The general HPC market might be growing, and the very definition of HPC is expanding thanks to the addition of advanced analytics and machine learning to the HPC toolbox. But it is tough slogging right now in the upper echelons of HPC where supercomputers roam.

There is perhaps no better barometer of the state of supercomputing than Cray, which sells a mix of processing, storage, and interconnect technologies to address the ever-widening scope of modern supercomputing. Because of a general slowdown in supercomputer sales thanks to the fact that organizations are keeping their systems around for longer than they usually do, it is taking Cray more time to make the deals even as new technologies are coming into the field.

That said, we also think there is a bit of a slowdown in supercomputing inasmuch as both IBM’s Power9 and Intel’s “Skylake” Xeon SP processors entered the market later than expected and both Nvidia’s “Pascal” and “Volta” GPUs, which came out last year and this year respectively, took longer to be widely available than anyone wanted. (It is nice to have a product that is in high demand, but these GPU accelerators are among the most complex devices ever created and they are difficult to make at yield.) AMD’s entry into the HPC market with its Epyc X86 server chips and Radeon Instinct GPU accelerators in the summer probably also caused a bit of a pause. And the uncertainties around budgets for supercomputing in the Trump Administration through the first half of the year and around the future of Intel’s “Knights” Xeon Phi family of parallel X86 processors did not help the situation, either.

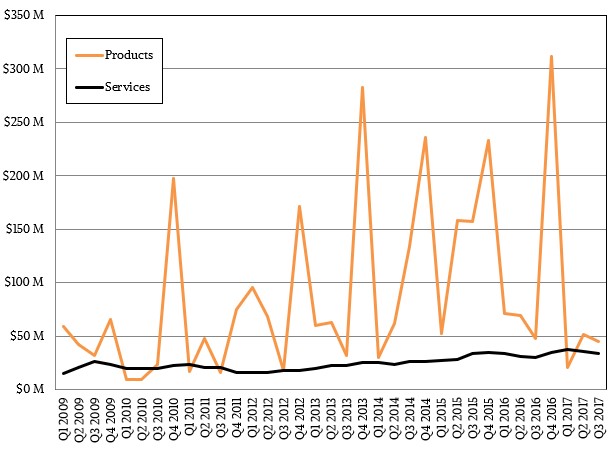

It could have been worse, and in fact, Cray was bracing for it, having already warned Wall Street that revenues might only be $60 million or so in the third quarter of this year. As it turned out, Cray hustled and got an acceptance done early and pulled $20 million of revenue in from the fourth quarter, and was able to boost its revenues for the quarter ended in September to $79.7 million. Cray restructured its workforce back in July, laying off about 14 percent of its employees, saying it would record a $10 million restructuring charge and would save about $25 million a year in costs by doing so. Most of the job cuts were effective soon after the announcement, and the company booked a $7.65 million restructuring charge in the quarter, which pushed the company to a $10.2 million loss in the September quarter. Cray also recognized a $3.3 million gain on an investment in a small technology company that was recently acquired (it did not divulge who it was), and that helped cushion the blow, too.

The big problems for Cray’s top line growth are the uncertainty in the budgetary environment and how different architectures are going to play out for analytics and machine learning workloads, but there is also another big factor: the massive spike in memory and flash prices that started late last year. If memory prices had come down, as expected, and new processors had come out early this year, as expected, then we might be looking at a totally different situation. The memory spike cuts both ways – it hurts Cray’s bottom line directly for contracts that were already negotiated before the spike, and it hurts future sales because customers want newer machines with bigger memory footprints and they are willing to wait for them, and if they can’t, they have to buy smaller machines to compensate for the 2X to 3X increase in memory costs per gigabyte. This issue affects all server makers right now, but it hits HPC hard because these workloads are memory constrainted. But there are ways to mitigate it, as the techies working on the “Sierra” supercomputer at Lawrence Livermore National Laboratory demonstrated.

Cray is clever, too, and is no doubt helping customers choose memory bandwidth over memory capacity in its systems, and at some point, 3D XPoint memory DIMMs will be available next year to extend DRAM memory somewhat more cheaply and the prices of DRAM and flash will also come down, too, and fatter systems will take off. What we can tell you is that the 3D XPoint, DRAM, and flash makers are making money hand over fist on this, and it is hurting all OEMs and ODMs.

