The first half of last year was relatively weak for Intel’s Data Center Group last year, but despite the coronavirus pandemic – and in some cases, we think because of it – the world’s largest datacenter chip manufacturer is looking to not only have a good first quarter, as it just turned in, but could see growth across its various data-centric businesses well into the second half of the year.

It certainly has not hurt matters that Intel did a very unusual refresh in the “Cascade Lake” Xeon SP lineup back in February – the so-called Cascade Lake-R bin resorting – and also that it quietly killed off the “Cooper Lake” Xeon SP follow-on, which was to have supported Google’s bfloat16 data format for machine learning. Knowing that there would be no new Xeon SP processors until the long-awaited 10 nanometer “Ice Lake” Xeon SPs come out in the final quarter of the year means that hyperscalers and cloud builders can just invest in the Cascade Lake-R chips now, which offer more cores, higher clocks, more cache, and better price/performance than the original Cascade Lake chips that debuted in April 2019. Sometimes, knowing you are not going to get a better or different deal can grease the skids, and we think this certainly happened in the first quarter of 2020 for Intel.

We also think that hyperscalers and cloud builders, as well as their telco and service provider peers, figured as the coronavirus pandemic outbreak started spreading from China in the middle of January to Europe and the United States in February and early March that they would need to build out their infrastructure. There’s nothing cynical about that, if that indeed happened, and Intel’s top brass never came out and directly said that in the call with Wall Street going over the financial results for the company for the first quarter of 2020. Intel had been expecting a strong Q1, but not as strong as this, and it also expected for a period of slowdown in Q2 and possibly Q3 this year as hyperscalers and cloud builders digested the compute they already acquired. Now, according to Bob Swan, Intel’s chief executive officer the “demand signals are very high” and “the trends are very encouraging” and it looks like Intel will ride a capacity wave all the way into Q3. It may be a leading indicator that these companies are not particularly impressed with “Ice Lake” and they will wait for the fourth generation “Sapphire Rapids” Xeon SPs to make big investments in 2021. We shall see.

All we can know for sure is that Intel is selling a lot of PC chips to people working from home thanks to the pandemic and is selling lots of server chips and flash and other stuff to datacenter operators who are seeing demands on their infrastructure grow as they support people working remotely and their bored children during the day and their bored and stressed out selves at night. We also know that Intel can’t know how any of this will play out in the coming quarters, and that is why the company has removed its guidance for the 2020 year. Times are good now, but that does not mean by any stretch that it will stay that way.

In the quarter ended in March, Intel basically turned in a carbon copy of its fourth quarter of 2019, at least at the top level:

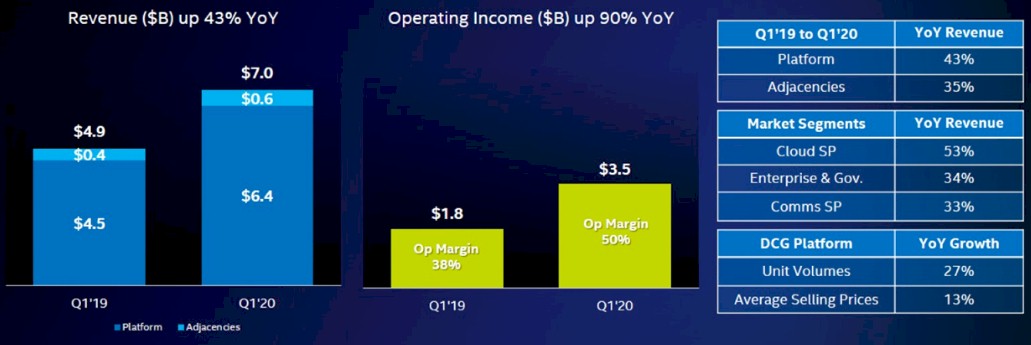

Well, to be honest, Intel’s revenues in the Data Center Group dipped a little from Q4 2019 to Q1 2020, and its profits held, which means it was able to make it up in average selling prices, which rose by 3 percent quarter on quarter, while volumes actually fell by 5 percent. The growth compared to Q1 2019 was nothing short of stellar, but remember it was against an easy compare because the first quarter of last year was not very good at all – at least compared to what Intel has been doing in recent years. Data Center Group platform volumes rose 27 percent and ASPs were up 13 percent year on year in the March quarter, and that is just truly amazing. Nothing seems to stop Data Center Group. Intense competition from AMD, a pandemic. The only thing that does slow it down is the buying patterns of the hyperscalers and cloud builders.

Platform sales in Data Center Group rose by 43.4 percent to $6.43 billion, and adjacency sales in networking and other areas rose by 34.8 percent to $566 million. So overall, Data Center Group posted sales of $6.99 billion, up 42.7 percent. Operating profits at Data Center Group skyrocketed by 89.7 percent to $3.49 billion. This was Data Center Group’s most profitable quarter in its history (better than Q4 2019) and its second highest revenue generating quarter (second only to Q4 2019).

