There is perhaps no better logo for Hewlett Packard Enterprise than the box.

HPE receives a bazillion boxes of components, assembles them into boxes we call servers, storage arrays, and switches, and then ships them out wrapped in other boxes to its millions of customers worldwide – mostly, by volume, to large enterprises, governments, and academic institutions but also to a representative share of small and medium businesses.

The fact that HPE chose the box as its icon means it is self-aware, which is a good thing in a Fortune 500 company – particularly one trying to make a living in the cut-throat datacenter arena. While being a box shifter has honor – someone has to make and support this gear, after all – a lot of the profits in the datacenter sector end up in the makers of compute engines and other semiconductors or the systems software that runs on all of this machinery. HPE is in a tough, tough business and it is getting tougher as the central banks of the world are trying to curb inflation by raising interest rates and giving spending – including IT spending – electroshock therapy to calm it down.

There are lots of indications that this engineered slowdown is working, and HPE’s diminished box shifting for its server business in its second quarter ended in April (for its fiscal year 2023) is a one of them as its revenues dropped and the outlook looks softer than expected. That said, HPE’s revenues and profits for its core systems business remain within an acceptable range for its recent history.

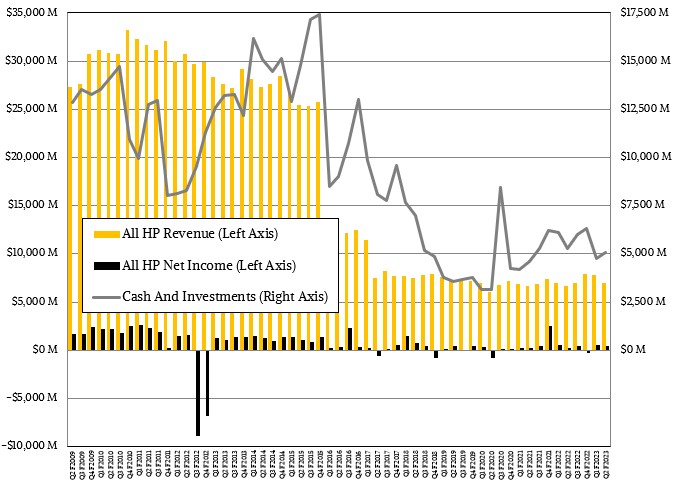

In the quarter, HPE actually increased sales by 3.9 percent to $6.97 billion, and net income rose by 67.2 percent to $418 million. (If you calculate the revenues in constant currency in the local economies around the world where HPE does business, the growth rate was more like 9 percent; it is the strength of the US dollar that diminishes that growth when it is converted into dollars after being brought back to HPE HQ in Houston.) HPE had been telling Wall Street it would bring in somewhere between $7.1 billion and $7.5 billion in the quarter, so this was a pretty big miss.

Revenues were down 10.7 percent and income was down 16.6 percent sequentially, which is within the realm of normal, and the company exited the April quarter with $5.06 billion in the bank, 4.3 percent lower than this time last year.

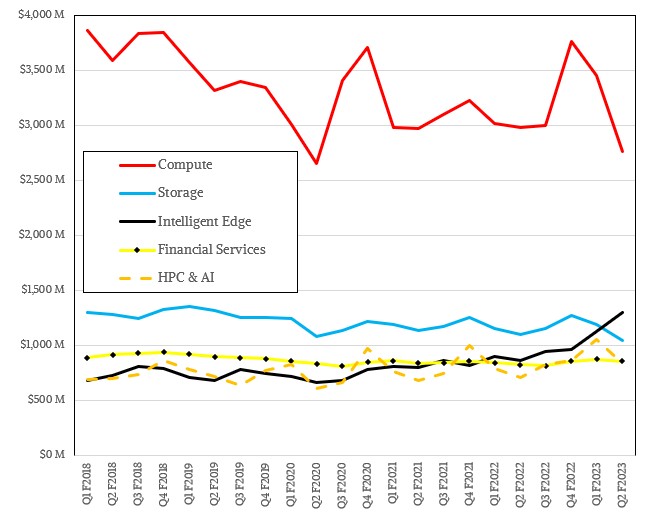

There are two concerning aspects to HPE’s Q2 F2023 numbers, however. Sales in its Compute division, which peddles servers and switching gear, were down 7.5 percent year on year to $2.76 billion, which was a 20.1 percent sequential decline from Q1 F2023, and which was more than $1 billion lower than Q4 F2022. Operating earnings before taxes for the Compute division were up 1.2 percent to $420 million, which shows a certain kind of supply chain and pricing genius on the part of HPE as far as we are concerned.

The other concern is that the HPC & AI business, which managed to increase revenues by 18.3 percent year on year to $840 million – most of this is the Cray supercomputer business, but not all of it is –nonetheless posted a $2 million loss. It is very difficult to make any money (meaning generate profits) in the HPC simulation and modeling systems business, as historical financial results from SGI and Cray demonstrated for decades; it is possible to generate big revenues given the size of exascale and pre-exascale system deals. But we worry that all the profits for these big deals are ending up at AMD and Nvidia and none are making it to the HPE till.

HPE’s portfolio of storage products brought in $1.04 billion, down 5 percent, and earnings fell by 40.6 percent to $82 million.

“In the second quarter, we saw some decline in the health of macroeconomic conditions, causing unevenness in customer demand, particularly in general purpose compute,” Antonio Neri, chief executive officer at HPE, said on a call with Wall Street analysts. “We also see unevenness when comparing customer size, industry, or geography. European, Asian, and mid-sized company deals are holding up better than expected, while large enterprise businesses and customers in certain sectors such as financial services and manufacturing in North America have been more conservative with their spend. In the last few months, sales cycles have elongated because customers are more reluctant to quickly commit to large projects or some will seek additional internal approvals at the time of the order. We continue to focus on our soft processes to accelerate closing deals wherever possible.”

