This is how a competitive chip market is supposed to look, and this is how a competitive chip maker recovers from faults, competes against a seemingly unassailable foe, and then rides up the revenue and income curves to be able to invest in the future and profit from the present.

AMD turned in the best quarter that we can remember, and is now firmly in place as the gadfly counterbalance to the former hegemony of Intel. And that is good for everyone who buys a game console, a PC, an edge device, and a server. And the game is only going to get more interesting with Intel getting its chip together and preparing for a long battle with AMD and other XPU usurpers in chip design and as well as Taiwan Semiconductor Manufacturing Corp in chip etching and packaging.

If you were a little worried that the future of the datacenter might be boring, just more of the same, then break out the popcorn and put some extra butter on it because the next few years are going to be both fast and furious.

An aside before we get into the AMD numbers: Much has been made about how both Intel and AMD beat Wall Street’s expectations, and as we write this while listening to Bloomberg radio, the hosts have explained that back in the day some decades ago, you really had to work hard to beat the Wall Street estimates and it meant something. These days, more than 90 percent of publicly traded companies have been beating expectations, and before the coronavirus pandemic the beat rate was in the high 70 percent range. If that many companies are beating expectations, then Wall Street is low-balling most publicly traded companies – intentionally or not – and needs to adjust what it is expecting. It’s a kind of pump and dump, although a subtle one. Luckily, none of our retirements are depended on this giant pachinko machine. Oh wait. . . .

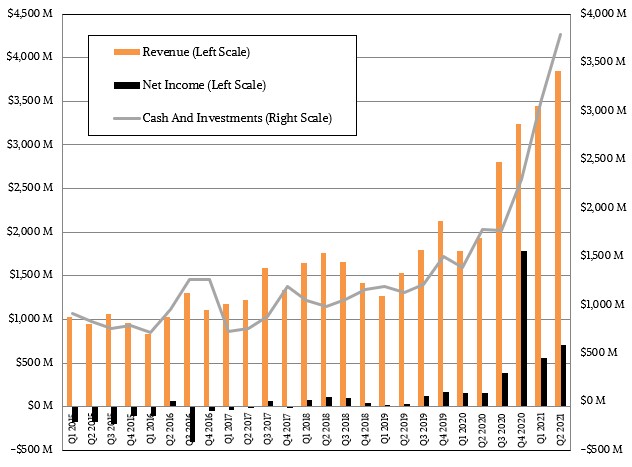

In the second quarter ended in June, AMD’s revenues nearly doubled – up 99.3 percent – to $3.85 billion, and operating income rose by 4.8X – that’s 380.4 percent to be precise – to $831 million. That operating income represented 21.6 percent of revenues, which is less than half of the roughly 50 percent operating income rate that Intel’s Data Center Group was able to rake in during its peak years of 2013 through 2015 and 2018 and 2019. Intel DCG is averaging just shy of 30 percent of revenue for operating income in the trailing twelve months, and with AMD being this strong, we think it will stay there. AMD’s net income rose by a factor of 4.52X – that’s 352.2 percent – to $710 million. Income is growing much, much faster than revenues, which is what happens when a company bets big against an incumbent and delivers better TCO after many years of investment. And Intel’s declining operating income is no accident, either. It is the direct result of Intel’s costs in trying to keep up with TSMC on the foundry front and with AMD on the CPU front.

We shall see how sustainable this turns out to be for AMD, but the company’s top brass is being extremely careful as well as appropriately aggressive in its swordfight with Intel. They also know that “only the paranoid survive,” as Intel co-founder Andy Grove once famously quipped.

