Some patterns are very hard to break. From the very early days of the systems business as we know it, which started six decades ago, the fourth quarter of the calendar year has been the money maker for companies like IBM, and the second quarter has been a relatively big one for those who could not get their budgets together before the end of the prior year.

And even here in 2024, when the X86 server still dominates everything AI training and inference (which is done on GPU systems by and large) and online transaction processing and the associated application serving and transaction monitoring at scale (which runs on a pretty large base of IBM Z mainframe and Power Systems iron at many of the Global 20,000), this trend of buying in the fourth quarter has persisted. And Big Blue’s financials for the fourth quarter show it well, even if this probably be the last hurrah until follow-on Power11 and z17 processors and their systems launch sometime in 2025.

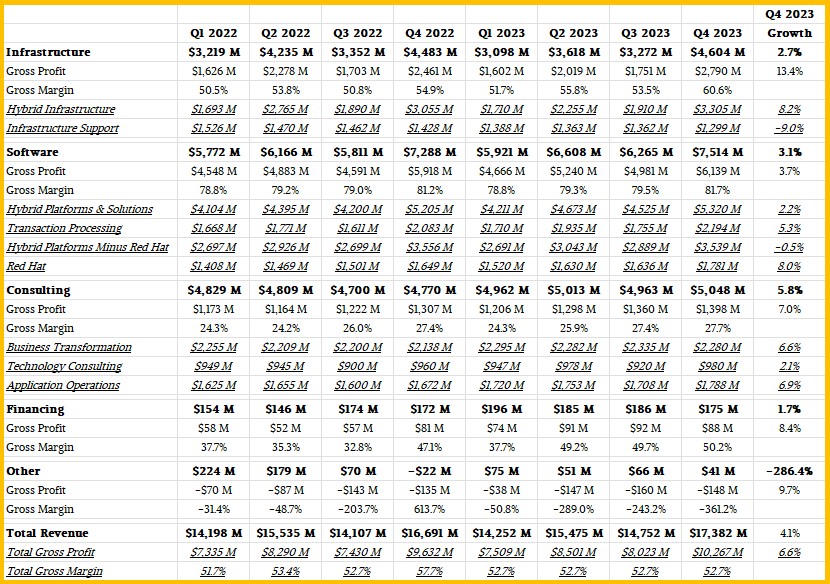

In the quarter ended in December, IBM posted a 4.1 percent increase in revenues, to $17.38 billion, with gross profits up 6.6 percent to $10.27 billion and net income up by 21.3 percent to $3.29 billion. IBM exited the quarter with $13.1 billion in cash and equivalents, up 65.7 percent compared to a year ago. Aside from some small software acquisitions here and there, we do not think that IBM is inclined to do anything with that cash hoard but see it grow and build up some strategic reserves to hedge against an uncertain future. This is particularly true given that we are probably 18 months away from the Power11 and z17 launches, which will help rejuvenate the systems cycle at the company after what is expected to be a slight decline in both revenues and profits going forward in systems.

“In Infrastructure, as we are entering the year seven quarters into the z16 cycle, we expect 2024 infrastructure revenue to decline,” Jim Kavanaugh, IBM’s chief financial officer, explained in a call with Wall Street analysts going over the Q4 numbers. “This should drive over a point impact to IBM’s overall revenue growth. And given the Z cycle dynamics, we expect Infrastructure pre-tax margin to be lower year-over-year.”

While Kavanaugh didn’t say this, the same general dynamics (pun intended) are at play with the Power Systems lineup.

IBM’s Infrastructure group, which sells servers, storage, operating systems, and tech support for the Power and Z lines, saw sales rise by 2.7 percent to $4.6 billion, but thanks to new system sales and in-field and often on-demand upgrades of existing gear, gross profits for the group rose by 13.4 percent to $2.79 billion. Pre-tax income for the Infrastructure group rose by 15.5 percent to $1.19 billion, representing 25.7 percent of revenues.

