About half as much. This is the pattern we have been seeing as many growing tech companies close out their 2022 or fiscal 2023 years and look ahead to their 2023 or fiscal 2024 years. And what we are referring to is the revenue growth rates for those companies in the future year being about half the growth rates that they enjoyed in the year that just ended.

This slowing growth is a function of the uncertainty in the global economy, or rather perhaps the growing certainty that this year will, in fact, be a lot harder to extract growth from than last year was.

Such is also the case with software platform builder HashiCorp, which went public in December 2021 and which is a kind of bellwether for investments in modern software stacks.

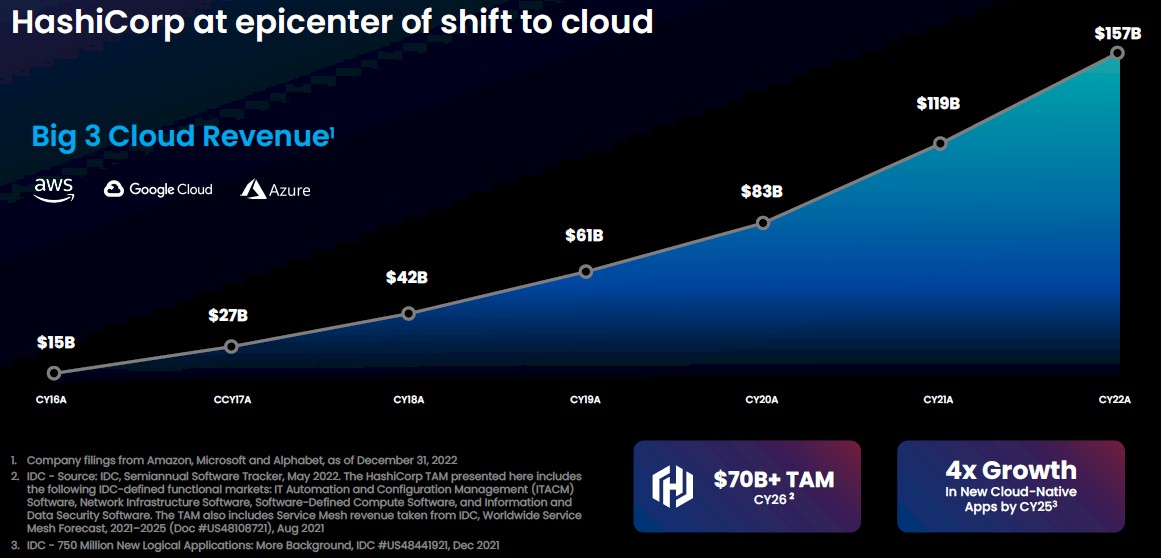

“I think we’re seeing just a lot more caution both with procurement departments slowing things down and extending deal cycles, but also general caution overall just like all of our peers,” explained David McJannet, the chief executive officer of the company, in a conference call with Wall Street going over the numbers for HashiCorp’s fiscal 2023 ended in January. “That being said, the secular trend towards cloud remains intact. I don’t think we’re really doing anything that different to be honest. I think the value proposition of our products is pretty straightforward. We do reduce cost for people’s cloud programs. And I think we remain as convicted as ever of the value proposition. So in short, not really material changes.”

Well, no material changes in the strategy, but the projected growth rate deceleration is certainly a material change. But not at of whack with a world where inflation is running high and central banks are trying to slam on the economic brakes with interest rate hikes.

