Imagine, if you will, that your two biggest rivals were Intel and Nvidia, and that you had to fight a two front war to storm the datacenter. You would not reckon, given the sorry financial state and technology portfolio of AMD five years ago, that the company would have much of a chance to chip away some market share from these two behemoths and revitalize itself.

But that, in fact, is what AMD is doing, slow step by steady step, particularly with its “Naples” Epyc processors, which entered the market a little more than a year ago and which the company is hoping will have 5 percent market share as it exits 2018 and solid double digit share in 2019.

AMD is making some headway in the datacenter with its Radeon Instinct GPU accelerators, which are fine machines for single precision floating point math but which lack half precision capability and have weak double precision math. Hopefully, with the forthcoming “Vega” GPUs that are coming out later this year, these issues will be fixed and AMD will, for the first time, have a GPU that can reach some sort of parity on many fronts with Nvidia’s “Pascal” and “Volta” GPUs used in its Tesla accelerators. The Epyc line has reached some sort of parity with Intel’s “Skylake” Xeon SP processors, and with the future “Rome” follow-ons, which will be etched in 7 nanometer processes at the Taiwan Semiconductor Manufacturing Corp factories and which will sport architectural improvements on top of the process shrink, AMD might be able to leap over Intel’s future “Cascade Lake” and “Ice Lake” CPUs. (GlobalFoundries made the Naples chips, and it is new data that TSMC was selected to do the Rome chip. AMD has hedged its bets and can make any Epyc chips at either fab – or both – if need be.)

In the meantime, AMD is making money in the datacenter again, and it probably feels pretty good. The foundation of that datacenter business is, as has been the case with Intel for decades, the client CPU and GPU business. (To be fair, AMD really saved itself by winning the chip deals for the Microsoft Xbox and Sony PlayStation game consoles, of which 100 million have been sold to date.) The CPUs based on the first generation “Zen” architecture are doing well, as Lisa Su, AMD’s president and chief executive officer, explained in a conference call with Wall Street analysts. The client chips are sold under the Ryzen brand and shipments doubled year on year and were up by double digits sequentially in the second quarter. Devinder Kumar, AMD’s chief financial officer, said that Ryzen chips accounted for about 60 percent of client revenues.

These Ryzen processors are counted in the Computing and Graphics division, where the Radeon GPUs are also located. AMD launched its second generation Ryzen chips in April, a little more than a year after the first chips based on the Zen cores came to market, and significantly, the three biggest PC makers – Dell, Hewlett Packard Enterprise, and Lenovo – all have enterprise-class notebooks and desktops based on AMD processors. Thus far, there are 44 different client machines in the market based on Ryzen, and AMD expects for the number to hit 60 by the end of 2018.

Graphics is a big part of the AMD business, of course, and has been since it acquired ATI Technologies to take on Nvidia back in July 2006 for $5.4 billion. (That doesn’t seem that long ago, does it?) Graphics cards are used to drive displays, of course, but they are also used for compute jobs such as seismic analysis, financial modeling, machine learning, and cryptocurrency/blockchain workloads where single precision math is what is preferred. In the second quarter, sales of GPUs into the datacenter and into the retail channel exhibited growth compared to the prior year’s quarter, according to Su, but cryptocurrency mining sales were down and could not be offset by that good datacenter growth.

Kumar said that in the second quarter, sales of GPUs to run cryptocurrency and blockchain workloads accounted for about 6 percent of revenues, or $105 million, down from 10 percent of revenues or $165 million in the first quarter of this year. AMD had been projecting pretty aggressive sales of GPUs in this area, but now says there will be very little activity here in the third quarter (reasonable giving that a new GPU is in the works for Q4) and that instead of accounting for somewhere between mid-to-high single digits of revenue for the year, it looks like just mid-single digits. Call it a drop from 9 percent to 5 percent of overall sales just so we don’t get lost in that language. Still, this could present somewhere around $350 million to $400 million in revenue for the year, and that is not business either AMD or Nvidia can – or will – walk away from.

