If we could take the Fugaku supercomputer out of the HPC market equation and while we were at it, pretend the pandemic never happened, the supercomputing market would be much easier to pin down. However, both have skewed the state of the HPC market and have also added a few unknowns into the forecasts from Hyperion Research, the go-to analyst firm for the supercomputing set.

At just over a billion dollars, the Fugaku machine has created some imbalance in what the market is worth but that is easier to contend with in the data than the impacts of the coronavirus. Some areas of the HPC market were hard hit from the pandemic like the workgroup segment, which is one of the few negative areas of spending because of an increase in cloud use for those workloads (which likely would have happened anyway), some of which may have been driven by a shift to remote for most centers.

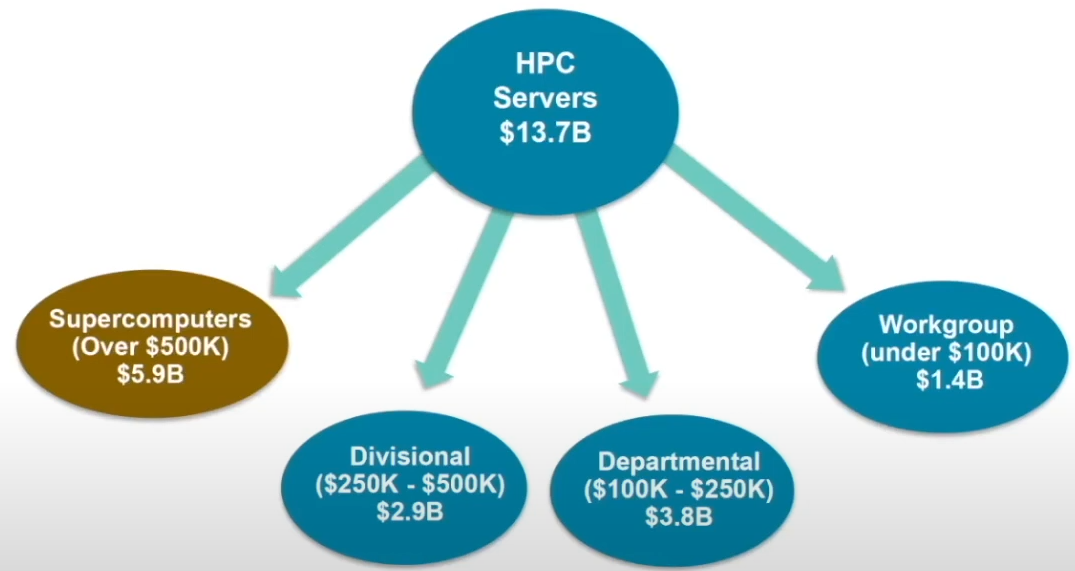

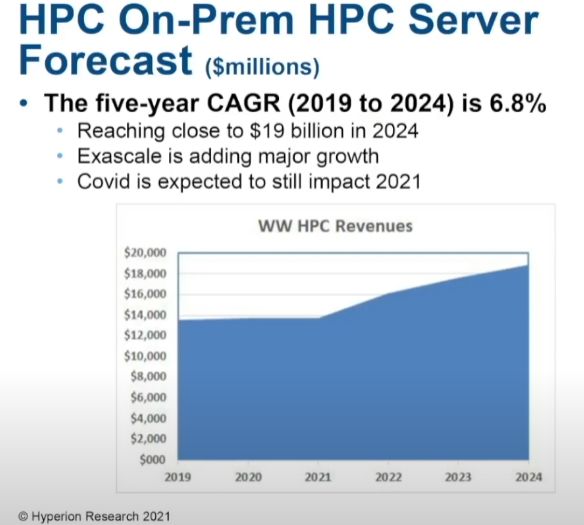

Even with Fugaku spend, Hyperion says the worldwide market for on-prem supercomputing is up 1.1% with 2020 reaching $13.7 billion. To contend with the imbalance of the largest exascale supercomputer spending, the research firm hit refresh on how they break down the market, dividing the market into the largest systems, followed by divisional, departmental, and workgroup by spending volume as seen below.

While this is incredibly helpful, it still skews forecasts and projections for that “rest of us” view of the HPC market. And even mild picking apart shows that for that “middle class” of HPC, the market is flat, which is not surprising in a world of unknowns.

