Hewlett Packard Enterprise has been building a mainstream and grassroots server business aimed at large enterprises, HPC centers, and academic and government institutions for two decades. HPE took a run at the hyperscalers and cloud builders and large service providers with its Cloudline minimalist machinery, but has largely backed away from that business because margins are thin to non-existent.

The systems business that is left represents the core of HPE after it has largely divested its software and services business, which it spent tens of billions of dollars to acquire to try to create a clone of IBM, and split off its PC and printer business into an entirely different company.

While the original Hewlett Packard has a long history in proprietary and Unix systems, it was the acquisition of Compaq way back in September 2001 for $25 billion that gave what is now HPE a volume server business aimed at small, medium, and large enterprises as well as the emerging webscale companies. The rivalry with Dell (and to a lesser extent with Lenovo, Inspur, and Sugon) and the rise of the original design manufacturers who work directly with the hyperscalers and large public cloud builders (Foxconn, Quanta, Inventec, WiWynn, and such) have put the hurt on this ProLiant server business. But that ProLiant business is still formidable, and has many millions of loyal customers.

After losing the bulk of the Tandem parallel SQL database server business as well as its HP-UX and VMS businesses – porting this all to Itanium was not as fruitful as either Hewlett Packard or Intel had hoped – what is left of the high-end of the HPE systems business is an amalgam of these legacy systems running on very old Itanium machinery that is still available and supported even though it is long in the tooth plus the high-end Xeon server business and NUMAlink interconnect from the $275 million acquisition of SGI in August 2016 and the high-end “Shasta” system business, which supports a mix of X86 CPUs from Intel and AMD and a mix of GPUs from Nvidia, AMD, and Intel plus HPE’s own Slingshot interconnect variant of Ethernet and Nvidia’s InfiniBand interconnect, all gained through the $1.3 billion acquisition of legendary supercomputer maker Cray in May 2019.

What a long and strange journey it has been over those two decades, with several different chief executive officers – Carly Fiorina, Mark Hurd, and Meg Whitman – and their seeming perpetual building up and stripping down of Hewlett Packard in the enterprise. The company is trimmed down to its bare essentials, and Antonio Neri, who has been president and chief executive officer of HPE for three years, is trying to chase profits as best he can as a system maker under immense pressure. The Cray acquisition, which has been a boon for HPE’s sales pipeline and its prestige as it takes down deal after deal for next-generation supercomputers, is probably the smartest move HPE could have made, but that does not mean that dropping money to the bottom line is easy in that cut-throat supercomputing business. But the bet that Neri and his team are making is that HPE can scale this business in a way that Cray alone never could, and that profits will follow in the form of services and Greenlake utility-style pricing for on-premises systems.

It’s a pretty good bet, and judging from the latest financials coming out of HPE, those bets are paying off.

It is perhaps not a coincidence, then, that this is the moment that Pete Ungaro, the long-time president and chief executive officer at Cray and a long-time HPC executive at IBM before that, is deciding to step down from running the High Performance Computing & Mission Critical Solutions group at HPE. Ungaro will be staying on in a consulting role for a period of time as Justin Hotard, a rising executive who has been working with Whitman and Neri on HPE’s transformation, takes over as general manager of this core business unit. (Longtime interconnect architect Steve Scott left HPE/Cray in June 2020 to become a Technical Fellow and corporate vice president of hardware architecture at Microsoft. Ungaro could end up at either Google or Microsoft or AWS at some point, if he decides not to retire given these companies all have huge presences in the Seattle area where Cray has been located for decades.) In fact, we would not be surprised to see Ungaro and Scott team up some years from now with their own startup – and we hope they do just that, solving some incredibly difficult problem.

