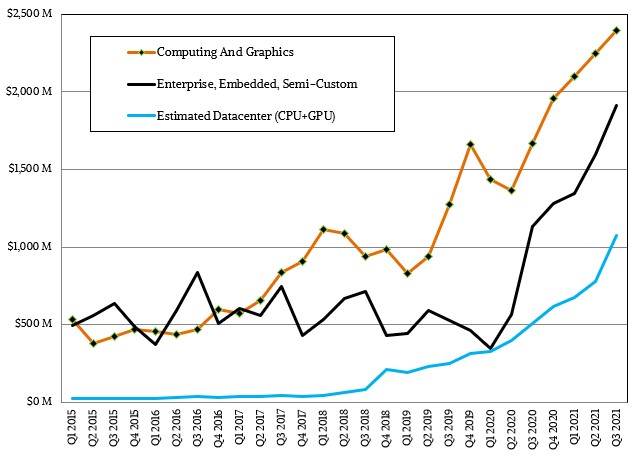

Here is a moment that Lisa Su, the chief executive officer who has lead the team that brought AMD back into the datacenter with the vigor the market needs, has been waiting six years for. In the third quarter ended in September, AMD’s datacenter CPU and GPU business broke through $1 billion in sales for the first time in a very, very long time.

Based on statements from AMD and our own model, we think that AMD’s datacenter CPU and GPU business rose by 38 percent sequentially from the second quarter of this year and more than doubled year on year, reaching $1.08 billion. Of this, we reckon, again based on hints from Su on a call with Wall Street analysts, that datacenter GPU sales more than doubled compared to Q3 2020, that Instinct GPU sales rose by 105 percent to $164 million, and that means Epyc CPU sales rose by 30.3 percent sequentially and by 105.6 percent year on year to reach $914 million.

The big jump in CPU and GPU sales is due in part to widespread adoption of AMD’s CPUs and now GPUs among the hyperscalers and cloud builders, but the big push has come from the first installations of the custom “Trento” Epyc CPUs and Instinct MI200 GPUs accelerators that are the heart of the “Frontier” supercomputer being built at this moment by Hewlett Packard Enterprise with the help of its Cray division and AMD for Oak Ridge National Laboratory. Earlier this month, we compared and contrasted the Frontier system with the “Aurora” exascale system being built by HPE with Intel CPU and GPU motors going into Argonne National Laboratory. To reach its greater than 1.5 exaflops performance, the Frontier system will have more than 9,000 Trento Epyc CPUs and more than 36,000 Instinct MI200 accelerators. And as we have said for some time, we think AMD is going to pull a “K80 maneuver” and put two Instinct MI100 GPUs into a single card with doubled up memory to make the Instinct MI200 (we shall see soon enough). So that is really like having more than 72,000 GPUs paired to 72,000 CPUs, since each the Rome, Naples, and Trento Epyc CPUs all have eight independent CPU chiplets in each socket. That balance could be coincidence, but we think not.

The resurrection of AMD’s datacenter business has come through guts, determination, contrition, great engineering, and unflinching execution, often in the face of adversity (such as when GlobalFoundries spiked its 10 nanometer and 7 nanometer chip manufacturing efforts one after the other). And now, in the next couple of years, particularly in the HPC and AI arenas, we are going to see the work of Su’s team start paying off handsomely — particularly with Intel still not quite firing on all cylinders.

In the chart above, the lines are not cumulative, so don’t add them up. The Epyc CPUs are booked in the Enterprise, Embedded, and Semi-Custom group and the GPUs are booked in the Computing and Graphics group. For the past couple of quarters, AMD has been explicit — more or less — about what its combined datacenter CPU and datacenter GPU sales are, and this time around said that it was in “the mid-20s” as a percentage of overall revenues.

Back in Q1 2015, which is when AMD first started talking about the “Naples” Epyc 7001 processors and had put a stake in the ground for future GPU accelerators that would become the Radeon Instinct line and then just the Instinct line, we think AMD had maybe $2 million in sales of its Opteron processors and maybe $24 million in datacenter GPU sales for some HPC and AI workloads, and possibly for VDI, and cryptocurrency mining. Maybe this business had an operating income of around $8 million. It was basically at zero against an Intel with a monopoly on datacenter CPU compute and Nvidia with a monopoly on datacenter GPU compute.

Fast forward to Q3 2021, and datacenter CPU sales have grown by a factor of 592X to $914 million (up 105.6 percent year on year) and datacenter GPU sales have grown by 6.8X to $164 million (up 152.3 percent year on year). We think AMD might be pulling down operating income of maybe $377 million against that $1.08 billion in datacenter sales, or about 35 percent of revenues, compared to overall sales of $4.31 billion for all products in Q3 2021 and an operating income of $948 million (net of operating losses on investments outside of the two groups in the chart above), which works out to 22 percent of revenues. AMD has built a profitable datacenter business that is helping to fund its future development, which was Su’s goal all along.

To be frank, AMD is now doing better than we thought it would do in 2021, but it did not do as well as we thought it would do in 2019 and 2020.

