As one of the four key engines of compute and networking, we like to keep an eye on what is happening with field programmable gate arrays and the SoCs that incorporate them and have a mix of network and CPU and other accelerator circuits increasingly embedded on them. That got a little harder this week when Xilinx, which is in the middle being acquired for $35 billion by CPU and GPU maker AMD, released its financial results but did not have its usual call with chief executive officer Victor Peng.

We will just have to make due with looking at the numbers ourselves and comparing and contrasting them with what we see coming out of Intel with its Programmable Systems Group and what we learned about Achronix, the smallest of the big three FPGA makers, that is doing a complex deal to raise money and get listed on the NASDAQ exchange. That deal, which covered here, was announced three weeks ago and is expected to close by the end of June of this year. Lattice Semiconductor is the other big player, but is more involved with embedded and client devices. Eventually, we will add all four into our financial analysis. Stay tuned for that.

And when we say the four key engines of compute and networking, we mean CPUs, GPUs, FPGAs, and network ASICs, all of which either move data or chew data or both – the lines are getting harder and harder to draw.

As for what is happening with FPGAs, let’s start with Xilinx, which is the big player these days when it comes to FPGAs. It is the company that we currently have more visibility into, since Intel doesn’t give more detail than revenue and operating profits for its Programmable Solutions Group, formerly known as Altera. (Which used to give out fairly detailed financials like Xilinx still does and almost assuredly will not do when it is acquired by AMD. Which is a shame, really.)

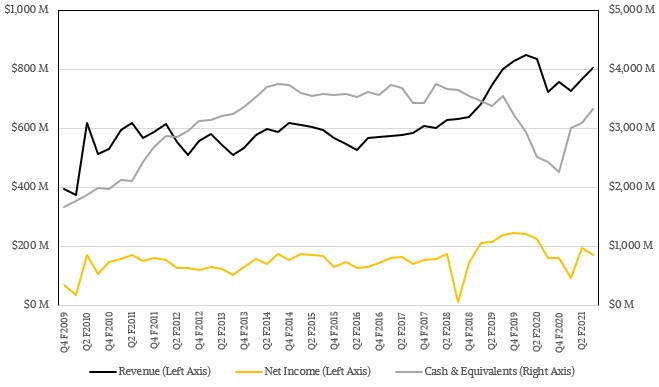

In the third quarter of fiscal 2021 ended on January 2, which very closely aligns with Intel’s fourth quarter of calendar 2020 ended in December, Xilinx had sales of $803 million, up 11.1 percent and net income of $171 million, up 5.6 percent.

As you can see from the chart above, the company’s cash pile keeps growing and it exited the quarter with $3.32 billion in cash, which will cushion the financial blow of the AMD acquisition, which the CPU and GPU maker said this week is on track to close before the end of the year. In the trailing twelve months, Xilinx sales are down 5.6 percent to $3.05 billion, and net income has declined 29 percent to $621 million.

While datacenter-related FPGA spending was down 13.6 percent to $56 million in fiscal Q3 2021, for the full year spending on FPGAs for datacenter products rose by 40.5 percent to $326 million in the trailing twelve months. Xilinx had some accelerated sales in the first half of its fiscal 2021 as the trade war between China and the United States heated up, and companies like Huawei Technology bought in bulk to stuff their supply chains. The 45 percent sequential decline was “in line with expectations,” according to the brief statement that Xilinx put out.

Thanks to the 5G ramp in the wireless telco space, the Wired and Wireless Group boosted sales by 3.9 percent to $233 million in the quarter but fell by 31.6 percent to $1.24 billion for the year.