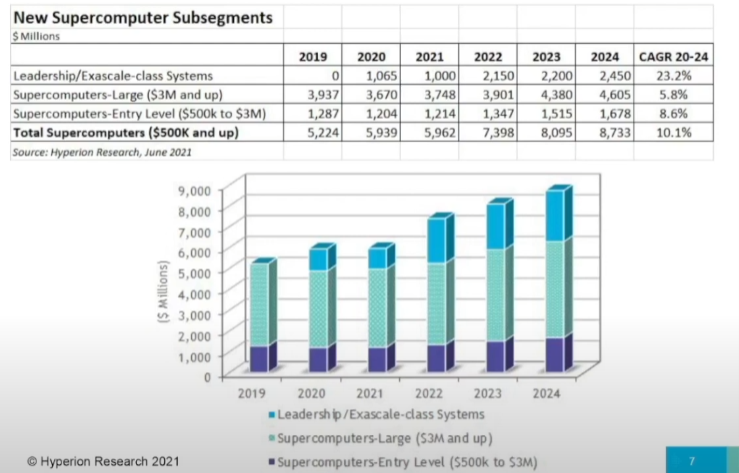

It’s worth remembering that out of the $5.9 billion in the supercomputers category, just over one billion of that is from a single system (Fugaku) and while the exascale category is interesting as a segment, it does not necessarily reflect the broader HPC market, especially for mid-sized research and commercial HPC users, where cloud adoption is growing and server refreshes are a bit slower.

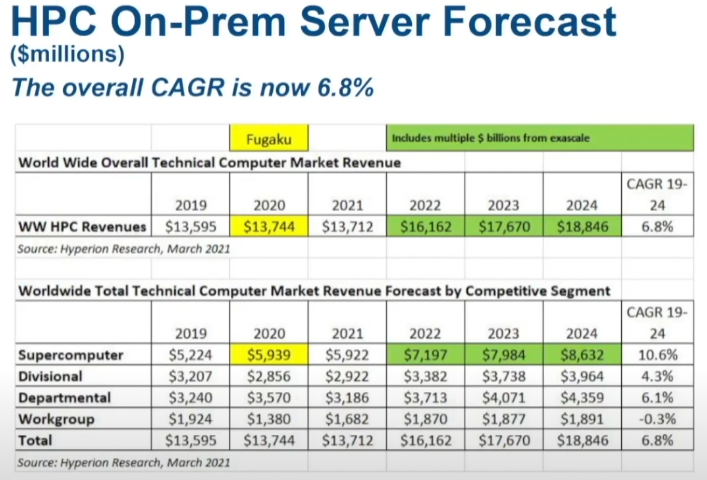

With all of that said, let’s take a look at what’s happening for the broader market (numbers shown in millions).

With all of that said, let’s take a look at what’s happening for the broader market (numbers shown in millions).

By this data, the addition of a massive new exascale machine in the supercomputing category is the buoy with other areas showing declines, with the exception of departmental systems. There could be several reasons for this, including server refresh schedules. Many of the machines in this category are not superstars but rather research or commercial workhorses that are purpose-built and a guaranteed steady part of the HPC market.

Notice the decline in workgroup segment, as mentioned above. This is where we think cloud is starting to really chip away at the on-prem business, a trend that began when ISVs serving the HPC market aligned their pricing and usability models with the major cloud platforms. That, coupled with the impetus of remote work, likely sent that segment tumbling—something we expect might continue over the next years—as does Hyperion, although 0.3% isn’t much of a dip in their forecast for all segments below.

This big picture view is complicated at the top end by the most expensive exascale systems making the overall market look larger than it is but breaking the supercomputing segment out separately helps provide a clearer view. We already know about several of the machines that will make up that 10.6% growth by 2024 but it’s the other segments that are worth noting in their relatively slow, but steady growth. What might drive more of this, even with expanding cloud adoption in some of the lower price point segments, is the addition of AI/ML into the HPC mix along with more advanced analytics, both of which require ever-increasing volumes of data.

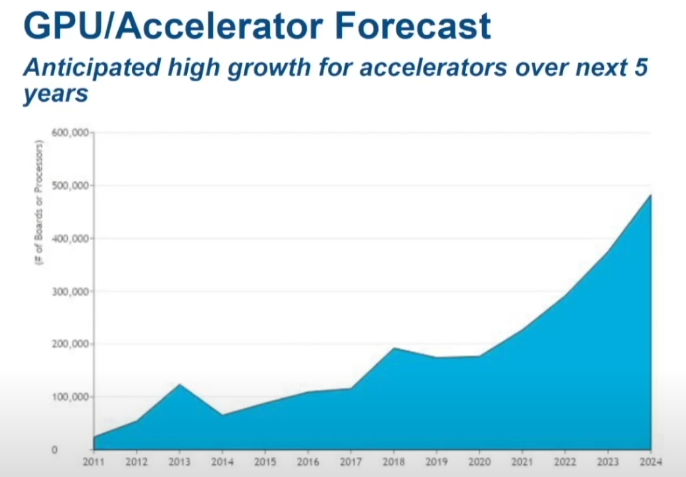

For instance, take a look at two areas of the market that will have big impacts from AI/ML and advanced analytics—accelerator adoption projections and the forecast for storage growth:

While GPUs are far and away the dominant accelerator type in HPC, Earl Joseph, CEO of Hyperion Research, was careful to point out that there are others that might find inroads, especially among the AI chip upstarts. This list could also include accelerators like FPGAs and custom ASICs (offload) for particular workloads. Nonetheless, that spike is noteworthy.

