Expect Datacenters To Get Denser, Hotter, And Smarter

The datacenter industry today looks very different than it did a decade ago. …

The datacenter industry today looks very different than it did a decade ago. …

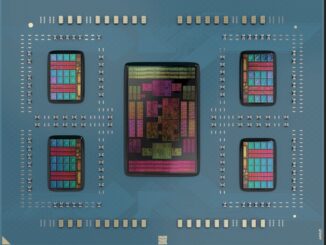

We have five decades of very fine-grained analysis of CPU compute engines in the datacenter, and changes come at a steady but glacial pace when it comes to CPU serving. …

You might be thinking that with all of the investment in AI systems these days that the boom in InfiniBand interconnect sales would be eating into sales of high-end Ethernet interconnects in the datacenter. …

It is hard to keep a model of datacenter infrastructure spending in your head at the same time you want to look at trends in cloud and on-premises spending as well as keep score among the key IT suppliers to figure out who is winning and who is losing. …

If the original equipment manufacturers of the world had software massive software divisions – like many of them tried to do a two decades ago as they tried to emulate IBM and then changed their minds a decade ago when they sold off their software and services businesses and pared down to pushing tin and iron – then maybe they might have been on the front edge of AI software development and maybe they would have been closer to the front of the line for GPU allocations from Nvidia and AMD. …

As Moore’s law continues to slow, delivering more powerful HPC and AI clusters means building larger, more power hungry facilities. …

There is little question that generative AI as well as other kinds of machine learning are going to augment applications in every industry and in every part of the application stack in the coming years. …

Welcome to the second part of our Debunking Datacenter Compute Myths series. …

The rise of the merchant silicon suppliers for datacenter networking and routing, which was spearheaded by Broadcom with chips and Arista Networks with switches, was not a foregone conclusion. …

There has always been a certain amount of fear, uncertainty, and doubt that IT vendors sow as they try to protect their positions in markets that they participate in. …

All Content Copyright The Next Platform