It is hard to make a living in the open source software business, although it is possible, through the contributions of many, to make great software. In many ways, HashiCorp is arguably the standard bearer for the next wave of commercialized open source, much the way Red Hat was two and a half decades ago with the second wave the saw the rise of Linux and the death, pretty much, of Unix.

The first wave of open source, of course, was in the academic roots of computing, when Unix, C, a zillion databases and file systems and all kinds of stuff for Unix platforms were created. Once software became copyrightable in 1974 and once computing became a big business as Moore’s Law exponentially scaled down the cost of hardware and ever-inflating human costs continually scaled up the cost of software in the next decade, it was inevitable that software would start closing up code and opening up shop.

To a certain extent, the rise of Linux and open source databases and middleware that ran on it in the 1990s – software that ironically ran on other proprietary platforms and still does to this day, as does Linux itself – was a reaction to the excesses of the RISC/Unix vendors, who might have been cheaper than an IBM mainframe platform by a factor of 2X but who certainly were not cheap enough for them to be the foundation of hyperscale computing. By giving up on software licensing and trying to live off of software support for open source, companies like Red Hat, along with comparatively lower cost X86 iron – 2X to 4X cheaper than Unix iron – based on Intel and sometimes AMD processors, infrastructure got a lot cheaper. And the hyperscalers and cloud builders all created their own internal Linux distros (like the big HPC centers do, too) and that removed even more cost.

Thus fueling the hyperscaler and then cloud computing booms.

It is not clear that Mitchell Hashimoto and Armon Dadgar, the co-founders of HashiCorp, who have spent more than a decade building what is turning out to be the likely commercial alternative to the Kubernetes stack that can also run Kubernetes if you want it to, set out to start a commercial open source software company. Hashimoto and Dadgar wrote good software to solve real problems with configuring, provisioning, controlling, and securing infrastructure at scale, and like many other open source projects.

What is clear is that they have done this, and it is also clear that this is both a commercial operation and an open source operation, and that the two are not exactly compatible. The great thing about the most permissive open source software licenses in their purist forms is that anyone can create a fork at any time for any reason. The bad thing is that such forking can create a CentOS problem, where one company selling support is really living off the work of a large number of other people at Red Hat. All of the people working on open source software have to get paychecks somehow, and that is why Red Hat made some major changes to the CentOS variant in 2019 five years after it acquired the company behind CentOS just to try to get its arms around the problem. HashiCorp wants to avoid the CentOS problem.

And thus, a few weeks ago, HashiCorp shifted its code to the Business Source License, or BSL, that was created by MariaDB, which was famously founded by Monty Widenius. MariaDB is the open source follow-on to MySQL, the open source database of the Dot Com Boom that disappeared into the gaping maw of Oracle, the king of proprietary software that has also created its own Linux distribution in the mode of CentOS – much to the chagrin of Red Hat. The BSL, as our colleague Liam Proven over at The Register explains well, has provisions that allow for code to be open source and for people to make derivative works, but it absolutely has restrictions on commercial use – namely, restricting companies from creating clones of all or parts of the Hashi Stack platform or from just grabbing it and selling it as a service on the cloud.

This move has upset purists, but for those of us who have started and run businesses with payrolls, it makes perfect sense even though it is an unhappy reality. The BSL splits the difference between a fork and a knife, and if you want to create a commercial derivative work, you can negotiate a commercial license. Which will, by definition, be so expensive as to render the effort moot because it will be larger than $0. (Technically, Intel would have licensed the ISA for the X86 processor to anyone who asked, but there is no law that ever said it would have to be at a price that engendered competition. This is no different.)

The BSL will not have an immediate impact on HashiCorp’s financials, but it sure as hell will have one for its future years. There can be no CentOS-like alternative to Hashi Stack unless and until HashiCorp goes bust. Which it probably not going to happen.

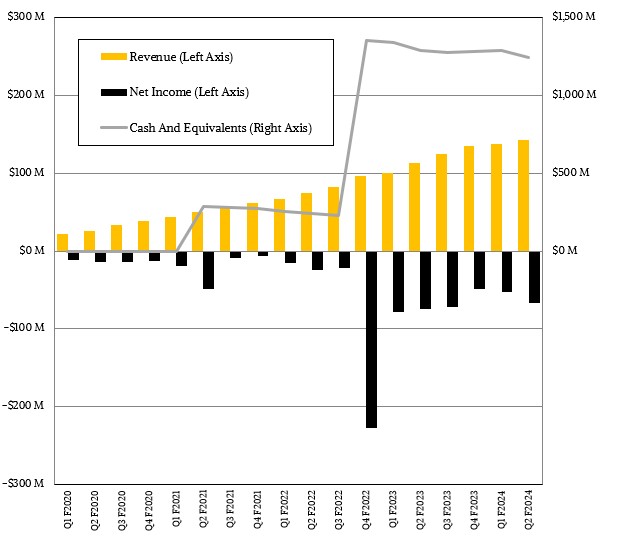

That said, during the second quarter of fiscal 2024 ended in July, HashiCorp cut $20 million off its expected revenues from a forecast it gave six months ago for the fiscal year, but it also tightened up the range from between $571 million and $575 million, which means there is more precision in what it is seeing. The downward change in the past six months is not a big deal, but it does show how companies are taking a hard look at their software spending these days.

