The hybrid cloud is convincing established players that they need to play on both sides of the net, in the cloud (as well as the edge) and on premises. We’ve seen Amazon Web Services (with its Outposts appliances), Microsoft Azure (with Azure Stack), Google Cloud (with Anthos) and Oracle Cloud have all found ways to enable enterprises to run their cloud services in their won datacenters or in colocation facilities.

Likewise, established datacenter hardware vendors like Dell Technologies, with the Apex project it announced last year, Cisco Systems and Pure Storage are pushing initiatives to eventually offer most or all of their portfolios as a service, essentially giving organizations cloud-like capabilities around scalability, agility and flexible, opex-based consumption models in their own datacenters. In addition, the vendors are enabling many of their services to be accessed via public clouds as well.

Hewlett Packard Enterprise was a little ahead of the game, announcing in 2019 that it planned to make its entire portfolio available as a service by next year, using its GreenLake hybrid cloud platform as the foundation. Since then the company has steadily built up the capabilities in GreenLake. Most recently, HPE last year made its Nimble Storage dHCI disaggregated hyperconverged infrastructure available via GreenLake. At the same time, HPE rolled out a new software portfolio – Ezmeral – aimed at modern workloads, from artificial intelligence (AI) and machine learning to data analytics and MLOps. It made the Ezmeral Container Platform and Ezmeral MLOps available as cloud services in GreenLake, which brought it into closer competition with other Kubernetes and container offerings, including VMware’s Tanzu and Red Hat’s OpenShift.

Later in 2020, HPE began offering its broad portfolio of HPC hardware and software available as a service via the platform, enabling organizations to run pre-configured HPC cloud managed services on premises or in colocation facilities. With the flexible payment modes, enterprises can get access to massive amounts of compute power and storage capacity without high upfront or operational costs. Last month, the vendor announced an expanded storage-as-a-service effort that involves software and hardware technologies from its own lineup and that of its networking arm, Aruba Networks, leveraging GreenLake.

At this week’s virtual Discover 2021 event, HPE again is putting the focus on GreenLake, from the new Lighthouse platform and Project Aurora to expanded partnerships and the acquisition of startup Determined AI in an effort to enable enterprises to more easily adopt, deploy and run AI workloads and to view HPE and GreenLake as the best environment for such applications. HPE wants to continue to push its advantage over its rivals in the rapidly expanding as-a-service movement.

“This is about advancing our vision to offer everything as a service through a major cloud architecture, where GreenLake is the North Star of everything we do in the company,” HPE president and chief executive officer Antonio Neri told journalists during a briefing before the show opened. “Clearly, we have a market leadership and differentiation and we are accelerating that differentiation. This is all about an experience. It’s not about technical widgets. That experience, to bring it together, is very hard to do. It happens through the software layers and that’s where HPE has been investing for a number of years, with the original vision – with Flex Capacity – but ultimately, that GreenLake experience that we’ve brought to the market over the last 24 months.”

The development of GreenLake – as with other as-a-service initiatives – is being driven by the increasingly distributed nature of IT and business, all of which was only accelerated by the COVID-19 pandemic. IT spans datacenters, colocation facilities, the cloud and the edge, data and applications themselves are distributed throughout those different locations and workforces are increasingly working remotely outside of main or branch offices.

The push appears to be working. According to Keith White, senior vice president and general manager of HPE’s GreenLake Cloud Services business, the vendor now has 1,200 enterprises using GreenLake, which comes to almost $5 billion of total contract value. The retention rate is close to 97 percent, said White, who came to HPE in late 2019 after 25 years at Microsoft, where he worked on developing the Azure cloud. Recurring revenue from GreenLake jumped 30 percent year-over-year in the most recent quarter.

