Server buyers have longer memories and perhaps deeper disappointment of AMD’s exit from the X86 server processor business than consumers who buy PCs, and a manufacturing constrained Intel has clearly sacrificed some Core PC chip market share to maintain some Xeon SP server market share over the past two years. But that will only blunt the sustained and forceful AMD attack with its Epyc processors for so long. And perhaps right now, before we know it, AMD is breaking down the walls and getting traction with its third generation “Milan” processors, which are set to launch in March but which are already shipping to hyperscalers and the big public cloud builders.

AMD has managed to crest above 20 percent shipment market share in the PC sector with its Ryzen mobile and desktop processors, according to data from Mercury Research, and we have no trouble believing, given the respective roadmaps for AMD and Intel over the next two years, that AMD can get to this same market share in servers. Big share gains could come on the public clouds and in HPC systems first, and we suspect that these markets will accelerate their adoption of Epyc processors in 2021. We don’t hear of a single big HPC system in the United States that does not have AMD CPUs, and more than a few of them have AMD GPU accelerators, too. The public clouds around the world now have over 200 instances running atop Epyc processors, twice the number as a year ago, according to AMD chief executive officer Lisa Su, who spoke to Wall Street after the company releases its financial results for the fourth quarter of 2020 on Tuesday. Enterprises are lagging a bit on their Epyc ramps, as we and AMD both expected, but companies in the manufacturing, financial services, and automotive sectors are embracing Epyc processors in their systems at a higher rate than the enterprise sector at large.

“We set a new, all-time record for annual server processor revenue,” Su told Wall Street. “Server processor sales more than doubled year over year, and our overall datacenter sales are now a high teens percentage of our total annual revenue.” (This is a case where high teens is a good thing.) Both cloud and enterprise spending on Epyc processors increased sequentially from Q3 2020. “We are seeing a strong datacenter environment,” Su continued. “We see servers up sequentially in Q1, and that is on the strength of both our current Rome products as well as the Milan ramp.”

There is no reason why this datacenter percentage of overall sales can’t keep growing, particularly as AMD gains traction, with its ODM and OEM partners, in large distributed systems used across industries and sectors. We don’t expect a lot of action in the SMB arena, in contrast to the Opteron attack on the Xeon line back in the early 2000s when Intel was also vulnerable in servers.

While AMD may have set record server CPU revenues in 2020, the market is considerably larger than a decade and a half ago. During the heyday of the Opteron, when AMD crested above 20 percent shipment share, X86 server revenues represented around half of all server sales and on the order of $25 billion a year or so. These days, the X86 server represents on the order of 90 percent of a $90 billion or so market, or around $81 billion in sales, so it takes 3.3X as much absolute sales to get the same share of the X86 server market here in 2020 and 2021. (If you inflation adjust those sales in 2005, the gap closes a bit, of course, and you really need to do that over such a long period of time.) Our point is, eating market share is much harder in some ways than it was in 2005, but on the other hand, when the clouds shift, they make big shifts. Like the HPC sector did with Opterons a decade and a half ago and is seeming to do with the Epycs plus the Instincts this time around. This is what Su referred to as “the high performance computing megacycle,” which is not just happening in the datacenter, but on the desktop and laptop and game consoles, too.

What is interesting to us is that Intel’s top brass is talking about a period of “digestion” among the hyperscalers and the cloud builders happening in early 2021, but AMD is not. In fact, said Su, AMD is seeing robust cloud demand that is strengthening, and it makes sense given the TCO differences between Intel and AMD X86 server processors at this point. And even if Intel is more price aggressive with the “Ice Lake” Xeon SPs, AMD will be ramping up the performance with the Milan Epycs and the gap will still be there even if Intel can close it some. (We shall see.)

