For the first time in a very long time, and even including the Great Recession, chip maker Intel booked less revenue in the fourth quarter of the year than it did in the third quarter of that same year. And the culprit is a slowdown on many different fronts in its datacenter business, with enterprises and governments slowing spending at the same time that there is a slowdown in China that is rippling around the world and some of the companies that Intel sells chips too paid a bit slower than is usual.

All of these changes took Intel a little bit by surprise, with the company falling short of the guidance that it gave back in October of last year. And with the company posting a record year with $70.85 billion in sales, up 12.9 percent, and net income of $21.1 billion, up by a factor of 119.3 percent (that’s nearly 2.2X), there is really not much to complain about. Intel has about a quarter of its self-proclaimed addressable total addressable market of $300 billion, and it is every bit as profitable as it has been in recent years despite the difficulties it has had getting its 10 nanometer manufacturing processes to market.

But it is beginning to look like the growth engine is taking a breather for a while as companies consume the 14 nanometer “Skylake” Xeon SPs they have already bought and they await the 10 nanometer “Ice Lake” Xeon SPs that will be available towards the end of this year and early into next. The impending “Cascade Lake” Xeons, while offering some benefits over the Skylakes, look to be coming to market just as the server buying frenzy that occurred in the first three quarters of 2018 starts to slow. It is hard to say what is cause and what is effect here. The differentiation between Skylake and Cascade Lake Xeons may not have been sufficient for the big hyperscalers and cloud builders to spread out their acquisitions, and it could turn out that they just bought tons of Skylakes last year so they could sit out the Cascade Lake generation and wait to do big deals again with the Ice Lake Generation.

“We had three quarters and really, really strong growth in 2018 in the cloud, and that was driven by product cycle, as well as the typical multiyear build out pattern with Xeon Scalable,” Navin Shenoy, executive vice president and general manager of the Data Center Group at Intel, told Wall Street when going over Intel’s Q4 and full year 2018 financial results. “If you look back at all the historical trends we have had in the cloud business, we have always said there is some lumpiness to the business, and there is periods where people build and then there are periods where people consume. The signals we get from our customers are that the period of build for compute is going to shift now to a period of consumption, and that started in the second half in the fourth quarter and we expect that to continue through the first half of the year.”

It is important to not get the wrong idea, buy the normal decline from the fourth quarter of one year to the first quarter of the next year is on the order of 8 percent to 10 percent in the Data Center Group, and Intel’s chief financial officer and interim chief executive officer warned Wall Street that it could be double that in the first quarter of 2019. And it looks like the air pocket will extend out to the middle of 2019, when the Cascade Lake Xeons are expected to be shipping in volume and when AMD will be ramping up its “Rome” Epyc X86 server processors, too, and causing Intel a certain amount of competitive grief.

We have been wondering for years when the peak of the Xeon business would be crested, and we think that we just saw it in the review mirror.

Don’t get the wrong idea, though. This is an incredibly strong and profitable Data Center Group, and just because growth slows doesn’t mean Intel cannot dominate for many years to come. It just will not have the same level of control over the pace of technology and pricing as it has enjoyed for the better part of a decade because it has manufacturing issues and it has competition like it hasn’t seen since then.

