In the early years of Amazon Web Services, the collection of compute, storage, networking, and platform services (database, analytics, and such) were so good that Amazon, its parent company, did not have to spend a lot of money on sales and marketing to get startups to flock in droves to this public cloud to use it as their computing platform. It was easy. Like catching fish in a kiddie pool.

Ironically, as AWS has created an increasingly diverse set of services above and beyond raw compute, networking, and storage capacity and as it has chased the enterprise customers who have a long history of running their own computing environments, Amazon has to be more active in spending money on sales and marketing. The low hanging fruit has long since been picked, and now AWS has to climb into the higher branches where the power wires and weak trunks are sometimes found.

This bigger money is harder to come by. It takes countless meetings and much consideration, but it pays off for longer because established businesses that have been paying for infrastructure and people to run it for three, four, or five decades are probably going to make it another decade or two. Large enterprises make long bets on IT because they cannot, by definition, make the short ones that startups, who might run out of money next year, can. And in a way, the fact that they have existed for three, four, five, or more decades is not just a testament to their conservatism, but is also due to their having made correct (and well considered) decisions along the way.

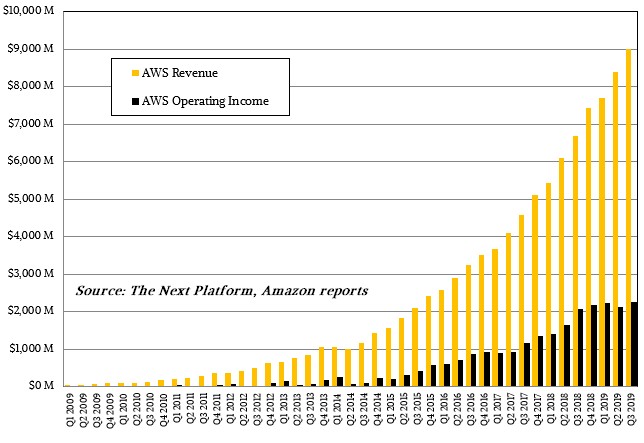

Given all of this as well as other factors, it is no surprise that sales have been slowing down at AWS for the past decade. There is no need to panic, considering the $3.7 trillion or so that the world blows on IT products and services each year. From that perspective, AWS has only an infinitesimally small slice of the IT budget pie, with its $32.5 billion in sales in the trailing twelve months. And while its operating profits of $8.8 billion in that time comes to 27 percent of revenue – much higher margins that most IT vendors can command – it is nowhere near the profit levels that IBM once commanded in the 1960s and 1970s with the System/360 mainframe. It is still a very, very good operating margin – and one that Big Blue sorely wishes that it had with its own systems business today. Hence, it bought SoftLayer a few years back and has been trying to build out its own public cloud.

As we have pointed out before, AWS is arguably the largest systems business in the world, and we think within the next six or seven years it could break through $100 billion in annual sales, becoming the largest IT supplier if Dell doesn’t grow appreciably. There are limits to how far AWS can grow, and some of them have to do with culture and geographical and political limits to using an American-based public cloud provider when the indigenous telecom and hosting providers are the safe political choice. We think AWS is kissing some of those limits, with sales growth slowing once again in the third quarter. But global IT spending will continue to track above gross domestic product in the major economies of the world, and public clouds will continue to grow faster than this for years. AWS is now growing at 58X the rate of IT spending on a global basis and is growing at 10X the rate off IT spending in North America, to give you some perspective. We think that gap will remain open for a while, but it is inevitable that it will close.

But for now, AWS can bask in the growth. In the third quarter ended in September, AWS posted sales of just a tad under $9 billion, up 34.7 percent. Operating income for AWS represented 25.1 percent of revenues, at $2.26 billion. But that operating income only grew by 8.9 percent, which was a bit disconcerting to Wall Street and to Amazon itself. AWS brought in an incremental $2.32 billion in Q3 2019, but only $184 million of that dropped to the operating income line.

