Anyone building any kind of system that employs any kind of chippery – which means any device today excepting maybe an old-school hammer or screwdriver – is suffering from the vicissitudes and capriciousness of semiconductor supplies. And as financial results of public companies in the IT sector are reported each quarter, we get some insight into who is managing the chip shortages and who has the deep partnerships to do so, and who does not.

The good news for Arista Networks, which has been a key supplier of switch and now routing equipment to the hyperscalers and cloud builders for more than a decade, is that the supply chain issues are compelling these key customers to make commitments earlier than they might otherwise and to give more insight into the architecture of their datacenter-scale networks and datacenter interconnect plans so they can ensure that their own network gear suppliers can orchestrate the means to fulfill their needs.

In a conference call with Wall Street analysts going over the financial results for Arista Networks in the third quarter of 2021, Jayshree Ullal, co-founder and chief executive officer of the company, said that before the coronavirus pandemic, these “cloud titans,” as Arista Networks calls them, normally give the company a head’s up three to six months before they want to buy gear. Which ain’t much when you have to manufacture a capital-intensive thing like a switch or a router with hundreds of components. Now the visibility that Arista Networks has with these customers is a year or more, and among the growing pool of enterprise customers, who will comprise a larger and larger share of company revenues going forward and diversify the customer base, the visibility has gone from basically nothing to six months or more. And because of this increased visibility, Arista Networks is able to work with its suppliers and lock in its own contract for parts and manufacturing capacity.

This has meant that Arista Networks has been able to negotiate the pandemic a whole lot better than it did a severe downdraft in its business two years ago when many of the cloud titans decided to skip the 200 Gb/sec generation of switches, preferring to wait for the onset of 400 Gb/sec products, which are ramping now, and to look ahead to 800 Gb/sec generation to come.

Now, annual growth across the company for the first three quarters is 25 percent, and every sector – service providers, cloud titans and enterprise – every product sector – datacenter and cloud switching, campus networks and routing, and network software and services – and every geography are all growing, and all growing at more or less the same clip.

“In some ways, I feel bad that I even have to rank and rate them,” Ullal said on the call. “But if you ask me to highlight some of the growth vectors, I would say obviously cloud titans are back. We had a rough spell if you remember, two years ago. Halloween was not a treat, it was a trick, and it has just come back and it is a volatile sector and it’s positively volatile right now. So while we are enjoying the growth of cloud titans, we are also enjoying many parts of our enterprise market growing. And they really sell verticals there that are doing very, very well, not just the financials, but different parts of the enterprise. I think it’s fair to say Arista has arrived in the enterprise.”

Ullal said that Arista Networks has been growing in the double digits for the past couple of years, and expects to see double digit growth in the enterprise sector going forward. And the routing business, which has been made possible as routing functions have been added to commodity switch ASICs, is not just going to grow at cloud titans, but spread into service providers and enterprises, too. It is not hard to see a path where Arista Networks could be a $3 billion company in 2022 and be kissing $5 billion in 2025.

A lot of things will have to happen between now and then for this to all happen, of course. For instance, Arista Networks may have to bury the hatchet with Cisco Systems and use its Silicon One switch and router merchant silicon and port its Extensible Operating System (EOS) variant of Linux for networking to those Cisco chips. We think such a move is going to be desirable, even if it is not inevitable given the bad blood between these two companies. They will get over it to make money, and a lot depends on how Silicon One chips stack up against Broadcom chips for switching and routing. Based on what we have seen, the answer is pretty damned well. (We are working on a report on the new Silicon One chips, stay tuned.)