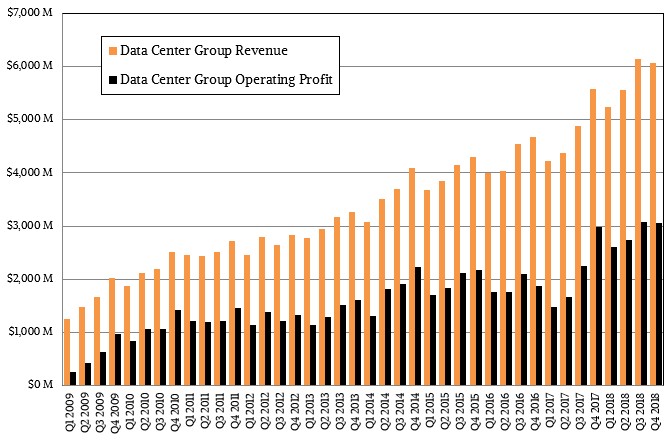

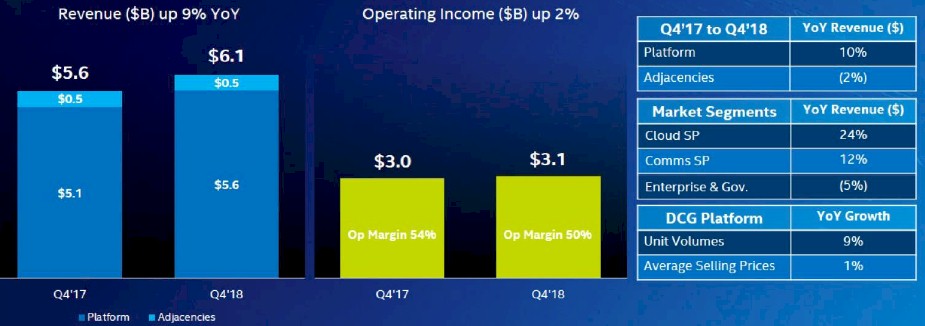

In the fourth quarter, Intel’s overall sales grew by 9.4 percent to $18.66 billion, and net income came in at $5.2 billion, a sharp rebound from the $687 loss it posted in the year ago period. During the quarter, platform sales at Data Center Group – which includes processors, chipsets, and motherboards – rose by 9.9 percent to $5.59 billion, and adjacencies – things such as Omni-Path and silicon photonics networking or Rack Scale Architecture, and custom server manufacturing – posted sales of $475 million, down 2.5 percent year on year. All told, Data Center Group had $6.07 billion in sales, up 8.7 percent, and posted an operating profit of $3.06 billion, up 2.1 percent.

It is hard to complain about the major part of a business growing by only 24 percent, as sales of products to the hyperscalers and cloud builders did for Intel’s Data Center Group did in the fourth quarter of 2018, but you have to remember for the first three quarters of 2018 together sales were up 45 percent – so that is a significant slowdown. And it radically impacts Intel’s sales because hyperscalers, cloud builders, and communications service providers now account for about two thirds of Data Center Group revenue, with enterprises and government only comprising a third of sales; this is a flip in shares of these two broad categories over the past decade. Swan said that server inventories out there in the channel were a little bit higher than usual, and that the company’s free cash flow was down $1.2 billion because of accounts receivable being higher than expected by that amount. It looks to us like server makers had been thinking the Xeon party would just keep on going full tilt boogie, and they bought a little ahead of the demand that can be expected in Q4 2018 and in the first half of 2019.

Communication service provider sales rose 12 percent in the fourth quarter, and enterprise and government sales fell by 5 percent; Swan said that the compares were tough for the latter, but the way Intel has been growing for the past decade, this has mostly always been true in any given quarter. Demand in China is being hurt, and you can bet that China will use alternatives to Intel, such as AMD Epyc chips and their Chinese clones and various Arm server chips and maybe even merchant or clone Power chips, as much as possible going forward.

But the main thing is that Intel believes that sales to hyperscalers and cloud builders will continue to grow, and Swan put a stake in the ground on the call with Wall Street. “In the long-term, the cloud business is going to continue to grow,” Shenoy said. “There is no doubt about that. Both the consumer cloud and the enterprise commercial cloud, we see both of those continuing to grow. And the appetite for compute, I think, is somewhat insatiable. Our five year forecast for compute cycle growth, or MIPS growth, is a 50 percent CAGR over the next five years. And I see nothing slowing that down over the next number of years.”

At some point, when hyperscalers and cloud builders are 90 percent of Intel’s business and enterprises and governments are only 10 percent, the profitability profile of the CPU and related businesses could be very different. Enterprises and governments do not get the same kind of volume pricing the hyperscalers and cloud builders do, and they are still one of the reasons why Data Center Group is so consistently profitable, and indeed, why the OEMs can still sort of make a living pushing tin.