We expect to speak to Hotard at some point in the near future, but in the meantime, here is some background. Hotard got a bachelor’s of electrical engineering from the University of Illinois in 1997 and then a master’s of business administration from MIT in 2000 while working at Motorola as a sales engineer. After that, he spent four years at RFID equipment maker Symbol Technologies, which was then acquired by Motorola. In 2007, Hotard moved to NCR, where he held a number of business and corporate development roles for nearly eight years. In the summer of 2015, Hotard moved to Hewlett Packard to become vice president of strategy, planning and operations for Hewlett Packard’s Datacenter Infrastructure Group, and after HPE split from HP Inc, Hotard took over as senior vice president and general manager of its Compute Global Business Unit, which not only meant running the $8 billion ProLiant server business but also the $1 billion H3C partnership in China. In October 2019, in the wake of the Cray deal, Hotard was named president of HPE Japan and a year later was tapped by Neri to be senior vice president of corporate transformation. Neri is a long way away from retiring, at 53, but it is safe to say that Hotard is one of the key executives in line to take over as HPE CEO some years hence.

Hotard takes over the HPC & MCS business at a time of transition for both HPE and its high-end systems business, and continuing difficulty extracting profits from its various remaining business lines. (We have said this before, and we will say it again: We are grateful on behalf of the IT industry that companies like HPE actually build the gear that millions of organizations depend upon for their infrastructure. We just wish that the component makers like Intel or operating system makers like Microsoft and Red Hat would share some of the wealth with the hardware makers. Someone has to build this stuff, and make the substantial investments in big iron and HPC systems, too. Like running a co-op in New York City, as I have done, this is a thankless job. To which I always responded when shareholders said that to me: “You could just say thank you.” So on behalf of IT shops the world over, Antonio, I am saying “Thank you.”)

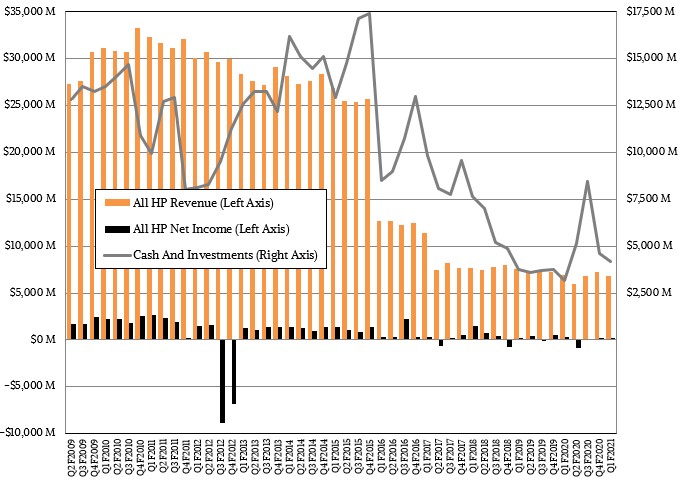

In the first quarter of fiscal 2021 ended in January, HPE’s sales were off 1.7 percent to $6.83 billion, and net income fell by 33 percent to $223 million. Despite the revenue and profit crunch due to the coronavirus pandemic in calendar 2020, Neri & Co are being responsible and paid down $3.7 billion in debt in the final quarter of fiscal 2020, which is why you see so much cash vaporize in the chart above. (We thought HPE did some massive acquisition and we missed it. . . .)

HPE changed the classification of its revenues and changed its business groups in fiscal 2019 after Neri had taken over for a while.

