Would you rather have tens of thousands of customers who collectively spend a lot of money but their spending rises and falls with the gross domestic product, or a couple of dozen customers who spend almost as much on your product but who do so with massive checks that are not always predictable?

For Intel, this question is moot because it has both kinds of customers, and sometimes they both take a slight pause at exactly the same time. This is precisely what happened for Intel’s Data Center Group in the second quarter of 2016, as revenue growth slowed as enterprises cut back on spending and hyperscalers and cloud builders did likewise. Unfortunately for Intel, the slowdown in revenues for Data Center Group coincided with higher costs relating to the 14 nanometer manufacturing processes used in the “Broadwell” Xeon E5 processors launched in March and the Xeon E7 chips that made their debut in June, basically bookending the second quarter. So Intel had increasing costs as revenues did not grow as much as Wall Street might have been expecting and this put a pinch on profits.

For its part, Intel was not surprised, and the top brass at Intel said in a conference call going over the numbers for the quarter that Data Center Group actually did a little better than it was forecasting internally, and perhaps more importantly, during the second half of the year as the 14 nanometer processes mature on Broadwell Xeon parts (reducing costs) and customers ramp up their use of these chips while at the same time buying up the SKU stack, Data Center Group revenues will get back on track to double-digit revenue growth and gross margins will get back to something closer to the normal 50 percent level that this part of Intel has enjoyed since basically taking over compute in the datacenter in the early 2000s.

In the quarter ended in on July 2, Intel’s overall revenues rose by 2.6 percent to $13.53 billion, but after taking a $1.41 billion hit for restructuring charges relating to its layoff of approximately 12,000 employees – about 11 percent of its workforce – that was announced back in April, net income fell by more than half to $1.33 billion. Those restructuring charges are about $200 million higher than expected, but will save Intel something on the order of $750 million in costs in 2016 and have an annual run rate of around $1.4 billion in 2017. Basically, there is a twelve-month payback on the layoffs, which is not a bad payback so long as it does not hurt the business by losing so many people.

Intel had $8.17 billion in cash and short-term investments, $9.5 billion in trading assets, $5.39 billion in securities, and $3.57 billion in long-term investments on its balance sheet as the second quarter came to an end, and this was offset by $4.56 billion in short term debt and $24.1 billion in long-term debt. Considering that Intel shelled out a whopping $16.7 billion to acquire FPGA maker Altera as the 2016 year got rolling, its balance sheet is pretty well . . . balanced. But clearly Intel is restructuring itself to be able to maintain its profits and get more cash than debt even as the PC industry continues to slump and it faces increasing competition in the compute and memory sectors.

