Usually, innovation starts with the hyperscalers, HPC centers, and cloud builders of the world and spreads to the enterprise. But every once in a while, a technology establishes itself in large enterprises and the migrates upwards. This may be finally happening to Pure Storage, which was founded in 2009 and which started selling its first all flash arrays a decade ago, with the first significant win of sales to one of the top ten – and unnamed – hyperscalers.

It has been a while since we looked at the financials of Pure Storage, and with a whole new line of FlashArray//C appliances coming to market next week, we thought it would be a good idea to take a look at how the company has been holding up through the pandemic and how close it is coming to being profitable after years and years of losses.

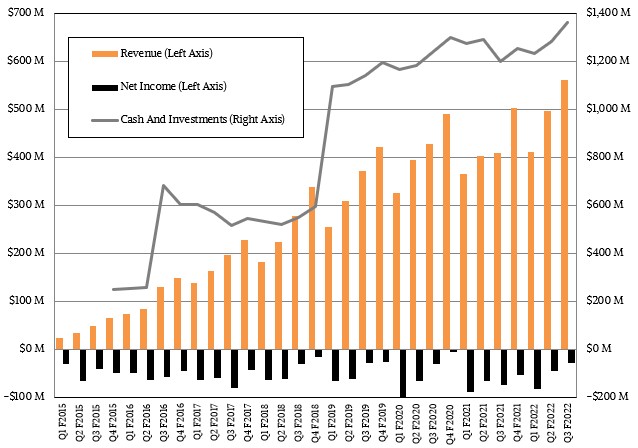

The coronavirus pandemic has not been kind to a lot of technology companies as it disrupted the sales cycle while at the same time as messing with the supply chain. And as a maker of hardware – yes, Pure Storage has a variant of its Purity software stack that runs on the server and storage infrastructure of clouds, making a sort of virtual FlashArray block storage or FlashBlade object storage appliance, but it still makes most of its money from selling hardware and software and support for it – the company has had its share of troubles during calendar 2020 and in early 2021. But as you can see, Pure Storage is getting back on its growth path in recent quarters, and most significantly including the third quarter of fiscal 2022 that ended in October:

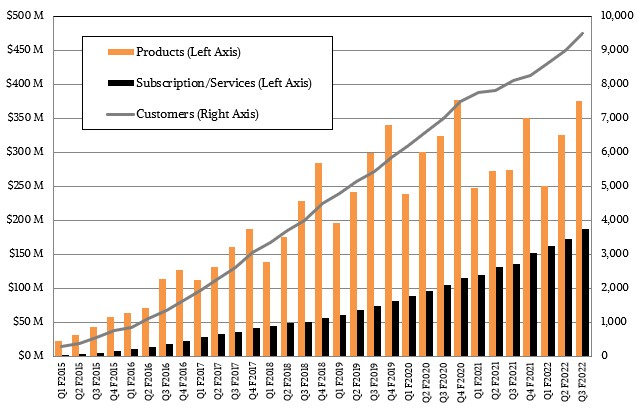

In the quarter, product revenues were up by 36.6 percent to $374.9 million while subscription and services revenues rose by 38 percent to $187.8 million. Add it up and total sales rose by a flat 37 percent to $562.7 million, and perhaps most significantly, Pure Storage cut its losses by more than half year on year to a net loss of only $28.7 million. If the pandemic doesn’t get worse, it looks like Pure Storage could break through 10,000 customers in the next quarter or two and could push enough revenues to break even for realsies, not on a non-GAAP basis or with any talk of exceptions.

This will be a true accomplishment for the company, which was on track to do so in calendar 2020 until COVID-19 came along.

Since we started tracking Pure Storage beginning in the first quarter of fiscal 2015, the company has brought in a cumulative $8.53 billion in revenues but has posted a cumulative loss of $1.62 billion on paper. The company raised $529.3 million in many rounds of venture capital, raised another $425 million in its initial public offering six years ago, and has $1.36 billion in the bank, which means that it has been able to walk the fine line between taking losses to grow and taking too many losses to make Wall Street unhappy. The company also has $950 million in deferred revenue for its subscription-based services and technical support services. As we go to press, Pure Storage has a market capitalization of $8.7 billion and Wall Street can see the light at the end of the long tunnel.

We don’t know much about who the hyperscaler is that is buying Pure Storage, but Kevan Krysler, chief financial officer at Pure Storage, said on a call with Wall Street analysts that this unnamed hyperscaler acquired the company’s FlashArray//C and whoever it was got a pretty good deal on the volume they bought because it had a sufficiently negative effect on gross margins that Krysler called that out. Whoever it is, it is not Microsoft, which has a partnership with Pure Storage to run EDA applications on the Azure cloud with FlashArray appliances backing it up. This deal was big enough to add somewhere between 5 and 10 percent of growth – what Krysler said is that without this deal growth would have been “in the high 20s” instead of 36.6 percent, and if you do a little math, that means it was somewhere between $35 million and $40 million of revenue. You don’t have to name names under Securities and Exchange Commission rules unless a company represents 10 percent or more of revenues, and this would be somewhere between 6 percent and 7 percent of revenues, give or take.

Apple might be the hyperscaler customer that Pure Storage is hinting about, and frankly, Pure Storage arrays have looked and have been sold like Apple products from the get-go. If Apple won’t build servers, maybe we can talk Pure Storage into doing it? Heaven knows we have tried to convince them to do it … but they are too smart for that.

Be the first to comment