Let’s face it. Given how poorly the server market was doing in the final quarter of 2018 and the first two quarters of 2019, we had no idea how well or poorly 2019 might end up for Intel’s Data Center Group and the server industry at large. As it turns out, the close of the 2019 year more than made up for the pothole in the road, at least for Intel. It looks like the good times will keep rolling into the first quarter of 2020 that we are in, and then we are, as far as Intel can see, heading into a “digestion phase” among hyperscalers and cloud builders that will see yet another pothole develop.

This is not the normal cycle for the server market, of course, which was dominated by the enterprise budgeting cycle more than any other factor in prior four decades before the hyperscalers and cloud builders started dominating the infrastructure landscape a decade or so ago. Before then, IT departments the world over set an annual budget and the majority usually committed to doing their upgrades at year end, usually in the third or fourth quarter, depending on their busy times, and fewer did it during the first and second quarters because they had just spent money on infrastructure one or two quarters earlier.

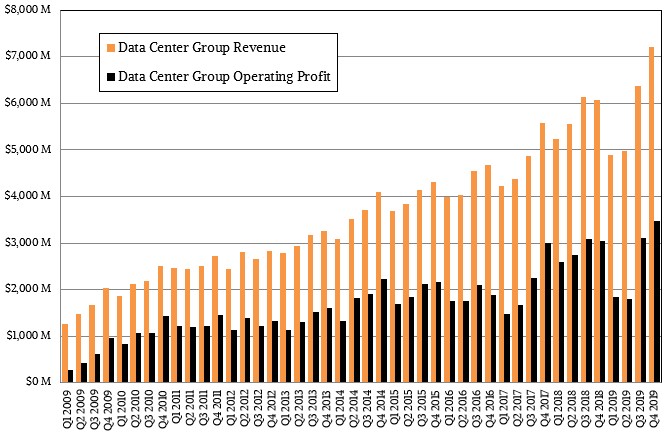

That cycle is still one of the waveforms underlying server sales and therefore the Xeon processor sales at Intel, and you can still see pushing the aggregate up and down in the revenues below, which we have plotted since the belly of the Great Recession in 2009:

That upgrade curve was very steep coming out of the Great Recession because spending had been curtailed since late 2007 and things were starting to warm up. There was a little pothole in the market at the end of 2016 and early 2017 and another that started forming in the server revenue road in Q4 2018 and extended until well into the third quarter of last year. If you just eyeball that curve, somewhere around $2 billion in sales of processors, motherboards, chipsets, and other gear by Intel’s Data Center Group did not materialize from late 2018 until into the third quarter of 2019, but the fourth quarter made up about $500 million or so of that ground. But this was against a relatively easy compare because sequential sales from Q3 2018 to Q4 2018 were muted. Yes, turning in 18.8 percent revenue growth year-on-year to $7.21 billion, a very high record, is impressive; and bringing $3.47 billion of that to the middle line of operating income – 48.1 percent of revenues – is equally impressive, but only up by 13.6 percent. Intel is getting pinched profits, even if they are high. And for the full 2019 year, Data Center Group’s revenues were only up 2.1 percent to $23.48 billion, and its operating profits actually fell by 10.9 percent to $10.23 billion.

On a conference call with Wall Street analysts going over the numbers for the final quarter of the year, George Davis, Intel’s relatively newly minted chief financial officer, had this to say about the 2020 year, and we wonder if Wall Street and investors will remember this: “We expect revenue from our data centric businesses to be up high single digits for the full year as we capitalize on the secular trends that Bob [Swan, Intel’s chief executive officer,] outlined. We are expecting an exceptionally strong Q1 as cloud customers continue to build capacity and adopt our highest performing products. This will mark three quarters of strong cloud buildout and we expect more modest capacity expansion for the remainder of the year as CSPs move to a digestion phase. We are also planning for an increasingly competitive environment as we move through the year. As a result of these dynamics, we expect total revenue to be more front-end loaded in the first half than we have seen historically.”