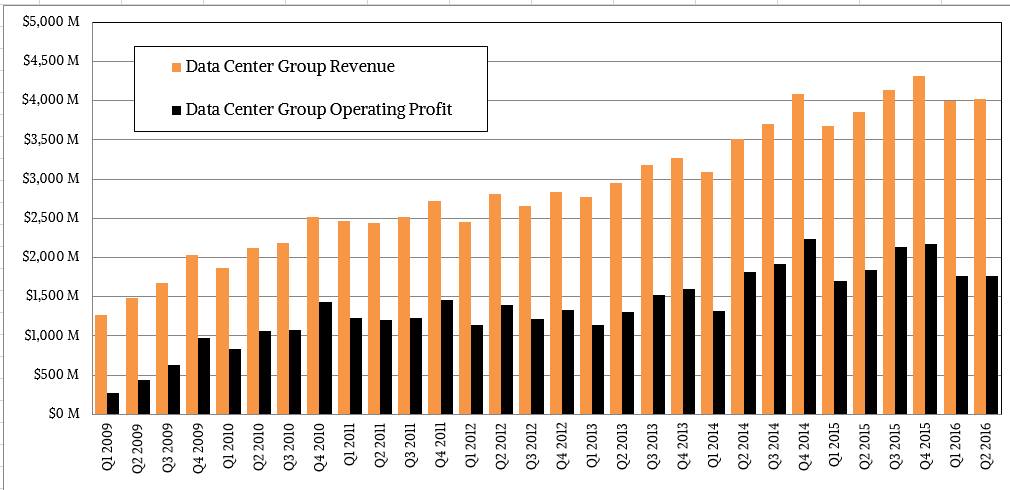

The Data Center Group continues to throw off juicy profits, but as we pointed out, things are a bit leaner than usual. In the second quarter, this key part of Intel posted just over $4 billion in sales, up 4.5 percent from the year-ago period; operating income for the Data Center Group fell by 4.2 percent to $1.76 billion.

Intel CEO Brian Krzanich said on the call with Wall Street that revenues from cloud service providers (which includes hyperscalers and cloud builders) rose by 9 percent, quite a bit cooler than the normal 20-plus percentage growth that these companies normally drive. Ditto for communications service providers, who have been growing at a similar pace in recent quarters but who saw a slowdown to only 10 percent growth in the quarter. Spending on chips, chipsets, and motherboards aimed at enterprise customers, which still represent the majority of sales for Data Center Group, fell by 1 percent and this may be a good indicator of the true state of the global economy. (Or more precisely, an accurate indicator of a less-than-stellar situation.)

“We achieved some critical milestones in the quarter that give us confidence in our growing momentum as we enter the second half of the year,” Krzanich said, adding that Intel is seeing an “ongoing preference for performance up and down the pricing stack,” including Atom and Xeon D chips at the low end to Xeon E5s in the middle to Xeon E7s and Xeon Phis at the high end. Ironically, the expanding adoption of low-end X86 chips among network equipment providers pushed down average selling prices for chips in the network infrastructure segment to fall by 1 percent in the quarter. This was offset by the use of fatter and more expensive Xeons by enterprises, hyperscalers, and cloud builders.

The “Knights Landing” Xeon Phi processor also helped drive up revenues and average selling prices, too, and Krzanich said that in the first two quarters of the year, Xeon Phi revenues grew by a factor of 8X compared to the first six months of 2015; he did not elaborate on how much revenue this was, but given the efficiencies of the Xeon Phi over the Xeons, each Xeon Phi can replace around three or four Xeons in terms of single precision and double precision floating point math, depending on the Xeon SKU, there has to be some self impact here as tens of thousands of Xeon Phi units roll out.

On the networking front, Krzanich bragged that half of the systems added to the recent Top 500 supercomputer rankings that had 100 Gb/sec interconnects had deployed Intel’s Omni-Path follow-on to the True Scale InfiniBand products it bought from QLogic four years ago, and said that the company believed that Omni-Path had achieved on the order of 30 percent market share in the overall market for 100 Gb/sec switches. Interestingly, Intel has shipped its first silicon photonics in-rack and cross-rack networking products, which have been in development for years and which have been delayed by energy consumption and heating issues. The combination of Omni-Path switches and adapters, Intel’s Ethernet adapters and switch chips and silicon photonics already account for 12 percent of the overall revenues in Data Center Group, according to Krzanich, and he added that these pieces of the datacenter business, which he called “adjacent,” would grow at more than 20 percent for the full 2016 year.

While neither Altera FPGAs nor flash (and soon 3D XPoint) memory are formally part of the Data Center Group, we know that system makers, enterprises, hyperscalers, cloud builders, and telecoms are big buyers of these technologies, much as they are consumers of Atom and Xeon chips for compute.

The Programmable Solutions Group, which is what Intel calls Altera now that it is part of the company, had a 12 percent revenue increase to $465 million in the quarter, but it had $162 million in writedowns post-acquisition (as often happens in the wake of deals), wiping out a $100 million operating profit.

Because of intense pricing competition, Intel’s Non Volatile Memory Solutions Group stomached a 20 percent revenue decline in the second quarter, but Intel is confident that 3D XPoint SSDs coming to market later in 2016 and in DIMM form factors in 2017 will help turn this business around. The memory group at Intel had $554 million in revenues, but a $224 million operating loss, which has to sting. (Intel remembers well the bloodletting in the DRAM memory business it exited decades ago. . . .)

