Like many of you, we are trying to find out what the heck is really going on in the global economy. And as such, we are paying particularly close attention to the original equipment manufacturers, or OEMs, who peddle servers, storage, and often switching into the enterprise. They are leading indicators for enterprise IT spending in the way that semiconductor makers are not because somewhere around half of their volumes come from the hyperscalers and cloud builders who have their own boom-bust spending cycles that seem to be independent (although not perfectly so) from the larger global economy.

We already did a deep dive into the latest financial results Hewlett Packard Enterprise, and today we are going to take a look at Dell Technologies – no one really calls it that, do they? – and we will follow up later with Lenovo Group and Supermicro. With those four public companies, we can build a pretty good idea of how IT spending across the enterprises, governments, academic institutions, and service providers who are the main customers of the OEMs and who still represent around half of the datacenter infrastructure buying that goes on here on Earth.

Suffice it to say, it was not a particularly stellar quarter for Dell in general and for datacenter infrastructure in particular.

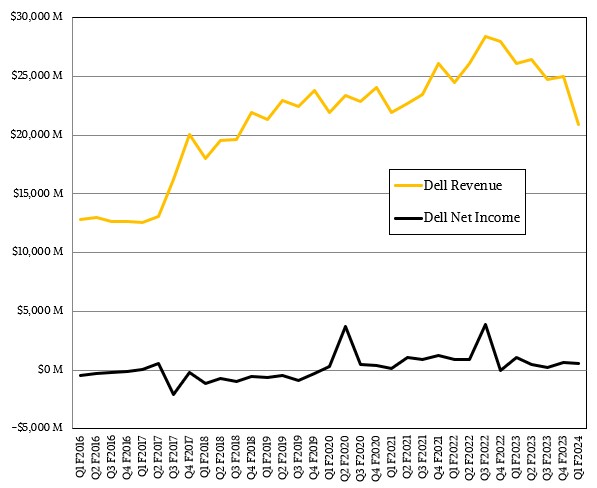

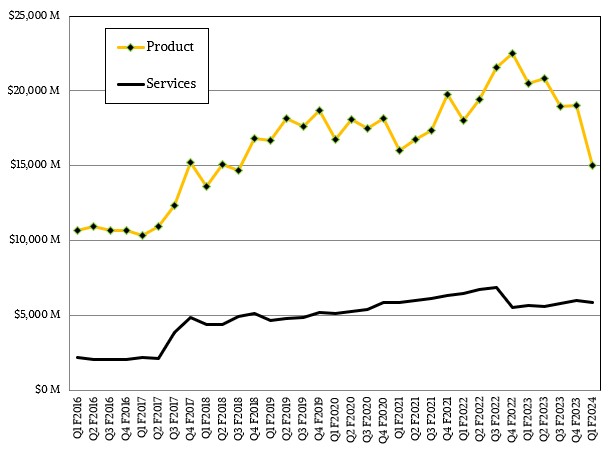

In the first quarter of Dell’s fiscal 2024, which ended on May 5, Dell posted product sales of $15.04 billion, down 26.5 percent, while services revenues grew by 4.1 percent $5.89 billion. Total revenues came in at $20.92 billion, down 19.9 percent year on year, and net income dropped by 45.5 percent to $583 million.

Dell had a very favorable mix of PC and server sales in the year ago quarter, and frankly turned in the best first quarter it has had in many years before the PC market cratered and concerns about the economies of the world started rising regionally and the effect of interest rate hikes by various national authorities started having the desired effect of curbing demand to prick a hole in the inflation bubble caused by (understandably) aggressive spending by governments during the coronavirus pandemic.

That party is clearly over, and it looks like we have to make a bit of an economic mess before we can clean it all up. Don’t step in that barf over there as you walk back to the office. . . .

Dell can’t just blame the PC market, either. It was down across all of its four divisions – Servers & Networking, Storage, Commercial PCs, and Consumer PCs – and down by the double digits in all of them at that. If Dell has its fingers on the pulse of enterprises and consumers, then consumers have really cut back and enterprises are cutting a halfback. Consumer PC sales were off a staggering 41.3 percent to $2.12 billion in the quarter, and if you add up all the enterprise PC and datacenter gear together, then spending on Dell’s enterprise products were down 17.9 percent to $17.46 billion.

