Supermicro has always been an interesting IT supplier for the datacenter, and it is getting more interesting by the year as it continues to grow very fast and has set itself a goal of break $10 billion in annual sales, which would put Supermicro behind only Dell and Hewlett Packard Enterprise, on par with Inspur, and ahead of

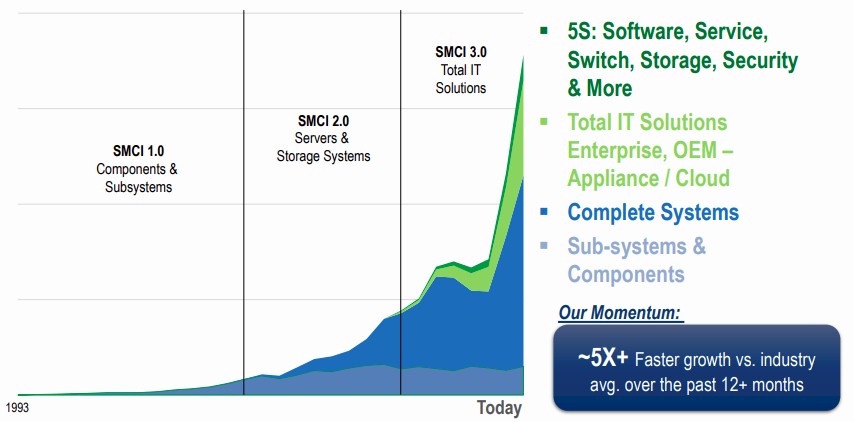

Since the advent of the X86 server market thirty years ago, Supermicro has been unique among its server making peers in a number of ways. At first, it made motherboards and other components for servers so others could build and sell them, but eventually (and when the company came onto our radar) it made complete systems that customers could buy directly.

Supermicro has also been interesting because it spanned the very distinct worlds of original equipment manufacturers such as Dell, Hewlett Packard Enterprise, Lenovo, and Cisco Systems and of original design manufacturers such as Foxconn, Inventec, Quanta, and Wiwynn. The former creates servers that span lots of use cases and sells them to enterprises, governments, and other organizations while the latter works with the hyperscalers and cloud builders to co-design bespoke machinery and then make it for them.

In many cases, the hyperscalers and cloud builders control their own supply chain of parts, which is why the ODMs cannot command the kinds of margins that the OEMs do.

Not that OEMs have very high margins, mind you.

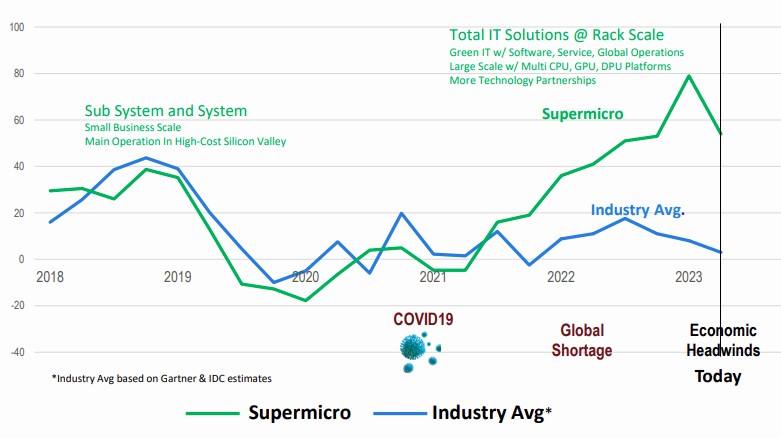

The coronavirus pandemic has been a double-edged sword for a lot of OEMs and ODMs, but it has been particularly good for Supermicro because it is, in many cases, its own supply chain. That, we believe, is one of the reasons why Supermicro has had explosive growth in 2021 and 2022 as other OEMs and ODMs have had their supply chain issues. Landing a few very big (and unnamed) customers happened because of this, and we only know that because the US Securities and Exchange Commission requires companies to report concentrations of supplier and credit risks above 10 percent of revenues the quarterly 10-K reports that public companies have to file.

