Dell took a look at the two weeks between the rollouts by AMD and Intel of their latest server processors and, after some debate, decided to unveil its entire portfolio of new and enhanced systems – featuring the new chips from both vendors – at the launch of AMD’s latest Epyc silicon rather than announce servers in line with the chip makers’ timing.

As Ravi Pendekanti, senior vice president of server and networking product management and marketing at Dell, told us last month, the company decided that enterprises were less interested in which chips were in which servers and more concerned with what the OEM’s refreshed server portfolio – which included 17 systems powered by the new “Milan” Epyc 7003 and “Ice Lake” Xeon SP chips – had to offer.

It wasn’t an earth-shattering stop-the-presses sort of decision, but highlighted the changes occurring in the IT industry, including the growing focus on workloads running on the systems rather than simply the systems themselves, the understanding that modern servers are platforms that are more than the processors they run on and the re-emergence of AMD as a viable alternative to Intel in the datacenter.

“This meant the entire organization had to work on a pretty broad portfolio,” Pendekanti said. “We have never done this, honestly – 17 platforms in one go – and as we did that we also wanted to put the lens on workloads, which is why we said that we see that AI [artificial intelligence] and the machine learning with the GPU stuff that customers want. But the other thing that’s happening is the advent of things like 5G that’s coming to the telco space.”

The emphasis on platforms was front and center this week for both Intel as it introduced its Ice Lake SP processors and many of the OEMs and original design manufactures that rolled out new systems based on the processors. During the video announcement of the new chips, Navin Shenoy, executive vice president and general manager of Intel’s Data Platforms Group, said Xeon server processors are “at the heart of our unmatched portfolio [and] is the foundation for the cloud, for the network and for the edge.”

Intel’s platform includes the company’s Optane persistent memory technology, Ethernet offering, GPUs and field-programmable gate arrays (FPGAs) and Habana AI processors and capabilities included in the new chips include AI acceleration with DL Boost and advanced security features through technologies like Software Guard Extension (SGX) and Crypto Acceleration. The portfolio also includes chips optimized for everything from networks to machine learning.