Within the Infrastructure group, sales of servers and storage – what IBM calls the Hybrid Infrastructure division – rose by 8.2 percent to $3.31 billion, while Infrastructure Support saw revenues decline by 9 percent to $1.3 billion.

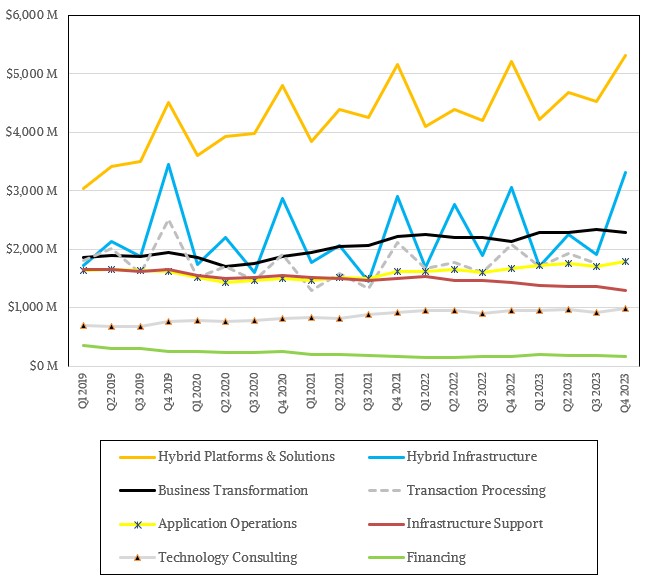

IBM’s Software group, which sells myriad kinds of middleware, database, and application software to run atop these systems, had $7.51 billion in sales, up 3.1 percent year on year and a very respectable gross profit of $6.14 billion, or 81.7 percent of revenues. If you want to know why – or how – IBM can invest billions of dollars every three years or so to keep the Z and Power lines rolling, there is your answer. Pre-tax income for Software group was down 36.7 percent, however, as IBM stumbled selling security software and is apparently under some pricing pressure. Within that software stack, Red Hat comprised $1.78 billion in sales for Q4 2023, up 8 percent.

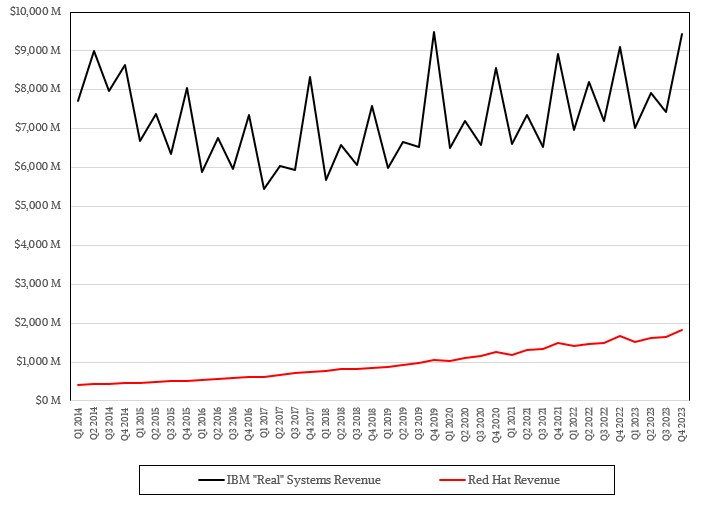

Speaking of Red Hat, as we said more than four years ago when the Red Hat acquisition was announced, it has helped saved the systems business at Big Blue and given it a new story to tell and hope for the future even as the company serves its legacy installed base. Here is a plot of Red Hat revenue versus IBM’s “real systems revenue, and you can see that decline reverse because of the addition of the datacenter portion of the Red Hat stack:

The Red Hat revenue shown above is for all of the division, but the portion of red Hat is that is allocated to the “real” IBM systems revenue estimates in our model includes sales of Red Hat Enterprise Linux, OpenShift, OpenStack, Ansible, and other middleware sold into the datacenter for both IBM’s own systems and those of others. The remaining portions are for storage, database, application development, and other Red Hat software that is not part of what we consider a core system.