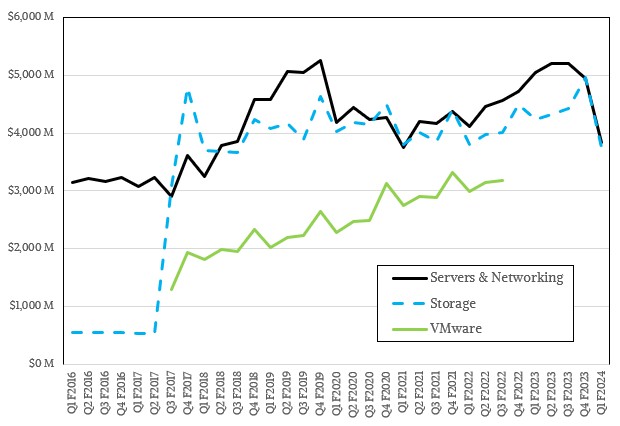

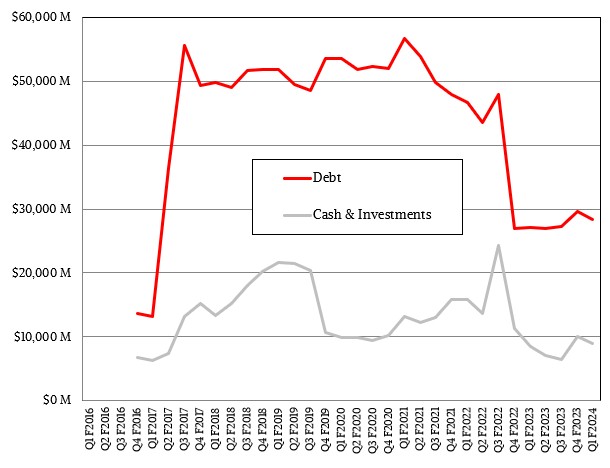

Drilling down into the datacenter products proper, which are not just sold to large enterprises but to millions of small and medium businesses that still have machines running in their offices, factory floors, and warehouses, spending on servers collapsed. One quarter ago, servers and storage hit the same level as they have a number of times since the finalization of the EMC acquisition back in the fall of 2016, and they fell in concert to combined low that was set three years ago. (Strange coincidence.)

About right now, Michael Dell, the founder of the company that bears his name, might be wondering if it was wise after all to sell off VMware to Wall Street. Then again, in its most recent quarter ended on April 29, VMware had sales of $3.09 billion, up 3.1 percent, but net earnings fell by 43.1 percent to $242 million. VMware would have helped the datacenter top line, but probably would have hurt operating income for the datacenter stuff. (It’s hard to say for sure.)

Sales of servers and switching gear fell by 24 percent to $3.84 billion in the fiscal first quarter, and storage sales, including legacy EMC products and their follow-ons (like the VMAX storage area network hardware) and new types storage systems created by the Dell and EMC teams in the wake of the merger of the two companies (PowerStore and the APEX as-a-service offerings), fell by a much less dramatic 11.4 percent to $3.76 billion. Add them together and the Infrastructure Solutions Group had sales of $7.59 billion down 18.2 percent.

That is less severe than the current PC slump and even better than the hit the server OEMs took in 2009 when the Great Recession kicked in, but it is not great. This is only the first quarter of “negative growth” as the people on Wall Street and the boardrooms of the world say – people who can’t bring themselves to face the word “decline” – so it is not officially a recession in server spending for Dell.

But on the call with Wall Street analysts, Yvonne McGill, corporate controller and chief financial officer for the Infrastructure Solutions Group, said ISG revenues would be down “in the low single digits sequentially” for the second quarter of fiscal 2024 while sales for CSG would be “roughly flat sequentially” in the second quarter. Dell’s overall revenues would be in the range of $20.2 billion to $21.1 billion, which is range of down 3 percent to up 1 percent. When we plug these numbers into our model, and leave some wiggle room for what “roughly flat” means for the PC business, we get ISG growing by anywhere from 9.5 percent to 18.9 percent sequentially (somewhere between $8.31 billion and $9.03 billion) and dropping by anywhere from 5.3 percent to 12.8 percent year on year at those numbers. Something does not add up in what McGill said. Either the CGS projection is wrong or the ISG projection is wrong. We think McGill wanted to say ISG sales would be down year on year on the low single digits, and it looks like that will only happen if Dell hits the top-end of its guidance with incremental PowerEdge server sales.