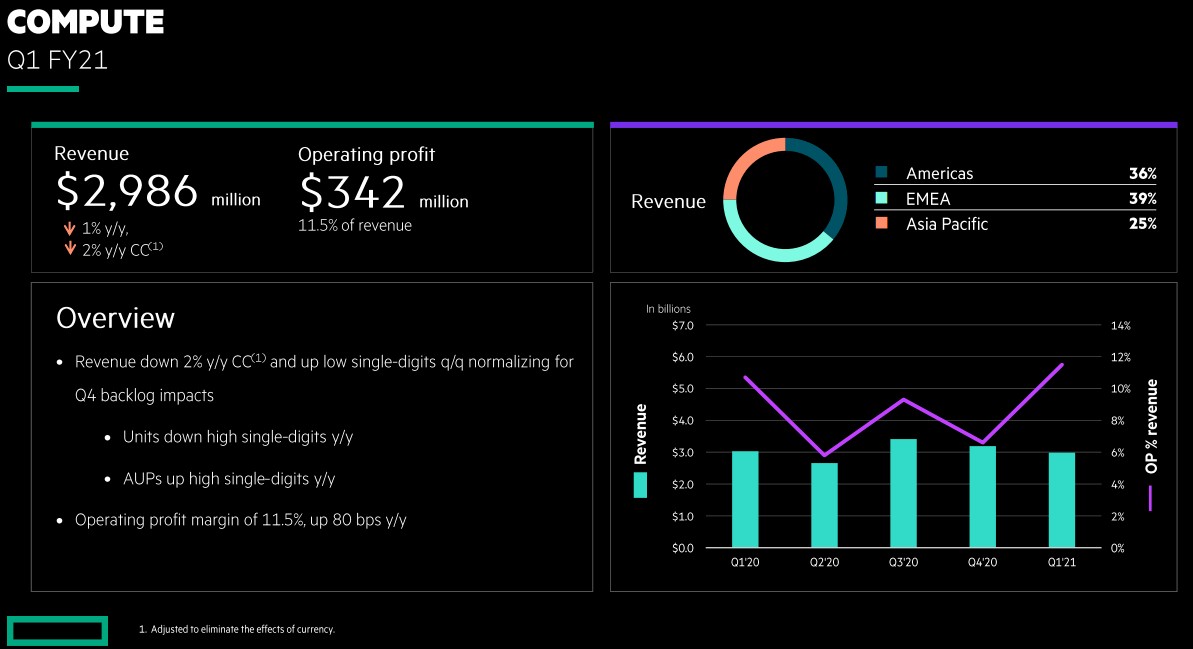

The Compute group, which Hotard used to run, posted sales of $2.99 billion, down eight-tenths of a point year on year, but earnings before taxes rose by 19.6 percent to $342 million. (You see now why Hotard is popular at HPE. He knows how to walk away from bad business as much as how to chase profitable business.) While revenues for ProLiant servers were off year on year, they rose a bit sequentially and bucked the normal trend for the January quarter as HPE works down a backlog of orders that has built up due to shortages of various kinds of chips in the IT manufacturing sector. Q2 is having a stronger than usual intake of new orders, Neri said on a call with Wall Street analysts going over the results.