Currently, 80% of the Top 500 list of the most powerful supercomputers are GPU-accelerated but only 30% of the rest of the list is accelerated (mainly GPUs, but there are some holdovers from Xeon Phi still on the list). The chart shows a doubling of boards but remember that skewing from the largest machines we talked about? The same holds with accelerator growth—all the exascale machines on the horizon are accelerated. So it’s hard to say how gently sloping that accelerator line would be for the rest of the market.

Storage growth is clearer cut. With a rise in AI/ML and analytics comes a need for expanded storage. Joseph says storage is a “wildcard” internally at Hyperion, with opinions ranging from the chart above to quite a bit higher, he says.

The broader forecast from 2019 to 2024 below shows how this sorts more generally. Notice that the Covid impact remains, leading to a flat market with a jumpstart happening into 2022. Again, there will be a large number of massive-scale machines hitting floors in that time, so this projection is heavily weighted in that direction.

In terms of this growth, there are already five end user segments that are over a billion per year: biosciences, CAE, defense, government (which Hyperion breaks out separately) and university (one machine alone could make that billion figure). Geosciences, always an HPC stronghold isn’t quite there yet with $865 million of segment share.

The vendor ecosystem supplying those high-value areas is still HPE-held, a benefit of having the Cray brand under their wing. Dell is holding steady at close to 21% of the system share. Fujitsu has 10%, almost exclusively due to the Fugaku system. Another vendor in APAC, Inspur has 7.2 also due to a number of system wins in native China, many of which are at hyperscale/cloud and telco datacenters, comprising over 50 entries on the Top 500 (and not without some controversy).

And if you’ve been following HPC for years, it still feels weird to see IBM with such a slim share: 3.2%. Lenovo has 6.8% and others, often regionally-focused system makers like NEC and ATOS are 1.4% and 1.8% respectively.

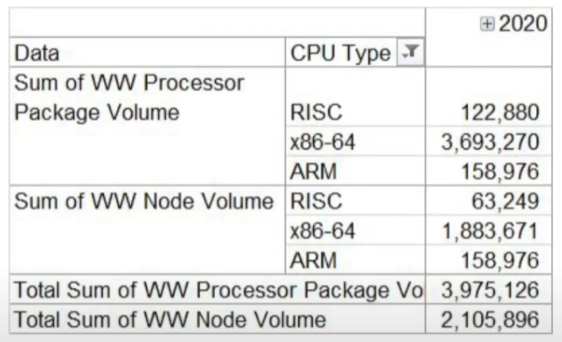

If we take a look at the worldwide market by processor with around four million base (non-accelerator) processors sold each year in the HPC market, we see the trend emerging everyone expected: there’s definitely growth in Arm, but again, the Fugaku system skews.

If we take a look at the worldwide market by processor with around four million base (non-accelerator) processors sold each year in the HPC market, we see the trend emerging everyone expected: there’s definitely growth in Arm, but again, the Fugaku system skews.

As we noted back in May, there is a high-level hum of money coming in for machines that will be somewhere between $2 billion and $3 billion a year at the upper echelon of supercomputing. Which is great. But if you subtract that out of the market, the overall HPC market is expected to grow underneath it, including the rest of supercomputers (again, machines that cost more than $500,000) but probably not workgroup machines, which we think will be largely killed off by the cloud.

What held true then is definitely standing now: “Don’t think that all of that exascale action in the next five and a half years will necessarily mean that the HPC business will be profitable. History suggests that these big boxes break even at best for the vendors who are the prime contractors on them, and any profits and a lot more revenue has to be made on peddling smaller versions of the systems to the wider HPC community in government, academia, and other research institutions. It looks like the prognostications of the analysts at Hyperion are assuming this will be the case. Which is good news. “

Hyperion GPU/Accelerator forecast in unit volume, from 175K to 475K units annual 2020 through 2024, on the installed base of Xeon Scalable Skylake and Cascade Lake waiting refurbish to GPU compute, seems very under whelming to me. I acknowledge Hyperion states an HPC estimate. I’d say for commercial GPU acceleration unit volume potential is more like a million units now growing quickly to 5 M on its way to 20 M units within the next three years. Due to the mass of installed Xeon waiting platform retrofit to accelerated compute this salvage market opportunity is the largest in the history of compute that hundreds of thousands of units of GPU and the jockeying innovative replacements would surely under supply.

Mike Bruzzone, Camp Marketing