The rise of public clouds, the Internet of Things, greater mobility, and the more devices connecting to corporate networks is creating highly distributed environments for enterprises where applications can come from a variety of places, workloads can run on-premises or somewhere in multiple public clouds and computing resources can be located anywhere from the datacenter through branch offices and the network edge and out in the cloud. For organizations, the benefits they can derive from all this in terms of speed, agility, scalability and cost savings often are offset by concerns around security, management, compliance, and complexity.

The connective tissue through all this is the network, which is increasingly stretching beyond the datacenter and enable workloads to move around distributed environments, applications to find their way from the cloud to employees and businesses to get a clearer view of what’s going on in their expanded universes. They’re also becoming more software-based, open and automated and a platform for everything from security to development. This evolution has forced established networking vendors that had grown large and rich over the decades by selling proprietary hardware to become more focused on software and solving problems as well as making them more open and friendly to partners that actually push their products.

Cisco Systems is a classic example of that trend. The company over the last several years under CEO Chuck Robbins has aggressively shifted its strategy from a vendor that wielded its broad networking product portfolio like a sledgehammer against competitors to one that understands the value of tech partners who can drive the expansion of its growing software portfolio and that customers with heterogeneous networking environments are looking for tools that can manage products from other companies or to run third-party solutions atop their Cisco boxes.

Cisco is shifting from one-off hardware sales to subscriptions and recurring revenue, is leaning more on channel partners to not only sell more products but help create long-term relationships with customers and is touting its networking portfolio less as the pipes that run between the datacenter and branch offices and more as a platform. This role was the key theme during the company’s Cisco Live 2018 show this week, with its DNA Center network management software at the center.

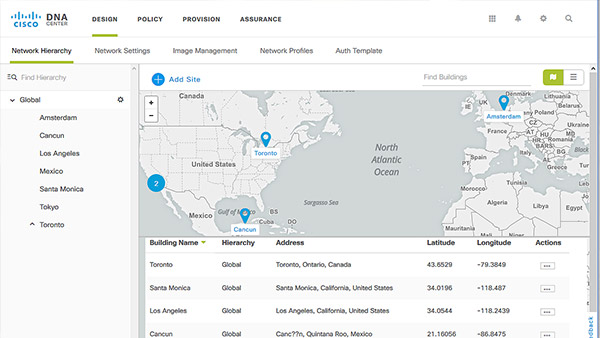

DNA Center is a key part of the vendor’s intent-based networking initiative – dubbed the Network Intuitive – that was unveiled last year. As we’ve talked about earlier this year, the idea behind intent-based networks – which other companies, including Juniper Networks, also are pursuing – is to create an architecture in which the network administrator can express an intent and then have the network translate that intent into policies and configure the systems and orchestrate the policies to meet that intent. In recent months, Cisco has added assurance capabilities to let administrators know how well the network has done and to detect and fix problems that may come up.

The seeds of Cisco’s intent-based networking strategy really began in 2013,when it launched Application Centric Infrastructure (ACI), its software-defined networking (SDN) offering. With ACI, Cisco introduced its efforts to essentially have applications dictate what datacenter resources they needed to perform at the highest level, and have the infrastructure automatically make those resources available. In 2016, the company launched Tetration, an analytics platform aimed at giving businesses real-time visibility into everything going on in their datacenters through data gathered by sensors in software and hardware and analyzed using machine learning techniques.

With DNA Center, the company moved the intent-based networking effort out to branch and remote offices and the network edge. Cisco also has been moving these capabilities into the cloud – for example, the company last year announced it was extending ACI – which had been aimed at datacenters and on-premises clouds – into the public cloud, including Amazon Web Services, Microsoft Azure and Google Cloud Platform.

“We sort of have a technology paradox,” Robbins said in a meeting with journalists at the show. “Our customers have never cared more about the technology, and they’ve never cared less about the technology. They want all the tech, but they just want it so they can get to the business value of the technology immediately. Our customers increasingly are less interested in being systems integrators and they’re more interested in just buying stuff that works, that fits with the outcome that they’re trying to drive for. For us, when we talk about how these next-generation network architectures evolve, you can look at the cost of how the traffic flows and the future is going to be completely different. We had a study that for every dollar spent even on an Ethernet switch upfront, they spend $15 over the life of the product operating it. So if we can go at those costs, I think that is at the heart of why we’ve had success with intent-based networking and DNA Center.”

Now the company has taken the next step by opening up DNA Center and evolve the technology from a software solution to a platform that developer and partners can now develop applications for. The vendor create more than 100 APIs as well as adapters and connectors to enable integration with other network systems like IT service management (ITSM) and IP address management (IPAM) and with such infrastructure domains as the cloud, security and the datacenter. More than a dozen tech partners, including IBM, Wipro and ServiceNow, already have developed solutions for DNA Center, and Cisco is creating an app store that will enable tech partners to make their solutions available to others.

Cisco also created an SDK to enable businesses to use DNA Center to support networking gear from other vendors, like Hewlett Packard Enterprise and Juniper. In addition, Cisco is introducing a number of new programs for the 500,000-plus developers who are part of the company’s four-year-old DevNet program to enable them to more easily build applications for the management platform.

David Goeckeler, executive vice president and general manager of networking and security at Cisco, said during the Cisco Live show that opening up DNA Center – the new capabilities will be available this summer – is another step in enabling organizations to make their networks more open and programmable and able to run like software. However, during the meeting with journalists, both he and Robbins pushed back at the assumption by some competitors that Cisco’s hardware puts it at a disadvantage in evolving modern datacenters. Goeckeler pointed out that the Catalyst 9000 switches, which were launched last year with the intent-based networking strategy, have been bought by 5,800 customers.

Robbins argued that hardware is necessary to enable many of the capabilities that Cisco is bringing to its networking portfolio, such as Encrypted Traffic Analytics, which is designed to enable businesses to detect threats in encrypted traffic by finding anomalies in the behavior of the traffic.

“We will continue to add more software content to our portfolio, but we will continue to build massive, high-performance hardware that our customers need,” Robbins said. “If we hadn’t built the Catalyst 9K with custom ASICs in it, you couldn’t do Encrypted Traffic Analytics, so we will have a combination. To the extent that you can use software that allows you to move faster, so we’re still in the hardware business and we will be for quite some time.”

Goeckeler added that “it gets a little confusing with Cisco because we have not monetized our software independent of our hardware until recently, but if you look at the company, I’ve got 25,000 engineers and more than 80 percent of those are software engineers. There’s a lot of value being created in the software. When we have shipped a switch, it has had an enormous amount of software in it. Right now, we’re just finding ways to innovate on that software, and when we can find ways to innovate on software to bring unique differentiation to our customers, that’s when we can go in and change the business model to more of recurring revenue because that’s just the way the world monetizes software innovation.”

Be the first to comment