“Compared to our seasonally low first quarter, we saw better contract activity both in total and also within the global enterprise segment during the second quarter,” Navam Welihinda, HashiCorp’s chief financial officer, said in a call with Wall Street analysts going over the numbers. “Similar to last quarter, sales cycles remain elongated, and procurement scrutiny was ongoing. We expect this cautious spending environment to persist through the rest of 2024. However, we also expect the bigger trend of enterprise cloud transformation efforts to continue despite the current economic uncertainty.”

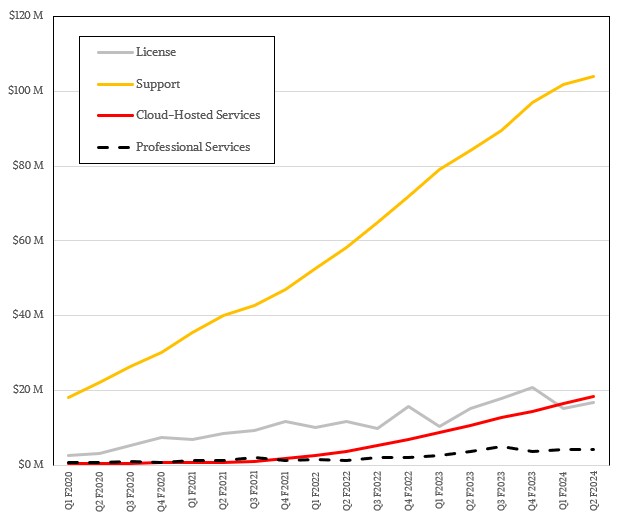

In the July quarter, software license sales only grew by 9 percent to $16.7 million, but support sales rose by 23.4 percent to $104 million. Cloud-hosted services – meaning running parts of the Hashi Stack of infrastructure control tools on a cloud and having it managed by HashiCorp itself – rose by 73.3 percent to 18.4 percent.

This may sound pretty impressive for an established software powerhouse, but the license growth in the July quarter is a quarter of the rate of growth during fiscal 2023, and support and cloud-hosted services are both growing at half the rate. So while companies are interested in controlling their cloud infrastructure and in many cases, especially when it comes to AI training workloads, are interested in doing so over multiple clouds with an external, independent set of tools, something has changed in the market and that is the ongoing concerns over the economy. There are also alternatives to the Hashi Stack, including the OpenStack-OpenShift combo from Red Hat, which with IBM’s backing is also a fast-growing, multi-cloud infrastructure control stack in its own right.

You can see why HashiCorp wants to nip any potential CentOS-alikes in the bud.

Add it all up, and HashiCorp booked $143.2 million in sales, up 25.8 percent and a bit lower than the 30 percent revenue growth it has been shooting for as a minimum bar in recent quarters. The good news is that net losses shrank despite this, coming in at a $66.4 million loss compared to a $74.6 million loss in the year ago period. HashiCorp exited the quarter with $1.24 billion in cash and equivalents, down 3.7 percent year on year but still a lot of money to make acquisitions and fuel the growth in the business organically.

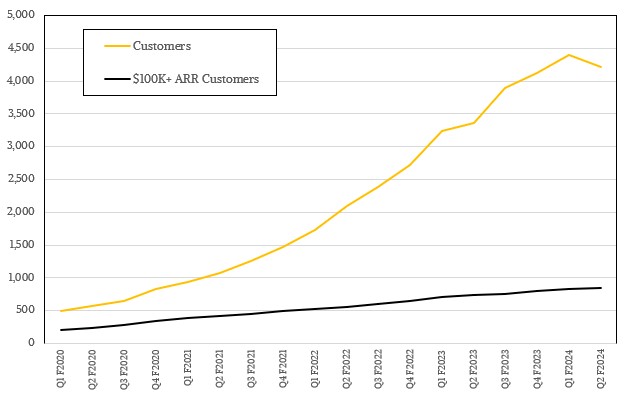

Interestingly, HashiCorp lost 175 paying customers between Q1 and Q2, ending the quarter with 4,217, but it added 21 customers who spend at least $100,000 in annual recurring revenue. This might be the mark of a shift to a more enterprise-dense customer base. By its own admission, HashiCorp has lots of SMB customers who only spend around $2,500 a year on its tools. These are the ones it is losing. Gaining the enterprise customers – over the longest of hauls, tends of thousands of them – is the name of the game going forward.