So there’s a new cycle emerging, of binge spending by clouds and hyperscalers for three quarters, that is overlaid on top of the gradually increasing sales by enterprises that has dominated the IT sector for as long as there has been one. These two waves, rising and falling – and not precisely independently from each other because enterprises of all sizes are using the free services and buying the priced ones at those hyperscalers and cloud builders – are creating a much less stable and predictable wave than we might have expected. The cloud service providers and communications service providers are reckoned separately by Intel’s bean counters, which is good because we can see this set of telecom companies and Internet service providers, and in the fourth quarter, sales of Data Center Group products rose by 14 percent, in stark contrast to the 7 percent decline for products going into enterprise and government accounts and the staggering 48 percent growth of products shipped to the cloud service providers – what we call hyperscalers and cloud builders.

On the competitive front, it looks like Intel is getting its 10 nanometer processes finally ramping, although it has shown full well that at the right pricing for hyperscalers and cloud builders, it can appease them with 14 nanometer Xeon SP processors for quite some time, with the “Cascade Lake” Xeon SP ramp being the fastest one in Intel’s history. We don’t know how low the pricing is going as the volumes are rising, but what we do know is that across all markets, Data Center Group volumes rose by 12 percent in Q4 compared to only a 5 percent rise in average selling prices (ASPs) during the same period. We suspect that ASPs went down – way down – among these upper echelon customers, and that enterprises and smaller CSPs paid for more as they got more features in the Cascade Lake lineup. While AMD is making inroads into the datacenter with its hybrid 7/14 nanometer “Rome” Epyc processors, we think the market has expanded enough that AMD can get a piece of the pie but still not hurt Intel.

This will not hold. At some point, and it is looking like it will be the second quarter of this year, AMD will start to hurt Intel in CPUs, and if AMD keeps to its plans, it will hurt increasingly more as they compete in GPUs. Intel is wisely making all the money it can while it can as it sorts out its Xeon SP roadmap and the processes that it will use to make future server CPUs, GPUs, FPGAs, and NNPs. But in the longer run, we will have genuine competition, and it will bring down costs for compute and it will definitely eat into Intel’s profits. Period.

In the meantime, we see a new team at Intel, at the top with Swan and Davis and in the CPU and GPU chip design teams with Jim Keller and Raja Koduri, and in many places above and below. Intel is adding 14 nanometer and 10 nanometer capacity, mostly to help with PC volumes, but frankly, it has benefitted mightily by focusing on high end PC chips and charging a premium for them and leaving some of the low-end to AMD. (The other option, just lowering production on all PC chips would have let AMD in anyway and resulted in less revenues and profits for Intel. So this is smart in the short term and maybe in the long term. We shall see.) The 10 nanometer rollout started in the datacenter with the Agilex FPGAs last November, and will expand with the first (and as yet unnamed) Xe discrete GPU and the “Ice Lake” Xeon SP processors in the second half of 2020. Server makers, Swan explained, have already received Ice Lake Xeon samples, and during the first half Intel will start production of wafers for these chips and in the second half they will ship them to server makers – and they will appear in products – in the “latter part of 2020.”

As a reminder, Swan said that Intel’s follow-on 7 nanometer process will be used to make the second generation “Ponte Vecchio” Xe discrete GPU at the end of 2021 and to be followed in early 2022 in Xeon processors.

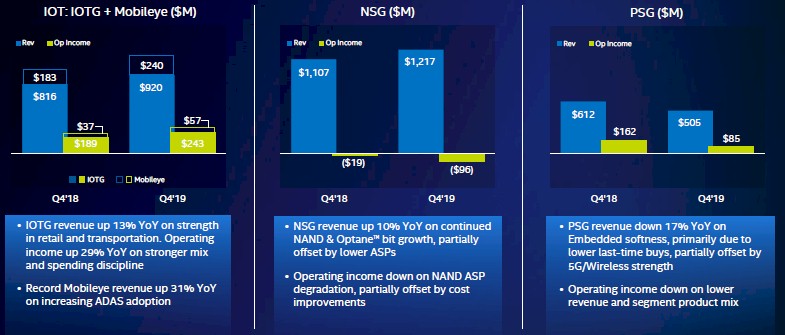

Intel has a bunch of products that get sold into the datacenter that are not counted in its Data Center Group, including some flash and Optane memory as well as some FPGAs in the Programmable Solutions Group (the formerly independent Altera business) and some Internet of Things products, too. Here is how these products did in the quarter:

