A few years ago, about two dozen Oracle employees began work in downtown office space in Seattle to start mapping out how to make the enterprise software giant and occasional system maker a competitive player in a crowded public cloud space that is dominated by the likes of Amazon Web Services and Microsoft Azure, and also includes a host of other high-profile companies, from Google to Salesforce to IBM.

Their position wasn’t helped by the fact that Oracle was getting a somewhat late start into the market, with co-founder and chief technology officer Larry Ellison originally dismissing the cloud as more of a passing fad than a trend that would soon come to revolutionize how organizations do business.

The group began by taking stock of not only Oracle’s strengths but also areas where its rivals were falling short. What they determined what that while AWS had grown big by focusing on the needs of developers, what it and other companies were not doing was doing much in the enterprise, a place where Oracle had decades of experience. In addition, thanks to the Sun Microsystems acquisition in 2010 gave it a hardware business that Oracle built on, particularly the Exadata database systems that are foundational to its Oracle Cloud Infrastructure (OCI).

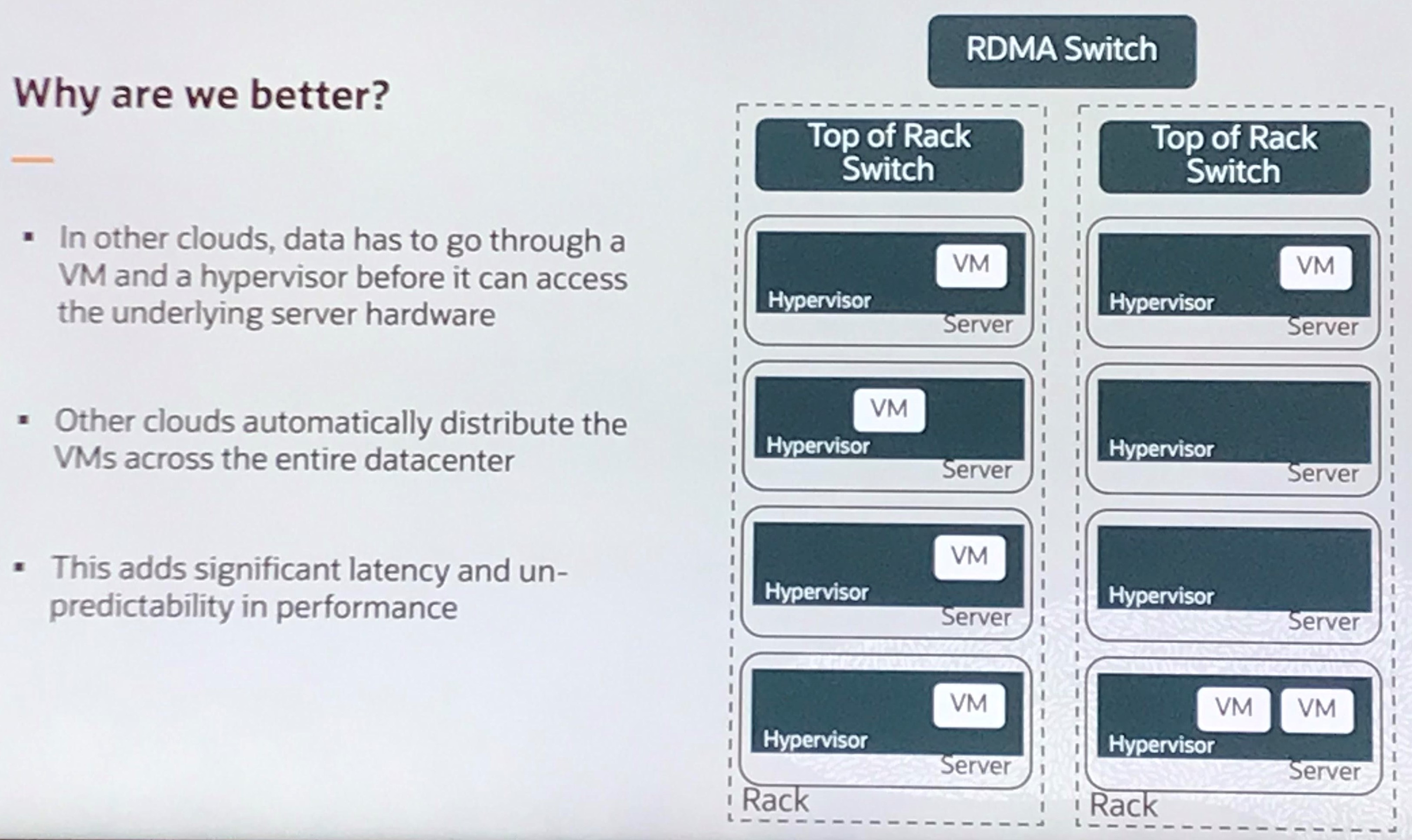

“We thought, what if we built a cloud for the enterprise?” Vinay Kumar, vice president of product management for Oracle Cloud, said during a recent day-long event at the company’s cloud headquarters in a much busier building in Seattle. “What if we shifted the conversation from the lower end of the cloud to the truly high end? Everything that was compelling about the cloud – easy to access, easy to sign on, paying only for what we use, everything is programmatic and with an API interface – nothing that was in the cloud was not compelling to enterprises other than the security was not good because the security was an afterthought and performance was variable and not consistent. Secondly, the older clouds were not targeting the existing workloads.”

It wasn’t going to be easy. There was a “big mismatch in expectations” in what the cloud could offer to and was delivering for enterprises, Kumar said. Enterprises didn’t want to spend a lot of time recoding their applications to run in the cloud, for example. In addition, putting in place everything that that was needed to be a cloud provider to compete with Amazon and Microsoft – such as a bare minimum of services and a presence in multiple regions around the globe – requires hard work and a lot of money.

According to Kumar, Oracle also is experimenting with what it calls dedicated regions, which are essentially on-premises instances of Oracle Cloud for large enterprises that are limited in what they can do in the public cloud for geographic, political or regulatory reasons. In those instances, Oracle will set up a cloud instance in the enterprise’s facilities. It’s a nod to the growth of hybrid cloud adoption and something other cloud providers are addressing, such as AWS with Outposts appliances, Microsoft with Azure Stack and Google Cloud with Anthos.