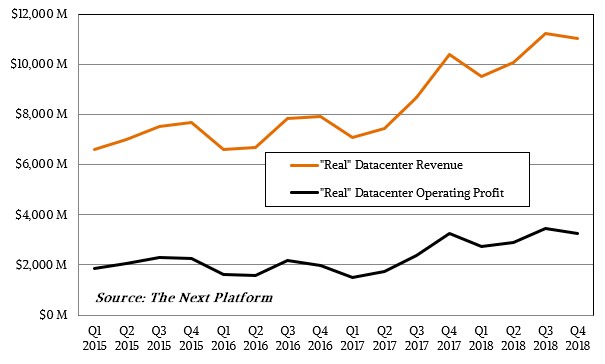

As we have pointed out before, Intel’s actual datacenter business, which includes sales of flash and Optane memory, FPGAs, IoT gear, and other stuff to datacenter customers, is considerably larger than the Data Center Group as reported – and it also has a much lower operating profit, according to our estimates, and that is why you don’t see Intel actually break its revenues down into PCs on one side and datacenter on the other.

As best as we can figure, that “real” datacenter business at Intel brought in $7.77 billion in the fourth quarter, up 9.2 percent, and had an operating income of $3.26 billion, flat year on year and about 42 percent of that revenue.

No doubt there’s a lot of data center growth, and re-architecting with carrier, wireless, network communication’s upgrade plugged into the expanding connected world.

There is no leading incumbent that did not build component inventories and overage across the relatively worry free 28/22/14/12 nm lithography regimes to stay incumbent through volume financial control over development resource, production system, channel procurement for end market product sales.

Merely a matter of producing along the road map that next desirable component in mass volume to fill channel’s first financially keeping others out. And, yes, times have changed at this inflection point to whatever comes next. As commercial art morphs back toward applied science where the art of manufacture is being relearned from the fresh starts of adaptation and adoption, the freedom to compete in an open commerce system?

For Intel and to some degree Nvidia as the development train crashed into ITRS physical walls, back in time secondary product availability on price performance took control over primary design production and this certainly effects Nvidia in the near term and Intel into the long term.

Intel inventory in channel by product generations;

Cascade Lake = 0.2685%

Coffee Lake = 3.7215%

Kaby Lake = 3.3908%

Sky Lake = 8.6425%

Broadwell = 21.7875%

Haswell = 39.3123%

Solely Xeon;

Cascade Lake; 0.33%, where there should be more on historic time to yield in 14 weeks.

Skylake Scalable; 6.64%

Broadwell v4; 25.15%

Haswell v3; 41.86%

Ivy Bridge v2; 26.02%

Noteworthy, Intel did this too themselves where division revenue splits don’t do justice the reality of back in time Xeon secondary market dominance. Where in the enthusiast market, back in time Xeon, not Core Extreme, today rules primary sales; 2600 v2 10C appears to be among the top sellers. Fast 1600s snapped up. v3 Hexa/Octa made great Christmas gifts.

In GPU space how many are aware the overwhelming majority of RTX 6000 available in sales channel are introduced integrated into fast refurbished v3 2P. Makes a lot of system procurement on applications sense.

Intel 5 year long run product availability in channel today on volume;

Desktop; 10.66%

Mobile 13.15%

Xeon; 76.19%

By value on volume discount, where 25 year long run discount is 50% HERE Core less 50%, Xeon less 70%;

Desktop; 4.59%

Mobile; 4.96%

Xeon; 90.43%

Think about all that Xeon down bin that gets sacrificed into sales bundle. When communications revenue is up you know there’s down bin sitting in Intel inventory.

There’s plenty of good product in channels. Where in first-in first-out sales system something has to sell to procure new. Unlocking secondary and overage the quicker those frozen values are unlocked the faster the primary market will recover. But you can’t break the channel financially doing so. Where Intel has not only held up but raised the price umbrella there’s certainly run way to unlock frozen values. Until Intel starts the squeeze again. And where this inflection point, process saturates and the train stacks from behind differs from other process and package transitions.

Normalizing channel inventory value with Intel division revenue split, Xeon highest volume discount again seems to be 85%, indicator cloud has leverage. Intel is selling into cloud and for high volume procurement at commercial price between 4 and 5x cost.

Core discount appears 30 to 35%, that is higher than normal, where Intel marginal cost also appears to be rising, still under, but closer to AMD foundry price.