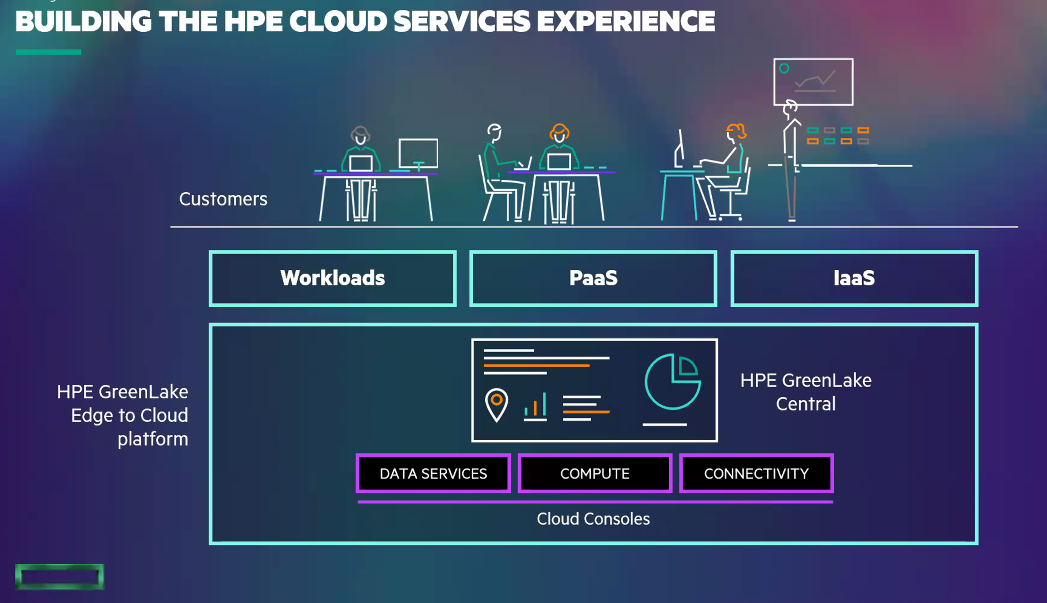

“The cloud has really driven a lot of cloud expectations,” White said during a press briefing. “As we think about customers and their focus on digitally transforming as well as moving to this Age of Insights with all of the data and the ability to monetize and make decisions on data, it becomes even more important that they have a set of platforms that provide them with the capabilities they need, with which to analyze and make decisions of that data itself. With these expectations that the public cloud has brought, we’re seeing a lot of that come to the on-prem space and this is where GreenLake really shines.”

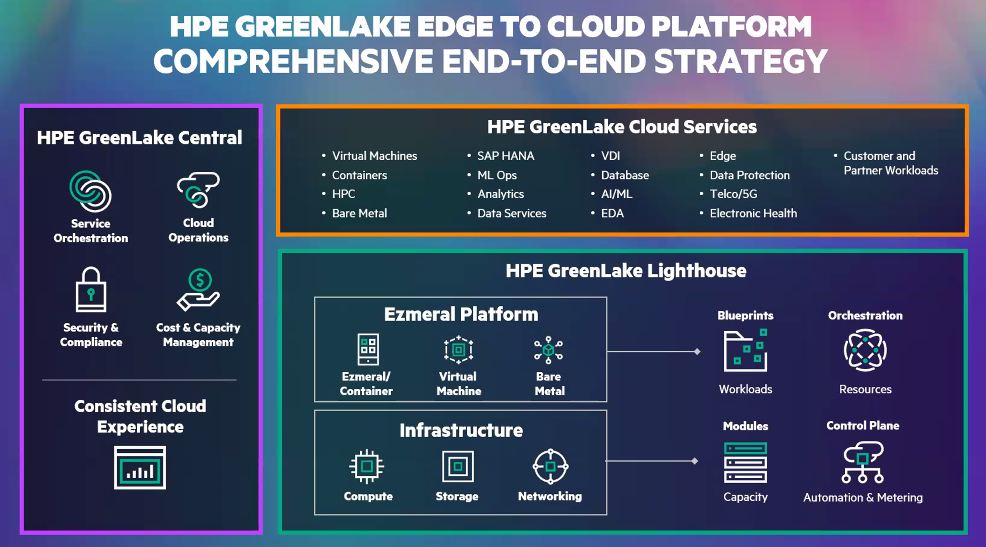

Lighthouse encompasses both the Ezmeral containerized software platform and the compute, storage, and networking infrastructure that the software runs atop. It also comes with a range of other resources, from metering and automation to orchestration. Kumar Sreekanti, HPE’s chief technology officer and head of software, described Lighthouse as a “purpose-built cloud platform that is designed to run the cognitive applications that are distributed across from edge to the colo to the datacenter. It’s modular, it’s flexible. It’s API-driven and it has the ability to expand elastically.”