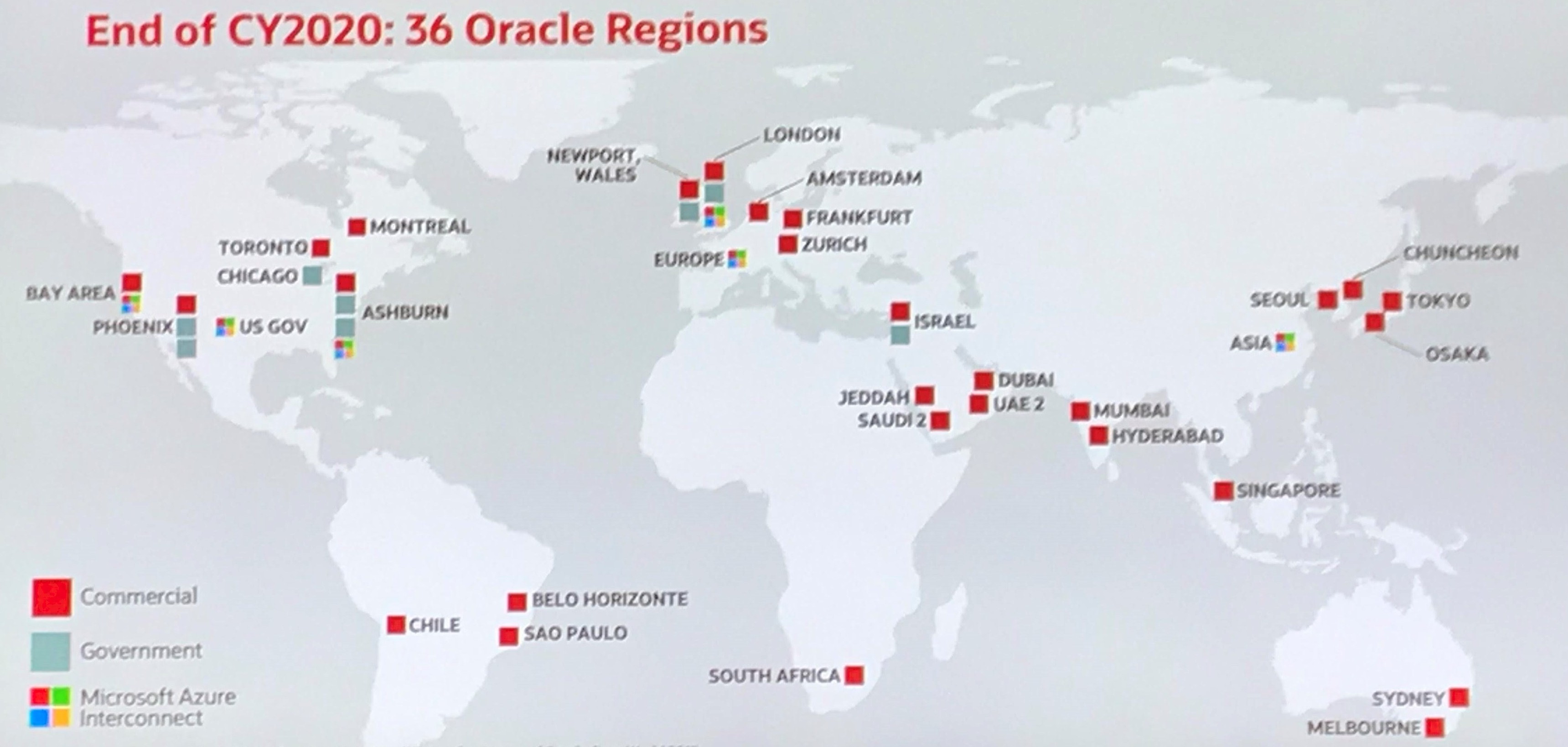

Oracle has made strides over the past three years, including last year rolling out the second generation of its cloud infrastructure and growing from four regions last year to 16 in 2019, with plans for 36 by the end of 2020. It is adding 500 to 800 customers a month and also is entering into partnerships with other tech vendors, particularly VMware and Microsoft Azure, in which enterprise customers of each can migrate and run their mission-critical workloads on the other’s cloud. Oracle and Microsoft also are developing dedicated high-speed interconnects between their datacenters.

The company is all in on the cloud. Oracle earlier this year cut an unspecified number of jobs reportedly to focus more on its cloud efforts and this month announced it was planning to hire another 2,000 people for OCI. The focus is on infrastructure-as-a-service (IaaS), with OCI running the company’s myriad software-as-a-service (SaaS) offerings. In its most recent financial quarter, total cloud services and license support revenues hit $6.8 billion, a 4 percent increase.

Putting A Focus On HPC

About a year and a half ago, Oracle turned its attention to HPC. As we’ve noted at The Next Platform, not all HPC organizations have rushed to embrace the cloud, with concerns around everything from latency and networking costs to software licensing and application portability. In addition, HPC on-premises infrastructures tend to be vary efficient. But Kumar said it was an area that Oracle could address and use as a way to expand its reach into the enterprise. With Exadata and its database and other software, the vendor already offered the tools to work with HPC workloads.

With that in mind, Oracle began bringing in executives with both cloud and HPC experience from other cloud providers – including Taylor Newill and Tajas Karmarkar as senior managers of product management, both of whom had worked at Microsoft with HPC and Azure – and building out cloud infrastructure aimed specifically at the HPC space.

“When we started this a little over a year ago, there were the three of us doing this,” Newill said. “There are, including the sellers who are actively selling HPC if you include the teams that are working with us both, on the engineering side and product management side, there’s probably over 200 people now that are directly engaged specifically on HPC and GPU development, testing and selling. We feel like we’ve been pretty successful.”