The shift to BSL is not explicitly about boosting revenue per customer, but in limiting clones of all or parts of its stack, it does give HashiCorp the chance to more safely raise its license and support prices without the threat of fostering a clone that will do it for less. The timing of the BSL license transition and the shift to a focus on enterprise accounts are part of the same pattern, not coincidence.

HashiCorp is certainly building a huge base of potential customers, and the trick, of course, is to flip them from free to pay. The Terraform provisioning tool has had over 370 million downloads through Google Cloud, which is a recent development and milestone, and Amazon Web Services just crossed a cumulative 2 billion downloads. That is a lot of software downloads. And, once again, it shows how hard it is to convert freebie and tire kicker users to active subscriptions. One way that HashiCorp is doing this is by doing away with a free tier of its Terraform tool that had only a subset of Terraform functions activated. Now it has a standard tier and a premium tier, and the new free tier is just a version of the standard tier that has its capacity, rather than its function, crimped. So potential customers can see the full Terraform tool in action but not have to pay for it for small testbeds. There was a near-term revenue impact here, too, which Dadgar openly admitted in the call with Wall Street. Some customers who had been paying now don’t have to because their Terraform capacity needs were modest.

“I think an expectation is that it is going to make it easier for us to onboard users and then graduate them from our free tier into our paid offering as they continue to scale,” Dadgar said on the call referring to software packaging and pricing changed. “Obviously, we are constantly fine-tuning and looking at pricing and packaging. I think our goal philosophically is we want to enable our customers to land small and align a unit of value ultimately to their consumption and their usage, so that as they grow their cloud programs and as they are getting more value out of the tooling that we grow with them.

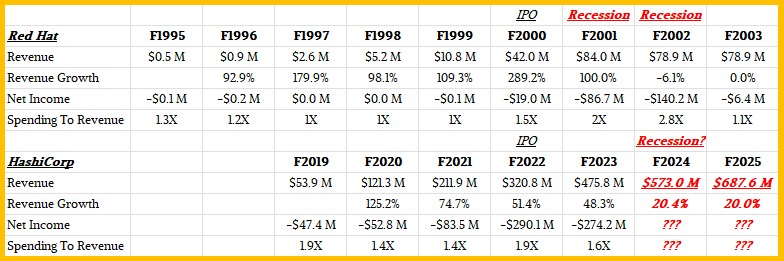

Which brings us to the final point we want to make. How is HashiCorp stacking up to Red Hat in a historical sense? Let’s take a look:

History doesn’t repeat itself, but it does mutter a bit. The coincidences are weird, but the uniqueness of the situations of Red Hat and HashiCorp also shine through. It is still amazing to us that Red Hat had a $20 billion market capitalization way back in its fiscal 2000 when it only had $42 million in revenues. That was how big the change from RISC/Unix to X86/Linux was. It was an infrastructure explosion. But the Dot Com Boom busted and Red Hat hit a wall, and its market capitalization took until early 2018 before it passed that $20 billion mark again. Revenues have grown like clockwork, however, through many different recessions and IT transitions, and in the trailing twelve months ended in June, Red Hat had just a tad of $6 billion in sales, up 12.8 percent. IBM, of course, paid $34 billion to acquire the company in 2019, so its market cap recovered quite nicely by that measure.

HashiCorp has a market capitalization of $5.36 billion as we go to press, significantly down from the $18.5 billion valuation it had almost immediately after going public back in its fiscal 2022. Most of that decline happened early on, so don’t think it happened because of the most recent financial results.

What we want to look at is how much were Red Hat and HashiCorp spending relative to how much revenue they were taken in during similar times in their corporate existence. To get a proxy for spending, we took the revenue from each quarter and then add to it the value of the losses for that quarter, and then compute the ratio between the two. The smaller that ratio, the better. And we want to see a trend for that number coming down over time, for the companies to be moving towards profitability.

This ratio often gets worse after an initial public offering because companies do a full court press to try to build their customer bases quickly rather than worrying about profitably. Oddly enough, this ratio did get worse for Red Hat after the IPO, but has been bopping around in the range of 1.5X to 1.9X before, during and after the IPO for HashiCorp. It is hovering around 1.5X in the trailing twelve months. When it reaches 1.0X, the company will be at breakeven. That could happen for HashiCorp in fiscal 2025, but it will take a lot more paying customers to get there as well as ever-embiggening contracts with the Global 2000.

Interesting read! I guess IaC tools like Terraform (or similar) could be quite useful to declaratively compose specific cephalopodic incantations from the heterogeneous pool of compute, network, and storage, that constitutes the disaggregated manifestation of the coming ExaCthulhus; carving interwoven mission-optimized unums out of that block of e pluribus marble (or vice-versa?) … nice!

It’s interesting watching Hashicorp sabotage its business like this; rather than preventing a fork, this practically guarantees it. All older versions of Terraform are still available for forking under an open license, and their relicensing only will impact future proprietary releases, which will then have to compete with open versions of Terraform. OpenTF already exists, and people building infrastructure should prefer it over Hashicorp’s now-non-open software.