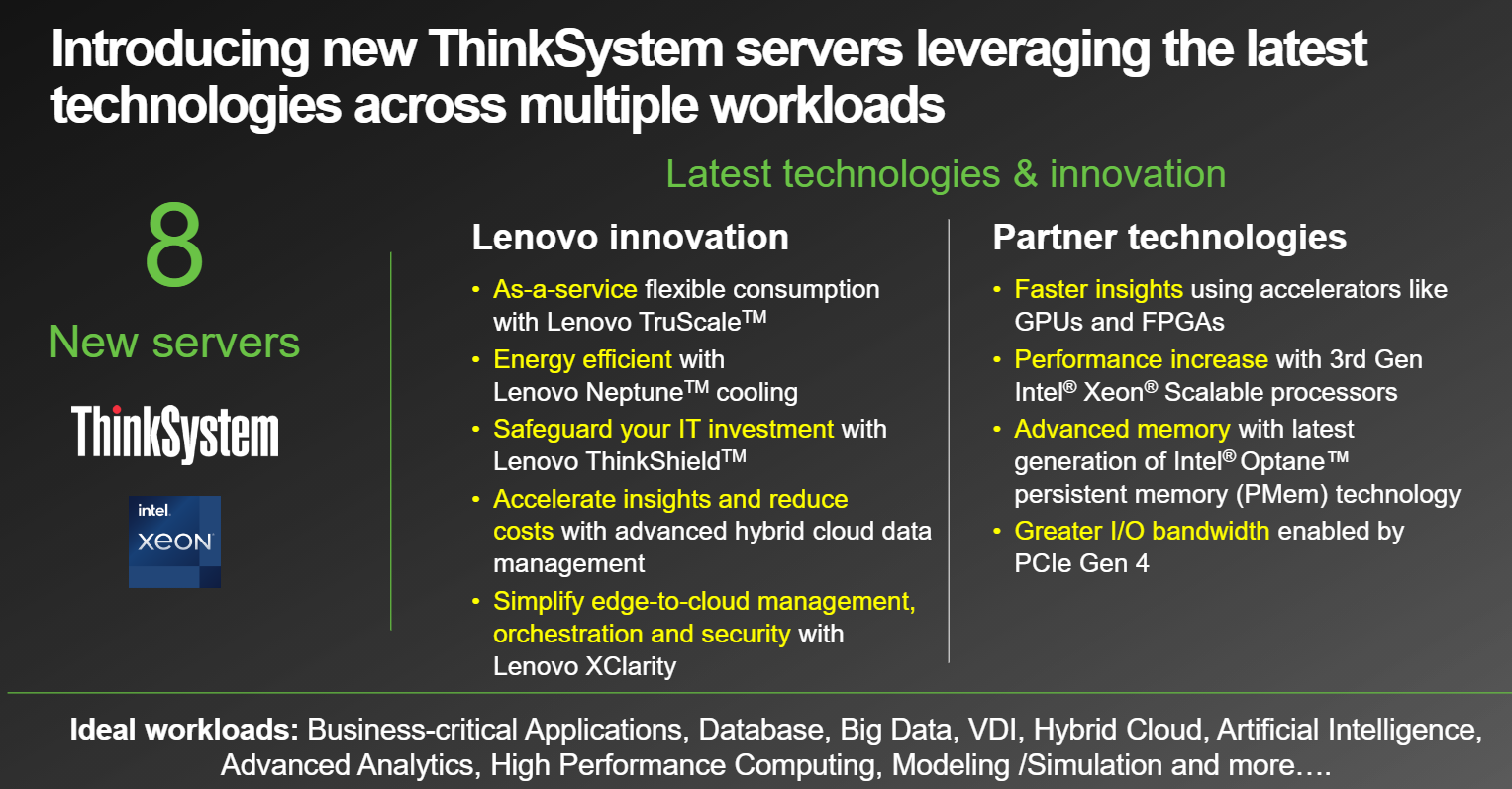

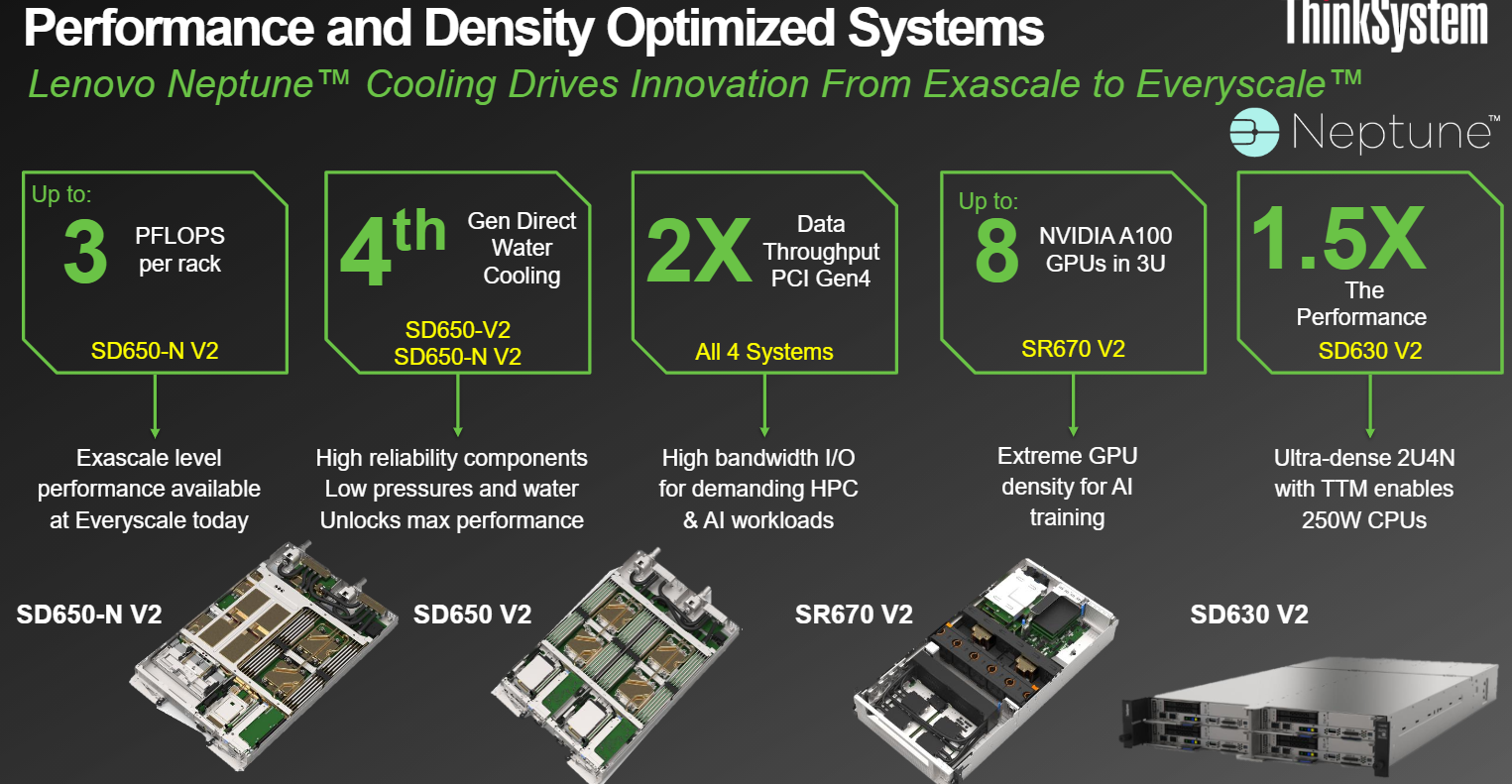

OEMs like Lenovo, Hewlett Packard Enterprise and Cisco also took a platform and workload-optimized approach to both the new Intel and AMD processors. Lenovo unveiled eight new systems powered by the Ice Lake chips – four of which were general-purpose machines and another four optimized for such workloads as HPC, the cloud, advanced analytics and AI. All are powered by the 3rd Gen Xeon SPs, with some coming with other technologies – such as Nvidia GPUs, Lenovo’s Neptune warm water-cooling system and security enhancements – that address compute- and data-intensive workloads and high density environments.

Kamran Amini, vice president and general manager of infrastructure solutions platforms within Lenovo’s Infrastructure Solutions Group, said during a briefing with journalists that with the systems, “we’re delivering beyond just the pure hardware and CPUs [and] we’re working with partners to bring further innovation to the table for our customers around a variety of applications that are either legacy applications, emerging cloud-based applications, or AI and machine learning and other HPC applications.” The Intel chips will drive performance gains, but other technologies are further honing the capabilities of the systems, Amini said.

In the systems that are designed for dense and accelerator-driven environments, Lenovo is addressing demand from HPC organizations, cloud services providers and enterprises for greater performance, density and efficiency in their large-scale datacenter environments. That includes extending its Neptune technology in such systems as the ThinkSystem SD650 V2 (aimed at workloads like AI and HPC), beyond CPUs and memory to the GPUs and SD650 N-V2, which puts three 3rd Gen Xeons and for Nvidia A100 GPUs into a 1U form factor.

For all servers there also is security enhancements with Lenovo’s SafeShield technology, management that spans the datacenter, cloud and edge with XClarity and cloud-like as-a-service consumption models through the vendor’s TruScale program.

For its part, HPE is using Ice Lake chips in eight systems, including three ProLiants, the Synergy 480 Gen 10 Plus composable systems (shown in the feature image at the top of this story), the Cray EX supercomputer and two Edgeline converged infrastructure solutions. There also is the Apollo 2000 Gen 10 Plus system for such workloads as AI and HPC applications. Cisco initially is putting Ice Lake chips into its Unified Computing System (UCS) servers B200 M6, C220 M6 and C240 M6, integrating the capabilities offered in the processor with its Intersight hybrid cloud platform.

