In a world where Nvidia is allocating proportional shares of its GPU hotcakes to all of the OEMs and ODMs, companies like Dell, Hewlett Packard, Lenovo, and Supermicro get their shares and then they turn around and try to sell systems using them at the highest possible price. Given that demand is several integer multiples higher than supply for GPU compute engines thanks to the generative AI craze, anyone who has GPUs can make some money, and that money can fill in some other gaps in the infrastructure business that are not doing so well.

Supermicro, for instance, just straight up blew the doors off its business in its most recent quarter thanks to AI systems sales, while Hewlett Packard Enterprise is still feeling the effects of the server recession that exists outside of the AI boom. Wall Street is throwing a party today because Dell has beat expectations in its infrastructure business, but we don’t give a care about expectations. All IT vendors manage those expectations very carefully. So what? The fact is, Dell’s infrastructure business is still down – significantly down – and it is only maintaining profits because it is walking away from deals – we presume big deals and we presume deals where hyperscalers and cloud builders are looking for GPU systems but they do not want to pay a high price.

Like the national HPC labs, the hyperscalers and cloud builders are used to commanding steep price discounts – because might makes right, as you well know – and for the past several quarters they have been scrambling everywhere to get more than their fair share of the GPU compute so they can use it to figure out how to compete with each other and to turn around and sell that GPU compute as a service on their clouds at somewhere between 65 percent and 70 percent operating margins – or more for on demand and one-year reservations that are shorter than the three-reservation terms and therefore have higher per-hour charges.

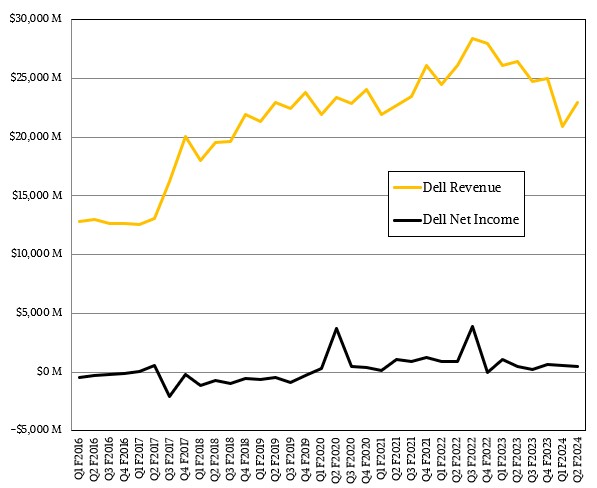

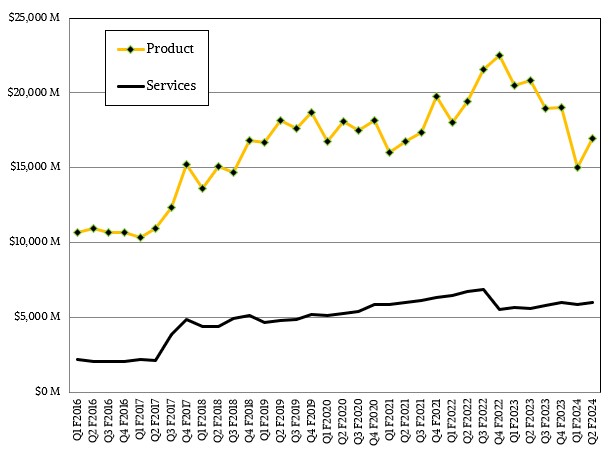

In the second quarter of fiscal 2024 ending the first week of August, Dell’s sales were off 13.2 percent to $22.93 billion and thanks to prudent deal making and cost cutting, net income only fell by 10.1 percent to $455 million. That income represented a mere 2 percent of revenues, which is the kind of profit level a chain food store makes, not an IT supplier that is also the largest OEM in the world.

The problem that Dell, HPE, and Lenovo all have is that both the PC business and the enterprise server business are down right now.

The PC business is in a slump because we all bought extra PCs and laptops during the coronavirus pandemic and we are in no mood to buy new machines at the same pace. While no market ever goes to zero, the PC business is not expected to return to sales levels experienced in 2020 and 2021 until three years from now.