In the fourth quarter of 2019, IoT Group revenues rose by 42.2 percent to $1.16 billion and operating income rose by 58.7 percent to $300 million, which is definitely moving in the right direction. Non-Volatile Memory Solutions Group posted $1.22 billion in sales, up 9.9 percent, but Intel still lost $96 million at the operating level in this business. Admittedly, it is a lot less than in the other quarters for 2019, which combined for a $1.08 billion operating loss in the first three quarters. Programmable Solutions Group had a 17.5 percent revenue decline to $505 million, essentially flat sequentially, and it posted an operating income of $85 million, a little more than half the operating profit from the year ago period.

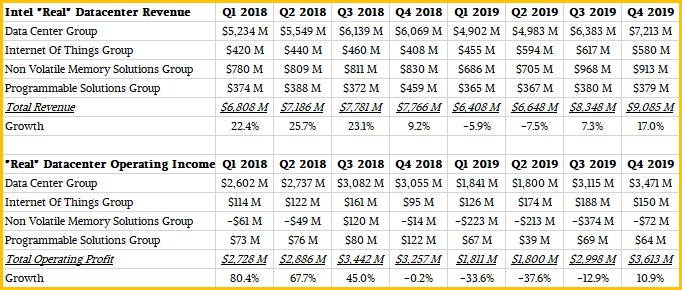

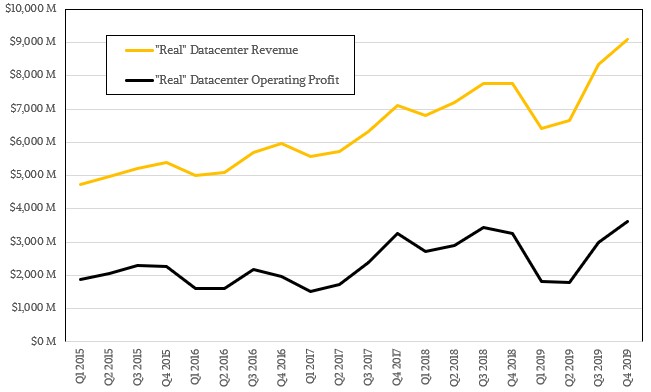

It is hard to know for sure how much of this stuff goes into the datacenters of the world, but we have a model that tries to put all of the “real” datacenter stuff from Intel into one basket and count it each quarter. Here is the table for that model:

And here is the trend chart for the Intel “real” datacenter group revenues and operating profit, evenly allocated by product (which we know is not perfect).

The operating profit trend mirrors the revenue trend when you add this all up, but the revenue trend is a bit steeper. You can see the revenue potholes that Intel goes into every now and then across this line. But let’s be clear. Every IT company would kill to have lines that look like this. Bad things happen to all companies, in time. It is how they survive and adapt that matters. Intel is adapting, and so are others, and this will be an ecosystem rather than a monoculture in the long run. And that is healthy for all players, even if it is of necessity somewhat less profitable on the whole.

“AMD will start to hurt Intel in CPUs, and if AMD keeps to its plans, it will hurt increasingly more as they compete in GPUs”

Not clear what you mean… Are you referring to the APUs? Intel has 0 market share currently in discrete GPUs.

Who believes Intel’s roadmap anymore? There have been leaks of the giant problems Intel has had coming out w/ 10nm at scale, for years, and they were right. Now the leaks are saying nothing competitive w/ AMD’s server CPUs until the 2H 2023 at the earliest. What we really need is more investigative value-add about how bad the situation really is.