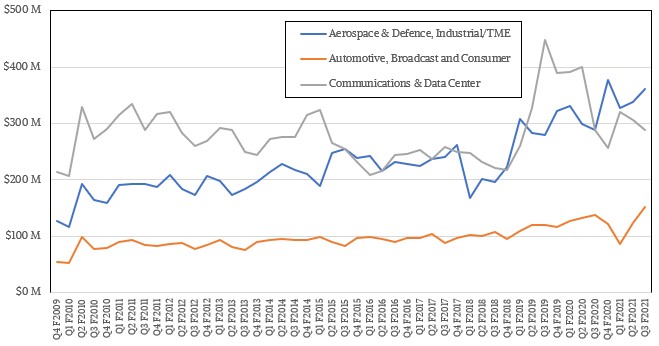

To be consistent with the way past revenues were categorized, the chart below combines sales in the communications sector (wired and wireless) with the datacenter, and that collective business has declined by 20.2 percent to $1.17 billion in the trailing twelve months.

Take a look at the trends:

In the past year, the aerospace & defense, industrial, and test/measurement collective has been the bright spot, with sales up 12.9 percent to $1.4 billion and hitting $361 million in the fourth quarter, up 24.9 percent. The automotive, broadcast, and consumer segment of the Xilinx business was up 11.1 percent in Q3 F2021, to $153 million, but down 6 percent in the trailing twelve months to $484 million.

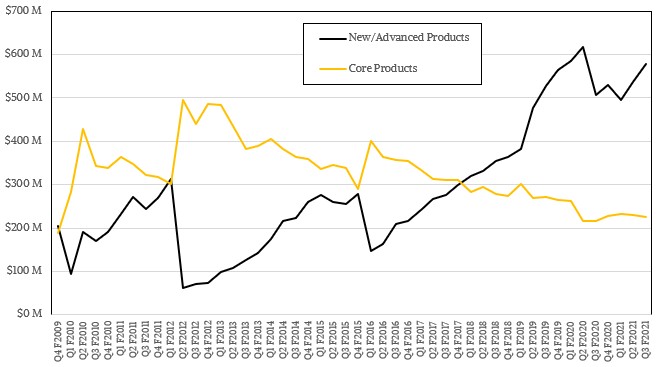

The trend to sell newer FPGAs based on the most advanced processes continues at Xilinx, as you can see below:

The advanced products include the Versal, UltraScale, UltraScale+, and Virtex-7 series devices plus the Alveo server cards that use them. The core products include everything else, which is by name means the: Virtex-6, Spartan-6, Virtex-5, CoolRunner-II, Virtex-4, Virtex-II, Spartan-3, Spartan-2, XC9500 products.

For whatever it is worth, all of this was above the guidance that Xilinx gave to Wall Street. Peng added in his statement that the first 7 nanometer Versal device has done into production with a “leading wireless OEM.” Thus beginning a new cycle after two years of preparing the market for it.

Shifting to Intel’s Programmable Solutions Group, formerly known as Altera, business, we talked a bit about this in going over Intel’s financial results for Q4 2020 last week. Altera definitely saw the same trend towards newer devices in the data we compiled between the Great Recession in 2009 and when Intel bought Altera in 2015, but we have no idea what it looks like between that time and now. Telecom and wireless were the biggest parts of its business, with a pretty even split among the remaining industry sectors Altera talked about: networking, computer and storage in the second bucket, industrial automation, military, and automotive in the third bucket, and “Other” in the final fourth bucket. But again, Intel does not provide any insight here.

Intel does report revenues and operating income from Programmable Solutions Group, and from that and past data from Altera, we estimate the net income attributable to this unit (using an allocation of costs to pull down operating income to net income that is proportional to Intel overall) so we can make comparisons to Xilinx. Using this method, we have Intel’s FPGA business off 16.4 percent to $422 million and net income down by 50.4 percent to $43 million in Q4 2020, the one most closely aligned with the Xilinx Q3 F2021. For the trailing twelve months, the Intel FPGA business was down 6.7 percent to $1.85 billion, with net income off 25.5 percent to $226 million by our model.

The Xilinx business is 1.65X bigger than the Intel/Altera business and it is 2.75X as profitable. And it will definitely be accretive to AMD in a way that Altera has not really been to Intel. AMD is small enough that Xilinx makes a big difference. Intel was big enough that it was hard for Altera to make a big difference. AMD is paying almost twice as much for Xilinx as Intel paid for Altera, and we begin to see why.

