Amazon Web Services is at the top of an expanding mountain, the dominant player in a public cloud services space that is expected to push past $200 billion in revenue this year and make its way well beyond $300 billion by 2022. The share of this massive and fast-growing market – one that the company played a significant role in creating – that AWS commands sits at about 40 percent, significantly larger than its rivals, including Microsoft Azure and Google Cloud. It is by far the biggest bully in the playground.

But AWS is a big kid with a healthy dose of paranoia, and for good reason. As Andy Jassy, chief executive officer at AWS, noted at the beginning of his keynote address at the re:Invent show in Las Vegas, while the cloud – private cloud, hybrid cloud, and multicloud – is a central focus in the IT industry and among businesses worldwide, it’s still in its relatively early phases, as illustrated by the fact that as much as 97 percent of the $3.7 trillion IT market is still running on servers and other systems housed in on-premises datacenters. So while AWS may have more than a third of the public cloud market, there are still massive numbers of workloads out there that are still up for grabs among cloud providers, and those rivals are not small startups.

Microsoft has deep hooks into the enterprise space and a broad installed base from which to draw from, as do other vendors like IBM and Oracle. Under CEO Thomas Kurian, Google Cloud is making a strong push to grow its enterprise customer base, and in China there are other large players with deep pockets, notably Alibaba and Tencent. AWS can count a lot of major corporations – GE, Goldman Sachs, Capital One, Pfizer and Shell, to name a few – as customers as well as notable high-profile cloud-based companies like Lyft, Uber, Airbnb, and Peloton.

But there’s a long way to go in the cloud and Jassy and other executives know that a significant market share lead is not guaranteed. His keynote was what the 65,000 attendees have come to expect at Re:Invent: a recounting of where AWS stands at the moment, a few shots at competitors – particularly Microsoft – and the unveiling of a host of new technologies and services designed to give enterprises and developers the tools in the cloud they need to continuing transforming their companies into digital businesses and to show the strength of AWS’ innovation engine. It’s like AWS is Elizabeth Warren for the cloud: if there is a problem, AWS has a plan for that.

