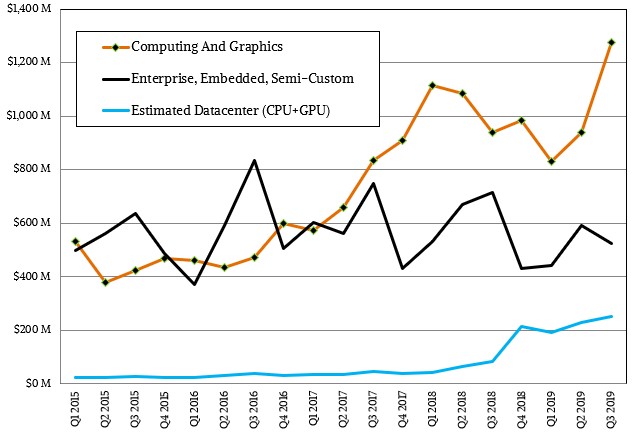

At some point, when the Epyc server CPU and Radeon Instinct GPU accelerator businesses are more substantial, AMD will probably be a lot less opaque about how its datacenter business is doing. Up until the past four quarters, when AMD was really building its pipeline for both types of compute engines, it didn’t make much of a difference. But we think that AMD’s datacenter business is material, now, and we are impatient to try to figure out how it is doing.

So, we did what we normally do, and that is to click on that Excel icon and create a model based on what little bit we know about AMD’s datacenter business that we catch here and there in market data and statements from AMD’s top brass. Mixed up with a certain amount of informed guesstimation, of course.

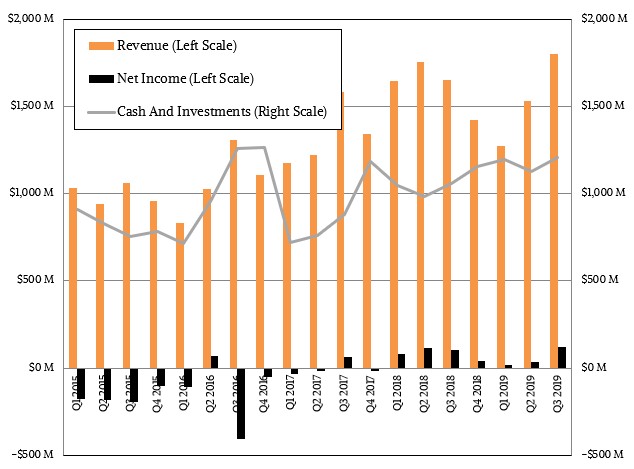

But before we get into that, let’s first talk about how AMD did in the third quarter ended in September. Revenues were up 9 percent to $1.8 billion and thanks to some very fortunate mix towards the high end of the Epyc, Radeon, and Radeon Instinct products for servers and the Ryzen CPU and Radeon GPU motors for client machines, net income rose by 17.6 percent to $120 million, or 7 percent of revenue. Profits could have been even higher if research and development costs were not intentionally jacked up by 11.9 percent in the quarter, which AMD chief executive officer Lisa Su said in a conference call will Wall Street analysts was based on incremental opportunities the company sees developing in its markets as well as an aggressive cadence of product rollouts. This increased spending has happened all throughout 2019, and is particularly significant given the substantial delays that Intel is having in getting 10 nanometer “Ice Lake” server CPUs to market (now slated for the second half of 2020) and the big investment it is making in the Xe discrete GPU engines that will come out for PCs in 2020 and in server accelerators in 2021.

It’s a tricky thing, balancing top line and bottom line growth. “We did spend a little bit more this year than we originally planned,” explained Su. “And that was frankly because the opportunities are very strong. Most of the additional spend is targeted at research and development with the notion of platform investments and software investments to ensure that we capture the opportunities that we have. I think we have the right balance.”