Finally who needs Ice Lake or Rome unless your network infrastructure needs Rome, Ice Lake, Cascade Lake or L3 starved Skylake when Broadwell v4 for majority of enterprise management tasks is known offering acceptable price performance to wait and see the result of what comes next.

Let other’s pioneer 100 GbE down from 400 GbE spine and rewrite the OS, system management and applications for in-memory compute. Oh you want it, some before others, but how to pay for it and what adoption hurdles are justified on the risk reward of commercial consideration. With more options then ever before no need to entirely own that responsibility?

Industrious play wait and see?

Full Intel Q4 inventory and AMD Q4 inventory reports and slide sets here;

https://seekingalpha.com/user/5030701/instablogs

Mike Bruzzone, Camp Marketing

Bruzzone correcting clarification; 3rd paragraph before last two hanging sentences;

“Core discount appears 30 to 35%, that is higher than normal, where Intel marginal cost also appears to be rising, still under, but closer to AMD foundry price.”

Whoops late night edit dyslexia . . . Core discount 30 to 35% is slimmer than normal.

1991 through 1998 and thereafter ME, 2001 Dr. Tom who I met once through Michelle won’t remember me, in 1995 Mike C who else? Our time of address is rapidly approaching. Bend over Intel mafia and give it to them up the as.

mb

Well now that Nvidia’s quarterly earnings are not meeting expectations, and Intel did not meet Wallstreet’s expectations also, comes AMD’s Quarterly reports. I’d expect that AMD may likewise show some pain but that pain may be tempered by some server market share numbers. Nvidia is definitely more extended in the GPU market place what with it having such a high percentage of the Server, and consumer/gaming, GPU market share.

AMD will become progressively more shielded from it’s consumer CPU/GPU market fluxuations once there can be more Epyc/Naples and Epyc/Rome(late in the year into 2020) sales/revenues figures/project design wins announced! Ditto for any Radeon Pro WX/Radeon Instinct Pro GPU revenue figures that will also be along for the ride with some Epyc/Naples and Epyc/Rome(Later in the year into 2020) server CPU sales.

One bright side for AMD is that the costs of its Epyc/Naples 32 core SKUs come in well under even some of Intel’s lower core count Xeon offerings so maybe with the world’s economy cooling off AMD will look the better for hosting more VMs per socket and its MB/Platform providing 128 lanes of PCIe connectivity standard with no product segementation by PCIe lanes compared to the manifold ways of product segemeting Intel enforces across its Xeon/MB platform offerings.

Let’s look at the TCO figures if the Interest Rates go up any further and the cloud services market has to really begin to watch their budgets if the economy cools off any more. AMD has some advantages of being in the beginnings of a steady growth phase and not as heavily extended into any x86 Server/Consumer, or GPU(Pro and Consumer) markets, even now.

AMD’s value proposition(Lower TCO, more cores/PCIe lanes per socket, 8 memory channels per socket) and other such features that come standard in AMD’s relitively non segemented Server/HPC CPU offerigs is what may just earn AMD more attention from the cloud services providors looking for the best deals in an unsure economic environment.

And before anyone can cast doubts on AMD not supporting more than 2 socket MB offerings well just look at the percentages of 1P, 2P, and Greater, Socket based systems out there worldwide before thinking that having more than 2 sockets per MB offerings adds up to any sizable advantage. Just an Aside remember that Epyc/Rome will double the cores/threads per socket to 64/128 as well as having more Cache/L3 Cache and those Epyc/Rome MB/Platforms will still support 128 PCIe lanes but those PCIe lanes will now be PCIe 4.0 lanes with twice the bandwidth per lane as the previous generation for even more storage/GPU/other PCIe attatched options. Zen-2 is espected to bring up the single core IPC metrics and AMD’s Epyc/Naples and Epyc/Rome are leading in the multi-core/multi-thread metrics.

Sure the Pie is not growing as fast and that growth rate is falling back a little but any economic downturn also means that the cloud services providors will be looking for the better deal and a smaller longer term TCO if the lending rates are not as attractive as before. If a reduction in demand for Server/HPC CPU SKUs solves Intel’s current shortage woes what will Intel’s gross margins have to do in order to compete with AMD’s Price/Performance metrics in a server/HPU/Cloud services market that’s not snapping up every Server Die that comes off the diffusion lines.