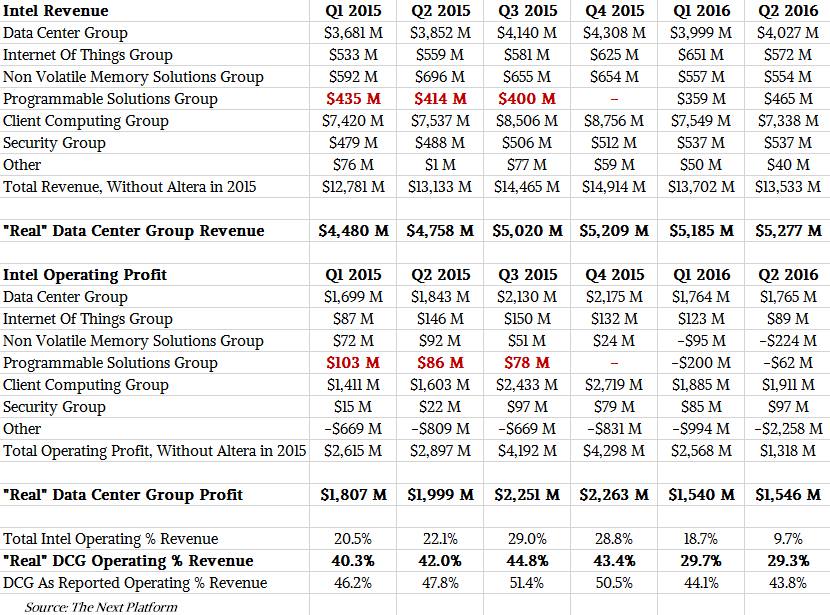

While the Data Center Group is its own entity within Intel, the “real” datacenter business at Intel is actually much larger. For fun, we took a stab at trying to estimate what the datacenter business at Intel really looks like over the past six quarters when Intel has been reporting its financials in the current manner. Take a look:

By our reckoning, the “real” datacenter group at Intel has about half of the Internet of Things revenue and about 90 percent of its flash memory revenue going into enterprise rather than consumer products. All of the FPGA revenues are aimed at enterprise products. (We might be erring a little on the high side here.) We allocate revenues and profits at the same proportion just to be consistent. If you do that, then this datacenter business at Intel had something more like $5.28 billion in revenues, up 10.9 percent, but operating profit was more like $1.55 billion, down 22.7 percent.

It is easy to blame the Q2 slump on the hyperscalers and cloud builders, whom Intel is catering to with custom Xeons as carefully as it is doing with the HPC crowd with its Xeon Phi and Xeon compute and Omni-Path interconnect. But over the long haul, the cloud business, as it is spoken of generically, is going to grow and outgrow the market at large until all workloads are cloudy and this approach to IT is just plain normal.

“It is going to be lumpy,” Krzanich cautioned. “These guys don’t build out their datacenters in a linear fashion. They build out a big chunk of overcapacity so that they can go and sell that and have expansion space, and they don’t build for a while. And so I know people worry about is it slowing down? But these trends in data that tell me no, it’s not slowing down over the long term, and what you are really going to see is just the buying patterns and the build-outs of the various structures that are going up.”

With Softbank buying ARM Holdings, the topic of competition came up and the idea was that with increasing investment by that Japanese conglomerate, ARM would somehow be more of a staunch competitor. (We happen to think that ARM Holdings is already competing pretty hard.)

“There is always going to be competition in this market,” said Krzanich. “I expect it, and that’s okay. We think of ourselves as competition, in fact. We are built on a model that says we have to build a continuous improvement of our products such that we are replacing ourselves with a better cost-per-performance model over time. And so we know that just even if there was no competition, the competition is we’ve got to build a product that is better and drives replacement as well as growth. And so I look at the competition as it is welcome. It keeps us better. It’s always been out there. There will always be somebody out there. But really what we have to do is build products that are so competitive that people want to replace our products with our new product. That is one of the best models to use for making sure you stay ahead.”

