The increasing cost of goods and services is making everyone a little crazy, and corporate IT departments are not immune from the effects of the dual concerns of rising inflation and the desire by central banks to use interest rates to curb our economic enthusiasm and slow that inflation to a much more sane level.

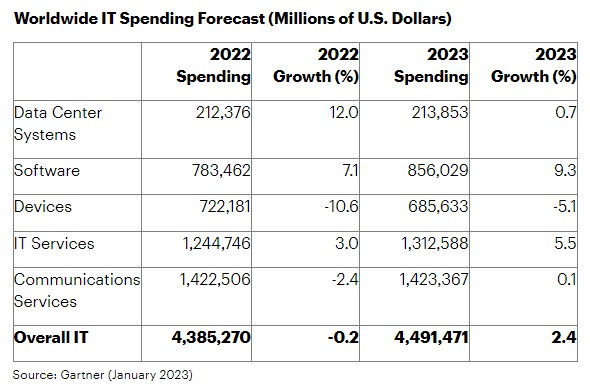

And so it has come as no surprise to us at all that Gartner has just revised its forecast for IT spending, showing significantly less growth across the board – hardware, software, services, telecom – in its forecast for 2023, which was just put out in October 2022 and which we covered here.

Back in October last year, Gartner reckoned that IT spending globally in 2023 – and reckoned in US dollars for the worldwide market – would rise by 5.1 percent to $4,658.4 billion. (That looks weird but we want you to see five significant digits.

In that forecast, Gartner said that datacenter systems spending would rise by 3.4 percent to $216.3 billion, enterprise software would rise by 11.3 percent to $879.6 billion, and IT services would rise by 7.9 percent to $1,357.9 billion. The core IT market – not including client devices and not including communications services that are part of the overall IT spending model from Gartner – of datacenter systems, enterprise software, and IT services was expected to grow by 8.7 percent to $2,454.3 billion and would represent 52.7 percent of all IT spending.

Jump ahead three months to the end of January, and Gartner has revised datacenter systems and IT services spending upwards a smidgen for 2022 and downshifted datacenter systems spending, enterprise software, and IT services spending and radically cut client device sales expectations, and thus IT spending is now only expected to grow by 2.4 percent to $4,491.5 billion.

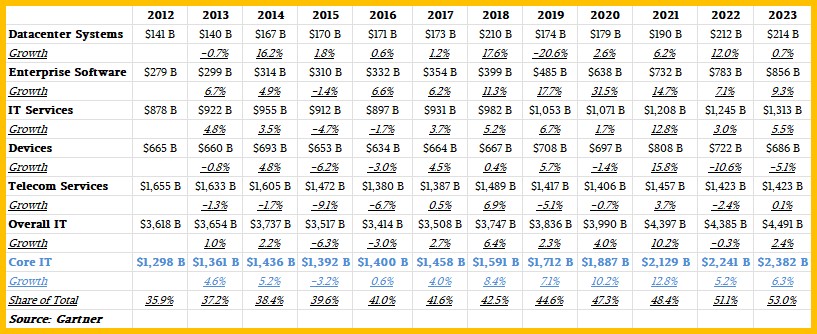

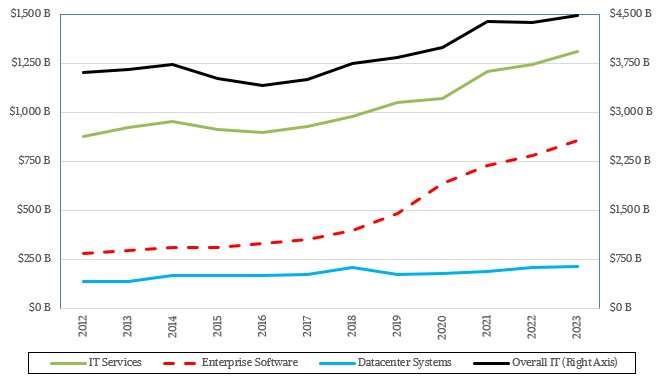

To see the trends, we have gathered up the IT spending forecasts since 2012 from Gartner – and their revisions – into a single table, which is here:

For those of you who think visually, here is the same data in a line graph, which shows the elements of what we call “core IT spending,” which is revenues derived from the sale of datacenter systems hardware, enterprise software, and IT services, plotted on one vertical axis and then the combined elements plotted on the other vertical axis.

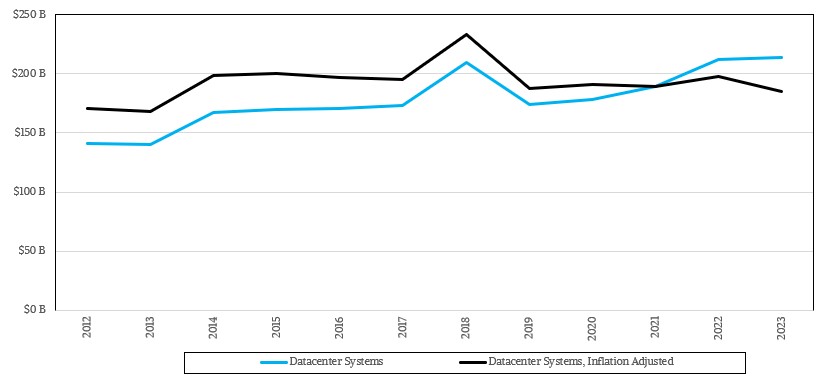

Datacenter systems spending is pretty flat compared to that of IT services and enterprise software, and in fact, and it is flatter than it actually looks over the past eleven years plus one for the 2023 forecast, which becomes apparent when you adjust the spending each year for the inflation index. Take a look:

Refresh cycles for all kinds of devices in the datacenter are being extended, says John-David Lovelock, distinguished vice president and analyst at Gartner who puts together the economic forecasts for the market researcher. Our inflation adjustment of this data assumes a 6.5 percent inflation rate this year, and the adjustment shown above it in 2021 dollars. Which was the peak of the pandemic before inflation went completely nuts around the world. And the effective budget in 2023 for datacenter systems is $185 billion when inflation adjusted, down 6.3 percent from $197.5 billion adjusted after taking out the inflation and is lower even that the levels of spending in 2021 and indeed, since 2013, when the inflation-adjusted spending on datacenter systems was $168 billion.

Interestingly, even with the layoffs in the tech vendor community that have been making headlines, job vacancy rates in the IT sector have been rising quarter after quarter and Gartner says that companies are hiring more and more outside consultants to fill in the gap. Spending on IT consulting will rise by 6.7 percent to $264.9 billion in the current 2023 forecast.

Still, we will not be at all surprised when this overall IT spending forecast is revised down again, and then again, as 2023 proceeds, thanks to cooling inflation and even faster cooling actual spending as people continue to be cautious.

As long as it doesn’t go below zero, it is not an IT recession. Just a slowdown.

Be the first to comment