Thomas Kurian’s arrival at Google Cloud in early 2019 after more than 22 years at Oracle marked a significant shift in Google’s thinking, putting an emphasis on expanding its cloud’s business use by enterprises as the key to making up ground on Amazon Web Services (AWS) and Microsoft Azure in the booming global cloud market.

Google Cloud has closely followed that enterprise drumbeat over the past two-plus years, building out its infrastructure, extending its each from the cloud into on-premises datacenters and out to the edge and leveraging its research and expertise in such rapidly emerging areas as artificial intelligence (AI) and data analytics.

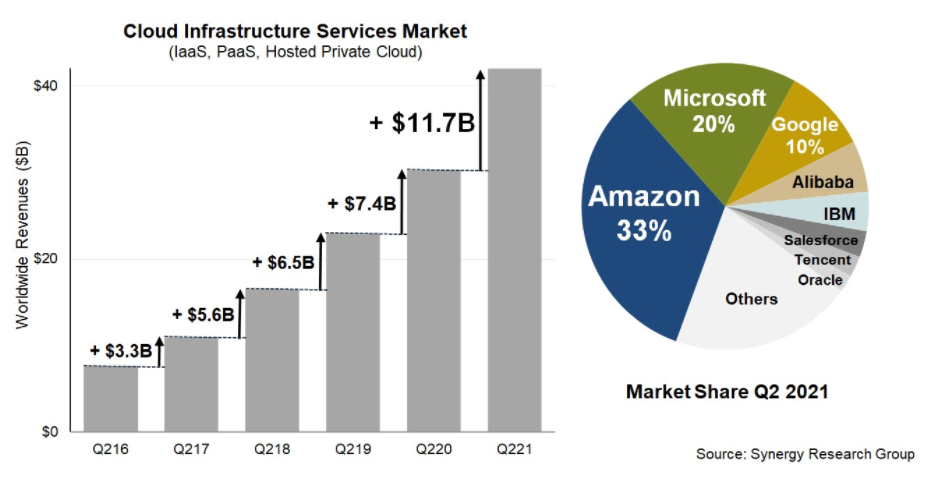

Google Cloud remains in third place in a global cloud infrastructure services space that Synergy Research Group said hit $42 billion in the second quarter, a $2.7 billion increase from the first quarter and a 39 percent jump from the same period in 2020. AWS still holds a commanding 33 percent market share, followed by Microsoft at 20 percent and Google at 10 percent. The market research firm said that both Microsoft and Google had chipped away at AWS’ lead over previous quarters, but that Amazon had in the second quarter had regained much of that ground.

John Dinsdale, chief analyst at Synergy, noted that the cloud services space continues to be a “runaway success” for those three and other cloud providers, but that success came at a cost. Amazon, Microsoft and Google are spending a combined $25 billion in capex every quarter, with much of that being spent on building and equipping more than 340 hyperscale datacenters.

“There remains a wealth of opportunity for smaller, more focused cloud providers, but it can be hard to look away from the eye-popping numbers coming out of the big three,” he wrote.

That said, Google is seeing progress. In its latest quarterly financial numbers, cloud revenue for the company increased almost 54 percent year-over-year, to $4.63 billion. Operating losses also improved 58.7 percent, coming in at $591 million. The losses during the quarter in 2020 reached $1.43 billion.

Given all that, it’s not surprising that both Kurian, Google Cloud’s CEO, and Sundar Pichai, CEO of both Google and parent company Alphabet, during the keynote address at the virtual Cloud Next 21 event this week emphasized the success the cloud business has had and dropped the name of dozens of major enterprises – ranging from Ford and Walmart to L’oreal, Proctor and Gamble, Ikea and The Home Depot. The executives focused on a range of Google Cloud services, from its Data Cloud and BigQuery Omni, a data analytics tool powered by Google Cloud’s Anthos data and infrastructure management engine that can run not only in Google Cloud but also AWS and – eventually – Azure, to its array of consumer-focused services like Android, Nest, Assistant and Maps, which all contribute to technologies that help enterprises.

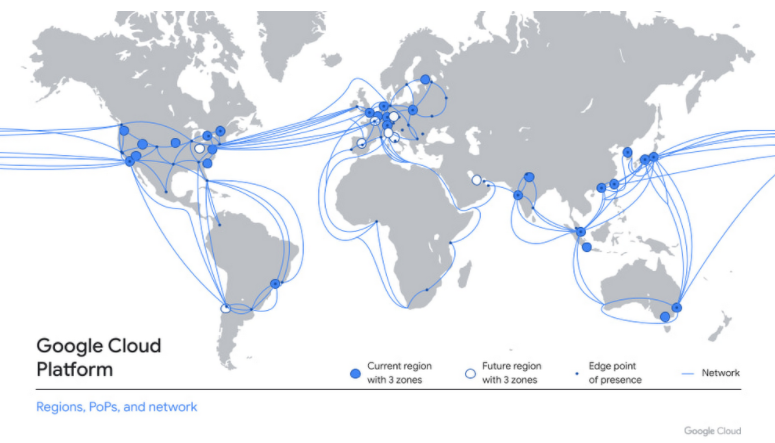

“Our cloud platform is designed to help enterprises transform to digitization, built on deep investments we made in technical infrastructure over the past 23 years,” Pichai said. “Looking at our networking and datacenter investments alone, we have the largest network with the lowest latency of any cloud provider.”

