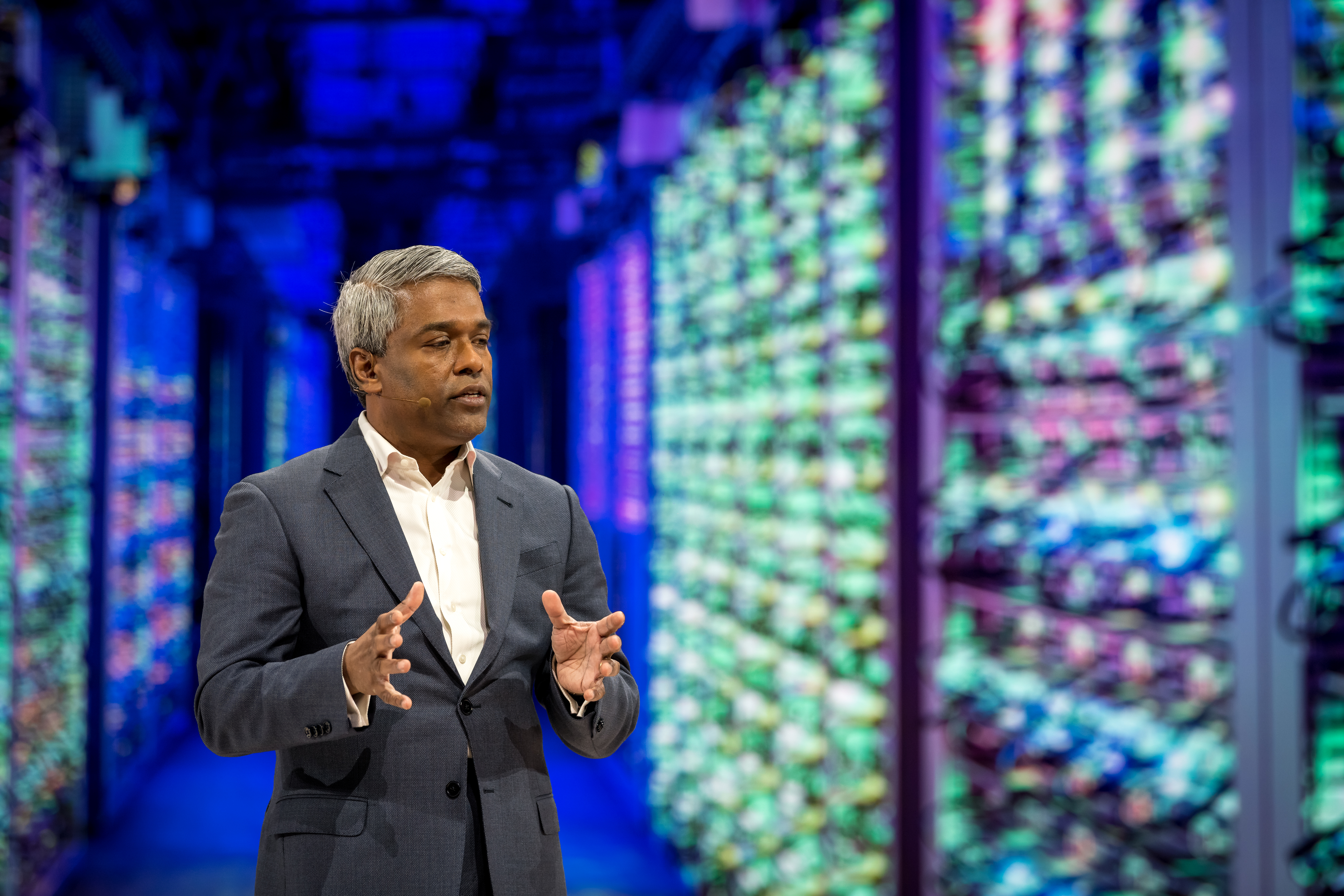

Google hiring of longtime Oracle executive Thomas Kurian to take over for Diane Greene as the head its cloud unit was a signal that the hyperscale company was serious about generating more enterprise businesses in hopes of better competing with larger public cloud providers Amazon Web Services and Microsoft Azure.

AWS is by far the dominant player in the fast-growing public cloud space, with a greater share of the market than the next three combined. However, there are signs that Microsoft is taking advantage of its long history in the enterprise to chip away at AWS’ lead, and that enterprises in such verticals as retail and tech are beginning to see AWS as more of a competitor than a partner.