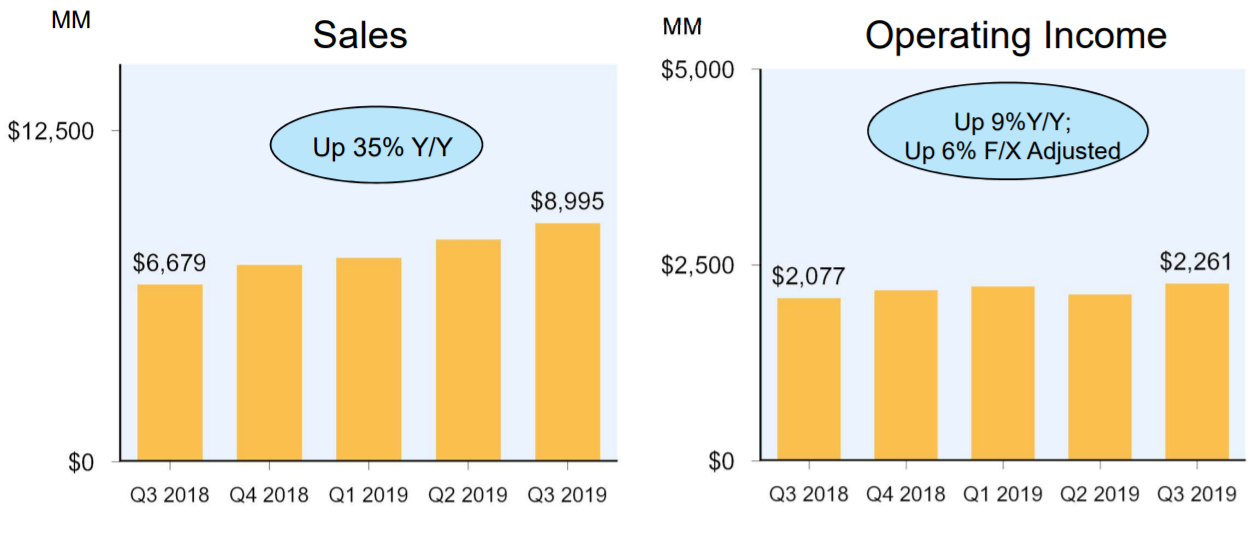

And the resources. In the third quarter, AWS generated almost $9 billion in sales, a 35 percent year-to-year increase, and during his three-hour keynote, Jassy showed what some of that money is going to. He made more than a dozen new announcement that touched on a broad array of areas but that still tied into a central theme of helping enterprises, more than 175 services and more on the way, outpacing others in the space.

“Nobody has close to the same number of services,” he said. “But it’s not just the number of services, it’s the depth of features and capabilities within these services. There’s a lot of noise out there and there are a lot of companies who have become pretty good at being checkbox heroes, where they kind of look at something we have and they rush to have it out there and say, ‘We have it, too.’ When you look at the depth and the details of the offerings, they’re pretty different. You’ll see this across all these major infrastructure components: compute, storage, database, analytics, machine learning and IoT [Internet of Things] and robotics, messaging and content distribution and marketplace for people services. Very big differences.”

It Is In The Chips

AWS uses X86 from Intel and AMD and GPUs from Nvidia in its datacenters, but through its Annapurna Labs unit, the cloud giant has become a chip maker as well when it launched its custom Arm-based Graviton chips last year. This week, the company unveiled new EC2 instances powered by its new 7-nanometer Graviton2 processors, based on Arm’s Neoverse platform that promise seven times the performance, five times the speed and four times the cores of the first generation. The Next Platform has done a deep dive into the new chips here.

Jassy also introduced a compute instance aimed at machine learning inference workloads. While much discussion in the field of artificial intelligence (AI) is around training, inference is where enterprise feel the real cost, he said. The new Inf1 instances are designed to drive down the cost-per-inference by 40 percent and is based on AWS’ Inferentia AI chip developed by the Annapurna division. The chip is available in EC2 now but will spread later to other AWS services, including the SageMaker machine learning platform, ECS container service and EKS Kubernetes service.