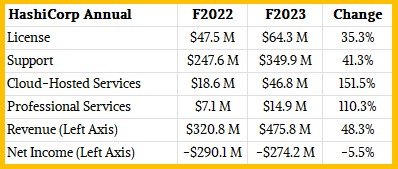

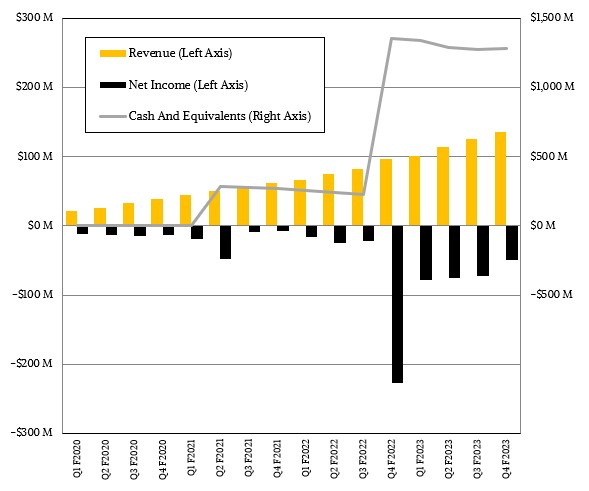

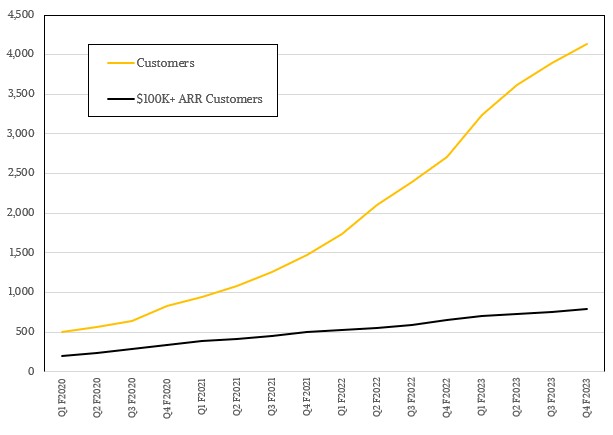

In fiscal 2023, HashiCorp, famously the company behind the Terraform virtual infrastructure provisioning tool that is part of the Hashi Stack, grew revenues by 48.3 percent to $475.8 million. But in the forecast for fiscal 2024, revenue is projected to be $591 million to $595 million, which is an increase of 24.6 percent growth over revenues in fiscal 2023. That is a pretty substantial slowdown, especially considering that in the past couple of years HashiCorp has grown in the high 50s and low 60s percents range. We do not think for a second that HashiCorp has saturated its potential market, certainly not with just 4,131 customers – an impressive number for such a young company, to be sure but nowhere near the tens of thousands to hundreds of thousands of potential customers in the addressable markets the Hashi Stack is playing within.

So, we think this is caution, and it is real caution, not just a company shooting low so it can over-deliver later.

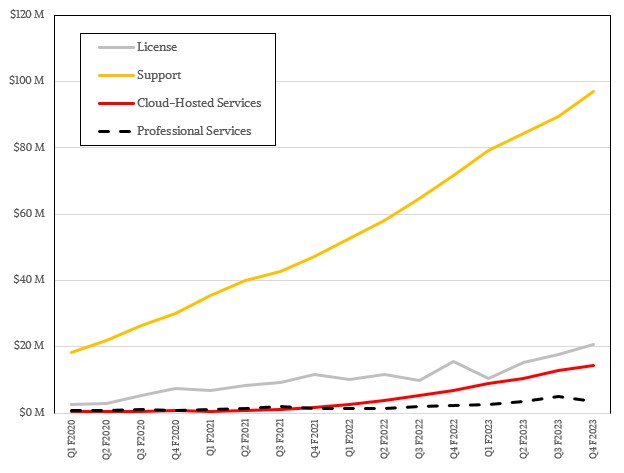

In the quarter ended in January, sales of software licenses for the components in the Hashi Stack – you don’t have to buy everything, but can buy a la carte – were $20.8 million, up 32.7 percent.

Support for installed software across those 4,131 customers generated $96.9 million, up 35 percent and representing the largest portion of the company’s revenue stream.