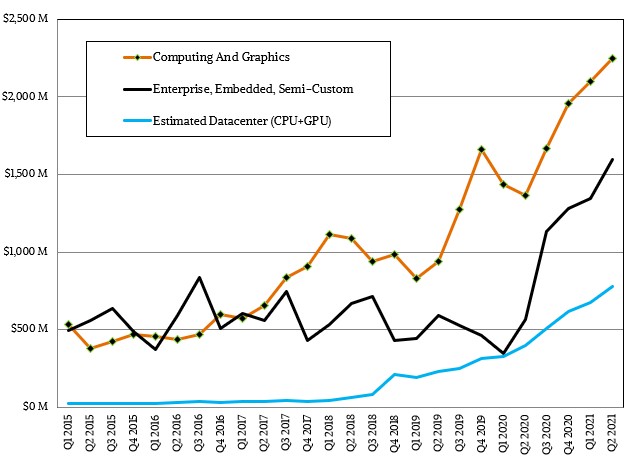

AMD does not have an easy proxy for its datacenter business, with datacenter GPU sales reported in its Computing and Graphics group and Epyc server CPUs reported in its Enterprise, Embedded, and Semi-Custom group. We think AMD should break its client businesses – including PCs and game consoles – into a new group and put its datacenter products and edge devices in another group and stop making it so hard to show how well it is doing in either of these. Such a rejiggering of financials could happen once AMD closes its $35 billion acquisition of FPGA maker Xilinx, and it would be helpful if the Xilinx business was broken down in some intelligent way as well if such a rejiggering happens.

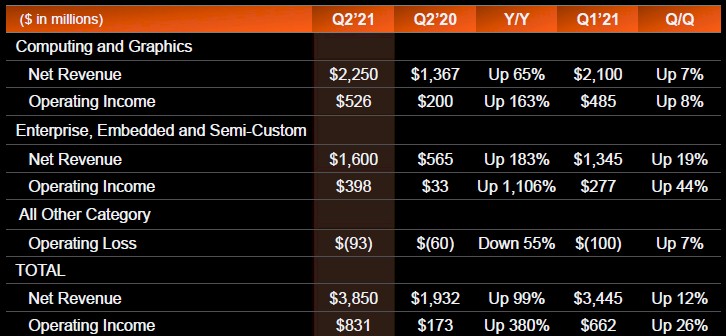

In the quarter, the Computing and Graphics group had revenues of $2.25 billion, up 64.6 percent, with operating income of $526 million, which works out to be 23.4 percent of revenues and which was up 2.63X year-on-year. The Enterprise, Embedded, and Semi-Custom business had $1.6 billion in sales, up 183.2 percent, and operating income rose by a factor of 11.1X to $398 million, which was 24.9 percent of revenues. Within either AMD group, this is a mix of relatively low and high margin products, and it all balances out to obscure just how profitable the AMD datacenter business is. This is absolutely intentional. The paranoid also do not give their enemies too much data, and give Wall Street just enough to feel good.

We do get some hints, however. Lisa Su, AMD’s president and chief executive officer, said that AMD’s datacenter business – at this point meaning Epyc CPUs and Instinct GPU accelerators – comprised more than 20 percent of the company’s overall sales, and the big driver in this quarter was not just second generation “Rome” Epyc 7002 and third generation “Milan” Epyc 7003 server chips – Rome is still outselling Milan, but the crossover is coming in the third quarter of this year – but the Radeon Instinct M100 GPU accelerators launched last fall. The datacenter GPU business more than doubled from a year ago, according to Su, and AMD expects it to continue to grow in the second half of the year as the 1.5 exaflops “Frontier” supercomputer at Oak Ridge National Laboratory in the United States, the as-yet-unnamed pre-exascale system at Pawsey Supercomputing Center in Australia, and the Lumi pre-exascale system in Finland all get their Radeon Instinct motors installed.

“We are very focused on the multi-quarter, multi-year progress with the server in the datacenter business, and we are excited with the momentum around our server business,” Su explained on the call with Wall Street analysts going over the numbers. “I think the product roadmap is very strong. I think the execution has been very strong. I think customers also – with the third generation with Milan – felt much more comfortable to go more broadly, just because this was sort of the third time.”