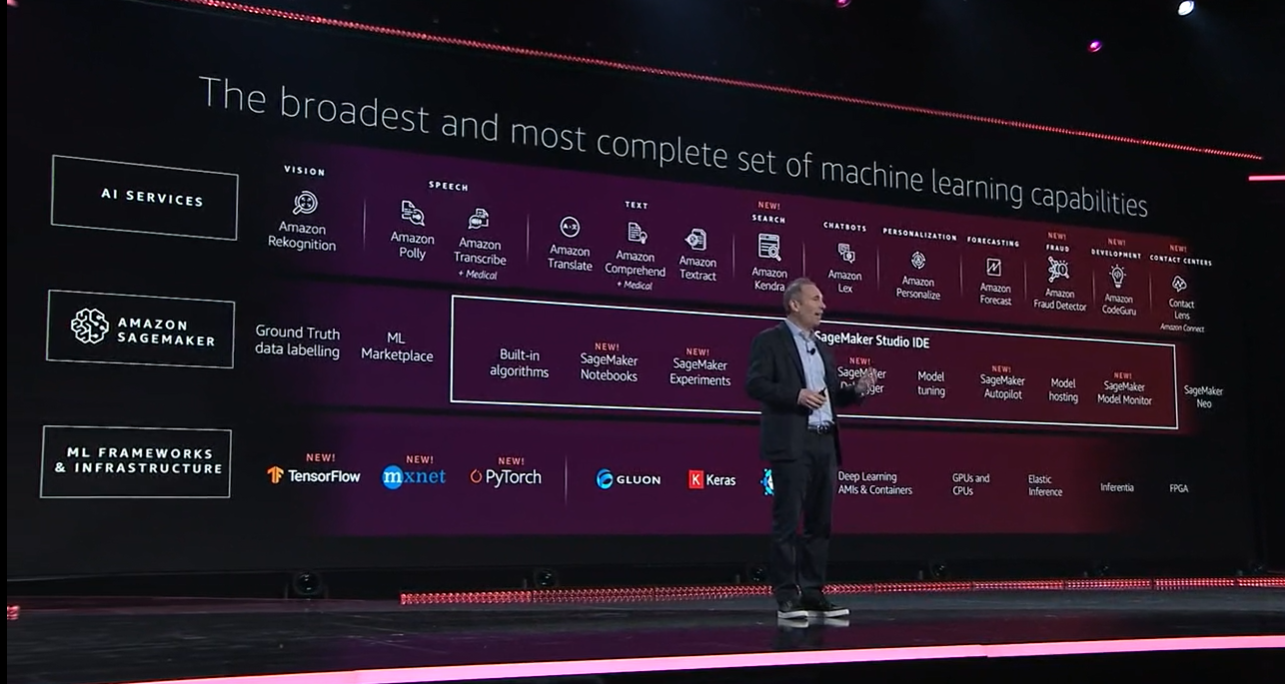

More Tools For Machine Learning

AWS also unveiled number of new services and tools for SageMaker, including SageMaker Studio, an integrated development environment (IDE) that serves as a single place for components like source code, dependencies and documentation. In addition, the company rolled out SageMaker Notebooks for quickly spin up elastic machine learning notebooks and for automating the process of sharing them, SageMaker Experiments to enable developers to more easily compare learning model iterations, training parameters and outcomes, and SageMake Autopilot to let developer put simple data into CSV files and have models spin up automatically.

There also is SageMaker Debugger for real-time monitoring for machine learning models and SageMaker Model Monitor to keep an eye on the performance of a model running in production.

There also were five new services for machine learning introduced. Amazon Kendra uses natural language processing and other techniques for enterprise search, CodeGuru to automate code reviews and find the most expensive lines of code, Fraud Detector to help business detect online identity and payment fraud in real time, Transcribe Medical for speech-to-text transcriptions for healthcare facilities, and Augmented Artificial Intelligence (A2I) for using human confirmations to validate machine learning predictions.

Keeping An Eye On The Hybrid Cloud

Almost two years ago, AWS announced Outposts, appliances for customer on-premises datacenters that connect easily back to their AWS cloud environments. Most enterprises will keep some of their applications and data in their datacenters for security or compliance reasons, so AWS and other cloud providers are offering ways to enable customers to more easily run their cloud services on premises and seamlessly link back to the cloud. Microsoft is doing this through Azure Stack and Azure Arc, while Google Cloud is leveraging its Anthos platform. AWS Outposts are appliances that the company will install and manage.

“This was very much something that we were thinking about over the last few years because there was a model out there to try and solve this issue that we’ve heard from customers didn’t work for them,” Jassy said. “That’s because they provided this solution that was different APIs, different tools, different control plane, different hardware. It was really hard for customers to use. It’s not that surprising. When you’re taking two things that are as different as on premises and the cloud and then try to connect those two things together with a clunky bridge, you end up with something that’s clunky and hard to use. … We took a different approach. We thought about it less as building this concrete bridge between these two different things and more about distributing AWS on premises.”

Outposts come in two variants. The first is Native AWS for traditional AWS environments and is available now. The other is for VMware Cloud on AWS environments and will come next year,

