Gone are the days of early warehouse scale computing pioneers that were based in the U.S.. Over the last several years, China’s web giants are extending their reach through robust shared AI and cloud efforts—and those are pushing ever further into territory once thought separate.

Alibaba is much like compatriots Baidu and Tencent in its desire to expand well beyond the borders of China and compete with global players like Amazon Web Services, Google, Microsoft and Facebook in such fast-growing areas like the cloud, supercomputing and artificial intelligence (AI).

The tech giant has significant resources at its disposal, pulling in more than $12.7 billion in revenue and almost $3.6 billion in net income during the last three months of 2017 and seeing significant jumps in such areas as its core and cloud businesses.

The company also has been vocal about its global ambitions, with co-founder and Executive Chairman Jack Ma saying a letter to shareholders in November 2017 that “by 2036, we envision that Alibaba’s infrastructure will support commerce activity with a combined transaction value that will rank as the world’s fifth-largest economy. We aim to be a platform that will enable the creation of 100 million jobs, serve two billion consumers and support 10 million profitable small businesses.”

While Alibaba will serve as an advocate, driver and platform, the economy supported by Alibaba’s commerce infrastructure will be far bigger than Alibaba the company. Through this ‘Alibaba economy,’ we hope to enable consumers and businesses to buy globally, sell globally, pay globally, deliver globally and travel globally. We want to enable more developing countries, small businesses and young people to share the benefits of globalization and free trade, and to share the innovation and opportunities that accompany technological advancement.”

While the company has the financial resources and stated ambitions to become a larger presence on the world stage, the company is still lacking in name recognition and reach beyond China. Gartner noted in September 2017 that Alibaba was the world’s third-largest infrastructure-as-a-service (IaaS) vendor in the world in 2016, behind Amazon and Microsoft but ahead of Google and Rackspace. That said, Gartner said the 125.5 percent revenue increase in this field reflected the company’s dominant position in the cloud services market in China.

However, Alibaba is looking to change its reputation as just a big player in the China market through R&D and technology innovation, with Ma noting “successful companies of the future will derive profitability from technology rather than market scale; they will win the market through innovation rather than big marketing budgets.” Alibaba has more than 25,000 and will expand on those numbers by creating research organizations around the globe, he adds.

The company has begun to make strides in that direction. Two years ago, Alibaba launched new cloud datacenters in regions outside of China, including Europe, the Middle East and other parts of Asia (Japan and Australia). In October 2017, the company announced plans to spend more than $15 billion over the next three years on R&D efforts, much of those through a new global research program called the Alibaba DAMO (Discovery, Adventure, Momentum and Outlook) Academy, which was tasked with overseeing the creation of seven research labs around the world. Two of those will be in the United States (San Mateo, Calif., and Bellevue, Wash.), with two more in China and one each in Moscow, Tel Aviv and Singapore (which opened last month in partnership with the Nanyang Technology University and will focus its research on AI applications in such areas as health care and city transportation).

The labs also will focus on such topics as data intelligence, the Internet of Things (IoT), quantum computing, machine learning, visual computing and natural language processing, network security and the interaction of humans and machines. Part of the effort also includes hiring 100 researchers from around the globe.