While Red Hat revenues no longer grow as fast as they did back then IBM first did the acquisition, they are still growing faster than global gross domestic product, global IT spending, and IBM overall, and that is something for Big Blue to be happy about.

“In Red Hat, revenue performance was similar to last quarter as we continue to see dampened growth in consumption-based services,” Kavanaugh explained on the call. “Our future growth indicators are encouraging. Red Hat annual bookings were up 17 percent, including double-digit bookings growth across all three key offerings: RHEL, OpenShift, and Ansible. Renewals have been strong this quarter with our NRR up well over 100% and up 6 points over last year. And OpenShift continued its strong performance with annual recurring revenue of $1.2 billion.”

And by the way, the aggregate capacity used by those legacy installed bases is growing, not shrinking. On the call, Kavanaugh said that the installed base of MIPS – a metric that used to be based on millions of instructions per second for the CPUs in an IBM mainframe up until the 1990s but which has since then been just a relative throughput metric – in the mainframe installed base has doubled between the z14 and z16 generations thus far, representing an acceleration in the appetite for mainframe capacity. Among IBM’s largest Power Systems customers, we expect that the trend is much the same. Workloads change much more slowly among the customers who use entry and midrange Power Systems iron.

As for direct AI revenue, there has not been a lot. In the third quarter, IBM said it had several hundred million dollars of AI bookings, and that this doubled in Q4. We would guess something around $300 million to $400 million in bookings in Q3 for the watsonx – we really hate that it is not called WatsonX – stack for large language models as well as other software and hardware, and therefore $600 million to $800 million in bookings in Q4. But that is admittedly a guess. Expect startup acquisitions here as IBM builds up its AI software stack.

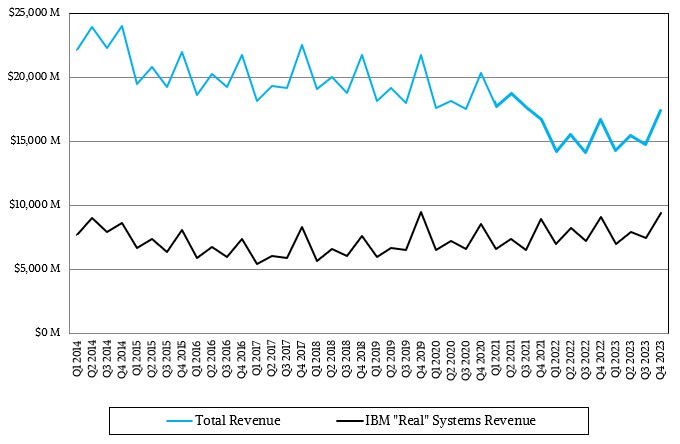

As best as we can figure, that core “real systems” part of IBM based on its System Z and Power Systems platforms brought in $8.18 billion, up 2.9 percent year on year and had a pre-tax income of $4.48 billion, up 9.8 percent. Add in those datacenter system parts of Red Hat and the “real” real systems revenues for Big Blue were $9.43 billion, up 3.5 percent. We do not have an easy way to calculate pre-tax income for the Red Hat division, so we are opting out of that for now.

Well, no. If we had to guess, it would be somewhere around $200 million to $250 million in pre-tax income for the datacenter system part of the Red Hat stack in Q4. The Red Hat datacenter stack actually dilutes the profits of the IBM System Z stack a little if this is true, and that stands to reason given the relatively high price that IBM mainframe shops pay for their software.

A mini-monopoly is a terrible thing – unless you happen to have one.

How did the IBM used / refurbished resale trade do? Doesn’t IBM have a revenue line for used and system sale turnovers? mb

They never have a line item on new versus used, and until the Kyndryl spinoff, it was all under IBM Global Asset Recovery Services, which was part of Global Services, not the Systems Group. After the reorg, used stuff moved into Infrastructure group.

Mainframe-cycle used to last 10 quarters – has that changed?

Closer to 12 these days.