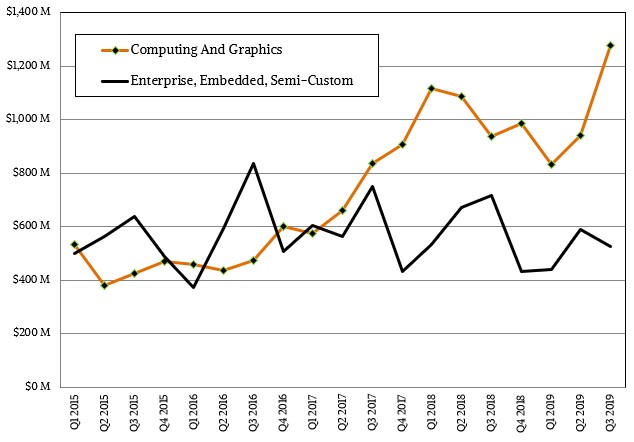

With the three major game console makers not having updated their consoles in 2019 and Sony and Microsoft both expecting to get new consoles in the field in time for the holiday 2020 season, the hodge-podge Enterprise, Embedded, Semi-Custom group at AMD had $525 million in sales, down 26.6 percent, and operating income was down 29.1 percent to $61 million thanks to the heavy investments being made both for future game consoles as well as future CPU and GPU products in the datacenter, and the impact of just having a lot lower revenues from consoles.

In the Compute and Graphics division, which sells CPUs and GPUs for client machines other than game consoles, business is booming, and this is a testament to the competition that AMD brought to bear on clients a lot earlier and easier than it can in the datacenter, which has a much longer memory and a much lower tolerance for risk when it comes to buying compute and graphics engines. Client shoppers buy best of breed products when they can afford them and shop largely on price/performance; server shoppers buy roadmaps and are as concerned with performance per dollar per watt and with things like cores per socket and sockets per machine because they have to deal with enterprise software licensing in a lot of cases – the hyperscalers and cloud builders that create their own software stacks excepted, of course.

Just like Intel’s Pentium client chip business of the 1990s gave it the ability to jump into the datacenter with Xeon line of server specific chips, this is happening as AMD’s Ryzen chips take off on clients and share technologies and development costs with the Epycs. The Opteron chip was a slightly different case in that it was successful because of that Athlon PC client business but also because Intel had 64-bit Itaniums and only 32-bit Xeons for servers, the former being something few wanted because of the software incompatibility and the latter because it had too little memory.

In any event, this Ryzen client business is what gave AMD the energy and the hope – and some modicum of credibility – that got its foot in the door of the datacenter again with the first generation of Epyc and Radeon Instinct devices, and now it is being more warmly welcomed with the second generation of datacenter products. The third time will probably be the charm if Intel doesn’t get its CPU and GPU roadmaps in order and stick to them.

In the September quarter, AMD’s Computing and Graphics division posted sales of $1.28 billion, up 36 percent, and operating income was up a very nice 79 percent to $179 million. Any time income is growing twice as fast as revenues – and is in the double digits like that – something is clearly going right. Both shipments and average selling prices of Ryzen chips rose in the quarter, and AMD posted its best sales in 2011 in client CPUs. This is the eighth quarter of share gains for client chips by AMD, and a new 16-core mainstream Ryzen as well as an updated Threadripper variant are coming in November. Mobile Ryzen processors had double digit growth, and the number of laptop machines using Ryzen chips has increased by 50 percent in 2019 – notably, a new Microsoft Surface 3 that only has a Ryzen variant.

However, Su said that datacenter GPU sales were down “down sequentially and roughly flat year over year.” These revenues are counted in the Compute and Graphics division, which is dominated by client devices, which is a pain in the neck to sort out. In our model, datacenter GPU sales were cut in half sequentially, which is a pretty big synonym for “down,” but in the trailing twelve months, datacenter GPU sales are up by a factor of 2.2X. A lot depends on when the hyperscalers and cloud builders bought Epyc CPUs and Radeon and Radeon Instinct GPUs.

We are not sure what the mix is, and have taken our best stab at it, quarter on quarter, and we were reminded after this story posted to not forget about he effect that Google might be having on AMD’s datacenter GPU business. If you assume that there is a baseline north of $40 million per quarter for datacenter GPUs — a mix of Radeon and Radeon Instinct cards — and then the rest is the custom GPUs that Google is deploying for its Stadia cloud gaming service, then Google bought somewhere on the order of $100 million of these devices in 2019 so far and accounts for all of the growth and the subsequent decline back to normal in the third quarter. Google is launching Stadia on November 19, so would have to have all of the necessary hardware in line, and assuming that this custom GPU used in Stadia — which has 56 compute units fired up, 10.7 teraflops at single precision, and HBM2 memory — costs somewhere between the Radeon RX 56 and Radeon RX 64 at list price and Google then can get it for 50 percent of list, then Google may have acquired as many as 300,000 to 350,000 units from AMD in the past couple of quarters. There is a lot of estimating and “if-then” in all of those numbers, we fully realize. But this does explain why the datacenter business went up and then went back down rather neatly.

