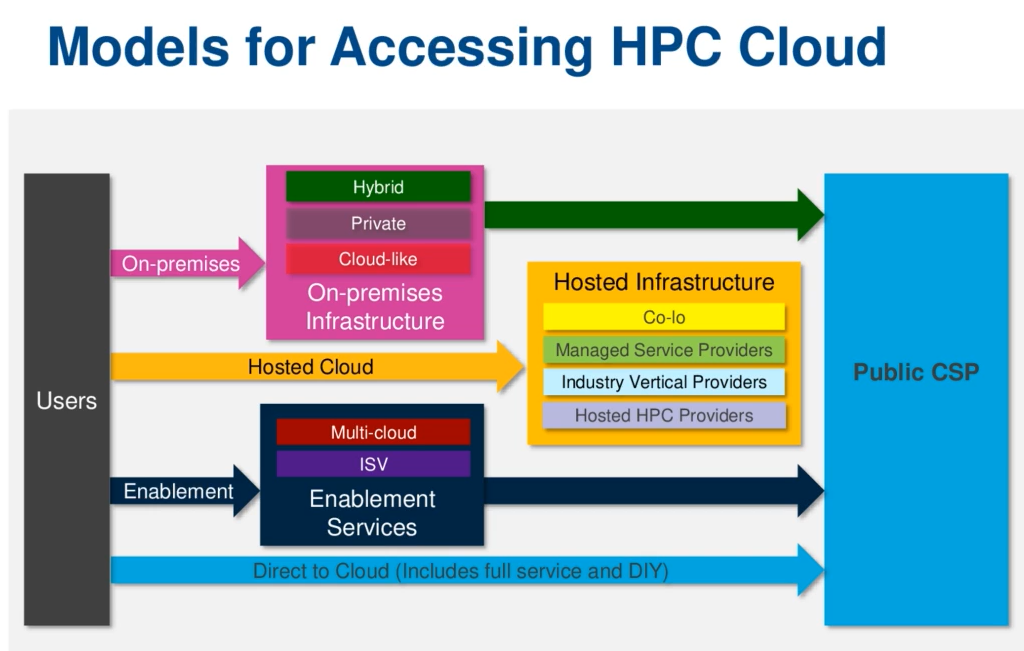

In the past, the cloud was seen as complementary to on-premises environments.

“It was used primarily for burst during peaks in utilization rates for on-prem systems,” he said. “However, over the course of the last few years and through multiple end-user studies, what we’ve seen is that as end users are increasing their cloud usage, their on-prem deployments or on-prem roadmaps are shifting. We see the cloud directly impacting those budgets in some ways. … Users sites are looking at cloud as a critical resource next to on-prem systems. And as they’re thinking of their next deployment, they’re looking at which workloads can run in the cloud, which workloads would best be run in an on-prem system and how they distribute their budgets, their skillsets and their workloads across platforms and across different resources for optimal HPC application running.”

In addition, as the skills around HPC in the cloud improve, organizations can take better advantage of what the cloud offers. Each site will then have to balance a range of factors, including budgets, performance demands, time constraints, and skillsets.

“As they think about all of these factors, ultimately it’s going to be an optimization problem around, ‘Where do I invest money and time in the cloud? What do I optimize my on-prem systems for and where does that balance fall?’” Norton said. “Ultimately each site is going to have to go through trials to understand which workloads can work well in the cloud in a cost-effective and performant way and which workloads should be the focus of on-prem deployments.”

They also will have to figure out the right mix that includes not only on-prem datacenters and public clouds, but also other players, such as colocation facilities, managed service providers, and industry vertical providers for hosted HPC systems.

The cloud’s growing presence was even felt in the workgroup sector of the on-prem HPC server space, which Hyperion’s Joseph said would grow 6.9 percent on average every year in the next five years. The supercomputer, divisional, and departmental sectors all show growth of between 6.6 percent and 9.4 percent, he said.

However, the workgroup area is predicted to see 1.4 percent-per-year growth. Part of that is simple economics.

“Each time the economy goes soft or bad, the workgroup gets hit the most and takes the longest to recover,” Joseph said. “We’re also in a situation where a number of workgroup buyers are looking to the cloud and they found that the cloud offers some very substantial opportunities for them, so we’re seeing both the economic pressures on the workgroup and movement to the cloud. Particularly if you have a variable workload or, given what happened with COVID, if you have to shut down your operations for two months, the cloud lets you turn your expenditures on and off very quickly.”

Be the first to comment