That infrastructure is continuing to grow its reach around the world. Google Cloud this year expanded into Warsaw, Poland, Delhi, India, Melbourne, Australia, and Toronto, giving the company 28 regions, with plans for 10 more, he said. It’s connected by 19 subsea cables and will soon include optical fiber switching.

Google Cloud is extending the reach of its infrastructure and services deeper into enterprise datacenters and out to the rapidly evolving edge. As IT environments become more distributed and organizations adopt multicloud and hybrid cloud strategies, cloud providers like AWS, Microsoft, Google and Oracle have worked to establish a presence in on-premises datacenters to essentially play both sides of the cloud fence.

This includes AWS’ Outposts infrastructure that can be installed on premises and give organizations access AWS services. Microsoft offers similar capabilities via software and services with Azure Arc and Google Cloud made a push in that direction with Anthos, which enables enterprises to run their Kubernetes workloads in myriad environments, including those of rival cloud providers.

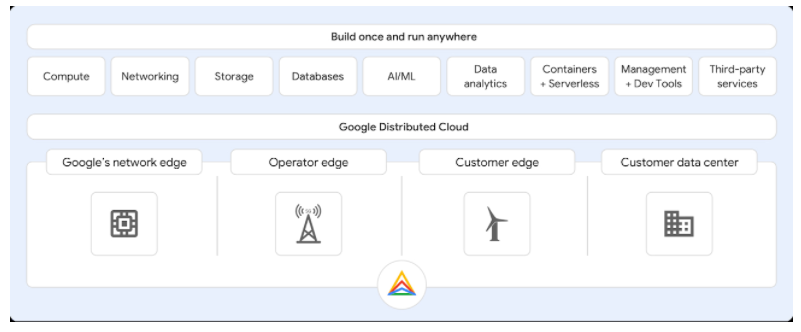

At the Cloud Next event, the company unveiled Google Distributed Cloud, a collection of fully managed software and hardware offerings that extends the infrastructure into datacenters and out to the edge, with the goal of bringing more enterprise workloads onto Google Cloud. Some workloads and data can’t be migrated into the cloud for security, data sovereignty, compliance reasons or latency issues, so creating these distributed clouds “can still take advantage of what the cloud has to offer,” Sachin Gupta, vice president and general manager of infrastructure-as-a-service (IaaS) at Google Cloud, wrote in a blog post.

‘Google Distributed Cloud taps into our planet-scale infrastructure that delivers the highest levels of performance, availability, and security, while Anthos running on Google-managed hardware at the customer or edge location provides a services platform on which to run applications securely and remotely,” Gupta wrote.

Anthos is foundational to the strategy and the Google-managed hardware will be from Hewlett Packard Enterprise, Dell Technologies, Cisco Systems and NetApp, which will be the primary tech partner supporting the storage infrastructure in Google Distributed Cloud, Kurian said.

Google Distributed Cloud can run across a variety of locations, including Google’s network edge, where organizations can use more than 140 global Google network edge locations and the operator edge network, which can be used for latency- and bandwidth-sensitive workloads and which gives enterprises access to 5G and LTE services offering by communication service providers (CSPs) partnering with Google.

There also are customer edge and remote locations – such as retail stores, factory floors and branch offices, which need compute situated locally – and customer datacenters and colocation facilities.

The first two products are Distributed Cloud Edge and Distributed Cloud Hosted. The first, which is in preview now, is built upon Google’s telecommunications portfolio and is placed closer to where the data is being created. Organizations can run 5G and radio access network (RAN) tasks and enterprise applications at the edge to support such modern workloads as computer vision and AI edge inferencing.

Key partners in this include Ericsson and Nokia.

Distributed Cloud Hosted is aimed at public-sector entities and companies that run sensitive workloads that have to deal with requirements about where the data sites, privacy and security. Enterprises can run the product themselves or sign on with a Google-designated partner. Distributed Cloud Hosted doesn’t require connectivity to Google Cloud to manage the infrastructure, services, APIs or tools and leverages a local control plane in Anthos for operations. It will be available in preview in the first half of next year.

Be the first to comment