Reality is probably a bit messier than this.

Anyway, here is what the AMD datacenter business might look like against the two divisions it pulls from:

So, basically, the annualized run rate of the AMD datacenter business proper – bits from the two major divisions – is around $1 billion, with it hitting $252 million, by our estimates, in Q3 2019. That represented 13.9 percent of revenues in the third quarter, and around 15 percent in the first three quarters, which compares quite favorably to the 2.5 percent to 5.2 percent of sales that AMD’s datacenter business had – again, according to our model, not pronouncements by AMD – before things really started taking off in the fourth quarter of 2018. It seems very likely that AMD will at least break through a $2 billion annual run rate for its datacenter business in 2020, perhaps as high as $2.5 billion if it is a little better than we expect and maybe even $3 billion if growth stays at current levels.

But in the meantime, Su and her team are keeping their eye on the next quarter and on making sure the roadmaps are adhered to because what everyone wants as much as a resurgent AMD is a predictable one.

“We expect server revenue to grow sequentially by a strong double-digit percentage in the fourth quarter as we continue ramping our second-generation Epyc processors,” Su said when asked about the future of the server CPU lineup. “We remain on track to achieve our near-term goal of double digit server CPU share by the middle of next year. We are on track to exit 2019 with another quarter of significant growth, driven by the ramp of our 7 nanometer products, and believe we are well-positioned to build on our momentum in 2020 and beyond as we deliver an even stronger set of leadership products that can drive sustained growth and an increased share of the $75 billion market for high performance computing and graphics technologies.”

Do we have good reason to believe that AMD’s data center GPU sales are Radeon Instinct sales? My personal inclination is that they are mostly Google Stadia GPU sales along with some visualization and desktop virtualization sales. That’s why they suddenly grew and suddenly collapsed and also why AMD seem to be able to predict that they will grow again soon. Google built out Stadia and soon Microsoft will be building out their XBox game streaming service.

You know, you make a good point, and I didn’t mean to imply that at all. Let me take another look at this.

A little birdy telling you now, its Radeon Instinct sales. Custom chips are also in development for 2022 release. AMD threw down the hammer and the risk release is going to pay off. I cant wait to retire in 5 years.

“Enterprise, Embedded, Semi-Custom group at AMD had $525 million in sales, down 26.6”

And that would be worse if Epyc/Naples and Epyc/Rome sales where not there to offset the mostly consumer driven console sales numbers that AMD’s EESC division has been forced to depend on before AMD’s reentry into the Server/HPC market.

I just wonder how many more business quarters that AMD’s semi-custom gaming console sales will even factor in as a large enough part of EESC’s revenues to matter after Epyc/Rome is supplanted by Epyc/Milan. And strangely enough what about AMD’s server market share numbers post Q3 2019. AMD should be able to get to double digit server market share numbers with Epyc/Rome and have Epyc/Milan(Zen-3) in 2020 ready to push AMD back up towards their Opteron market share high numbers by the end of 2021-2022 after Epyc/Genoa(Zen-4) arrives in 2021.

AMD’s appears to be more focused on Zen’s generational micro-architectural improvements(See earrings call transcript) more so than only process node shrinks and so will Intel as the 7nm smaller process node shrinks are not going to as able to deliver the higher clock speed returns as was the case going from 22nm to 14nm. That clock speed boost from node shrinks has begun to show a more diminished return and both AMD and Intel have little choice but to go wider order superscalar with their CPU core designs by offering more Decoders, Integer and Floating Point unit numbers as well as increased load/store units/other on CPU core units etc. And this will be necessary in order to increase IPC in the face of not being able to obtain higher performance from higher clock speeds on those 7nm/smaller process nodes.

AMD with its console semi-custom driven sales has the usual cyclical/generational sales concerns and that’s gong to see some single year sales variance as well as the generational sales variances as AMD’s next generation of Zen/Navi-2 based gaming console APUs are scheduled to appear around Q4 2020. So that new generational boost in AMD console APU unit sales numbers should begin to ramp up by Q2 2020 in order for there to be the next generation of XBOX and PS5 gaming consoles ready by holiday season 2020.

