As AMD is getting closer to closing its $35 billion acquisition of FPGA maker Xilinx, it is natural to think about how well that business is doing and how it is competing against its main rival, Intel – specifically, the Programmable Solutions Group, formerly known as the free-standing Altera before the latter was acquired by Intel in June 2015 for $16.7 billion.

Shareholders of Xilinx should send thank you notes to Intel for driving up the market capitalization of both Altera and Xilinx ahead of the Intel deal for Altera and for Xilinx in the aftermath of the closing of that deal. But for the past five years, the market capitalization growth that Xilinx has enjoyed, and the substantial increase in its revenues and profits that helped drive it, has all been its own doing.

Since their respective foundings four decades ago, Altera and Xilinx have been leapfrogging each other in pushing the chip manufacturing process nodes, FPGA architectures, and the scale of their businesses. And this has been healthy for the FPGA market. But in recent years, especially as Intel’s PSG became dependent on the wafer etching of Intel – Altera was going to be Intel’s first big foundry partner until the chip maker decided it wanted the whole company – and as we all know, Intel had trouble moving to 10 nanometer technologies and is still way behind rival Taiwan Semiconductor Manufacturing Co with 7 nanometer and 5 nanometer processes. And that has, to stick with a metaphor, cut the frog’s legs off Altera, which under normal circumstances might have gone to TSMC or even Samsung (as IBM has done) for advanced processes to etch its chips.

So the leapfrogging has stopped, and it is no surprise, then, that Xilinx has proceeded on a revenue and profit trajectory that looks like what Intel must have been expecting – at the very least – when it acquired Altera seven years ago.

The contrast between the two companies right now in early 2022 is remarkable, but it is always important to realize that such comparisons exist at a point in time, and only a fool every counts Intel out of a technology or marketing race.

Since we know less about Intel PSG, let’s talk about it first. And this is particularly important because Intel is in the process of reorganizing its groups and divisions.

As part of that reorganization FPGAs will be merged with datacenter CPUs to create the Data Center and Artificial Intelligence group. By the way, the IoT products and Ethernet switch and network interface card business that was an adjacency for the Data Center Group will be merged into the Networking and Edge group. And finally, just like AMD does, Intel is going to bury its GPU-compute business in the datacenter inside of a graphics group, in this case to be called the Accelerated Computing and Graphics group. The Mobileye business will be freestanding, as will be Intel Foundry Services, and the flash business is being spun out. It is not clear where Optane 3D XPoint memory will be put, but the new Data Center and Artificial Intelligence group is the likely place. Intel will provide some insight into these new groups at its Investor Day on February 17.

The point is, we are going to be losing visibility into PSG very soon, and once AMD eats Xilinx, we will lose a lot of insight into the Xilinx FPGA business as it is very likely pulled into its Enterprise, Embedded, and Semi-Custom group. (There is an outside chance that after the Xilinx deal is done, AMD will create a true datacenter group and put datacenter CPUs, GPUs, FPGAs, and other stuff into one place.)

Anyway, in the quarter ended in December 2021, Programmable Systems Group posted sales of $484 million, up 14.7 percent year on year, and operating income rose by 18.6 percent to $51 million. We estimate, based on the ratio of operating income to net income at the overall Intel that PSG would have posted a net income of around $47 million.

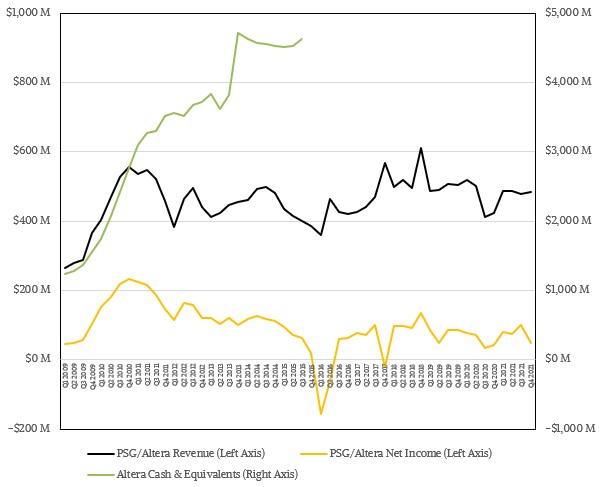

Here is what the Altera/PSG business looks like since the belly of the Great Recession back in 2009:

Since that time, over several generations and manufacturing process nodes, Altera/Intel PSG have averaged sales of around $450 million per quarter and net income has been about one-fifth of that revenue. In the trailing twelve months, the PSG division at Intel had sales of $1.93 billion, up 4.4 percent year on year and estimated net income was up 33.4 percent to $302 million, which was 15.6 percent of revenues – lower than the historical average since the Great Recession.

Importantly, during the call with Wall Street going over the financial results for Q4 2021, newly appointed Intel chief financial officer David Zinsner, who just moved over from Micron Technology, said this: “If not for the external supply constraints, we believe the PSG business would have delivered over $500 million in additional revenue in 2021.” We don’t know how constrained that Intel was on the FPGA front in 2020, so we don’t have a good compare, but if Intel was not constrained with its Stratix and Agilex lines in 2020, then that growth would have been a much more impressive 31.4 percent to $2.34 billion in sales for FPGAs in all of 2021.

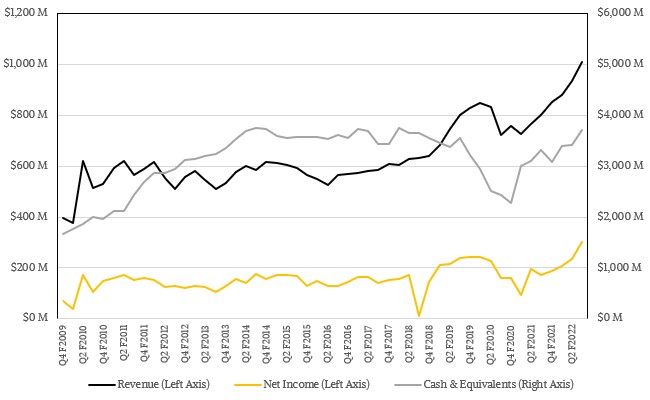

That did not happen, of course, and we think that thanks to the wafer and packaging capacity that Xilinx has worked out with TSMC, it was able to capitalize a little on Intel’s shortfall in FPGA sales. In the trailing twelve months ending on January 1, 2022, Xilinx sold $3.68 billion in products and services, up 20.4 percent year on year, and its net income rose by a very impressive 49.6 percent to $929 million. If $500 million in FPGA sales shifted from Intel to Xilinx, then Xilinx might have only done 4.1 percent revenue growth to $3.18 billion in sales. (We are not suggesting that the revenue transfer was this simple, directly from Intel to Xilinx. Intel might have been able to push some of that $500 million in lost sales into early 2022. The truth is probably somewhere in between.)

In the third quarter of fiscal 2022 ended on January 1, Xilinx posted its first “unicorn” quarter, hitting $1.01 billion in sales and posting $300 million of that as net income, which is 29.7 percent of the top line. Xilinx has done better than this by a smidgen on a few quarters in its past, but it was a much smaller company since then. We think that Xilinx is benefitting from the AMD acquisition and Intel’s shortages, and is also making sales on its own merits as well based on the architectural and process advantages it is bringing to bear with the “Everest” Versal FPGA hybrids, the roadmap of which we drilled down into last week.

Obviously, Xilinx has been able to grow while Intel PSG has been fairly flat in recent years, to the point that the annualized run rate for Xilinx is more than twice as large as it is for Intel PSG. Earnings are in the order of 6X higher. As the Great Recession got going, Xilinx was suddenly about 50 percent bigger than Altera and was able to more or less hold that size advantage until Intel bought Altera, and after that Xilinx entered a growth cycle that is hockey sticking up and to the right, as you can see here:

Xilinx has burned some cash to do acquisitions – AI inference engine maker DeePhi Technology was a big one in 2018 and SmartNIC maker Solarflare was the other big one back in 2019 – but is back putting coin in the piggybank as you can see.

