There are two major opposing forces in the datacenter that create tension in IT budgets. The first is that Moore’s Law makes the cost of compute, networking, and storage go down at an exponential rate, which leads to all kinds of new applications. The second is that software costs scale with the cost of the people who create and maintain it.

And this makes the job of trying to figure out what to charge for software on ever-improving hardware very difficult indeed.

Enterprise software has traditionally been priced on a per-core or per-socket basis, though in recent years the pendulum among most vendors has swung toward the former rather than the latter. (They were obviously the same thing prior to two decades ago when dual-core chips entered the market.) VMware, the server virtualization and cloudy middleware vendor that is part of Dell Technologies, has been one of the holdouts that stuck fast to the per-socket model. (What is sometimes referred to rather vaguely as the “per-CPU” model.) That has been a boon to enterprises that have been able to leverage increasingly dense processors in their systems that have been able to churn more work from the software without necessarily increasing the number of chips in the servers. They could do more work without seeing their licensing costs increase.

Given that VMware owns about three quarters of the enterprise server virtualization market, it has been a boon for organizations, not to mention OEMs and chip makers Intel and AMD, which are putting increasingly more cores into their server processors. But those days are about to come to an end, and that will have a ripple effect through the industry. In a recent notice, VMware said that come April 2, the company’s pricing model will change. The vendor is arguing that it is sticking with its per-CPU model, but depending on the number of cores in that CPU, the licensing fees will go up.

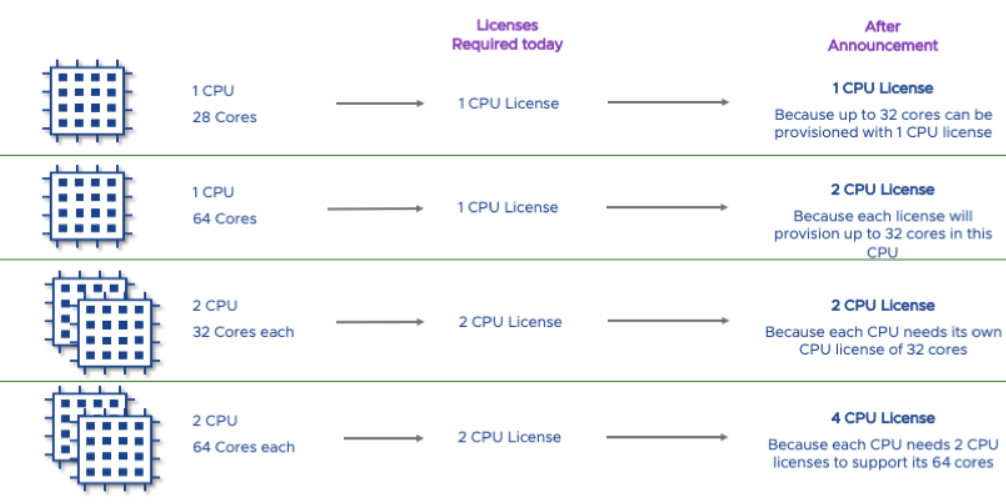

Right now, there is a flat per-CPU fee for every chip running VMware workloads on a server. With the new licensing model, there is a limit of 32 physical cores per CPU. Once a chip goes beyond 32 cores, it will require a second CPU license, effectively doubling the licensing cost. If a system is running two chips that each have 64 cores – which currently requires only two VMware licenses – it will soon need four. The plan is laid out in the diagram from VMware below:

This change is being driven by the industry trend toward per-core licensing, according to VMware, where the software price scales with the quantity of compute elements. That core scaling does not necessarily reflect the actual processing capacity of a system, since all cores do not run at the same speed in any set of SKUs within a generation of CPUs or across families or vendors, for that matter. But it has been a reasonable proxy according to software companies that want the value of the software to be pegged to the computational capability of the systems they run on so it goes up over time to cover the human cost of developing software.