Google Cloud Platform is a distant third, but in the six months since Kurian took over as senior vice president of Google’s cloud division, of which he is now the chief executive officer, and Kurian has been vocal about putting a focus on growing the number of enterprise customers. Google Cloud has some significant enterprise customers on its roster, including HSBC, Target, 20th Century Fox, and Bloomberg, but it still lags behind AWS, Azure, and IBM Cloud. That’s going to change, Kurian has said.

Kurian told attendees at the Goldman Sachs Technology and Internet Conference in February that the plan was to accelerate growth to more aggressively compete with its larger rivals and that expanding its enterprise business was a key. Kurian also has talked about rapidly growing Google Cloud’s salesforce, which is significantly smaller than the sales teams at AWS and Azure, and he spoke again about the need to add to the salesforce this week during his keynote address at the Google Cloud Next 2019 show in San Francisco.

During Kurian’s tenure, the cloud provider also has made a series of other moves to strengthen its position among enterprises, including the release in February of Google Services Platform (CSP), enabling organizations to run Google Cloud applications and services within their on-premises datacenters and managed them and workloads running in the public cloud in a unified way. CSP played into the trend among businesses of adopting multicloud and hybrid cloud strategies, and followed efforts by AWS, Azure, VMware, IBM and other providers to reach into enterprise datacenters.

AWS did this via its Outpost initiative, creating stacks of Amazon-designed hardware that can run on-premises and offer an easy link into the AWS cloud, while Microsoft in 2017 released Azure Stack as a way of bringing the Azure cloud behind the firewall. VMware is doing this through its Project Dimension.

Google Cloud also is making acquisitions to entice organizations to adopt its services. The company in February spent $15 million to buy Alooma, a Google Cloud technology partner whose platform collects data from disparate sources, including databases and applications, into a single data warehouse and then eases the processors enterprises have to go through to migrate that data into the cloud.

At the Google Cloud Next show, the company showed that another key to the cloud provider’s growth will be through partnerships, which were a central theme of the event. During the conference, the company announced tighter strategic partnerships with a range of open-source database providers: Confluent, DataStax, Elastic, InfluxData, MongoDB, Neo4j and Redis Labs. Google Cloud will be offering managed services by these companies that will be integrated into Google Cloud, which will make it easier to enterprises to build applications using these open-source technologies.

“There’s been a lot of debate in the industry on the best way for delivering these open-source technologies as services in the cloud,” Manvinder Singh, head of infrastructure partnerships at Google Cloud, said during a press conference in the runup to the show. “Given Google’s DNA and the belief we have in the open-source model, which is demonstrated by projects like Kubernetes, TensorFlow, Go and so forth, we believe the right way to solve this is to work closely together with companies that have invested their resources in developing these open-source technologies. We believe in an approach that is collaborative and not combative.”

Enterprises will be able to leverage these managed services and turn to Google Cloud for unified support and billing. They’ll only have one vendor to deal with rather than chasing after several vendors, Singh said. There will be a single user interface for managing the applications.

“We are elevating the experience of these services on our platform,” he said. “The experience will be just like our first-party offerings. Developers, for example, can natively manage these services [and] can discover these services within our console, just like you can with a first-party service, essentially making it a first-class service on our platform. The idea is to make it really seamless. The idea is to make it very easy for customers to buy these services on GCP. Customers if they want can just buy the service from Google, Google will bill them for the services, support these services and work in collaboration with partners.”

Dominic Preuss, director of product management at Google Cloud, said customers that move to the cloud often adopt managed services.

“Every company is resource-constrained in terms of its IT and its people, so by allowing Google to take on some of the management of their IT services, it allows them to have those people focus on the higher value parts of their business,” Preuss said. “We’ll take away the mundane tasks of managing their services and updating the software and all those things and then their really valuable resources, which they have internally, can focus on higher-value items.”