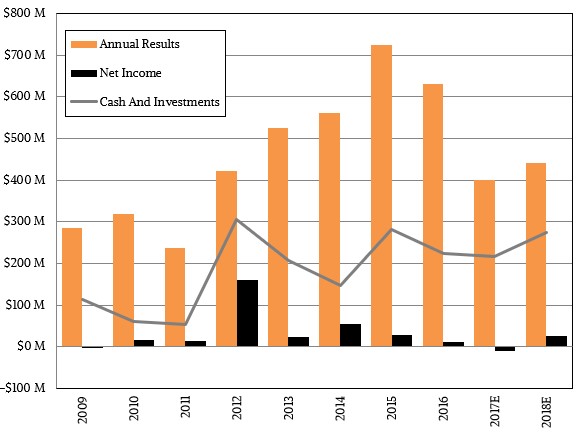

It is very difficult to make projections of future sales and profits, but Cray has always been good about taking its best shot at prognostication – something you would expect from a company that does forward looking simulation and modeling for a living, we suppose. On the call with Wall Street, Brian Henry, Cray’s chief financial officer, said that, with the normal caution of possible fluctuations beyond its control, said that the company expected for revenues to be around $400 million for all of 2017, a 36.5 percent decline compared to 2016’s very good $629.8 million in overall sales and a 44.8 percent decline from the $724.7 million in sales Cray booked in 2015, its best year ever in terms of revenues but not, as it turns out, its most profitable year. It is very difficult to project profits, especially from the outside, but Cray has posted a $36.2 million loss so far in 2017, so it has to book that much profit to break even, and that would be 20.8 percent of revenues – a level it exceeded in the fourth quarters of 2011 and 2014. It could happen, but there are $22 million of write-offs coming relating the Cray’s acquisition of the ClusterStor disk array business from Seagate Technology, which we told you about last quarter.

Here is the thing to remember: Cray wants to have a steadily growing and broadening HPC business that is not so dependent on traditional supercomputing, and it wants to build that business profitably and that will take time. But we believe that is precisely what Cray will do with its usual methodical approach.

Looking ahead, Henry said that Cray expects for revenues to grow by about 10 percent in 2018 – a number that would have been considerably higher had the “Aurora” machine proposed for Argonne National Laboratory, based on Intel “Knights Hill” Xeon Phi processors and 200 Gb/sec Omni-Path 2 interconnects, come to fruition. The planned for Aurora was scrapped over the summer and now the plan is for Intel and Cray to build a new exascale-class ALCF “A21” machine based on an unknown processor architecture and Cray’s “Shasta” system in 2021. At current supercomputer prices, that machine would cost around $1 billion, but four years hence, it certainly will not. Probably somewhere between $100 million and $200 million is a good guess, and somewhere around 200 cabinets is normal for the top-end machine at any time in the history of supercomputing.

Cray is taking the long view, as it always does. Peter Ungaro, Cray’s chief executive officer, said on the call that the company evaluated a bunch of factors to come up with its projections and the strategy to meet them.

“From a competition perspective, our win rates remain strong and I believe we’re continuing to gain market share in our target market at the high end of supercomputing,” explained Ungaro. “However, this market is still not as strong as we need it to be. That being said, we have seen some early signs of a potential market rebound beginning in 2018, including our expectations for significantly higher levels of new large opportunities expected to be decided during the year. Some of those will be for revenue in 2018, but the large majority of the opportunity will be systems delivered and put into production in 2019 and beyond. Given our strong competitive position, we remain confident that when the market activity returns to healthier levels, we will be in a good position to see that translate into a rebound in our revenues and we believe we will take the first step in that journey next year.”

Ungaro noted, by the way, that the expected bump that normally comes with a new generation of processors from Intel has not yet materialized with the Skylake Xeons. We think that Intel’s charging of much higher prices for Skylake compared to the prior generation “Broadwell” Xeon E5 v4 chips has chilled the market a bit, even if Intel can argue that the “Purley” platform enhancements, which are substantial, particularly when it comes to floating point math, justify that increase. But this is ill timed with the memory and flash price hikes, obviously.

Next year is the big year for supercomputing, and not so much for revenues, but for decisions. Ungaro said that a lot of machines that will be installed in 2019, 2020, or 2021, including the successor to Aurora at Argonne, will have their fates decided next year, and likely based on technologies that we don’t yet know about yet. But Cray does.

Be the first to comment