Penguin Computing is putting the new chips into its LiveData and TrueHPC Linux-based servers aimed at HPC, AI and enterprise datacenters. The vendor’s LiveData with MemVerge’s Memory Machine leverages the Intel chips to offer large memory capabilities with DRAM, persistent memory via Optane and low-latency and high-performance networking. It delivers 1.5 times the memory footprint of a system using only DRAM. Supermicro unveiled dozens of systems powered by the Intel chips.

Cloud providers, including Amazon Web Services and Microsoft Azure, also are embracing the new Intel processors. Oracle Cloud said it has Ice Lake-based instances in limited preview now with plans to take them live April 28.

The datacenter has gotten a lot of attention from chip makers in recent weeks. Along with AMD’s Milan chips launched last month and now Intel’s 3rd Gen Xeon SPs, Arm late last month unveiled Armv9, the first new compute architecture design in a decade, promising performance, efficiency and security improvements. Meanwhile, Nvidia – which is continuing to press into the datacenter with its GPUs and now the hoped-for $40 billion acquisition of Arm – this month kicks off its virtual GTC event.

Throw in IBM’s plans for Power10, various AI chip makers like Ampere Computing and the push by cloud providers like AWS, Google and Azure to develop their own silicon, and Intel finds itself in a market that is the most competitive in recent memory.

However, enterprises tend to be more interested in what servers can do and less in what CPU is driving them. At least one vendor is seeing that if a workload requires a high core count, enterprises are leaning toward AMD. That said, according to Lenovo’s Amini, organizations are looking at capabilities more than brand names.

“It depends on what they’re looking for,” he said. “If a customer is not going to be running top-end CPUs, top-end cores, they’re not driven by performance. They’re driven most likely by a price/performance number. They want to have, from a platform capability, that drives different value. … It comes down to economics, use cases, application, a variety of things for a customer to decide which architecture. As an OEM and IT provider, our goal is to provide that choice and flexibility.”

Be the first to comment