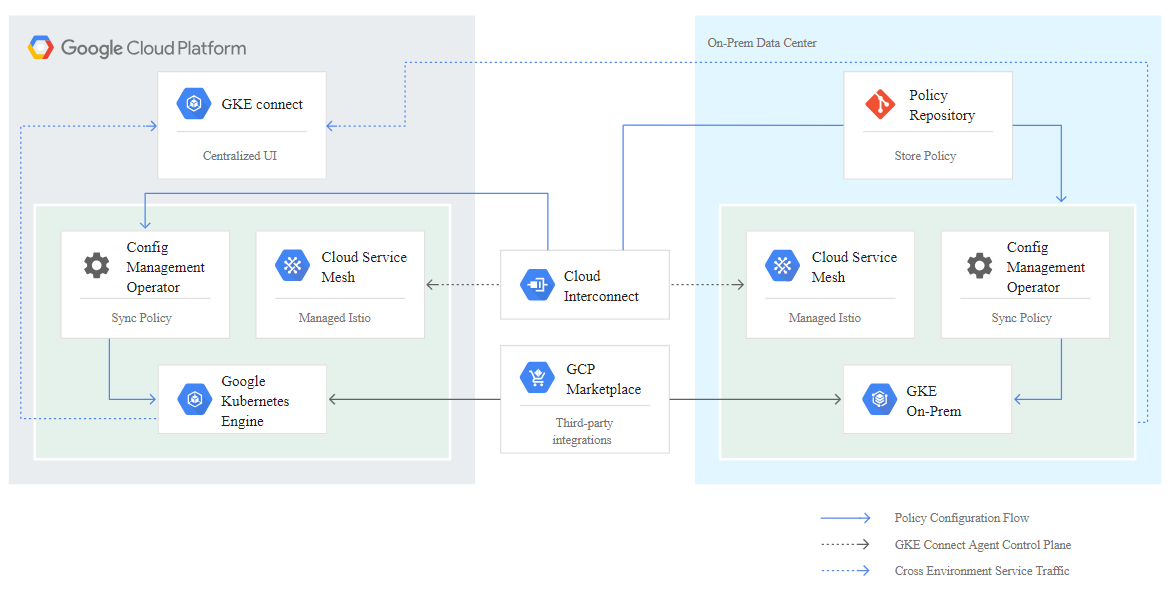

Google Cloud also is using partnerships with datacenter hardware OEMs to grow its hybrid cloud capabilities. At the show, the company unveiled Anthos, an open platform that is a muscled-up version of the Cloud Services Platform. Anthos is designed to let enterprises their applications – unmodified – in the public cloud or on their existing datacenter hardware. And by public cloud, Google means not only on its own cloud but also in AWS and Azure without having to learn new environments or APIs, another nod to the multicloud and hybrid cloud push among organizations.

Anthos is available on Google Cloud with the Google Kubernetes Engine (GKE) and in the datacenter with GKE On-Prem. Anthos Migrate, which is in beta, automatically migrates VMs from on-premises environments or other clouds into containers in GKE, making migration easier.

Anthos is available on Google Cloud with the Google Kubernetes Engine (GKE) and in the datacenter with GKE On-Prem. Anthos Migrate, which is in beta, automatically migrates VMs from on-premises environments or other clouds into containers in GKE, making migration easier.

Top hardware makers like Hewlett Packard Enterprise, Lenovo, Dell EMC, VMware and Cisco Systems are supporting Anthos. Cisco is integrating Anthos with products from its datacenter, networking and security units, including the HyperFlex hyperconverged infrastructure solution, the Application Centric Infrastructure (ACI) networking technology and software-defined WAN offerings. Google Cloud also announced an integration partnership with Lenovo to run Anthos on the OEM’s ThinkAgile servers while HPE is creating Validated Designs for Anthos for its SimpliVity hyperconverged infrastructure and ProLiant servers with Nimble Storage.

Google Cloud’s partnership-heavy approach is a bit different than that of AWS. Google Cloud is looking to partners to help build its capabilities in such areas as databases and hybrid clouds. AWS has done a lot of in-house development of its own technology, for example in databases, where its offers such services as RedShift for relational databases and DynamoDB for key-value databases, though they do support such open-source databases like MongoDB and Redis. On the hybrid cloud side, where Google Cloud and Azure look to OEMs to help bring their cloud capabilities on-premises, AWS is relying in part on enterprises to bring its Outpost hardware into their datacenters.

Anthos is getting some enterprise traction. HSBC and Siemens both are early adopters of the platform.

Google Cloud’s Preuss, when talking about adding four new cloud regions – in Seoul, South Korea, Salt Lake City, Utah, Jakarta, Indonesia and Osaka, Japan – to bring the total number to 23, noted that the regions were part of a $47 billion in capital expenditure investment the company spent between 2016 and 2018.

Be the first to comment