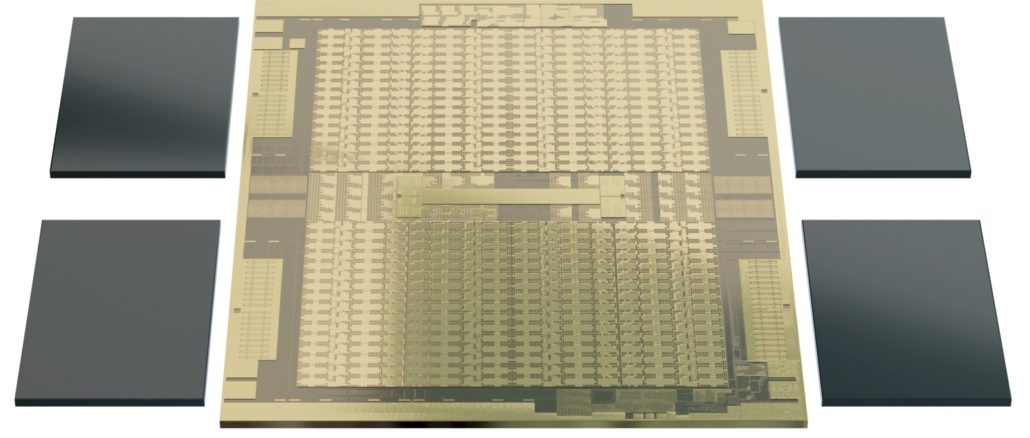

As for datacenter GPUs, this business was down year-on-year but up sequentially, and Su expects for this business, which has been dominated by cloud gaming, to shift to being dominated by HPC and AI workloads in the coming year, particularly as the “Frontier” supercomputer being built by HPE/Cray for the US Department of Energy at Oak Ridge National Laboratory using AMD CPUs and GPUs comes online later this year. Other HPC systems will follow fast. Su said that the first milestone for the Instinct GPU compute business was to push this to be a business that brings in $500 million in revenue a year.

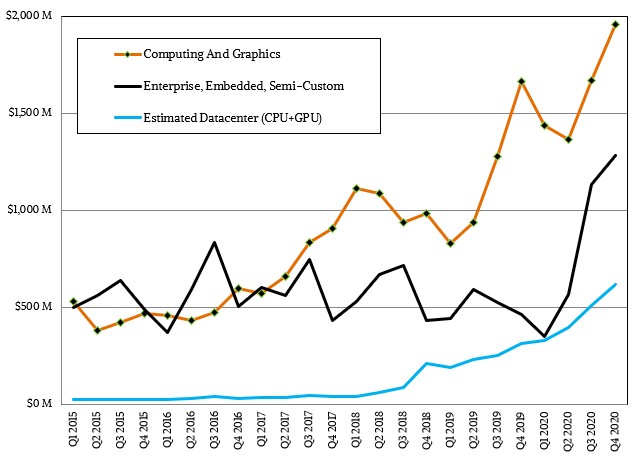

According to our own model, we figure AMD sold $72 million in datacenter GPUs in Q4 2020, down 12.2 percent year on year but up 10.8 percent sequentially. Add up the last four quarters, the datacenter GPU business was down 5.4 percent in 2020 to $277 million. Call it AMD being halfway to its first milestone, but the goal no doubt would be to have more than 20 percent datacenter compute market share against Nvidia. Our model shows AMD’s datacenter CPU sales to be $544 million, up 2.35X from a year ago and up 22.4 percent sequentially. For all of 2020, Epyc processors accounted for $1.58 billion, up 2.27X.

Add them together, the AMD datacenter compute business accounted for 19 percent of total AMD sales, to $616 million, up just under 2X year on year. For all of 2020, datacenter sales came to $1.58 billion, up 1.9X.

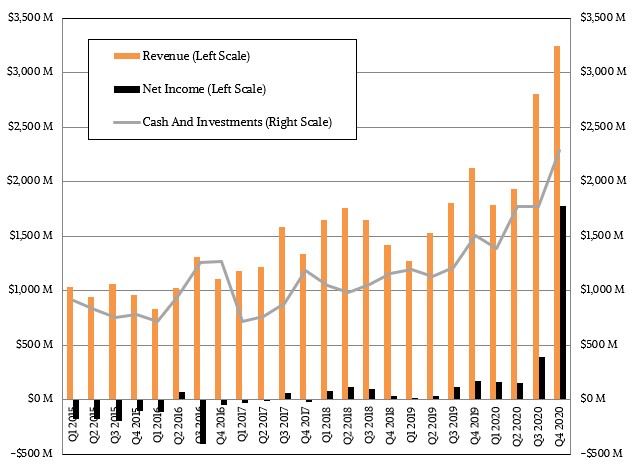

Across all of AMD, revenues were $3.24 billion, up 52.5 percent, and thanks to a massive $1.3 billion tax benefit that AMD’s bean counters slapped down, it was able to book a $1.78 billion net income, nearly 10X what it posted in the year ago period. For the full year, AMD posted sales of $9.76 billion and net income of $2.49 billion. But more than half of that net income is driven by that tax benefit. In 2021, AMD expects to grow by 79 percent to around $3.2 billion in the first quarter of 2021 and is projecting sales to grow by 37 percent, to around $13.38 billion. With that incremental $3.61 billion in sales, a lot of it will drop to the bottom line and be real net income, Datacenter might be somewhere between 20 percent and 25 percent of that, we reckon, or somewhere between $2.68 billion and $3.34 billion.

This would be a big victory for Su and her team. And it is absolutely attainable. It is also very early in the year, and a lot of things can happen – or not happen.

Will you do a similar article following up this Q1 report today? That’d be awesome, thank you!