How much is a pinch of sand worth? Well, that all depends on what you do with it.

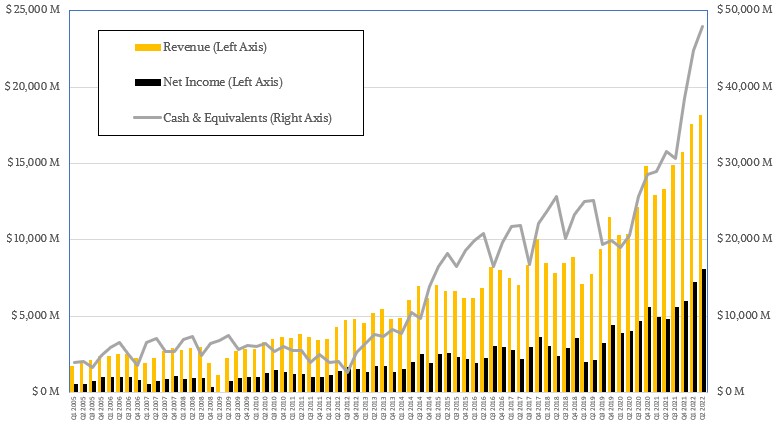

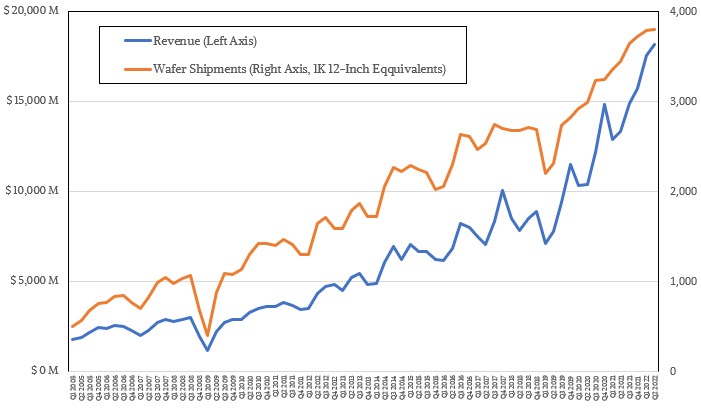

If you get someone to pull the silicon from the oxygen and make quasi-glassy plates from it, then you can etch transistors into circuits on that wafer, cut it up into discrete chips, and sell those chips for a whole lotta money. In the case of Taiwan Semiconductor Manufacturing Co, the world’s biggest and most successful foundry, in the second quarter of 2022, we are talking about $18.16 billion in revenues (up 36.3 percent) across nearly 3.8 million 12-inch silicon wafer equivalents (up only 10.1 percent). But most amazingly, TSMC brought $8.06 billion of that – a staggering 44.4 percent of revenue and an increase of 67.6 percent from the year ago period – to the bottom line.