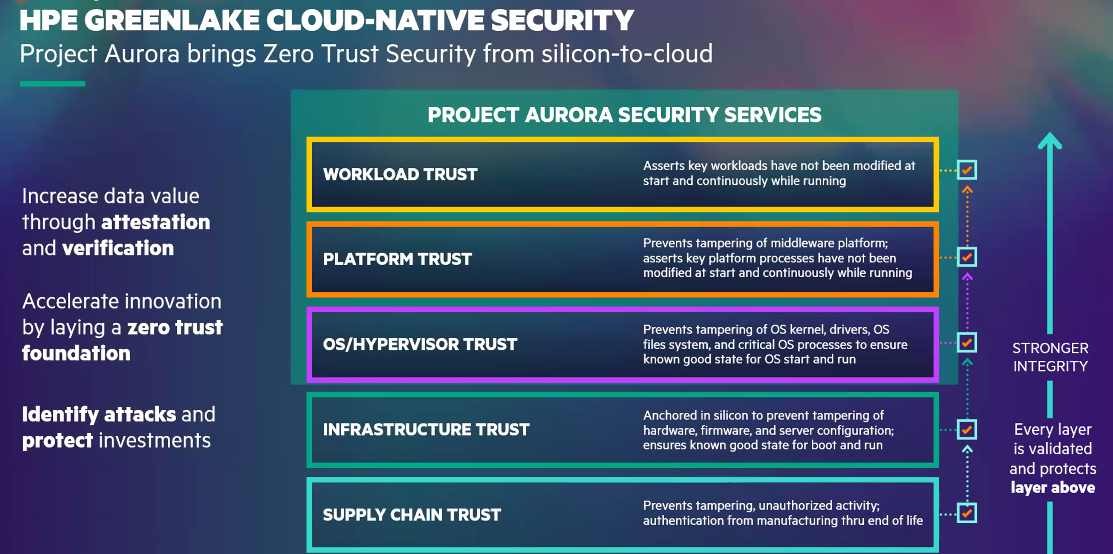

Meanwhile, Project Aurora is designed to provide cloud-native, zero-trust security to GreenLake’s cloud services. The goal is to embed the technology throughout GreenLake, starting with Lighthouse, to automatically ensure the security and integrity of a range of components, from hardware to operating systems to platforms. Journalists noted that Aruba also has a zero-trust framework, as does Silver Peak, which HPE bought last year for $925 million. When asked where all these zero-trust capabilities fit, Sreekanti said the issues of integration still have to be worked out. The zero-trust effort with Lighthouse started after HPE bought startup Scytale earlier last year.

“That’s why we call this Project Aurora, to remind you it’s the project Aurora and not the product Aurora yet,” he said. “That means the next steps that we have to go figure out how to extend Scytale. I’m very confident that the teams will come back with more cohesive integration for the customers.”

The new Compute Cloud Console is being placed alongside the Connectivity Console and Data Services Console (introduced last month). All the consoles are based on the Aruba Central technology, which has more than 100,000 customers and supports more than a million networked devices. The Compute Cloud Console is a cloud-based management service automates an enterprise’s compute capabilities.

HPE also is partnering with Intel to create Silicon On-Demand, a capability that will enable enterprises to leverage the consumption-based payment model to the core and persistent memory via Intel’s Optane. Through a single click, organizations can ramp up or down the compute power and pay only for what they use.

The vendor also unveiled a range of new partnerships, including GreenLake support for Microsoft’s Azure Stack HCI (hyperconverged infrastructure) and SQL Server. There also are new partnerships with Nutanix for virtual desktop infrastructure (VDI) – which became more in demand during the pandemic with so many employees working from home – and databases, Veeam for data protection and Qumulo for storing and managing unstructured data. In addition, HPE announced it was buying startup Determined AI, which offers a machine learning-based software platform for training AI models more quickly and at any scale. The plan is combined Determined AI offerings with HPE’s HPC portfolio.

Neri called the deal “a small acquisition, but very symbolic of what we see in the market. AI is a unique company focus on artificial intelligence and deep learning would really make it simple for customers to adopt it. … If you think about AI today or machine learning or deep learning, one of the biggest challenges customers have is they don’t have the expertise. Second is there is a lot of preparation of data that happens upfront. Then you need to architect the right algorithms to run it and then to deploy that outcome somewhere. With Determine AI, we complete that stack from obviously best foundation technologies with the acquisition of Cray that can be integrated into a system of massive scale – exascale – capabilities. Second is the fact that we already had an attractive programing environment for AI, big data simulation and modeling with the Cray Programing Environment. Now we put on top of that Determined AI with these training models, which are ready to be deployed.”

The CEO was clear that HPE is not done building on GreenLake. When asked whether GreenLake eventually will become better known in the marketplace than HPE, his response was quick.

“Yes, absolutely,” he said. “That’s the intent, right? That’s the goal. That’s why we let out a vision that GreenLake should be synonymous to HPE. Absolutely. This will be our leading product, our leading offer, our leading experience, where everything else underneath is part of that experience — whether it’s connectivity-as-a-service, whether it is … workload optimization, whether it’s AI [and] machine learning, all of that caters to that platform.”

Be the first to comment