If you follow the IT spending forecasts of IDC and Gartner, as we do with each revision, what you will notice is that spending forecasts are constantly changing as economic conditions change. This is perfectly rational.

But what also happens is that spending levels for hardware, software, and services for prior years, seemingly done and the ink dry in the books, are also recast, often dramatically and often downwards, which can make the present and future spending conditions look better than they might have otherwise.

It’s peculiar, and it happens all the time.

And so it is with the October revision of the 2022 and 2023 IT spending forecasts recently released by Gartner, which is ebullient in that “enterprise IT spending is recession proof as CEOs and CFOs, rather than cutting IT budgets, are increasing spending on digital business initiatives,” as John-David Lovelock, distinguished vice president analyst, put it.

From the many recessions and downturns that we have experienced in three and a half decades of watching the datacenter, we would never call IT spending “recession proof,” and this is particularly true of enterprise hardware, software, and services, which get the budget cutting soon after advertising and marketing have been slashed when things get bad.

We will give you some examples before we get into the latest Gartner IT spending forecast, which is a fairly positive affair considering the weird state of Earth at this moment. For which we are, honestly, thankful because it makes people less jumpy about investing in IT. Even if we are a bit skeptical how these numbers are generated.

In the forecast released in January, for instance, Gartner said that spending on datacenter systems in 2020 was $194 billion and grew at 11.4 percent to $216 billion, and said further that it would grow at a more modest 4.7 percent in 2022 to $226 billion. And in the latest forecast, datacenter system spending was revised downward to $179 billion in 2020, and the growth rate in 2021 was cut back to 6.1 percent to $190 billion and therefore the much smaller $209 billion in datacenter spending forecast for 2022 was a much more impressive 10.4 percent and the forecast growth of 3.4 percent in 2023 to $216 billion was lower growth and $21 billion in sales evaporated in the 2023 forecast alone and $80 billion in spending evaporated from 2020 through 2023 inclusive.

This is a lot of money, of course. If datacenter systems spending has been deflated over the forecasts, enterprise software spending has been inflated – and not because of inflation. Over the 2020 through 2023 period, between the January and October forecasts, spending has increased for enterprise software by $482 billion, to over $3 trillion.

We get that calculating IT spending for the entire world is a complex data gathering operation, and it doesn’t help the way the public IT vendors obfuscate like crazy about how they are really doing with different product lines. We are just suspicious of big swings like we see in the Gartner forecasts.

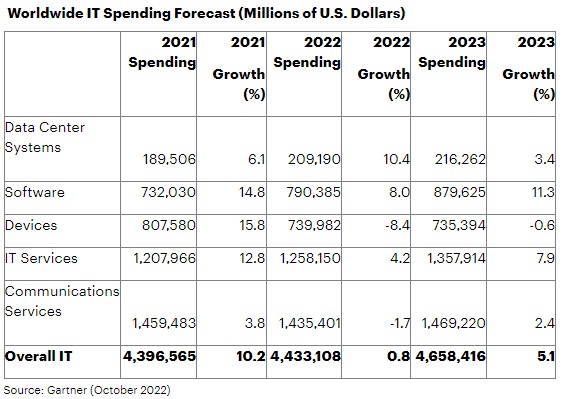

Now, setting all of that aside, let’s take a look at the latest IT spending and forecasts for 2022 and 2023:

In the categories above, software includes SaaS and PaaS offerings on the cloud, and these cloud services are a big driver of spending in this area, according to Gartner. We also think that growth in datacenter system spending is also being driven by clouds, but Gartner did not discuss this specifically in its reports.

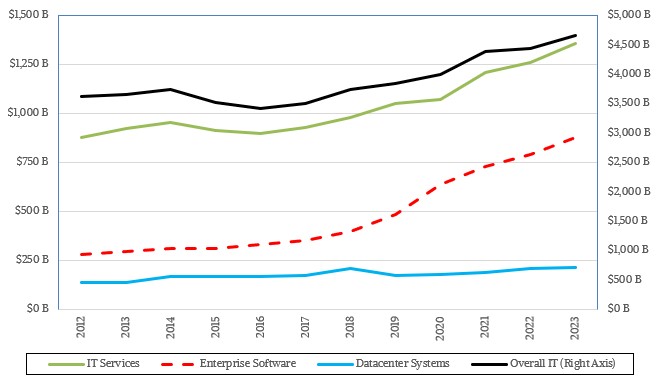

We like to hoard data here at The Next Platform, and so here are the IT spending numbers from Gartner stretching back to 2012 through the 2023 forecast:

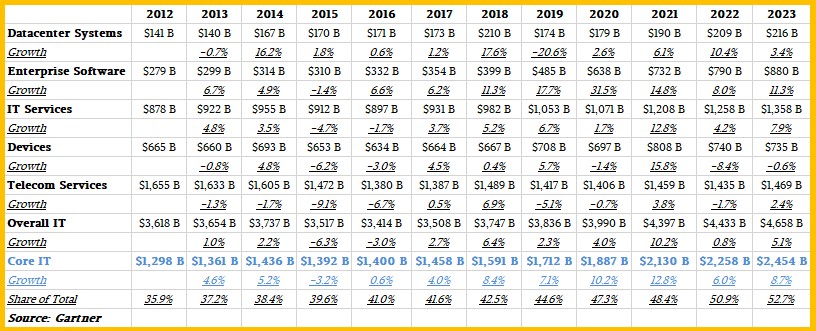

And here is a table that shows the underlying data for this chart:

We like to remove devices (PCs, smartphones, and tablets) and telecom services from the picture to get a better proxy for true core IT spending by enterprises (which includes stuff bought by hyperscalers and clouds and the services the offer on their wares).

As you can see, even after the revisions, this core IT spending grew by 10.2 percent to $1,887 billion in 2020 – thanks in large part to the need for infrastructure as we all changed the way we worked during the coronavirus pandemic – and continued to grow in 2021, up 12.8 percent to $2,130 billion. If you look at the current Gartner forecast, spending in this core IT segment will grow by only 6 percent to $2,258 billion this year, but thanks in large part to increasing spending on software, core IT is expected to grow by 8.7 percent to $2,454 billion in 2023.

Another thing we find interesting in this data is that the share of core IT spending as a portion of overall IT spending just keeps growing and growing. A decade ago, this was 35.9 percent of overall spending, and is forecast to be 52.7 percent of all IT spending in 2023. This is a huge shift, and it is driven largely by software with hardware doing some contribution. If you look at datacenter systems, the spending level in 2022 is 1.48X times that in 2012, but for software, the increase is 2.83X over the same period.

What is missing from all of this analysis is the cost of system architects, system administrators, programmers, site recovery engineers, project managers, and upper management like CIOs, who get more expensive over time thanks to inflation and every unlike hardware, which has Moore’s Law efficiency gains to cover some of the cost of capacity expansion. Software rides Moore’s Law, but has a lot of people costs embedded in it, and hence it has its own kind of inflation built in.

The benefits that IT hardware advances & economies seem to offer, tempting as they are, are moderated by the disproportionate volume & budget inflating costs of human input ingredients.

What is different now from the past, is more evolved AI. Thats a new ball game.

AI is a chance at the huge rewards of reducing the cost and quality of the human component in many things, but particularly in IT itself.

Comparing now against past patterns has limits. Yes its a weird world out there ATM, but spending on IT is historically uniquely attractive ATM.

Bang for hardware buck & per watt, has sure improved radically, but that power can also be utilized toward the nirvana of reducing human costs.