Only a few years ago, motherboard and system maker Supermicro set a target of breaking through $10 billion in sales, and thanks to the explosion in systems for training and inference for AI applications, it looks like the company is going to bust through that goal in its fiscal 2025 ending next June. And now, the company says it can break through $15 billion in annual sales in the next several years – way ahead of plan – and is considering how it get factory capacity to support a $20 billion business.

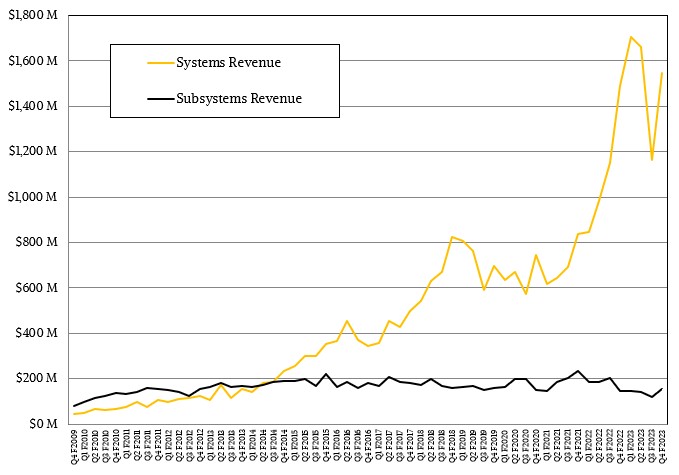

The Supermicro that is experiencing this explosive growth is not the Supermicro from the Dot Com Boom and its aftermath. Back then and up through the Great Recession in 2008 through 2010, Supermicro was known for making very good motherboards and plug in cards – and a wide variety of them – and also made enclosures and other bent metal features available so third parties could assemble custom systems and resell them to actual IT shops. Supermicro sold to some of the biggest users of its iron directly – at the insistence of those customers – and had a tidy little business of a couple hundred million dollars a year and had a unique niche that sat between the original design manufacturer (ODMs, like Quanta and Foxconn and Inventec) used by the hyperscalers and cloud builders and the original equipment manufacturers (OEMs, like Hewlett Packard Enterprise, Dell, and Lenovo) used by smaller enterprises, governments, and academia.

Supermicro is now on track to be 20X bigger than that in its fiscal 2024 year ending next June, and is setting its sights on doubling in size again within the next several years.

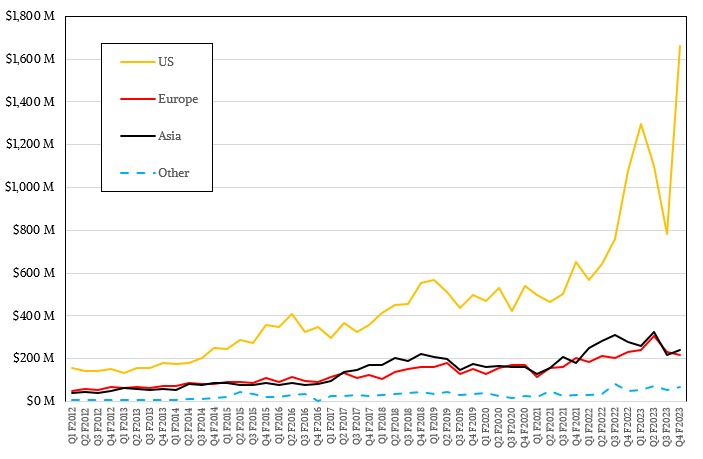

What is different in 2023 from what was normal in 2003 and even 2013 is that very large server buyers in the United States need alternative suppliers who can work the supply chain and build lots of machines – tens to hundreds of thousands at a time – on a tight schedule. In many cases, they want machines to be built here in the United States and not have to be shipped from factories in China or Taiwan. And, they want to have more influence with their supplier than they might be able to get with one of the ODMs in Asia or the OEMs like Lenovo, Inspur, and Dell that have groups that do ODM-like business for very large customers.

What is different in 2023 from what was normal in 2003 and even 2013 is that very large server buyers in the United States need alternative suppliers who can work the supply chain and build lots of machines – tens to hundreds of thousands at a time – on a tight schedule. In many cases, they want machines to be built here in the United States and not have to be shipped from factories in China or Taiwan. And, they want to have more influence with their supplier than they might be able to get with one of the ODMs in Asia or the OEMs like Lenovo, Inspur, and Dell that have groups that do ODM-like business for very large customers.

So, in short, Supermicro is benefiting bigtime from the reshuffling of supply chains and from the intense demand for AI systems and rackscale systems running Web infrastructure and microservices-style applications.

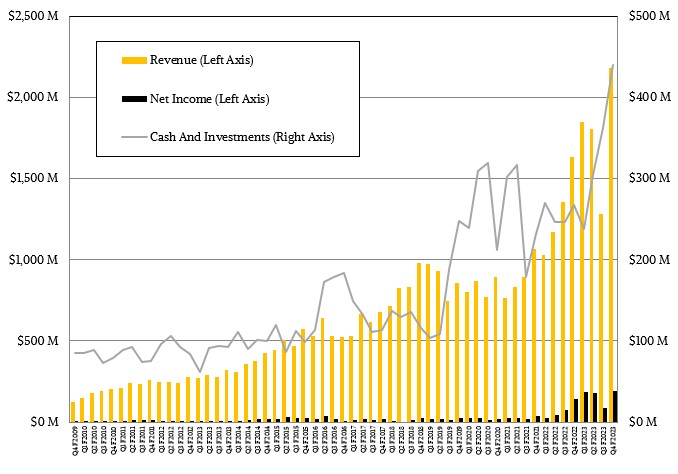

In the quarter ended in June, Supermicro had $2.18 billion in sales, up 33.6 percent and just blowing through its forecast of $1.7 billion to $1.9 billion. And net income grew even faster, rising 37.4 percent to $192 million, which just goes to show you that you can take on some hyperscale and cloud builder business and make a little money on the deals, too.