Cloud-hosted services, which these days is solely the Hashi Cloud Platform SaaS implementation of the Hashi Stack, grew by a factor of 2.1X to $14.5 million, and professional services rose by 66.5 percent to $3.6 million. Add it all up, and Hashi Corp sales for Q4 F2023 were up 40.7 percent to $135.8 million, the best quarter the company has ever turned in.

HashiCorp has implemented a true open source support company, like the Red Hat from days of old and even now inside of IBM.

As true believers in open source, all of Hashi Stack is free for the taking for those who have the skills and desire to self-support, but clearly there are a large number of customers who want the handholding that HashiCorp can provide once the Hashi Stack – or just elements such as Terraform or Vault (security) or Consol (network automation) or Nomad (application automation) or any of another handful of infrastructure tools in the box – goes into production. Hashi Stack doesn’t do everything, and it is a unique stack that grew naturally around Terraform and grew outside of the hyperscalers, cloud builders, and HPC centers of the world. It is unique, and we think developers and their companies are responding to it as such. It is in many ways a much more complete stack than was Mesos or OpenStack or VMware SDDC or Red Hat OpenShift plus OpenStack, and one created by developers who had to wrestle with infrastructure in a more complex way than was possible with Chef and Puppet system management and application deployment tools.

HashiCorp has a land, expand, and extend strategy, which means it lands with Terraform or Vault, it expands to other tools in the stack at these new customers, and then it extends the use cases at existing and new customers while at the same time extending the capabilities of the stack. That is why HashiCorp is growing eight times faster than the IT market overall, and why it will grow at four or five times that rate in the current fiscal year and beyond.

One of the factors that HashiCorp has in its favor is that Terraform is increasingly used to do cross-cloud provisioning as a means to pit the clouds against each other when it comes to cost. Reining in cloud-gone-wild projects at each company and putting it all under a single management and provisioning system is the key to control – particularly when it comes to a hybrid mix of multiple clouds and on-premises datacenters that are common among large enterprises. This is why OpenShift is being installed, and it is also why Hashi Stack is being installed.

Speaking of Red Hat, we are always eager to compare HashiCorp against Red Hat at the same time before and after their respective initial public offerings in 2021 and 1999, respectively:

Red Hat was ridiculously small when it went public, and was growing faster – depending on the year 2X to 6X faster. But Red Hat also hit a wall when the Dot Com Bust happened in 2000 and a global recession kicked in during 2001. HashiCorp has hit much bigger numbers much faster, which just goes to show you how much more valuable a true platform is compared to a Linux kernel and a couple of hundred systems programs that turn it into an operating system.

Here’s the fun bit. HashiCorp has told Wall Street that it would go profitable on a quarterly basis sometime in the second half of fiscal 2026, and now it is saying – despite the slowing revenue growth – that is can move that up by a year and get profitable on a quarterly basis sometime in the second half of fiscal 2025.

With a market capitalization of $5.3 billion as we go to press, it is amazing to us that someone has not tried to swoop in and buy HashiCorp, especially considering that in December 2021 shortly after going public the market capitalization for the platform upstart was $17.1 billion. The exuberance for HashiCorp has worn off, but the underlying business is moving towards profitability and girth. All we hope is that it can stay independent and stay out of the grips of a jealous Microsoft or Google or Oracle. The IT sector needs an independent and truly unique option to Red Hat OpenShift plus OpenStack and VMware SDDC and the entire Microsoft Azure stack plus the Windows stack.

By our math and given HashiCorp’s desire to grow at 30 percent per year, the company will break $1 billion in sales in fiscal 2026 and will very likely be for the entire fiscal 2026 year. By fiscal 2027, HashiCorp could be generating $1.25 billion in overall revenues, have somewhere between 15,000 and 20,000 customers, and be bringing anywhere from 5 percent to 15 percent of revenues to the bottom line.

We look forward to seeing if all of this can come to pass.

Be the first to comment