Only the paranoid survive, as Intel co-founder Andy Grove once astutely observed.

Still very hard to find a Xeon Phi system based on KnL that you can actually buy at the moment in the channel. Are they all going straight to HPC centers?

I’ve only seen SuperMicro having a new workstation based on XeonPhi but you don’t seem to be able to buy it anywhere (none of their distributors or resellers have it in their price list). Rather disappointing.

Maybe they are now in the server market going through the process of sizing up Zen, there are Zen engineering samples to be evaluated! Intel is getting the HPC Knights of Phi business because JHH/Nvidia’s GP100 pricing is more than even the Xeon Phi costs and Nvidia needs to be brought down a peg in the customers eyes, or more down a peg from the customer’s bank accounts flowing into Nvidia’s coffers. So Zen is there to bring those x86 costs down and the Xeon Phi is currently in favor for HPC because Nvidia is asking for the sky and not getting it. I am Waiting for Zen, and AMD’s HPC/Server/Workstation CPU only SKUs as well as AMD’s new server APUs on an interposer to shake things up even more for the Piggy bank, a bank that will still have some coins remaining to give that pleasing sound when I give that ceramic porker a good shake every now and then.

I’m look forward to any future FirePro(Polaris) variants to be tested so I can get a better look at GCN 4.0 and its new instruction pre-fetch and asynchronous compute in its GPU hardware. I want to see if there will be any compute acceleration efficiencies to be had with the Polaris GPU micro-architecture. Nvidia is definitely in need of more GPU compute accelerator competition, as is Intel for any x86 based competition from AMD for customers not going over to any Power/OpenPower offerings.

Can’t wait for a Zen hopeful need a fast ML training box this year not next year. Also I hate to say it but nVidia has nailed down the software infrastructure far better than AMD has when it comes to HPC/GPU. nVidia is far more aggressive when it comes to APIs, SDK and features that make development very easy even if they are proprietary but a lot of people have now stopped caring. AMD ecosystem is just miles away it isn’t changing very quickly as AMD is always a resource strapped company.

Leaving Q2 all Knights Corner in broker channels equals 0.000207% of all Intel Core, Xeon and Atom inventories. I’m registering for KL open market broker availability but none yet. Production economics report available near term.

Next Platform reports Intel said KL at 100,000 units. That’s helpful for the economic assessment. I have a Xeon D estimate from 10% Krzanich statement. Anyone know what Intel reports as the volume target?

Below less E3 which I record as desktop. Solely compares against broker held Xeon stocks by Intel product generation;

All Xeon v4 = 2.1% that is 15 weeks in before 2600 v4 ramp or bust. I’ll know in sixty days if BW is jinxed. Cloud procurement appears good procuring approximately 15 million units per platform cycle.

All Xeon v3 = 34.3%

All Xeon v2 = 64.3%

Open market availability is an interesting option for enterprise IT entering 6/8/10 core Westmere EX replacement cycle. This is the $100 billion upgrade market Intel sales has been anticipating for three years. The question is will enterprise opt for pricey Broadwells or price take from the open market broker inventories?

IT in traditional data and transaction processing will upgrade around what their applications are already optimized.

Broker inventories by Intel product line;

All E5 1600 v2/v3/v4 = 0.046%

All E5 2400 v2 only = 0.086%

All E5 2600 v2/v3/v4 = 76.6%

All E5 4600 v2/v3 = 8.0% (heavy v2s)

All E7 v2/v3/v4 = 0.04%

All XD = 0.04%

XD is still a development phantom in the open market.

All Phi = less than XD

The complete inventories, price and how to calculate Intel revenue and margin assessment can be found near the end of the comment string here:

http://seekingalpha.com/article/3984656-intel-anticipating-unexpected-ibm-attack

Mike Bruzzone, Camp Marketing