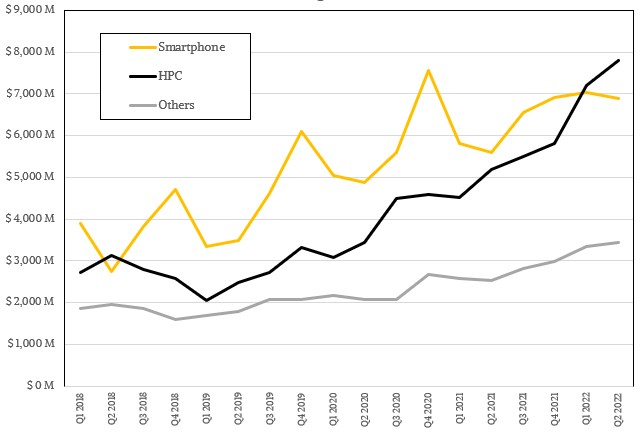

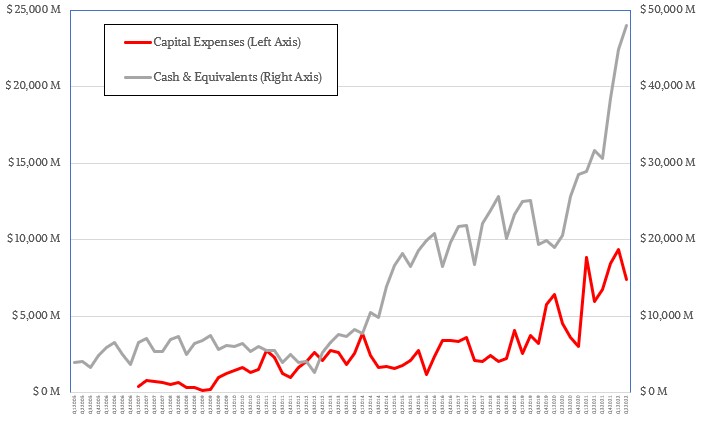

At the end of the quarter, TSMC was therefore sitting on nearly $48 billion in cash, even after shelling out $7.4 billion in capital expenses to keep advancing and expanding its foundries. That is probably enough money to build around two and a half fabs, and despite a slowdown in PC and smartphone sales, where it will take a few quarters to burn down inventories, the top brass at TSMC can be cool because there is so much pent-up demand for what it calls high performance components – a different kind of HPC that underlies the other kind of HPC simulation and modeling that we know so well at – that it will be able to meet more demand here and keep its revenue and profit engine chugging along into 2023.

During a recent call with Wall Street analysts, TSMC conceded these issues and also that because of supply chain problems with its chip manufacturing equipment suppliers some of its investments in its fabs to support current and future process nodes would be pushed out into 2023. The company was not precise about the supply chain issues and what mature and advanced nodes would be affected, or what customers might be affected, but in due time this will be more obvious, but did say that the 2022 capacity plan would not be affected and that some gear for 2023 had been pulled forward to fill the gap.

In this sense, a slowdown in PC and smartphone shipments is a blessing to the datacenter. It could not have happened at a better time, in fact.

In the quarter, the so-called HPC segment of TSMC’s business drove $7.81 billion in sales, up 26.7 percent, and CC Wei, chief executive officer at the foundry, said many times that this HPC segment – which includes fabbing for CPUs, GPUs, FPGAs, switch and router ASICs, and other beefy components – would drive the bulk of the company’s growth in the coming years. Fabbing of chips for smartphones brought in $6.9 billion, down 8.4 percent, and all other segments together – IoT, automotive, and digital consumer electronics are the big ones – grew by 12.1 percent in the aggregate to $3.45 billion.

While Intel is panhandling in the US Congress to help get more indigenous foundry operations in the United States through the $52 billion CHIPS Act, it has to be said quite frankly that Intel should have been investing more heavily in its foundry operations for the past decade instead of buying Altera, McAfee, a big hunk of Cloudera, and a bunch of other distractions that are too long to rattle off. The bind Intel is in with its foundry – and therefore with its compute engines that depend on them – is entirely of its own making. In absolutely stark contrast, TSMC has stuck to its etching and become the most advanced foundry and the most trustworthy one, too.

More than anything else, TSMC makes it look easy, But we all know that running a foundry and developing progressively more difficult process nodes is one of the toughest jobs on Earth. The contrast is even more embarrassing as rumors swirl around that the kicker to the Intel 10 nanometer SuperFIN process, now known as Intel 7, being used to create the future “Sapphire Rapids” Xeon SP processors and chunks of the “Ponte Vecchio” Xe HPC GPU accelerator, is having issues and therefore these chips are – once again – being delayed.

This is painful to watch, and it does indeed have political and economic implications for the IT industry.

While Intel is talking up its roadmap, with less and less credibility, TSMC has some issues but seems to be motoring through them. There were rumors last August that TSMC had hit some sort of snag with its 3 nanometer N3 process, but these seem to have been resolved, as Wei pointed out. And TSMC has ramped 5 nanometer and 4 nanometer nodes and has them in production, and is looking ahead to its 2 nanometer node somewhere around three years from now.