Either way, we think it is almost certain that Dell’s server business will officially enter its own recession in its fiscal Q2 and it is hard to see how it will climb out of it, even with the help of a Nvidia DGX H100 clone in the PowerEdge XE9680 16G server that was recently announced.

And Dell knows this even as it is excited, like everyone else, about generative AI.

“AI is going to drive demand for our business,” Chuck Whitten, co-chief operating officer at Dell – along with vice chairman Jeff Clarke – said on the call . “It is going to drive demand for our business on-premise and at the edge, which is incremental growth and profitability for us. I just caution as we said in our prepared remarks, that we are early in the demand cycle and it’s going to take time for that to translate to the P&L. Excitement for AI applications is ahead of GPU supply right now and AI-optimized servers are still a very small part of our overall server mix. So, ultimately to see a full recovery in our server business, it’s going to require mainstream service to accelerate as well.”

Whitten said that the demand environment for ISG was tough and that after a few years of heavy spending during the pandemic, customers were prioritizing their hardware spending and constraining investments. And for servers in particular, the big server deals by the largest customers were having their timelines extended and some belt tightening. Whitten added that storage spending tends to lag server spending, but reminded Wall Street that it is not immune to economic cycles.

We would say, not anymore and not in the enterprise in particular.

Pheeewww! I was worried there for a minute that Dell’s financials were so scary that no stock photo could be found to illustrate the story … (now Isilon and PowerScale storage arrays)!

My product idea for Dell, to be worked on with nVidia, is a Grace+Hopper engineering workstation (standard AC plugs go to 1.5 kW without too much trouble I think — just a bit above common microwave ovens). It could provide competition to some Apple M2-powered workstations, but would run Linux without having to everse engineer the whole device (and maybe Windows too). Engineers don’t really feel truly valued unless they get to use such awesome dragsters for their daily grind (I’d go to the office just to use that one I think)!

I loved the day when I was at a company long enough to get the rocketsled instead of someone else. (It was an office with only eight people, and it was my turn.) I think it was a 25 MHz 386 PC from Gateway. And a few years later, I was making enough money that I would shell out the big bucks to buy a blazingly fast 33 MHz 486 with I can’t remember video card, but it was probably an S3. My wife Nicole got a rocketsled from Lambda Labs four years ago with a top-notch AMD server CPU at the time and four Nvidia GTX cards (1080 Ti, I think) and the desktop I got from Dell two Christmases ago — which sat in the box behind my desk for a freaking year because I had too much going on and which has a 12-core i5-11500 at 2.7 MHz and a pair of Quadro P2000s that were probably two years old when I bought them — is nowhere near as fast. She never had a rocketsled before, and deserved one. That said, my current PC is 12,000X faster than the first rocket sled I ever used. I doubt I am 0.8X as smart, but have 3X more experience.

These nitro-powered, top-fuel, speed-racing, funny compute systems (aka rocket sleds) sure have come a long way since the 80’s! We just had the 100th anniversary Le Mans 24-hour race this past weekend (5000km, 3000mi) and the excitment and enthusiasm from enigneers, pilots, teams, and fans, was highly palpable — Ferrari used ANSYS/Fluent to win the podium in the hypercar/LMP2 class (Toyota was 2nd, Cadillac 3rd; Corvette won the GT podium). The awesome OoOoMpHhHh of their physical and computational motors are a definite draw for engineers to come into work every single day, and through pre- and post-race periods of skunkworks!

I think that the automobile’s evolved substantially, from the French Jospeh Cugnot’s 1769 steam-powered “fardier”, first in performance, reliability, and user-interface, and then, more recently, in efficiency. But, as with computational systems, their fire-breathing tribe still commands the hugest respect and life-affirming force of any (they’re hydrogen-powered this year, I think)! In this vein, Lambdalabs sure makes some mighty nice rocket sleds, …, and Dell should definitely compete with some roaringly savage gracehoppers!