We love spreadsheet models, and in March 2020 we put together one for AMD’s datacenter and PC and gaming sales, which you can see here in a story called AMD Determined To Get Its Rightful Datacenter Share. We reckoned that AMD would do $1.01 billion in sales in 2019 (the fourth quarter numbers were not out yet when we built this model), and it turned out to be around $986 million. In 2020, we were expecting the AMD datacenter business to grow by 25 percent to $2.32 billion, but our improved model (based on those hints from Su) show it only had about $1.85 billion in sales for CPUs and GPUs aimed at the datacenter. But, alas, here in 2021, if AMD only does a little bit better sequentially in Q4 2021, then it will book $3.64 billion in datacenter sales in 2021, which is considerably better than the $2.9 billion we expected in 2021. Call it the COVID-19 slide plus a whole lot more cloud and hyperscaler upside. We have to have a think about what the shape of the curve might look like in 2022, but clearly in 2021, the delays in Intel getting its “Ice Lake” and “Sapphire Lake” CPUs and its “Ponte Vecchio” GPUs into the field have hurt Intel and helped AMD. Nvidia is also resting on its “Ampere” A100 laurels in the datacenter, but will have to counter with something as the Instinct MI200s come to market.

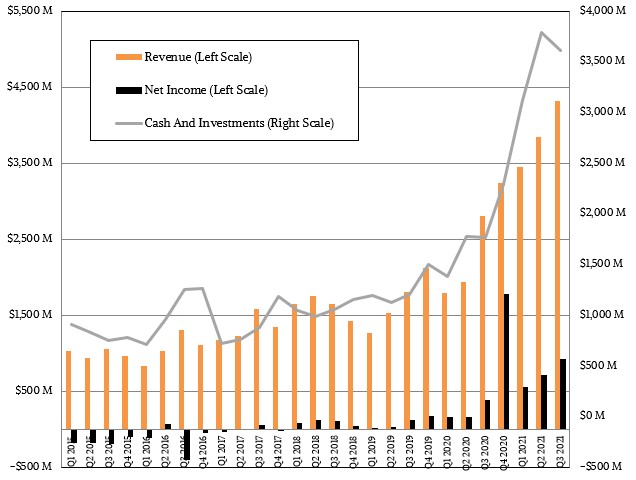

Add in the PC and gaming parts of the company, and as we said, AMD posted sales of $4.31 billion in Q3 2021, up 54 percent, and net income came in at $923 billion, up by a factor of 2.4X. AMD ate a little of its cash, which is down to $3.61 billion, and it says that it is still on track to make its $40 billion acquisition of FPGA maker Xilinx by the end of the year. That acquisition is not in any of our models, but a good portion of Xilinx revenues will be in the datacenter, although there are a lot more sales for embedded use cases with FPGAs. We reckon AMD will split its datacenter business and embedded business from each other once the Xilinx deal is done. And if AMD doesn’t do that, well, it should. Xilinx will add around $3.2 billion in revenues and about $700 million or so in net income to AMD’s 2022 year, which will be slightly additive to earnings and definitely additive to revenues. More importantly, it will give AMD access to FPGA compute engines, high speed interconnect expertise, and the Vitis software stack that can merge rather nicely with its ROCm CPU and GPU compute environment. (At least that is the idea.)

Back to the third quarter of this year, though. In the period, the Computing and Graphics group grew by 43.9 percent to $2.4 billion, and posted an operating income of $513 million, up 33.6 percent. The Enterprise, Embedded, and Semi-Custom group had sales of $1.92 billion, up 68.9 percent, and its operating profit increased by a factor of 3.8X to $542 million. The “Milan” Epyc 7003 processors announced in March of this year are hitting their stride.

“We are feeling very, very good about the server business and the datacenter market,” Su explained on the call with Wall Street analysts. “I think from a market standpoint, we have seen a strong market here in 2021 in both cloud and enterprise, and we see that continuing into 2022. I think from a competitive position standpoint, Milan is extremely well-positioned, so we were very pleased with the adoption rate of Milan. We said that we expected it to grow faster than Rome, and it has. And so, the crossover with Milan in the third quarter is an important metric for that. Going into the fourth quarter, we continue to see a strong environment. And then as the competitive environment goes into 2022, we always expect the competition to be strong, but our focus has been consistent execution of our roadmap and we feel very good about Zen 4 in general. In 2022, I think we feel very good about the competitive positioning there and we continue to believe that datacenters are most strategic part of our business, and we are making good progress with our customers and partners.”

Cloud and HPC made Rome and then Milan CPUs sell, and now by the time we get to Zen 4 cores and “Genoa” Epyc 7004 processors, enterprises will finally feel that AMD is a safe bet and Intel is going to have to keep whatever business it can with Sapphire Rapids Xeon SPs. It’s going to be a bloody price war, and Intel is going to be the one covered in red ink, not AMD. We shall see.

I have AMD shipments breaking through 30 million units up to 36,173,808 that include a very large volume of GPU on channel by product category data. AMD Navi 6x net take per consumer dGPU is $193 to $206 net. Across the full product line; CPU and GPU $119.23. At N6x net price my consumer (C&G) total quantity may be high on data center per GPU subsystem price. I also wonder whether data center end customers are producing their own accelerators from supplied components. Can you please elaborate on your data center q3 2021 dGPU revenue estimate $164 M, was it not $263 M when this report released on October 22nd and thoughts on end customers building their own subsystems. Thanks, Mike Bruzzone, Camp Marketing