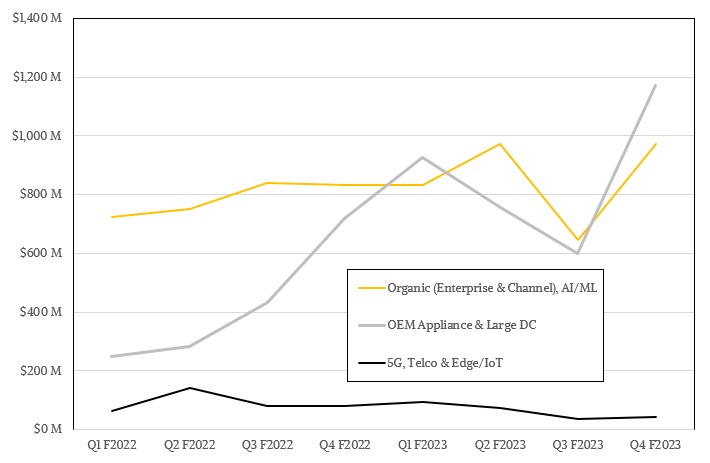

Speaking to Wall Street going over the numbers, Charles Liang, Supermicro’s founder and chief executive officer, said that 52 percent of the revenue in Q4 fiscal 2023 ended in June was drive by AI systems and rackscale systems, which works out to $1.14 billion and which represents a 3.1X increase from the third quarter of the fiscal year ended in March. (We don’t have data for this category going back further in time.)

In the quarter, subsystems – motherboards, enclosures, cards, and so forth – accounted for $153 million in revenues, an increase of 3.9 percent from the year ago period, and systems revenues rose by 36.5 percent to $2.03 billion.

AI system sales are so material to all server makers at this point that the US Securities and Exchange Commission might come around and compel companies to report their sales uniquely in their financial results in some fashion.

In its financial reports, AI and ML systems are grouped with enterprise and channel sales in a category called Organic, which had sales of $972 million in the period, up 16.5 percent. Sales of OEM appliances (like the DGX machines that we think Supermicro is building for Nvidia, if the rumors around that supply deal are correct) and of gear to large datacenter operators (like Meta Platforms and apparently a few others, since Supermicro had two “greater than 10 percent” customers in the quarter), accounted for $1.17 billion, up 62.6 percent. Equipment sold to 5G, telco, edge, and IoT customers fell by 47.4 percent to $43 million.

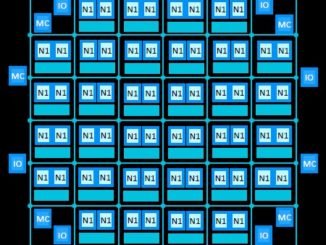

In the quarter, 76 percent of Supermicro’s sales went into companies located in the United States, and it is no surprise that the company is looking to expand. Liang said on the call that Supermicro was evaluating its factory and storage footprint and had just taken over a lease on a building close to its San Jose campus. (The Fry’s Electronics building nearby has been empty for a while in the wake of that company shutting down its stores in 2021, so that might be what Liang is hinting at.) Liang said that Supermicro was able to build 4,000 racks of servers per month and was adding this capacity to boost its rackscale output in fiscal 2025 above and beyond an expansion in Malaysia that has been already announced.

“We are also planning to build another manufacturing campus in North America,” Liang said. “At this moment, our US headquarters and Taiwan facility can support at least $15 billion in revenue, while the new Malaysia facility will further increase our total revenue potential by serving scale builds on a reduced cost structure in the coming calendar year 2024.”

We have been advocating for a factory in western North Carolina, which is where Meta Platforms and Google already have datacenters and Microsoft is building a whole bunch, thanks to the availability of cheap power, fairly cheap land, low taxes, and reliable water supplies.

Whatever is going on, Supermicro has a lot more visibility into what its customers are doing and is being very bullish about its prospects in the coming years.

“Due to the current key components supply shortages, we forecast revenue in the range of $1.9 billion to $2.2 billion for the September quarter,” Liang continued. “However, given the record high backlog, we see fiscal year 2024 revenue between $9.5 billion to $10.5 billion with room to deliver more depending on availability of supply. Our role as the leader of rackscale, total AI and IT solutions has only just begun. We are ready to deliver optimized AI infrastructures to existing and emerging markets, along with our value-added software and services. To say it plainly, our foundation and capacity are fully ready, and our demand is growing strongly. With large language model and other AI applications booming, I now expect the $20 billion annual revenue target to be just a couple of years away.”

That would put Supermicro on par with Hewlett Packard Enterprise, the number two maker of servers in the world behind Dell. (And quite a bit behind Dell, at that.) And if HPE isn’t careful Supermicro could pass it, even with the acquisition of Cray a few years back. And if Dell isn’t careful. . . .

Awesome decision for Supermicro to put a new manufacturing campus in western NC, a stone’s throw from the world-renowned TNP Studio-Garage, cheap power, inexpensive land, and a reliable supply of Texas Pete’s Original Hot Sauce (made in Winston-Salem)!. 8^d

P.S. Meta, Google, and Microsoft likely used the same AI Hot Sauce to site their NC facilities (ahem)!