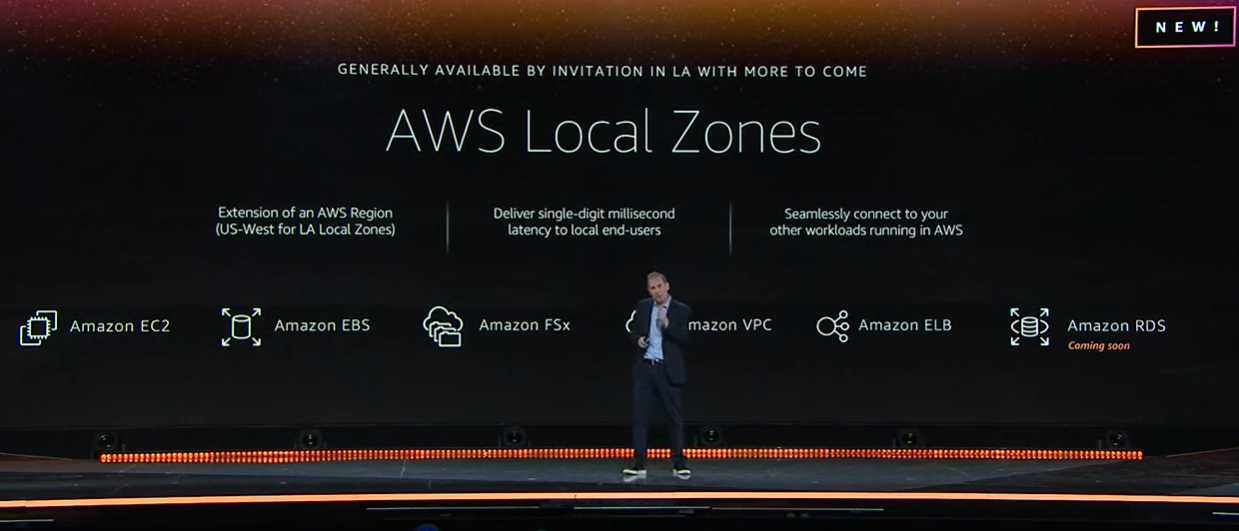

Jassy also unveiled two other offerings aimed at hybrid environments. AWS is developing Local Zones, cloud infrastructures that include compute, storage, database and other services that are located close to enterprises that need low latencies. They can access services like Amazon Elastic Compute Cloud, Amazon Virtual Private Cloud and Amazon Elastic Block Store locally while being able to easily connect to their workloads running in whatever region they’re in. The company initially is opening such a zone in Los Angeles with other locations coming later.

“We’ve taken Outposts and we’ve done some innovation and variance to it,” the CEO said. “Now for customers we couldn’t bring an Outpost to their on-premises datacenter those areas because they didn’t want on-premise datacenters, we’ve built local zones in metro cities that are buildings that we manage that have Outposts in them with compute storage and database and analytics so you can have single-digit millisecond latency for your end users in those metro cities where they need that latency to get their job done.”

In addition, AWS is partnering with Verizon to bring 5G networking to edge environments. The two companies will use Verizon’s Ultra Wideband network and AWS’s new Wavelength technology that enables developers to build applications that give enterprises single-digit millisecond latencies over 5G networks. The companies are piloting Wavelength on Verizon’s 5G Edge compute platform in Chicago, with additional deployments around the United States coming in 2020.

Containers, Databases, and Data Warehouses

Fargate for Amazon Elastic Kubernetes Service (EKS) enables organizations to more easily run Kubernetes applications on the cloud. Fargate was launched in 2017 on the Elastic Container Service (ECS) and Kubernetes users were asking that it be made available for them.

AWS also added to its Redshift data warehouse service, including with RA3 instances with managed storage designed to deliver higher performance than competing services and to enable enterprise to scale compute and storage separately. AQUA (Advanced Query Accelerator) offers new hardware accelerated cache for faster query performance, Redshift Data Lake Export allows for the exporting of data directly from Redshift to Amazon S3 storage in the Apache Parquet format for analytics. Redshift Federated Query enables organizations to analyze data across Redshift, S3 data lakes and Amazon RDS and Aurora databases. In addition, AWS is rolling out a managed Apache Cassandra database serverless service.

It is a continual and relentless pace of hardware and software innovation, and it is why AWS took the lead in cloud and why it will probably maintain it for the foreseeable future.

Be the first to comment