If you do a little math and magic, you can come up with some estimates for the AMD datacenter business, as we have in the chart below:

As best we can figure, the AMD datacenter business was 20.3 percent of overall revenues, or $782 million, up 97.3 percent. Su said datacenter CPU sales had almost doubled year on year, and we reckon in our model that they grew by 96.5 percent year on year, to $657 million, and importantly grew sequentially by 7.9 percent from the first quarter of 2021. Datacenter GPU sales were up by 101.6 percent in our model, to $125 million, which represented an 86.6 percent growth sequentially from Q1 2021. It is hard to say what operating income this datacenter business provides, but it is clearly more profitable per dollar than the game console or PC chip businesses are, and some day we will build a refined model that gives our best guess on this.

Our first guess is that AMD’s operating incomes are aligned to Intel’s because they are fighting all the same costs, and each other, so call it 30 percent of revenue, which works out to $234 million. Before eliminations from corporate overhead, that is about 25 percent of the operating margins for the company against around 20 percent of the revenues. At 35 percent operating margins, the datacenter business would account for 30 percent of AMD’s total operating profit, and at 40 percent operating margins, the datacenter business would account for 33.8 percent. These are the high-water marks, and are still very, very small compared to Intel’s Data Center Group, which had $6.46 billion in sales and $1.95 billion in operating income in the same quarter. Intel’s datacenter business is still 8.3X as large in terms of revenues and profits as AMD’s. But then again, not so long ago it used to be infinitely larger, and if you go further back, it was only 4X as large. It is not inconceivable that this ratio gets driven down to 5X, 4X, or maybe even 3X in the technology and price war that started in 2017 and is really ramping up now.

It will get more intense, and AMD has to be hoping and praying every day that TSMC doesn’t slip just like Intel has to be hoping and praying every day that it stops slipping. Both seem inevitable, and the timing will determine how the competitive situation shifts. Twice in AMD’s lifetime, Intel has slipped when AMD innovated and pushed hard, and once Intel has fought back. The company aims to make it 2 for 2.

All we know for sure is that if the competitive heat keeps stoking, datacenter compute is going to get a lot less expensive, and the battle will shift elsewhere. We think to networking, where Intel has proved itself ineffective and AMD has cards to play once it acquires Xilinx.

The only problem with such intel vs amd analysus is it begins w/ a fundamentally flawed basic premise.

Yes the various factors discussed matter and yes they can ebb and flow either way within pertinent time frames to check or reverse amd’s ascendancy as they have in the past, but the underlying foundation of amd’s ascendancy is overlooked, and this cannot change within a perinent time frame IMO.

By the time Intel have a response, they will be too far behind to regain ascendancy.

I refer to the Infinity Fabric at the heart of amd’s modular chiplet architecture.

This has been in the dna of all amd’s work since pre 2014, & is not some thing/device that intel can mimic & bolt onto their incompatible cpu architectures – they have to start at the beginning and evolve a whole new range from scratch.

Fabric is at the heart of amd’s competitive advantage – the yields/costs/cooling, scaling…

They have an answer to the demise of moore’s law, intel dont. They are screwed.

I agree that at some point, all leads are permanent. But I do not think this is the case now. Intel and IBM both have a long history with packaging, and they are partners now. IBM is particularly good at this–or at least was. I think that Intel can do chiplets and master this, and I think they can eventually catch TSMC on process. But I wonder if they can have the volume to drive the price down. One hiccup at TSMC, and we are in a new game. Two hiccups, and the odds are even again.

The only way to predict the future is to live it. So, we shall see.

My AMD q2 production analysis on channel data on financial reconciliation is here top of comment string;

https://seekingalpha.com/news/3721686-amd-climbs-more-than-5-following-ceos-upbeat-comments

Record Epyc sales quarter up to 4,298,939 units. AMD full line production volume on price and revenue is reviewed.

Mike Bruzzone, Camp Marketing

Just in passing, the new Pawsey Centre system does have a name: https://pawsey.org.au/pawsey-unveils-its-super-fast-tribute-to-the-quokka/

🙂