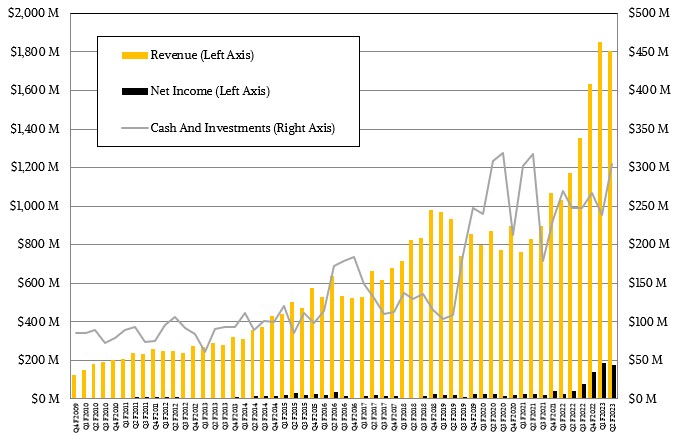

In the second quarter of fiscal 2023 quarter ended in December, Supermicro posted $1.8 billion in sales, up 53.8 percent, and net income rose by a factor of 4.2X to $176 million. Its cash hoard stands at $305 million, which doesn’t sound like a lot until you realize how hard it is to make any profit at all doing what any of the OEMs or ODMs do for a living. Especially when the factories always have to be expanded – not in any one place, but around the world. Supermicro builders computers in Fremont, California, which is a great place because it is near so much engineering talent and so many vendors, But it is probably the most expensive place in the world do to manufacturing. And while Supermicro has factories in Taiwan and the Netherlands (to serve the European market), it is looking for a way to get cheaper manufacturing that can also serve its Asian customers.

“Our US facility still has 40 percent capacity while Taiwan still has 50 percent capacity headroom to grow for the next one to two years,” Supermicro founder and chief executive officer, Charles Liang, explained on a call with Wall Street going over the numbers. “To accommodate stronger growth in the near and midterm future, our recently broken ground Malaysia new campus will start to contribute even better profit margins through economies of scale with our more and new high volume customers. I am very glad that the lower operation and production cost from our new Malaysia campus will be ready in just four to five quarters.”

When I saw Liang a few months ago, ahead of an interview we did with AMD’s chief executive officer, Lisa Su, I explained that western North Carolina was a great place to put the next factory in North America. For one thing, there is a long history if textile and furniture manufacturing in many of the cities. Lenoir, which is down mountain from where we live in Boone, is where Broyhill Furniture still makes stuff, but obviously not as much as it used to. The abundance of electricity and water, necessary for such manufacturing, is why Lenoir ended up being a datacenter location for Google. Ditto for Maiden for Apple and Forrest City for Meta Platforms. And a week later after I talked to Liang about this, Microsoft announced a $1 billion plan to create four datacenters a few miles more down the mountain in Catawba County. So four of the big five hyperscalers (we will give Apple hyperscale status for the sake of that sentence) in the United States have datacenter footprints not too far away. Seems like a perfect place to put a factory.

Moreover, there are plenty of people who need jobs who would be good at building things – something a datacenter only requires once but a factory always requires.

Anyway, back to revenue and profits. For the calendar 2022 year, Supermicro’s sales were up by 59.4 percent to $6.65 billion, so it is two-thirds of the way to its $10 billion goal. With only a modest 20 percent growth from here on out, Supermicro will kiss $10 billion in sales by the finish of calendar 2024, and if it can keep its costs down, it should be well about 10 percent of revenues as profits. In calendar 2021, Supermicro brought only 3 percent of revenues, or $125 million, to the bottom line, and that grew by a factor of 4.6X in calendar 2022 to $578.4 million.