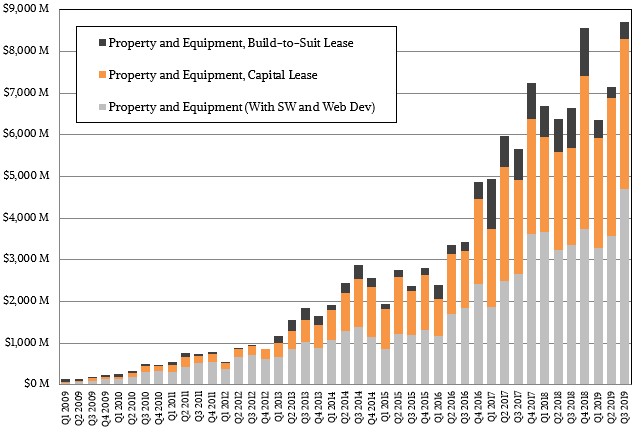

“If you look at the progression of our operating margin in that business, it reached a high of 31 percent Q3,” explained Brian Olsavsky, Amazon’s chief financial officer, in a call with Wall Street analysts going over the numbers. “As we mentioned, at the time it was very efficient, we had been banking some savings from forward investments in infrastructure in 2017. We continue to feel really good about not only the top line, but also the bottom line in that business. But we are investing a lot more this year in sales force and marketing personnel, mainly to handle a wider group of customers and an increasingly wide group of products. We continue to add thousands of new products and features a year, and we continue to expand geographically. So the biggest impact that we saw in Q3 year-over-year in the AWS segment was tied to costs related to sales and marketing year-over-year and also to a secondary extent, infrastructure. If you look at our capital leases or equipment leases line, it grew 30 percent on a trailing twelve-month basis in Q3 of this year and that was 9 percent last year.”

Our guess is that Amazon is loading up on “Cascade Lake” Xeon SP servers and is going to skip “Cooper Lake” in early 2020, waiting it out to be in the front of the line for the “Ice Lake” chips in the second half of 2020. The company can build up capacity now and burn it down and be there to either absorb the current “Rome” Epyc or future “Milan” Epyc processors from AMD as it needs to.

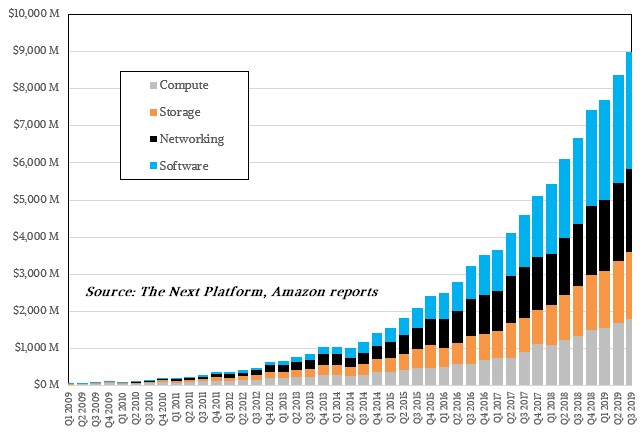

For fun, we have created a model of how AWS revenues are allocated to compute, storage, networking, and higher level software services, and we admit that we have just made a fair guesstimation of what this might have looked at over time. Take a gander:

Here is the funny thing about our model, which we didn’t realize until we looked at growth rates for the four categories in going over the Q3 2019 numbers. In the beginning, all three were growing in excess of 2000 percent, year on year, each quarter starting in 2007, but compute slowed down fastest first as AWS got aggressive about compute prices as a kind of loss leader to attract applications to its cloud. Storage and networking services costs fluctuated pretty wildly as new services were added. But this year, all four types of products sold at AWS, at least according to our model, have all converged close to the overall revenue growth rates for AWS itself. It looks like there might be a balance between the consumption of raw capacity and software services that run atop them. We didn’t expect that to ever happen, much less so soon in the cycle.

It would be fun to find out if this is really happening, but AWS will never tell.

The other fun bit of information, according to Olsavsky, is that AWS renegotiates with customers who have made long-term commitments to buying capacity and software services on its cloud to give them price decreases – they don’t just lock in a contract and leave it. Another interesting bit if data is that AWS has $27 billion in future commitments for services on AWS, and this is up 54 percent year-over-year. That is almost a year’s worth of revenue that is on the books and 3X the quarterly revenue at Q3 2019, and it is growing faster than the revenue that is getting recognized each quarter. IBM’s Global Services behemoth, which does all kinds of consulting as well as hosting, had a backlog of $107.6 billion as it exited Q3 2019 against a $10.8 billion quarterly run rate, or just shy of 10X. It is not hard for us to believe that AWS could build up a similar backlog ratio. It may take some time as more and more enterprise customers, who are thinking in terms of decades, come aboard with mission critical applications.

“The enterprise, we are making great progress there,” says Olsavsky. “It’s going to be hard on revenue growth, it’s going to fluctuate quarter-to-quarter, it’s hard to predict the pace of some of the sales cycles and the enterprise migrations that companies are willing to make. Some are faster than others and some have other work to do before they can migrate. So there’s a lot of factors at play there on the enterprise business, but we are having great success and we are adding a lot of sales representatives, especially for the enterprise market.”

Be the first to comment