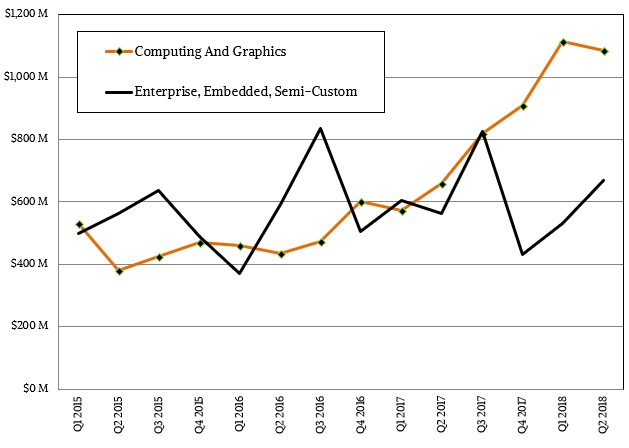

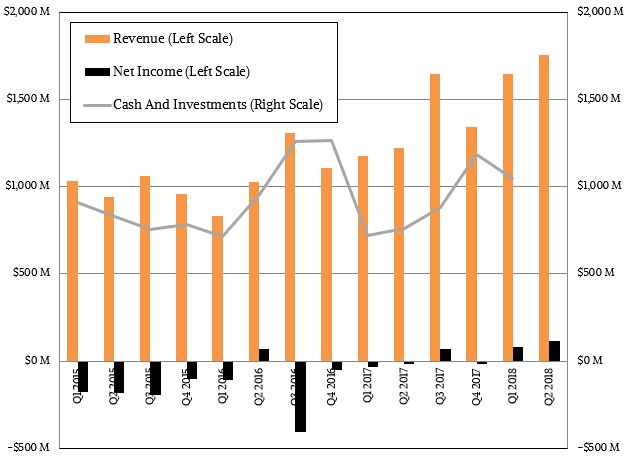

Add this all up, and the Computing and Graphics division at AMD posted sales of $1.09 billion, up 64.8 percent, and had an operating income of $117 million, a very big swing from the relatively meager (but much celebrated after so many quarters of losses) $7 million operating income in the year ago period.

The Epyc processor business is buried in the Enterprise, Embedded, and Semi-Custom division at AMD, and was put there because until recently, the sales of CPUs in the datacenter were probably not material enough to be counted in any specific way. That is changing, and it would be nice to see AMD eventually have a Datacenter reporting item that combines Epyc, Radeon, and Radeon Instinct sales into the glass houses of the world and break out Client Computing and also Embedded and Semicustom into their own respective divisions. Until then, we have this amalgam of products that together had $670 million in sales, up 19 percent, and delivered an operating profit of $69 million, up 64.3 percent. Companies always like when profits are growing faster than revenues.

Su said that as the Epyc ramp is building momentum, average selling prices are on the rise, which is helping to push up revenues for its server chips. In the second quarter, both revenues and shipments of Epyc chips grew by more than 50 percent. The forecast is for AMD to have 2 percent market share of server shipments in the second quarter, up from 1 percent in the first quarter, but it will take time to get the market statistics together to confirm if this had happened. For now, the swing vote on Epyc is happening at the cloud builders and the hyperscalers, and Su said that AMD was engaged with all of the Super 8 and has significant deals with five of the eight biggest buyers of servers in the world. Sales of Eypc chips to these mega datacenters, as she called them, more than doubled in Q2 2018 and AMD was working on big rollouts in the second half of the year.

There are over 50 different server platforms that have been certified to use Epyc chips to date, not including these hyperscale and cloud builder boxes. And all of these machines will be able to support the future Rome processors. It is not clear of the third generation “Milan” processors, based on a tweaked 7 nanometer process and sporting the “Zen 3 cores” will fit in the same sockets – AMD has not made any disclosures on this front – but it would ne interesting if they did fit in the same holes and still offered some advanced memory and I/O options.

