Back in 2015, when we were launching The Next Platform, a lot of stuff was going on all at the same time, which is part of the zeitgeist that we were tapping into and that we wanted to chronical upon and participate within. And Intel was front and center of it all.

Intel had made a whole bunch of interconnect and switching acquisitions a few years earlier – the Ethernet switch ASIC business called Fulcrum Microsystems, the InfiniBand switch business from QLogic, and the HPC interconnects from Cray – and it was also creating a GPU-like many-core HPC processor based on vector-heavy X86 cores that would ultimately be called the Xeon Phi. And then, all of a sudden, it paid a whopping $16.7 billion for FPGA maker Altera, which was over two decades old at the time and which was neck-and-neck with archrival Xilinx in advancing the state of the art in these gate-based programmable logic devices.

At the time, Intel believed that as many as a third of all of all of the server nodes being installed at hyperscalers and cloud builders would have FPGAs in them, presaging what we now call SmartNICs or DPUs or IPUs, depending on your preference and precision. Intel was partially right. A thing we call a DPU is now normal in the massive environments financed by hyperscalers and cloud builders – offloading storage, network, security, and other processing from server nodes so they can focus on real work – and the idea is even taking off in the enterprise and in HPC centers, too. But custom ASICs dominate the installs, although there are some FPGAs in the mix sometimes.

Despite the trials and tribulations that came with Intel making such a big acquisition and Xilinx getting the jump on Altera in both process nodes and in design for its FPGAs, the former Altera business, which has been in the process of being spun out of Intel since last October, is a contender in a growing market and had been one of the more profitable parts of Intel’s datacenter and edge businesses. Intel’s delays in getting advanced manufacturing processes out the door have hurt the Altera business to a certain extent, and Xilinx, which was acquired by AMD in February 2022 for an incredible $49 billion, has benefitted as Altera lost a bit of focus and momentum inside of Intel.

Sandra Rivera, who used to run the Data Center and AI (DCAI) organization of Intel, has been named chief executive officer of the reconstituted Altera, which is bringing back its old company name, and Shannon Poulin, who has had many roles within the Xeon server CPU organization for decades and who was steering the underfunded Altera roadmap for the past couple of years, will be taking over as chief operating officer. The re-separation of Altera financials began in Q1 2024, and as we suggested rather strongly back in October last year, Altera is the right name for this spinout company, given four decades of existing branding.

We still don’t know if Altera will be fully spun out or partially, but we do know that Intel needs the cash pretty badly to build its factories for the Intel Foundry business. Intel has $25 billion in the bank, which is not all that much when a modern foundry pushing advanced processes (think 5 nanometer or 3 nanometer) can cost somewhere north of $15 billion. That $16.7 billion that Intel spent back in 2015 to acquire Altera is like $31.2 billion, so this diversion in essence cost Intel around two fabs minus the revenue or profit streams that were added to Intel’s coffers in the past eight years.

As part of the unveiling of the re-newed Altera name and logo this week, Rivera gave an update on the markets that Altera is chasing these days and what products with which it will chase those opportunities.

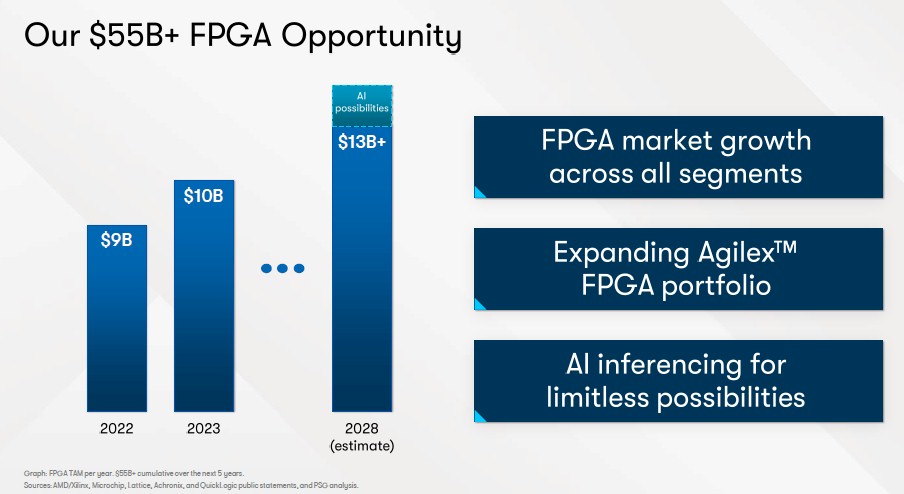

Here is the total addressable market that Altera is now chasing, mostly against Xilinx but also against Achronix and Lattice Semiconductor. Achronix sells FPGAs into the datacenter like Xilinx and Altera, and all four of them have embedded and edge use cases that span defense and aerospace, telecom and networking, industrial, and other industries and outside of the datacenter. Take a look:

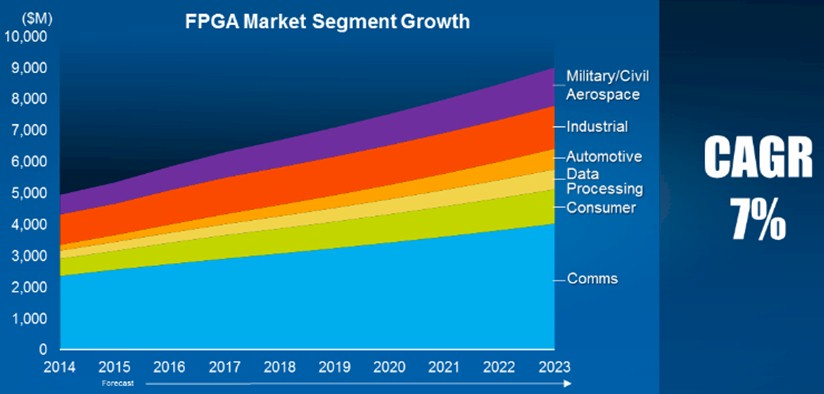

The TAM analysis given by Rivera today spanning from 2022 through 2028 did not give an industry breakdown for FPGA revenues. But the analysis that Intel did back in 2015 when the Altera deal was done gives a sense of it. Here is the breakdown of Altera’s revenues by industry, its shared of programmable logic device revenues compared to Xilinx, and the TAM of all chip types including PLDs, ASICs, and ASSPs:

And here is a forecast that Intel did of the FPGA market breaking revenues down by industry segment, spanning from 2014 through 2023:

The forecast for revenues done in 2015 was a little light by about $1 billion in 2022 and 2023 compared to the survey that Intel just did for those years. So the FPGA market is doing a little better than Intel expected almost a decade ago. But it is nowhere as big as it sounded it might be back in 2015 when the Altera deal was done and talk turned to Xilinx being acquired, too.

AMD paid a fortune for Xilinx to get engineers who were experts in algorithms and compiling software as well as hard block chippery like SerDes and CPU cores and DSPs that often wrap around malleable FPGA logic. And it got some great executives and techies in the bargain, too, and access to niche but profitable markets to boot. AMD needed Xilinx far more than Intel ever needed Altera.

Anyway, if you add up the TAM for 2024 through 2028 inclusive, which Intel decided not to show for some reason, it comes out to $55 billion across those five years. And, says Rivera, there are some analysts who believe that there is a supplemental AI opportunity for FPGAs focused on AI that could add another $3 billion in 2028 alone and obviously a smaller – but probably proportional – slice from 2024 through 2027. If you play around with the numbers between 2024 and 2028, there is no way to get linear growth and hit $13 billion by 2028. There has to be a flattening or a downturn in there somewhere for the total to reach $55 billion and still hit $13 billion in 2028; there are lots of curves to draw between there that fit this data. If you make some assumptions about FPGA revenues from AI and backcast this to 2024, the cumulative AI add-on boost for 2024 through 2028 might be a total of $8.4 billion by our back of the envelope guesstimates of the blanks Intel left in the FPGA TAM.

We wonder why Intel didn’t give out the full dataset? It tells a stronger story ultimately. But showing a flat or decline in the TAM is probably not good news for a spinout.

What Rivera did say is that the global FPGA TAM was between $9 billion and 10 billion annually and growing at a compound annual growth rate of 7 percent to 8 percent over five years.

And then she said this: “One of the things that we know is that AI is providing a tailwind for that market opportunity. And one projection from one of the analysts indicates that they believe that out by 2028, an additional TAM of $3 billion would be available for FPGA based solutions. And I personally think that’s a bit conservative, given just the pace of innovation and how much growth there is for accelerated computing, which of course, FPGAs are ideally suited for that. So we shall see. But certainly, we know that AI will also create more expansive opportunities for FPGAs.”

After all of this FPGA talk for the past decade, we certainly still believe that. It may not be in the datacenter to the degree where we like, but in the network and at the edge. We shall see, indeed.