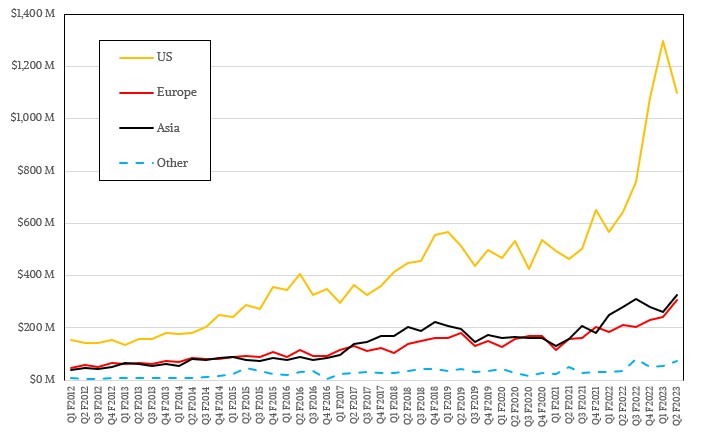

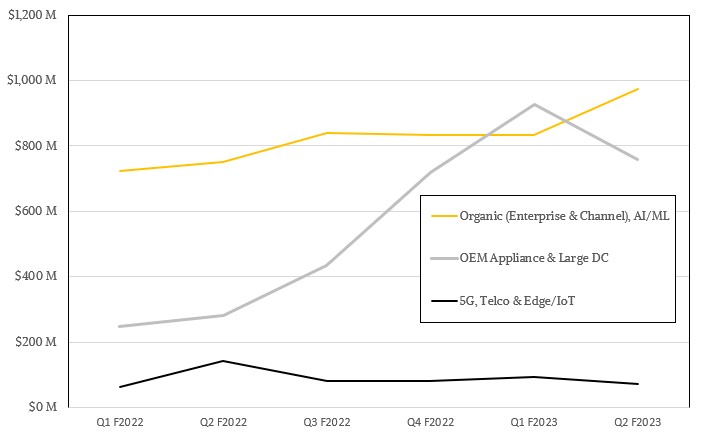

The big boost to revenues in 2022 came from an unnamed customer, and we can see that customer is based in North America by looking at the spike:

We can see it is a hyperscaler of some sort by looking at this spike:

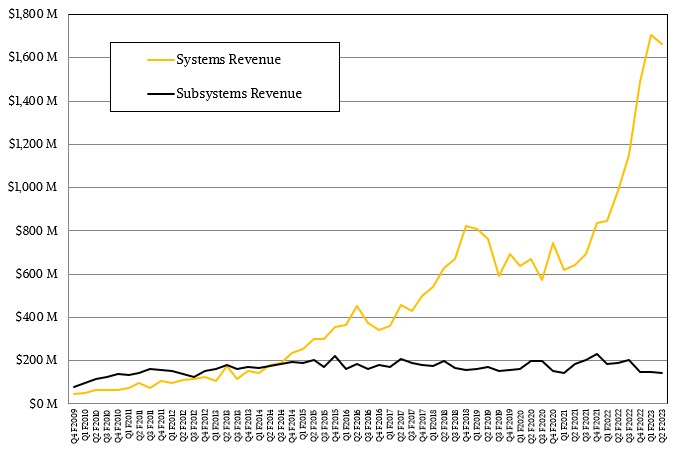

And we can see that whoever it was bought systems by looking at this spike:

It is a good thing that Supermicro still makes its own subsystems, but that business is not where the action is even if it is the very foundation of the action. Whoever was that big customer in calendar 2022, they did not spend big in the December quarter – at least not cresting about that 10 percent reporting threshold. But that company did account for 10.2 percent of revenues in the March quarter (which is Q3 of fiscal 2023), 21.7 percent of sales in the June quarter (which is Q4 of fiscal 2023), and 21.9 percent of sales in the September quarter (which is Q1 of fiscal 2023). If you assume that hyperscaler or cloud builder did not just stop spending in the December quarter – call it 8 percent of revenues, and we won’t know for sure until Supermicro finishes its fiscal year in June – then this superbuyer spent north of $1 billion on servers in calendar 2022, and represented around 16 percent of revenues for the year.

Way back in the day, before IBM bought SoftLayer in the summer of 2013 to become what was then the fourth largest cloud, and even after that despite the fact that IBM sold its System x servers, SoftLayer/IBM was Supermicro’s biggest customer. That big customer in calendar 2022 could be IBM – we don’t know. That’s a lot of money for Big Blue to shell out and to not show up on its books. If we had to guess, it is not Google or Amazon, which do not move outside of their Foxconn, Wiwynn, and Quanta ODM circles. Meta Platforms and Microsoft both like to build OCP-compliant servers, and there is no reason Supermicro can’t do that as a custom gig. Back when The Next Platform was founded in 2015, Liang told us Supermicro was not really interested in doing this.

If you put a gun to our heads, we think it is Apple. It would be funny if it was Microsoft, and Supermicro put a factory right next to where four new datacenters are going in. (Hint, hint.)

Looking ahead, due to normal seasonality as well as an expected decline in datacenter server spending (for which both Intel and AMD have said will hit both the first and second quarters of calendar 2023), Supermicro is projecting for revenues to decline by 18.5 percent to $1.47 billion, plus or minus $50 million. The typical sequential decline before the pandemic and all of the supply chain disruption was around 12 percent according to David Weigand, chief financial officer at Supermicro.

That sure sounds like that whale customer is done eating at the Supermicro server buffet to us for now. The numbers, if you monkey around with them, support this idea. There are other whales in the sea, of course.

Something’s missing:

…”which would put Supermicro behind only Dell and Hewlett Packard Enterprise, on par with Inspur, and ahead of”…

It’d be nice if Supermicro took security seriously, but then again, if they really intend to become huge, they’ll want to use security issues to make more money…

thank you for the article

Customer was Meta

Yup. Exactly. And I know this because they literally told me when they pushed my huge order for theirs.