“Our N3 is on track for volume production in second half of this year with good yield,” Wei explained on the call. “We expect revenue contribution starting in the first half of 2023, with a smooth ramp in 2023, driven by both HPC and smartphone applications. N3E will further extend our N3 family with enhanced performance, power and yield. N3E will offer complete platform support for both smartphone and HPC applications. We observed a high level of customer engagement at N3E, and volume production is scheduled for around one year after N3. Our 3 nanometer technology will be the most advanced semiconductor technology in both PPA and transistor technology when it is introduced. Thus, we are confident that our N3 family will be another large and long-lasting node for TSMC.”

The plan for the 2 nanometer N2 node is to start risk production in 2024 and volume production in 2025.

After careful evaluation and extensive period of development, our 2 nanometer technology will adopt nanosheet transistor structure to provide our customers with best performance, cost, and technology maturity,” Wei continued. “N2 delivers full node performance and power benefits to address the increasing need for energy-efficient computing, with 10 percent to 15 percent speed improvement at the same power or 20 percent to 30 percent power improvement at the same speed and logic density of more than 20 percent increase as compared with N3E. Our 2-nanometer technology will be the most advanced semiconductor technology in the industry in both density and energy-efficiency when it is introduced, and will further extend our leadership position well into the future.”

It is hard to see how this will not be true. Globalfoundries is not doing advanced nodes beyond 12 nanometers, Intel is struggling to get yield on its tweaked 10 nanometer process (or something is wrong in the Sapphire Rapids design) if the delay rumors are true, and Samsung’s first swing at HPC-class (in the TSMC sense of that word) devices is arguably IBM’s “Cirrus” Power10 processor and “Telum” System z16 processor.

If the fabless AMD and Nvidia are annoyed that the CHIPS Act is going to help Intel, who is a competitor in the sale of compute engines as well as a foundry, and Samsung and Globalfoundries and TSMC are annoyed that Intel will be given benefits as they are all expanding their own chipmaking operations in the United States. The bill is not law yet, but Intel could benefit to the tune of $20 billion from the CHIPS ACT, which would help it ramp up its foundry operations at the new fabs in Ohio it has planned and take some of the heat off of its compute engine business. And the companion FABS act, which would give 25 percent tax credits for the construction of chip making equipment and fabs, could potentially help even more. Congress could give chip designers like AMD and Nvidia a cut of the tax credit action, as is being suggested, but Intel will be able to apply for that, too.

To be absolutely fair, current Intel chief executive officer, Pat Gelsinger, who has been doing the panhandling, didn’t make the mess Intel is in. And it is no doubt painful for Gelsinger to try to clean up that mess, and he is doing whatever it takes to get the funds to do exactly what he believes will get Intel back on track. This market requires for Intel to be a great chip maker every bit as much as it requires TSMC to be. And at this point, we would argue the same requirement holds for Samsung and Globalfoundries, too.

We have yet to see an accounting over the decades of the benefits that TSMC might have received from the Taiwanese government. But clearly TSMC drives a big portion of the investment on the island nation, with so many companies in its orbit in the IT and electronics sectors. Japan, desperate to have an indigenous high-end foundry, is kicking in $3.5 billion for the construction of a TSMC fab in Kumamoto. It will be politically unpleasant for many to admit that if TSMC or Samsung build advanced foundries in the United States, they should benefit from the same CHIPS and FABS acts – and this is definitely true in the case of TSMC, which is building a foundry in Arizona and explained on the call with Wall Street that construction and labor costs are much higher in the US than they are in Taiwan.

IBM desperately needs to elect Timothy Prickett Morgan to it’s Board of Directors, and then IBM desperately needs to immediately follow Timothy Prickett Morgan’s sound and wise and obvious advice towards huge and immediate success rather than the currrent slow decline to failure of IBM.

So obvious for those who can and will see and who will take action to succeed.

Ok, that actually made me laugh out loud….

“pull the silicon from the oxygen” perhaps that should be the other way around?

Well, the way I see it, oxygen is the greedy atom. It wants to bond with everything is can.