Having commercialized its waferscale AI computing platform to a certain extent over the past several year, Cerebras Systems reportedly wants to get an initial public offering done before the AI hype peaks.

Citing several unnamed sources, Bloomberg reports that executives at Cerebras recently began meeting with advisors regarding a public offering that would value the company in excess of $4 billion, possibly sometime in the second half of 2024.

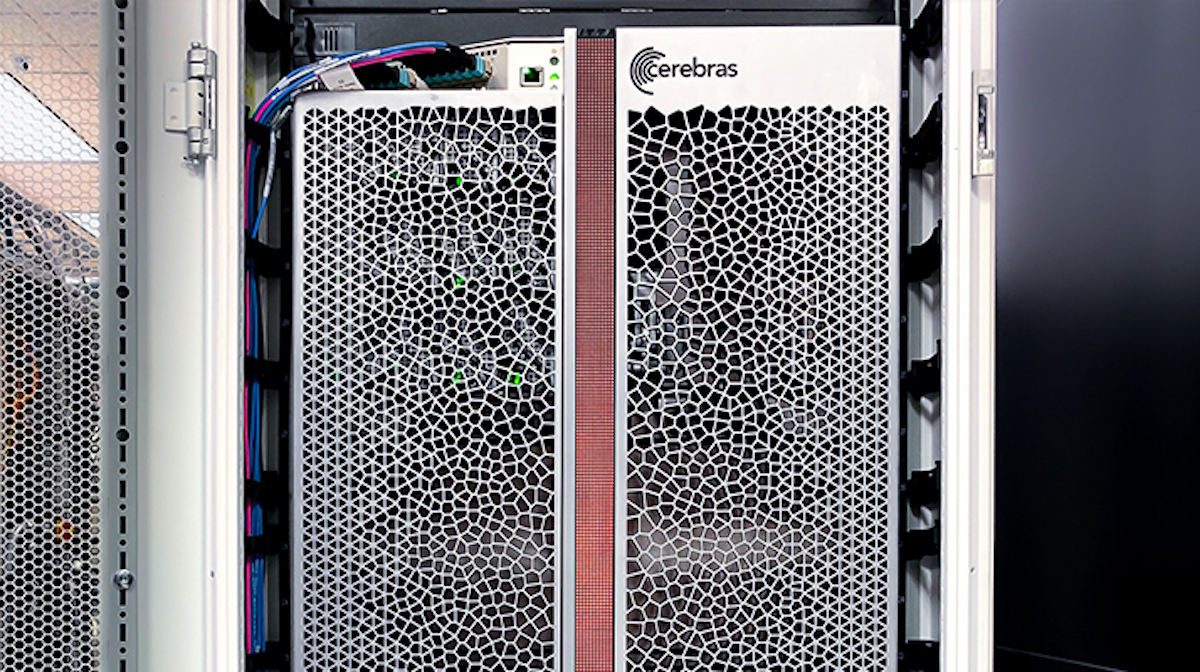

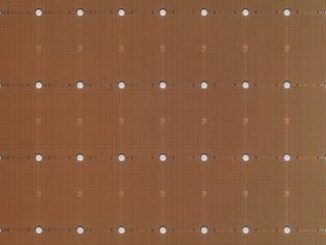

Founded in 2016, Cerebras Systems is a bit of an odd duck as chip startups go. Rather than developing chips for PCI-Express cards or a module like Nvidia’s SXM or the ones used by AMD and Intel for their GPUs for conventional systems, each of the chipmaker’s WSE-2 parts is built from a single wafer that houses 850,000 cores and 40 GB of SRAM. (You can find our deep dive into the Cerebras waferscale systems here.)

This unorthodox approach to chip design has helped the chipmaker secure $715 million in venture capital across six funding rounds. Its most recent, brought in $250 million in 2021. At the time, the company was valued at $4 billion. In the two years since, the company has gone on to demonstrate the practical application of its CS-2 systems at scale with the launch of the Andromeda AI supercomputer in 2022..

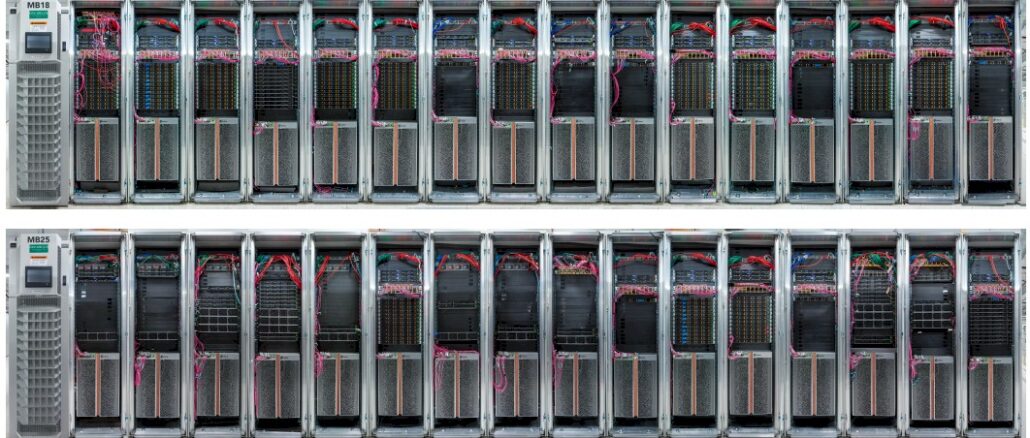

Composed of 16 CS-2 nodes and 284 AMD Epyc processors, the Andromeda system is capable of squeezing 120 petaflops of dense FP16 performance, or as much as an exaflop when employing sparsity, from half a megawatt of juice.

As it turned out, Andromeda was just a precursor to a far larger deployment commissioned by Abu Dhabi-based G42 announced last summer. Under the agreement with G42, Cerebras has begun construction of a distributed cluster of nine AI supercomputers based on its CS-2 architecture called Condor Galaxy. The complete cluster will eventually span nine sites and total 36 exaflops – 4 exaflops each – of sparse half-precision grunt, and will be used to train a variety of AI models for G42 and others.

Valued at approximately $100 million a site, the project is also Cerebras’ largest contract to date. Following the deployment of the first site at Colovore’s liquid-cooled datacenter in Santa Clara last summer, Cerebras and partner G42 have already begun churning out large language models (LLMs), demonstrating the system’s ability to compete with more mature platforms from Nvidia.

Recent successes at Cerebras haven’t been without controversy, however. Late last year, reports surfaced revealing that G42 was suspected by US intelligence agencies of secretly furnishing compute resources to Chinese interests. In response, G42 quickly announced plans to phase out Chinese equipment in a bid to assuage the United States.

Whether or not Cerebras will actually move forward with an IPO this year remains to be seen. Bloomberg reports that the company is also in talks to raise funds for a seventh funding round, which we suspect may push back the initial offering to 2025. It is unusual for a tech company to do more than a Series F (sixth round) of funding, but with the demand for AI application acceleration being at a fever pitch, there is probably room for an exception for Cerebras.

Rival SambaNova Systems has raised $1.1 billion in four rounds and had a $5 billion valuation in April 2021 when it did its Series D round of $676 million. SambaNova has been taking down money in bigger bites, and depending on the appetite for capital and the availability of it, if Cerebras goes public this year and does well, then SambaNova will probably follow.

Be the first to comment