As for the double digit revenue share that AMD has set as its “mid-term” goal, this is what Su had to say: “We view the double digit share goal as an important share goal. I think it certainly will come with the second generation of Epyc – so the Zen 2 product. But I view it as a journey. We have now three generations. We have Zen 1, which is in the market today. We have Zen 2 – that’s well into the productization phase. And then we have a very strong roadmap around Zen 3 as well. So we feel good about our competitive position and the path to double digit market share. I think this is all about rate and pace. And we are working very, very closely with our customers to accelerate that ramp.”

As was the case with the Opterons, the cloud builders and hyperscalers will call the tune, and the enterprises will follow. This time, though, the enterprises are less important, unless you remember it is enterprises that are using a lot of those hyperscale applications for business and it is enterprises that are buying that compute capacity on the public cloud. These big buyers are expected to ramp their use of Epyc in the third quarter and then deploy more broadly in the fourth quarter. So getting to that 5 percent share will depend in large part on that Q4 sales level, and that really requires not just growth against prior quarters of Epyc sales, but against the market at large.

Let’s do some math here. There were just under 2.7 million servers sold in the first quarter of this year, and the vast majority were two socket machines, with four socket and larger boxes offsetting single socket boxes to the extent that the total number of CPUs was probably around 5.4 million units. So that implies that, with 1 percent share, AMD sold 54,000 Epyc processors, and with a 50 percent bump in the second quarter, that is 81,000 processors. Server shipments up 20.7 percent in the first quarter, which is a growth rate we have not seen since the recovery after the Great Recession in the first two quarters of 2010. It is not reasonable to assume this growth rate can be sustained for all four quarters of 2018, although it could if the hyperscalers and cloud builders really build to try to capture more enterprise workloads. The growth rates in Q3 and Q4 of 2017 for server shipments were 11.1 and 11.5 percent, respectively, and Q1 was only 0.6 percent and Q2 was only 1.2 percent. The shipment growth for all of 2015 was 4.2 percent and for 2016 is actually declined by 0.4 percent, so the kind of growth we have been seeing is abnormal historically but may be a new normal. (Who knows?)

So then, let’s say shipment growth for all of 2018 will be 10 percent across the whole industry. That means all the server makers in the world who pushed 10.1 million machines, consuming 20.2 million CPUs, in 2017 will have to sell 11.2 million machines and 22.4 million CPUs in 2018. To get 5 percent share of sales in the fourth quarter – not for the full year, that is not what AMD said, remember – AMD has to grow a lot more than 50 percent sequentially. If the server market has shipment growth of only 5 percent in the second quarter, and AMD has 50 percent shipment growth, it is rising 10X faster than the market, which is great, but that will still only get it 1.6 percent share. If it does 50 percent growth sequentially in the third quarter, which might also only grow at 5 percent to reach that average growth of 10 percent for the full year, then AMD will rise to 2.2 percent share of the market. Another 50 percent sequential rise would be 91,000 machines sold in Q4 and if the market only grew by 5 percent again, then that would be against a staggering 3.14 million boxes, and only a 2.9 percent share. If the market plays out this way, AMD needs its channel partners to push 158,000 machines to get 5 percent share in Q4. If the market grows faster than this, the 5 percent gets harder to attain, and if the market stalls, it doesn’t necessarily make it easier because Intel will try to preserve its share with price cuts.

We will see how this all plays out, but it will only take one or two big orders to wildly swing AMD’s market share.

What we really want to know is when and if AMD can get back to 20 percent or even 25 percent market share, and if in doing do, it cuts all of the oxygen off Arm and Power servers in the datacenter. AMD can cover about 80 percent of the total addressable market for servers today, and for those other areas that have machines with four sockets and larger, Arm is not really playing and IBM’s Power architecture dominates alongside high end Intel Xeons with a smattering of Sparc and Itanium here and there. AMD has the best chance of all of the alternatives to take a big bite out of Intel, and it is not unreasonable to think AMD’s partners can sell over 2 million machines in a world that is consuming over 11 million boxes a year.

Pulling in $1.76 billion in revenues and $116 million in net income is a good way to finish off the first half and lay the groundwork for the second half.

Be the first to comment