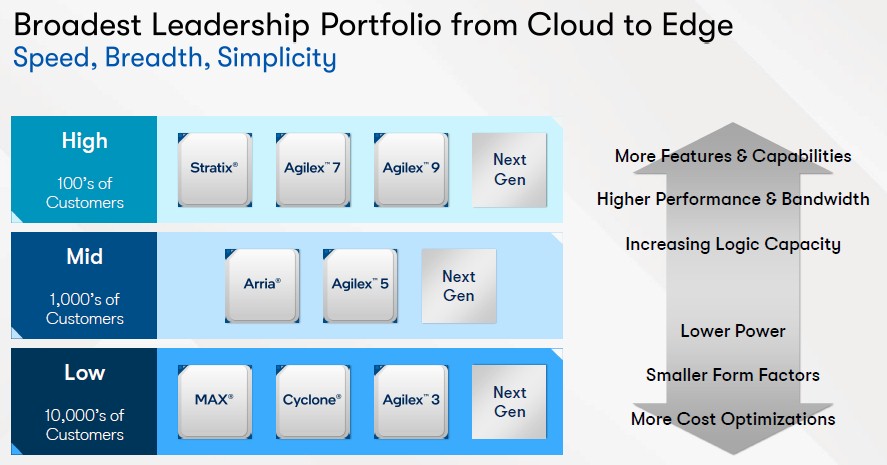

Here is the general roadmap and customer breakdown for the Altera FPGA lineup, and how they stack up to each other in terms of features, cost, and capacity:

The heavy duty Agilex 9 FPGAs are shipping in production and are aimed at high-end use cases, including datacenter devices like servers and switches and such, but are also used in all kinds of other devices such as circuit simulators. The F-Series and the I-Series in the Agilex 7 line are shipping in production, with other variants forthcoming, and Rivera said that Altera has over 300 design wins for this family of devices. The Agilex 5 FPGAs have been sampling since Q4 2023 and had the broadest early access program – with hundreds of customers kicking the tires – in the history of Altera, including its stewardship inside Intel. The “public software” for these Agilex 5 devices will be out in April of this year, presumably when they begin their ramp. The Agilex 5 is noteworthy because it will have an FPGA fabric “infused with AI,” as Intel puts it, and the spec tables say it will have 50 teraops at INT8 precision. And the low-end Agilex 3, which is aimed at low power and cost optimized embedded and edge use cases, will be launched later this year.

In general, Altera is chasing data analytics, SmartNICs and DPUs, 5G and 6G cell phone infrastructure, robotics and motion control, video conferencing and distribution, and machine vision workloads in addition to the standard use cases in networking, autos, consumer and industrial goods, test and medical, and defense electronics.

We will be watching to see what Intel does – and doesn’t do – with Altera and how it attacks the datacenter – or doesn’t.

Inspiring stuff! I guess one might imagine a future where all computing is FPGA-based, super-flexible, and instantly reconfigurable. Rather than a static arrangement of CPUs and GPUs, or a composable heterogeneous disaggregated system, one could have an array of rather potent FPGAs, and dynamically reconfigure them to tackle the computational load under execution. For dense matrix-vector-like computations one would configure them essentially as GPUs, for sparse and graph-oriented loads one would switch to a dataflow arch configuration (with distributed memory), and for the more classical office and cloud workloads a CPU-like configurations would be adopted. Over time, tech developments would enable such computational FPGA arrays to self-reconfigure dynamically to accomodate mixed workloads.

A future following these lines might see Altera eventually purchasing Intel’s chip division (for x86 IP), and even NVIDIA, while IFS would remain its own independent entity (that everyone needs), as would AMD (with Xilinx). Let’s hope Sandra Rivera is the person to push this type of next-gen computing forward, as it should!

Maybe you been drinking too much of the TNP Kool-Aid. HA! But I like that idea, in concept. A machine that can be used for ten years that costs $1 billion is cheaper than three machines with different architectures that cost $500 million each.

Yep … TNP is the Daaaaaali of computational refreshments! Like a camembert of special relativity, flambé au calvados, in persistent memory sauce (or so I hear)! Deliciously addictive (eh-eh-eh!).

After spin off Altera, how about the Intel oneAPI accl framework ? FPGA still can be a accelerator or just go back to new product prototype ?

In its current form, FPGA’s are gradually becoming more and more irrelevant despite what the vendors keep saying. The so called “FPGA in data center applications” never materialized and not for the lack of trying. For FPGA to be relevant again, the powers be need to first understand the core competency of an FPGA and then realize that its programing model is the biggest obstacle. Until they fix that FPGA’s are in the process of extinction. This extinction is based on natural selection (and no meteors) so, it will be gradual.

Wrong! FPGAs came way after CPU and Von Neumann. So, the newer ones survive while the older ones go extinct.

Touche! Accent acute missing, of course….