The server business, particularly the likes of Dell and HPE, which do not have significant business with the world’s largest hyperscalers and cloud builders excepting the recent GPU allocations as Nvidia is ramping its “Hopper” H100 compute engines and still pumping out its “Ampere” A100 predecessors, has been slumping a bit for a few quarters thanks to concerns over the national and global economies. Inflation on server prices has helped mitigate the shipment declines some, but shipments are down in the double digits for a few quarters now and even with component cost inflation and sales of very expensive AI systems heavy with GPU compute, companies like Dell and HPE cannot completely fill in the gap from that enterprise slump. Note: Supermicro has a handful of big hyperscaler and cloud customers that have turned to it in addition to their regular ODMs, and thanks to its GPU allocation and the ongoing desire to get less expensive infrastructure, Supermicro’s business is booming.

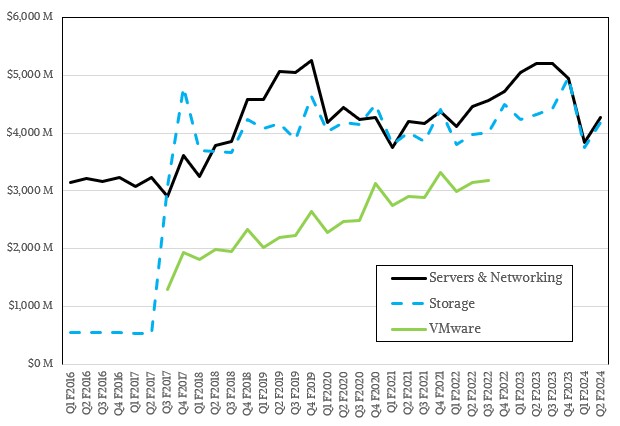

In the August quarter, sales in the Server & Networking division were down 17.9 percent to $4.27 billion, and sales in the Storage division were off 3.2 percent to $4.19 billion, so the combined Infrastructure Solutions Group booked $8.46 billion, down 11.3 percent year on year. Everyone is ebullient because Dell’s server, networking, and storage business had 11.4 percent growth sequentially from Q1 F2024, and that the growth was even across the two divisions. Operating income was flat year on year – well, up three-tenths of a point – but rose by 41.8 percent sequentially to $1.05 billion. This operating profit level of 12.4 percent of revenues was more consistent with the average level of profitability that Dell’s Infrastructure Solutions Group has had in recent years since the pandemic hit.

This indicates that Dell’s salespeople are exhibiting discipline in their pricing and its supply chain managers are chasing supply for components for which Dell can charge a premium. As an example: Dell’s eight-GPU PowerEdge XE9680, which is essentially a clone of Nvidia’s DGX-H100, is the fastest ramping product in Dell’s long history in the datacenter and it has a $2 billion backlog as the quarter ended, and GPU allocations are now 39 weeks out, according to Jeff Clarke, vice chairman and chief operating officer at Dell. But here is the rub:

“When I think about the role of AI servers, AI servers from an ASP point of view are significantly greater than a datacenter or a general purpose computer, if you will,” Clarke explained on a call with Wall Street analysts going over the numbers. “They’re dilutive on a margin percentage. They are accretive on a margin dollar basis. That’s how Yvonne [McGill, Dell’s chief financial officer] and I look at the business. That’s the backdrop of how we look at AI servers in our portfolio, continuing to drive gross margin dollars, making sure that it’s accretive from that point of view.”

So, as was the case with Intel CPUs in the general purpose computing era from say 2010 through 2018, when Intel was getting most of the profits embodied in a CPU when Xeon and Xeon SP chips were also on allocation, Nvidia is getting most of the profits from these AI system sales. The GPUs are driving high system prices, but Nvidia is not giving the OEMs and ODMs much in he way of a price break on them because, frankly, it doesn’t have to given the demand. And so, Dell and others have to wring what profits they can from their AI systems and work on selling services as part of those systems. Hence the Project Helix optimized hardware-software stacks that Dell and Nvidia cooked up last week. You can sure bet that if Dell sells the AI Enterprise software stack on PowerEdge XE9680 machines, suddenly it has more margin.

But let’s not kid ourselves. Something dramatic will have to happen for Dell to make more revenue and more profits in systems. If enterprises, governments, and academic institutions settle down about the economy and if Nvidia can ramp up GPU shipments to all of its partners and share some of the profits, then we think there is a chance to get the systems businesses at Dell and its OEM peers back to something that feels like normal. This quarter was perhaps the first step in that direction.

Be the first to comment