But the real earner for AMD will be Epyc/Rome, even more so than Epyc/Naples, and Epyc/Milan incoming in 2020 to really accelerate AMD’s server market numbers. AMD’s quarterly qross margins will continue to go up while Intel’s quarterly gross margins have now gone from Q3 2018 gross margins of 65.9% to Q4 2019 gross margins 60.4%. And Intel has just now started to half its competing Consumer CPU market markups in order to stop bleeding any more market share to AMD in consumer CPU sales percentages. One need only to research Intel’s gross margin history numbers at the time of AMD’s Opteron high water mark to see what Intel will have in gross margin trends going forward as the sales of Epyc/Rome and Epyc/Milan begins to reach those Opteron high levels of server market share(Around 23% server market share).

AMD has less to worry about from Intel’s entry into the Consumer Discrete Mobile GPU market as Nvidia has reasons to be concerned as AMD is not as extended into the GPU market as Nvidia. But in 2020 Intel’s entry, once again, into the discrete GPU market will probably not be an early 2020 concern and any new market for Intel with discrete GPUs will take time to ramp. Nvidia sets the bar on GPUs currently with AMD doing a good job in mainstream GPU market competition with its first RDNA micro-architecture based Navi offerings. AMD’s Navi-2 is scheduled to have some form of Hardware based Ray Tracing capability as well where currently Nvidia has the lead with that Ray Tracing(Specialized on GPU Ray Tracing Units) in hardware acceleration on GPUs.

AMD’s continued growth looks to be assured with 2 generations of Epyc generations brought to market and Epyc/Milan beginning the engineering sample stage. So the server market clients are now most thoroughly convinced of AMD’s server market potential with Epyc/Rome and later as AMD’s yearly cadence of server product improvements has now been proven since Epyc/Naples was first released. AMD is Keeping 2 generations ahead in the Zen CPU core development stages with dual CPU engineering teams, one working on Zen-4 and the other on Zen-5, after Zen-3’s design process was frozen and was moved into the verification stage and onto the certification/engineering sample stage.

The EPYC line alone will enable me to retire early.

If you bought in big time when AMD was selling for its lowest around Sep 25 2015 when AMD’s stock was $1.71 and ignored any dips and volatility afterwards then as of 11/1/2019 AMD’s share price at mid day eastern time in the US is around $34.76.

So some equity focused long term investors that bought into AMD at the lower end stock price points with some larger purchase amount of available fund, and just to set on that investment for a few good years. That’s been earning some mad equity money with the potential to see that maybe double once again as Epyc/Rome becomes supplanted by Epyc/Milan. Now that’s sure beating any market’s average over the last 5 years and even longer.

Shortly we will see AMD make an all the share price high that has not seen since 2000 and again almost as high around 2005-2006 when Opteron was at its peak market share numbers. And at the time of Opteron AMD was a CPU only company as they had yet to purchase ATI for it’s GPU IP.

If only I’d done that. I’m definitely way up but not “retire early” kind of way up.

They’ve disclosed this on the earnings calls in recent quarters.

4Q18 earnings call: “datacenter CPUs and GPUs accounted for a mid-teens percentage of overall revenue”

1Q19 earnings call: “Overall in the datacenter our CPU and GPU sales accounted for a mid-teens percentage of quarterly revenue.”

2Q19 earnings call: “the percentage is similar to the last few quarters in terms of percentage of our business”

3Q19 earnings call: “As a percentage of revenue, it’s similar to what it has been in the past few quarters, although the server portion was significantly higher.”

So 15% * $1801 = ~$270 million in the quarter or >$1 billion annualized. Exciting times!

On channel inventory data decomposition of AMD Q3 financial by product category volume and gross revenue here;

https://seekingalpha.com/instablog/5030701-mike-bruzzone/5370057-reconciling-amd-q3-19-cost-price

And in comment string here find data and commentary;

https://seekingalpha.com/article/4300171-advanced-micro-devices-inc-amd-ceo-lisa-su-q3-2019-results-earnings-call-transcript

Mike Bruzzone, Camp Marketing