It is hardly surprising that VMware or any other vendor would have a business model where it scale its prices in some fashion, or even raise them, somewhere along the way. There is a reprieve of sorts for current customers that are running VMware software on CPUs with more than 32 cores or that are in the process of buying servers that hold such chips. Those VMware customers that buy software licenses for deployment on a physical server powered by chips with more than 32 cores will get free per-CPU licenses to cover those processors.

“Today’s announcement is a continuation of VMware’s journey to align our product offerings to industry standard pricing models,” the company said in its online notice. “The change moves VMware closer to the current software industry standard model of core-based pricing. This approach will make it easier for customers to compare software licensing and pricing between VMware (using per-CPU with up to 32 cores) and other vendors (using per core pricing). It also helps us keep our pricing simple and relevant to where the hardware market is going. The 32-core limit is designed to minimize customer impact given current core counts for most CPUs used in the industry. This change will likely have no impact on the vast majority of our current customers since they use Intel and AMD-based servers that are at or below the 32-core threshold.”

The new policy will cover all VMware software, with the company pointing to Enterprise PKS for Kubernetes environments and NSX Data Center subscription for network virtualization being examples, so customers can expect their VMware licensing costs to go up as winter turns to spring. In addition, given the weight VMware carries in the industry, the change will be felt beyond the customer segment.

System OEMs And Chip Makers To Feel The Impact

In a column here at The Next Platform last year, Robert Hormuth, Technology Fellow and vice president of the Infrastructure Solutions Group, Office of the CTO, for Dell EMC, wrote about the trend toward single-socket servers in enterprise datacenters. Hormuth noted the increasing power and performance of CPUs – that a single CPU today carries the capabilities of two to four chips of previous years – and that dual-socket systems were increasingly raising performance and power cost issues.

Single-socket systems running CPUs with 32, 48, 64 or more cores also could result in lower licensing costs for software from vendors with per-CPU pricing models. He pointed to a paper by Gartner that indicated using single-socket servers with powerful chips could reduce licensing costs for VMware vSAN by as much as 50 percent. However, Hormuth was prescient in warning that he “would not count on ISV licensing models as long-term reason though, ISVs tend to optimize licensing models over time. If I were an ISV, I would license by core with a multi-socket kicker due to increased validation/testing as you scale beyond a single socket.”

Intel and AMD have been upping the core count in their CPUs. Included in AMD’s latest generation of “Rome” Epyc server chips is the 64-core 7H12, a liquid-cooled chip with 128 threads, a frequency of 2.6 GHz and a thermal profile of 280 watts that is equal to that of high-end datacenter GPUs. For its part, Intel this year is readying its 56-core “Cooper Lake” processor package. Both of these under the current VMware pricing model would have required a single CPU licensing fee. However, after April 2, the licensing cost will double. Where once it made sense for VMware customers to embrace chips with the highest core count – since paying for 64 cores cost the same as for 32 cores – that calculation now changes for enterprises and the decisions made could resonate with Intel and AMD.

In addition, as it rolled out its first-generation Epyc chips and as it continues with the next round, AMD has viewed Intel as vulnerable on price/performance at the single-socket server level and has seen its processors for such systems as a key advantage going forward as its looks to carve into Intel’s dominance in the server chip market. The virtualization space also has been viewed as a key one for AMD and its Epyc chips. However, VMware’s change in licensing model effectively doubles the cost for both single- and dual-socket systems running AMD’s 48-core and 64-core chips, which could slow to some degree the momentum AMD has been building since launching the first Epyc chips in 2017.

There Are Some Winners

While VMware customers will have to rethink how to move forward under the new licensing model, the move could help such rivals as Nutanix and Scale Computing, which could now see more interest from enterprises weighing their options. In a note sent out to media following VMware’s February 3 announcement, Scale Computing co-founder and chief executive officer Jeff Ready noted that he has seen a growing number of customers that want to embrace CPUs with higher core counts and that VMware’s new licensing plan will blunt that momentum. Ready also noted that at the edge – where Scale Computing also competes with VMware – the impact of the change will be further felt because of the large number of smaller servers that tend to be deployed there.

Be the first to comment