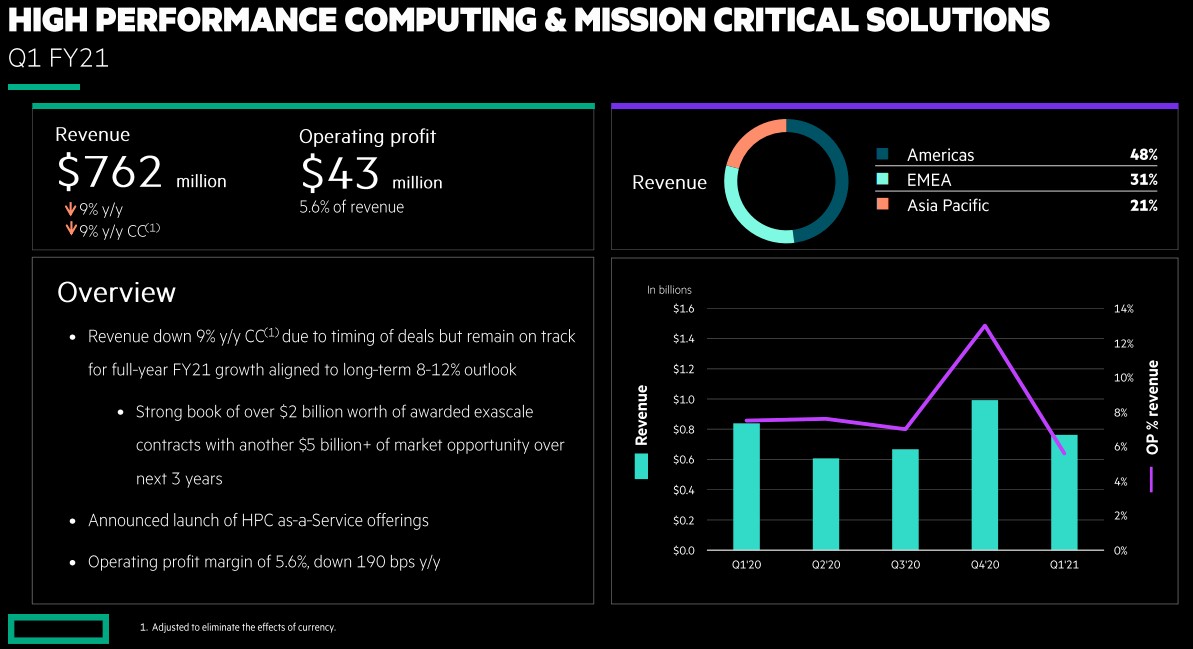

The HPC & MCS unit, which includes SGI and Superdome X big NUMA iron as well as Cray supercomputer sales plus what remains of those legacy HP-UX, VMS, and Tandem revenue streams, had sales of $762 million, down 7.4 percent. Earnings before taxes for HPC & MCS fell by 12.2 percent to $43 million. As we have pointed out before, this is not very much profit – in this case, a mere 5.6 percent of revenues.

Tarek Robbiati, HPE’s chief financial officer, said that the decline was driven mostly by the inherent lumpiness of the HPC and big iron sectors – something we have discussed often here at The Next Platform. The timing of deals moves around as processor and accelerator roadmaps shift here and there. Despite the decline in Q1 F2021, Robbiati reiterated that HPE expected its HPC business to grow at 8 percent this year and have a compound annual growth rate of 12 percent over the next three years. “We have an extremely strong order book of over $2 billion worth of awarded exascale contracts, with another $5 billion plus of market opportunity over the next three years,” he said on the call.

Some of that opportunity will be met with the HPC as a service utility, which HPE launched last December and which is expected to gain traction over the next year.