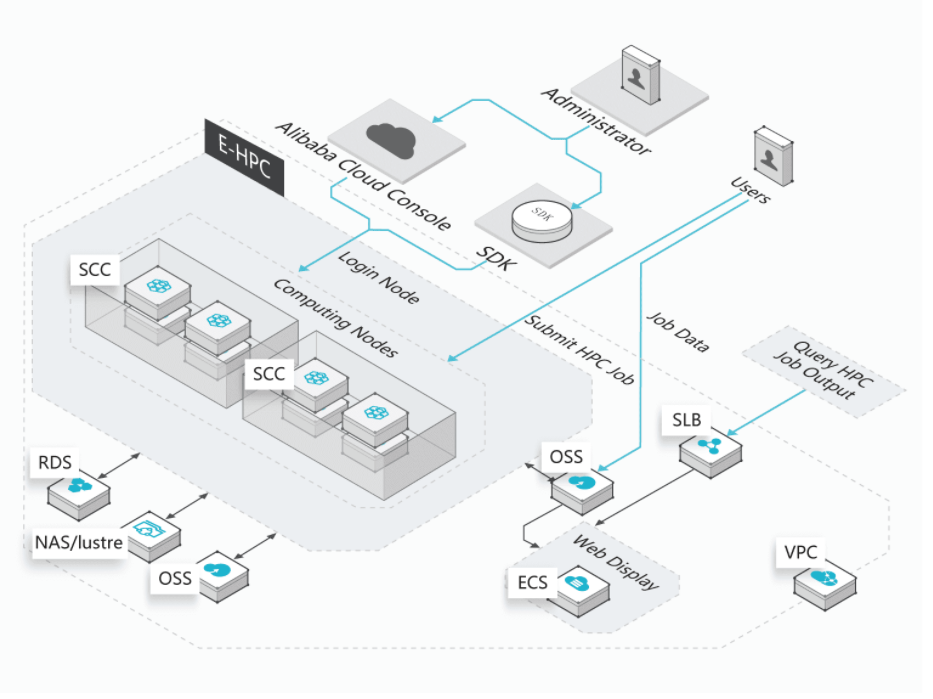

More recently, at the Mobile World Congress (MWC) show last month, Alibaba Cloud – the company’s cloud computing arm, which has 42 availability zones in China and outside markets – unveiled a range of new products and services for the European market that touched on such areas as AI, machine learning, big data and security, and included the cloud-based Super Computing Cluster (SCC) for HPC workloads like AI, science, engineering, and audio and video processing. The service is based on the company’s Elastic Bare Metal (EMB) instances that run on up to 96 Intel Scalable Processor “Skylake” CPU vCores, up to eight Nvidia GPUs – either the P100 based on the “Pascal” architecture or “Volta”-based V100 – and up to 512GB of memory, with the clusters connected via high-speed RDMA over Converged Ethernet v2 (RoCE v2).

Alibaba also introduced the Dataphin big data platform-as-a-service (PaaS), the Apsara Stack private cloud solution for enterprises and the Cloud Enterprise Network, which uses intelligence routing capabilities rather than physical routers between nodes to accelerate network speed.

The new offerings represented a new strategy the company is employing to accelerate its global expansion, not only in Europe but also the United States. Alibaba traditionally has looked to push its China products onto the international market. Now the company is designing products specifically for the markets overseas in hopes of speeding up its entrance into those markets. Alibaba is aiming to grow its U.S. presence by encouraging Chinese and U.S. companies that use Alibaba in China to do the same for their U.S. operations.

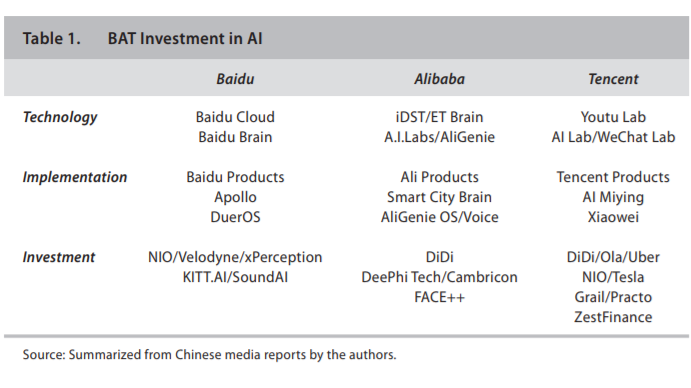

A report released last month by ETLA, a Finnish research firm, noted that Alibaba as well as Baidu and Tencent have all increased their investments in AI technologies and algorithms in an effort to help drive their expansions into the global market and compete more closely with the likes of U.S. companies Google, Facebook, Apple, Amazon and Microsoft. The researchers noted that the Chinese platform companies use a strategy different from their Western competitors that the researchers call the “platform business group,” in which they tightly link various platforms under their control to create multiple services under a single umbrella that they can offer to users. The report noted an increasingly level of investment and effort around AI by Baidu, Alibaba and Tencent (BAT).

However, despite the investments being made in AI, the Chinese companies face several challenges, including the huge amounts of venture funding that is being dumped into the space, the Finnish researchers wrote in their report. The money could fuel the rise of new competitors that could leverage AI and compete with those established companies in their existing business areas. The ETLA researchers pointed to Toutiao, a content-information company based in Beijing that uses AI to target recommended content to users and that over almost six years has grown to 120 million active users a day and has an estimated market value of $20 billion. Another challenge is that an existing competitor might become better with AI, with the researchers using JD.Com, a fast-growing ecommerce company in China. A third challenge is that companies that use the a BAT platform are using AI to become leaders in particular vertical markets might be able to leverage that leadership position to improve their bargaining power with the platform company.

“Given, on the one hand, the domestic success of the Chinese digital platform giants, and, on the other hand, the prevailing doubts of their ability to expand globally, whether AI will turn out to be a game-changer for BAT poses an interesting question,” they wrote.

Be the first to comment