The growth rates for Data Center Group in Q1 2020 by industry sector were through the roof, but remember this is against an easy compare. Cloud service providers – what we call hyperscalers and cloud builders – had a 53 percent revenue bump and communications service providers – what we call telcos and other service providers – had a 33 percent growth rate. Together, these two sectors accounted for $71 percent of Data Center Group’s revenues, or $4.97 billion. The other $2.03 billion came from enterprise and government customers, who also saw a 34 percent rise in sales in the period.

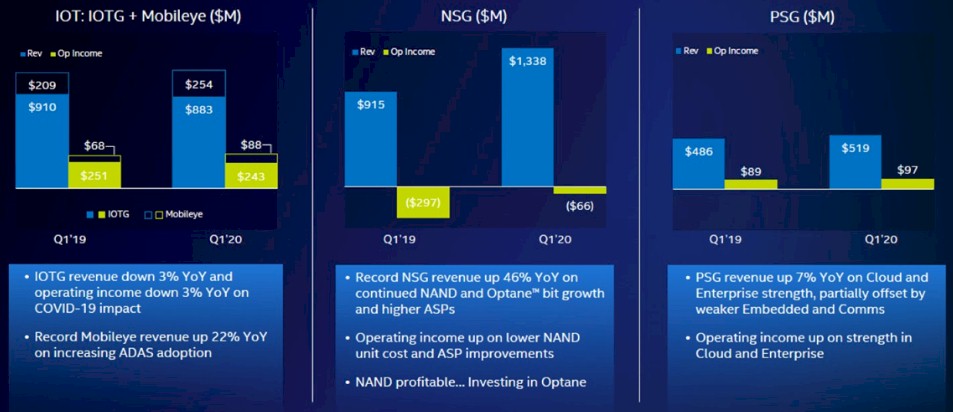

The IoT market is feeling the pandemic a bit, with sales off 3 percent, but flash and Optane sales were up 46 percent to $1.34 billion and the NAND flash business is now profitable. The Programmable Systems Group had 7 percent growth to $519 million, driven by cloud and enterprise, which boosted operating income for FPGA sales.

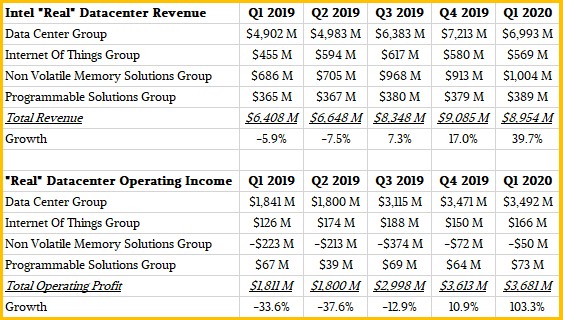

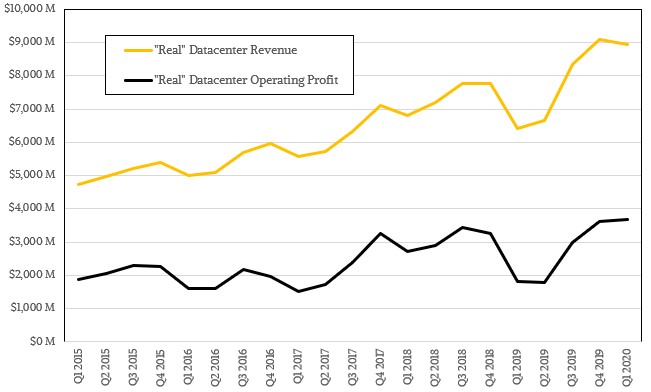

Every quarter, we do a reckoning of what we think Intel’s “real” datacenter sales are, including a portion of sales across these data-centric businesses. Not all Optane or flash storage or IoT or FPGA sales are for datacenter uses cases – some end up in client devices or other kinds of gear that is not datacenter equipment. Here is the table of the breakdown of those estimates:

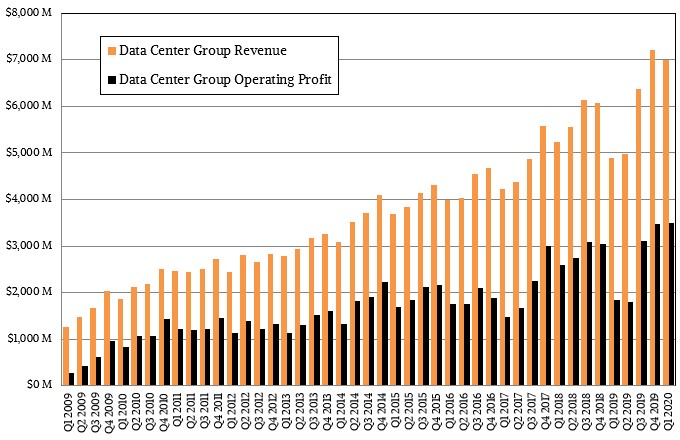

And here is the chart that shows the trends over the longer term:

We think this “real” datacenter business at Intel grew sales by 39.7 percent to $8.95 billion and operating profits more than doubled to $3.68 billion. This is an unprecedented amount of money for one vendor to extract out of the glass houses and glass warehouses of the world. No matter what, you have to admit that it is impressive as hell. But as we have said before, in the fullness of time, this cannot and will not hold – at least not at those levels.

Be the first to comment