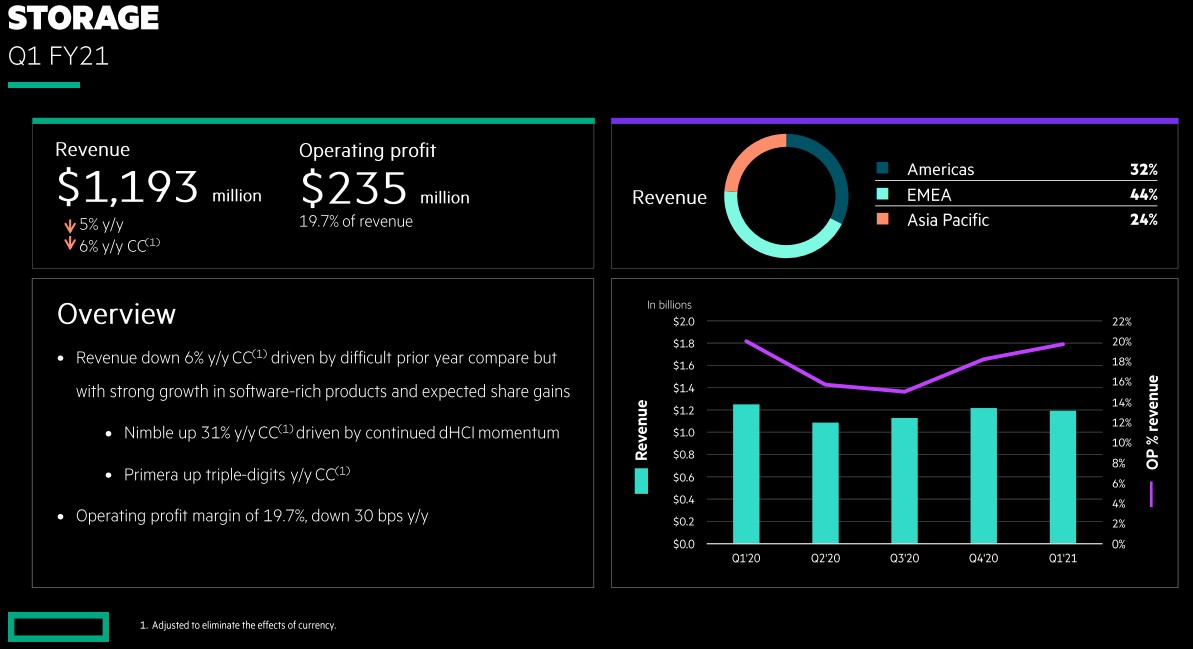

In the Storage group, HPE saw revenues slide by 4.6 percent to $1.19 billion, partly due to a mix shift away from storage appliances and towards software-defined storage. But the good news here is that the software is inherently more profitable, and earnings before taxes for Storage Group rose by 4 percent to $235 million, a much more respectable 19.7 percent of revenue. (The HPE Compute group, just to complete the set, brought 11.5 percent of revenues down to earnings before taxes, at $342 million, during the quarter.)

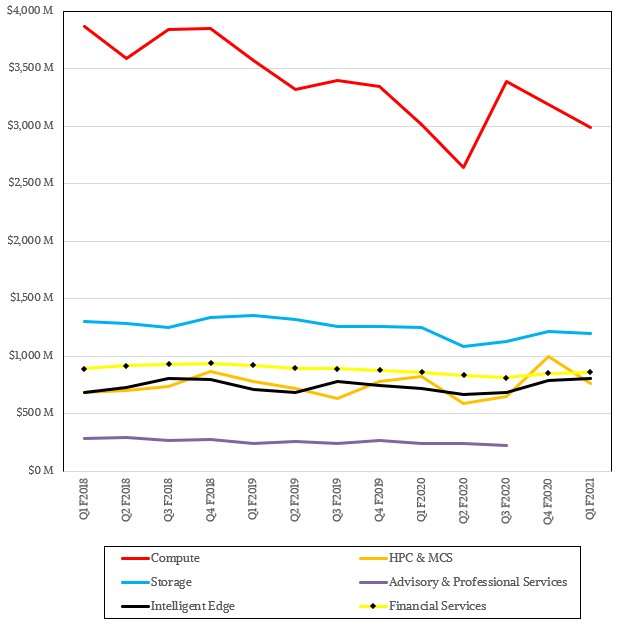

If you like to see the trend lines, here is what is looks like for the past thirteen quarters with these new HPE groups:

The Advisory & Professional Services group was disbanded last quarter and its sales and profits spread across the other units, which is why you see that line disappear in the chart above. It is hard to miss the secular decline in ProLiant server sales over this period, and as you can see the HPC & MCS unit helps here and there in terms of adding system revenue, but as we pointed out, it really doesn’t help profits all that much compared to the other HPE groups.

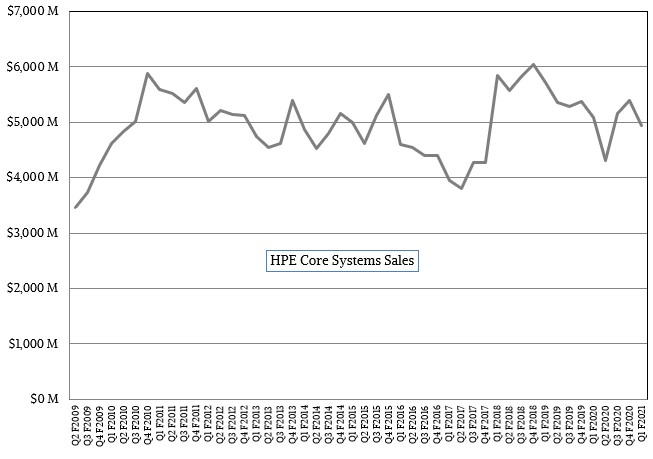

We like to look at longer trendlines than this, and cooked up sales of the core systems business at HPE – servers, switching, and storage – since the Great Recession. Take a look:

When you look at it over this long term and all together, it is a pretty stable business centered around $5 billion a quarter, with some obvious spikes and slips. But it all seems to average out, just the same.

And in this cut-throat systems business, maybe that is all you can reasonably expect.

I disappointed final way CRAY CEO Pete Ungaro,I think Justin had a pacifi managerial style but without necesary charisma,otherwise hard managerial style of Ungaro. The sucessful business performance need visionary persons, I believe Justin Hotard is a great strategist guy, but always in discreet plane.