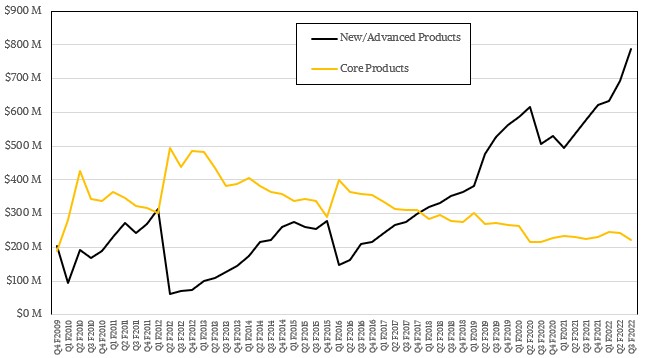

One of the things that has been driving Xilinx is its chip manufacturing process lead over Intel PSG, and as the chart below shows, and increasing part of Xilinx revenues come from FPGA hybrids (so called because they have programmable logic blocks surrounded by hard-coded transistors blocks for compute and networking) on more advanced processes. In the recent quarters, the Advanced Products include Versal, UltraScale+, UltraScale, and 7-series products as well as production boards in the Alveo and Solarflare lines as well as other network and system-on-modules products.

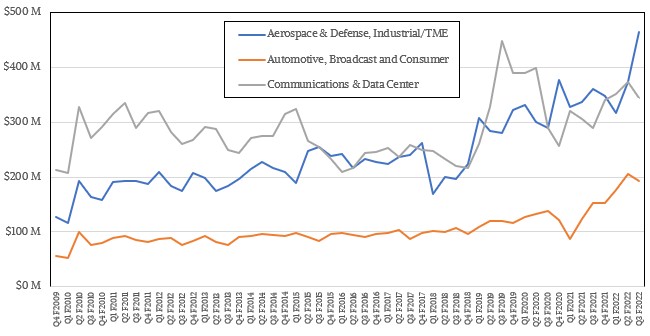

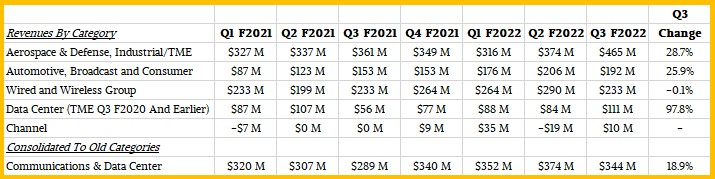

In the recent quarter, the datacenter business at Xilinx did particularly well, up 28 percent sequentially from Q2 of fiscal 2022 ended on October 2, and up 81 percent year on year to $111 million. To be consistent with the presentations Xilinx used for many years, we have merged the Data Center and Communications parts of the Xilinx industry segment revenue streams together in the chart below:

Here is a table showing the most recent quarters of data from this chart so you can see the numbers:

All three of the general sectors that Xilinx pushes its FPGA hybrids into are growing, but both the communications and datacenter businesses are choppy in recent years, and sometimes they combine for good highs and sometimes they combine for relative lows. As is the case with other forms of high performance computing, you have to be able to play the long game when it comes to selling FPGA hybrids.

You can see how the tendency is to use more advanced processes on more advanced products to maximize revenues:

One last thought: We would love for AMD to keep us informed about the Xilinx business in the kind of detail that the FPGA maker has done for Wall Street for many decades, particularly in recent years as FPGAs have become more relevant in the datacenter as well as being pervasive in all kinds of other appliances and equipment. We highly doubt this will happen, but there is always an opportunity for AMD to pleasantly surprise us.

AMD is playing its cards very close to the chest. mb

I can’t stand these completely one sided pieces.

Do You know what kind of FPGA Intel has (correction: had), which basically has no competition at all?

It’s called the MAX 10 Family build with a 55nm TSMC process.

There is absolutely NOTHING on the market, which can compete with these Chips price/performance wise… and Intel itself hasn’t even realized it; because otherwise these Chips should have AT LEAST a doubled price tag.

Instead it nowadays is basically impossible to buy these Chips at all… and of course instead everybody is talking about Datacenter/AI accelleration/Agilex and completely ignoring the USEFUL FPGAs Intel has – excuse me: had.