Oracle’s OCI HPC infrastructure is based on instances powered by Intel’s latest “Skylake” Xeon processors – with high core count and high frequency options – or AMD Epyc server chips and Nvidia’s “Volta” Tesla GPUs. They offer up to 51.2 TB of local NVM-Express storage per compute instance. The HPC instances leverage RDMA – and RDMA over Ethernet – for fast networks with low latency, block storage of up to 1 PB– as well as InfiniBand and bare metal compute instances. Oracle also offers software frameworks for HPC workloads such as rendering, manufacturing, design, artificial intelligence (AI) and machine learning. Cluster networks offer up to 20,000 cores and 1.5 millisecond latency between nodes.

Coming next year will be new E2 instances leveraging AMD’s Epyc chips based on the new “Rome” and standard and HPC X9 instances leveraging Intel’s latest Xeons. The HPC instances will include up to 36 cores, local NVM-Express SSDs, two 100 Gb/sec RDMA ports (we presume this will be Ethernet, not InfiniBand), and the ability to scale to tens of thousands of cores per cluster. Also on the horizon are GPU bare metal instances.

The cloud infrastructure with such features as bare metal instances and RDMA is a driver for Oracle in HPC and allows the company to further create a “beachhead” into the enterprise, according to Kumar. Oracle is currently focusing on three industries: automotive, manufacturing and aerospace, oil and gas and financial services. It’s also leveraging software partnerships with such HPC players as IBM (which has put its Spectrum Scale LSF on OCI), Altair, and Univa.

Newill said he is seeing customer interest in HPC through the Microsoft partnership.

“In practice so far, is a customer that has commitments, that has paid for both Microsoft and Oracle, wants to use some part of our cloud and some part of the Microsoft cloud,” he said. “It typically so far has been the intense interest in Oracle Automated Data Warehouse Cloud on the Oracle side and feeding that data or streaming that data into one of the instances on the Microsoft side. We’re starting to see interest specifically in HPC, where customers are actually asking to run a containerized HPC application specially on Singularity and streaming data from an object store inside of Microsoft Azure. This is a solution we’re in the process of building out for our customers and from the HPC perspective, it really highlights the value of us working together. We recognize that every enterprise customer we’re working with is looking at some sort of multicloud strategy and the two enterprise cloud players – Microsoft and Oracle – working together benefits our customers.”

Oracle isn’t the only cloud provider with an eye on HPC. Azure offers HPC instances with bare metal compute, CPU- and GPU-enabled systems with Linux and Windows virtual machines, RDMA-capable instances, and software from Microsoft and a range of partners. Google Cloud leverages Intel CPUs, Nvidia GPUs and its own Cloud TPUs in its HPC instances and offers a number of reference architectures.

Not Behind The Curve

Oracle’s evolution into a cloud company has been swift and aggressive, with a greater focus on everything from partnerships to open standards illustrating the changes that the vendor is embracing, according to Kumar. Customers can get an Oracle database in a multiple of ways, such as on a virtual machine or a bare metal instance, or as a complete service from Oracle. At the same time, they can run non-Oracle databases from other vendors on OCI.

“Oracle has always been a product company,” he said. “You hear – or you used to hear – the words ‘Red Stack’ or ‘the Oracle stack.’ If you’re not using only the Red Stack in your application, it’s not optimal. We were that company for a long time. With the big initiative of cloud, and especially the infrastructure investment, we are truly transforming from a product company to a platform company. We are no longer a single monolithic stack. We are truly heterogeneous in terms of customers being able to come in and build on this platform. My job is to give you the right set of services with or without the Oracle stack in it. “

Internally Oracle also is a cloud company, with its SaaS offerings running on OCI. The company is focusing on building out its business with its software running atop is cloud hardware. The enterprise cloud space also is still young and wide open and Oracle is poised to take advantage of it, Kumar said. The company’s entrance into it may have been more recent than other vendors, but it doesn’t mean that it’s too late to the game.

“A lot of people didn’t believe it at that time” that Oracle began its cloud efforts, Kumar said. “They told us: ’It’s too late. You’re laggards. The market is all taken.’ It’s not true. This is a massive market opportunity.”

Be the first to comment