Given all of this, and the ongoing political and economic tensions between the United States and China, it is not a surprise that HPE has negotiated to sell its 49 percent stake in the H3C partnership with Unisplendor in the Middle Kingdom. It is better to have the $3.5 billion in hand, for which it paid $2.3 billion back in 2015, then to find itself cut out of the Chinese market for datacenter infrastructure and not have the money in hand. HPE has negotiated a new commercial agreement to peddle iron through H3C as well as directly in China. This deal is expected to take six months to twelve months to complete, and there are tongues wagging that HPE is interested in using the proceeds to buy hyperconverged infrastructure provider Nutanix. There have been rumors about a Nutanix acquisition for years, the last round happening last October. With a market capitalization of $6.9 billion and only a little more than $5 billion in the bank and maybe $3.5 billion coming from the H3C sale, Nutanix looks to be a bit pricey for HPE to acquire unless it borrows money or issues new stock.

Neri said that despite the tougher economic conditions, HPE’s order book – boosted by a number of very large supercomputer deals this year and next – were 1.5X larger than “normalized historical levels” as the second quarter came to a close. Some of this is due to “a noteworthy uptick across customer segments from Fortune 500 companies including a large cloud provider to digital native start-ups looking for optimized AI supercomputing solutions,” as Neri put it when talking about a significant sequential uptick in orders in the HPC & AI division this quarter. So maybe there is a hope that HPE will ride the AI training wave up and enterprises will pay the premiums that they are expected given the smaller systems that they buy compared to the largest HPC centers in the world, who get very aggressively low priced machinery by comparison.

Hope springs eternal in HPC, even if it is now AI.

Neri was precise about this uptick in orders, which was refreshing, saying that there were more than $800 million in AI training system deals in the second quarter, and that most of these contracts at large cloud providers and enterprises were in excess of $100 million a pop.

“We expect this pipeline to continue to grow and anticipate these deals will generate significant revenue in later quarters,” Neri said on the call.

The other good news is that 66 percent of HPE’s annualize revenue run rate for subscriptions is for software and servuces, and total ARR amounted to $1.1 billion in the second quarter and that has a total contract value that stands at more than $10 billion. We think a substantial portion of the decrease in the Compute division is the conversion from transaction sales to utility pricing for ProLiant servers at large enterprises. HPE has not broken this number out, but every software and hardware maker that makes the shift from total sales to subscription pricing takes such a hit in the medium term and there is no reason to believe HPE is any different. Also, the difficulties facing banks, particularly regional banks, in recent months has put a chill on IT spending there as they preserve cash. The manufacturers who buy gear from HPE also tapped the brakes.

HPE says that going forward, it will see revenue growth of 4 percent to 6 percent at constant currency, compared to prior guidance of 5 percent to 7 percent growth. Even with that, given the strength of HPC & AI orders and sales of edge compute and networking, it can still meet its guidance of 2 percent to 4 percent compound annual growth rate between fiscal 2022 and fiscal 2025, inclusive.

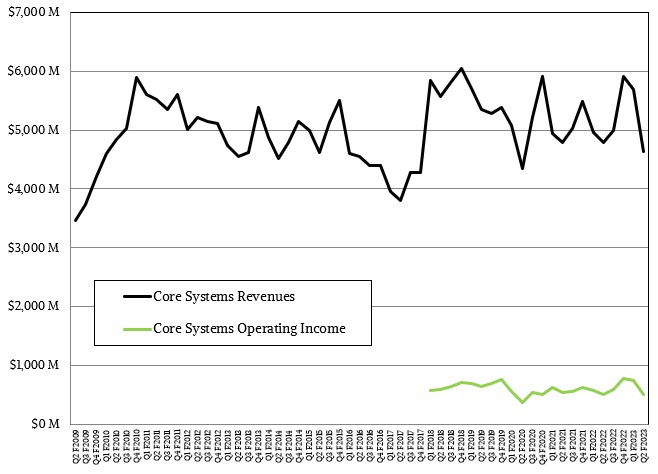

Every quarter, we try to gauge how the core systems business is doing and how this compares to historical data from the various incarnations of Hewlett Packard, which had more services and other things in the past.

The first thing to note is that sales are not anywhere near as low as they were for the former HP coming out of the Great Recession in fiscal 2009. The company quickly grew back to a $5 billion or so run rate for this core systems business and has held it there, with a few wild swings of course as SGI and then Cray was added to the mix, but they tend to average out over time now. This overall systems business, which includes ProLiant and Superdome servers, all storage, HPC and AI systems from Cray, and tech support and financing for all of this gear, has its ups and downs and it tends to bring 11 percent to 13 percent of revenues in as operating income (old HP data) or earnings before taxes (new HPE data). Clearly HPE had to add Cray to the mix to keep its average top line revenue in core systems, and even if this business was not profitable, cost cutting and disciplined pricing on other system sales has increased profitability so it has all averaged out as a more or less steady business.

It would be hard to do better than Neri & Co have done, given the cards that HPE has in its hand and the cut-throat datacenter game it is playing.

HPE Headquarters is in Houston, Texas and not San Jose, California. Producing economic conditions vs. non-producing ones positively affects peoples quality of life and production operations.

I looked it up because I thought it had moved, and it was HP Inc that moved. Ugh.

Well, HPE will never make up the loss with their new sales strategy of having all Aruba switches back ordered for 3 to 6 months and even a year on some of the smaller Aruba POE switches. They don’t tell you this until your have confirmed the purchase. The turnaround for servers is not 25 days as stated but 3 months. Sales will be down further next 2 quarters because of this.