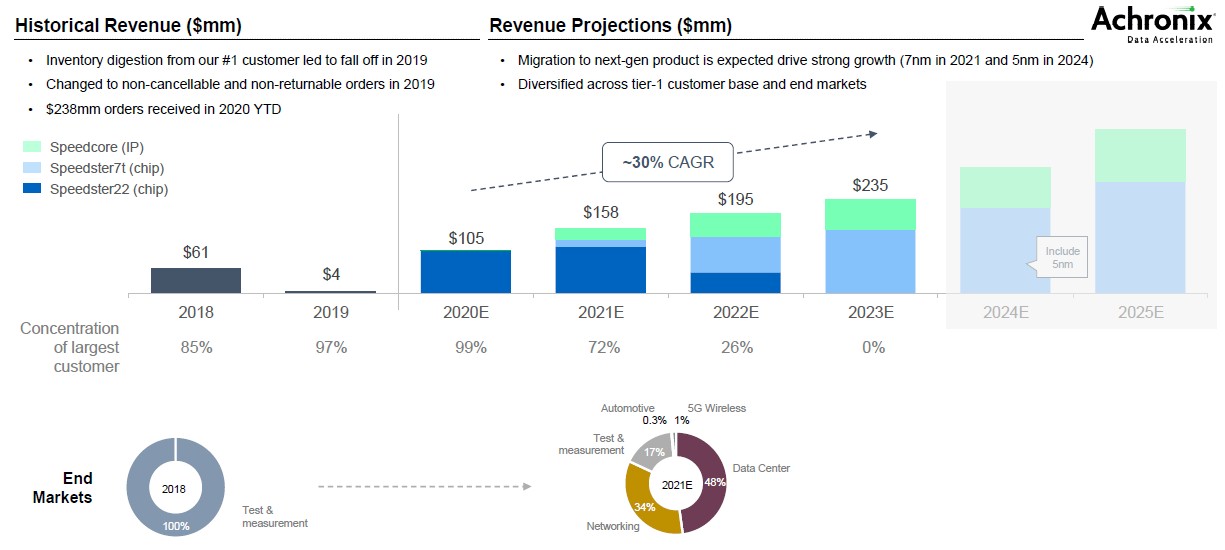

That leaves upstart Achronix, which has revealed some of its financials for 2020 and its aspirations for 2021 as part of its going public through a SPAC, not an IPO. (Read our story from last week to understand what happened on that front.) But this chart sums up the financial situation at Achronix nicely:

As you can see, Achronix has a lot of its financial eggs in one basket, and its main customer in 2018 didn’t really buy much in 2019 because they basically bought for two years. Achronix had raised $135.8 million between 2007 and 2013, so it had the wherewithal to ride out 2019 with a few smaller customers and get into 2020, where another customer accounted for 99 percent of the $105 million in revenue Achronix generated. Looking ahead to this year, Achronix will see its business start to trifurcate, with its Speedcore soft IP implementation of FPGAs starting to get traction as well as its new 7 nanometer devices, the Speedster7t, etched by Taiwan Semiconductor Manufacturing Corp. The Speedster22, which is etched by Intel in its very mature 22 nanometer processes, will still make up the bulk of sales at Achronix in 2021, but by 2020, Achronix hopes to be kissing $200 million in sales with a more even split between hard and soft IP and with a broader mix of customers.

Here is the fun bit. Achronix lost $33.7 million in 2019, but it actually had a net income of $33.4 million against $104.9 million in sales in 2020, and it expected to book a net income of $45.3 million against sales of $157.6 million in 2021 and $52.1 million against sales of $195 million in 2022. This business might be a lot smaller than either Xilinx or Intel/Altera, but it is throwing off a lot more cash per unit of revenue. So Achronix is someone to watch, as we have been saying all along.

“Shifting to Intel’s Programmer Solutions Group” should read …

“Shifting to Intel’s Programmable Solutions Group”.