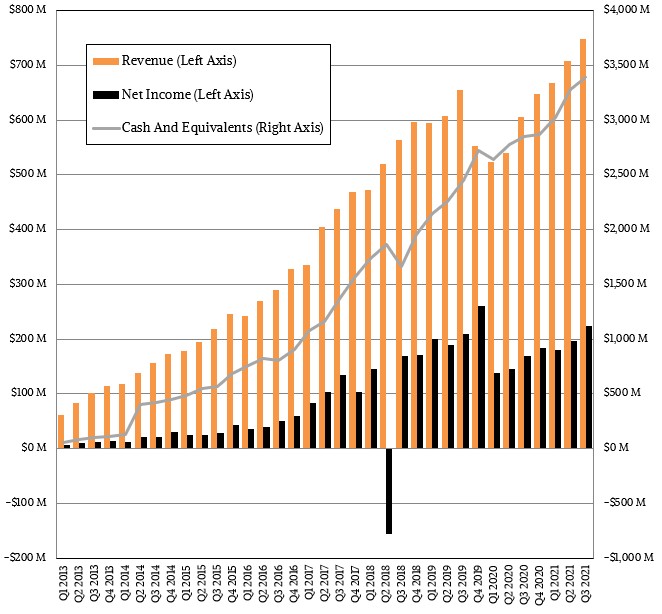

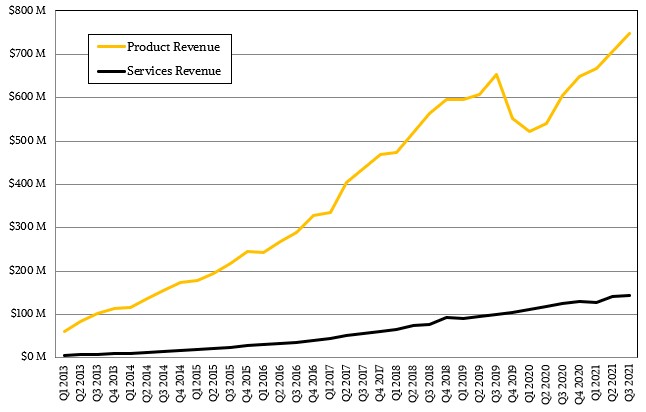

Arista Networks has basically pushed product revenues back where they should be based on historical trends, as you can see below:

In the quarter ended in September, product revenues rose by 25.8 percent to $604.2 million, and services revenues increased by 15.5 percent to $144.5 million. Software subscriptions and services revenues comprised 21.5 percent of total revenues, or $161.1 million, and we don’t have enough data to do a year-on-year comparison as yet, but presumably the software subscriptions side is growing faster than services, which just kind of does along with the number of ports in use in the base. Which is now 50 million ports worldwide, by the way, which is a very big number rivaled only by Cisco itself, which probably has on the order of 2X more switch ports in the datacenter and probably something more like 10X or 20X the number of switch ports in campus networks and something like 5X or 10X more ports in cloud titan and service provider routing. Over the longest of terms, it would not be surprising to see Cisco and Arista Networks reach parity with a third each of datacenter switching and for a third of Arista’s switch ASICs to come from Cisco itself. (The Silicon One business is independent within Cisco and is explicitly allowed to sell chips to competitors like Arista Networks.) Some years later from now, it is possible for Arista to reach parity with Cisco when it comes to datacenter and campus port counts, too.

The first 50 million ports shipped by Arista Networks took a decade. The next 50 million might only take five years, and the 50 million after that might only take two or three. This is the kind of growth path we saw with Compaq and Dell when the X86 server market took off, with lots of smaller X86 machines replacing big beefy RISC/Unix machines and proprietary gear. Routing and core switching seems primed for a similar transformation.

Here is what we know for sure. No one else looks like a contender except for Arista Networks, unless you want to count whitebox vendors as a group. For those who are buying a switch and routing platform as well as a commercial grade network operating system, Cisco and Arista Networks are the two obvious choices, and while Juniper Networks, Huawei Technologies, Hewlett Packard Enterprise, and Dell all have their customers and geographies, this will become a three horse race as time goes by. The ODMs will be the third horse, as much as they are in the server market where HPE and Dell dominate and Lenovo and Inspur are jockeying for the fourth position.

Arista Networks posted $224.3 million in net income in the quarter, up 33.2 percent, and ended with $3.39 billion in cash. This cash pile, which started building in earnest after it settled its lawsuits with Cisco two years ago, was one of the reasons why the board at Arista Networks authorized the repurchasing $1 billion of its own shares, which we presume are used mostly for compensating key employees as is the custom in the IT sector. So far Arista has repurchased 3.9 million of its own shares for $897 million, and this month, Arista’s authorized board authorized the repurchasing of another $1 billion of its own stock.

Because Arista Networks is a switch and router maker that uses different ASICs for its devices, it can’t improve its business by buying a chip designer and maker. And there are not very many left anyway, with Barefoot Networks going to Intel and Innovium going to Marvell. Xsight Labs is interesting, of course, from what we can tell as it operates in stealth mode, but Arista is a whole lot better off having multiple ASIC suppliers in this world of coronavirus supply chain hell than trying to run its own chips through someone else’s over-busy fab. Arista can’t really spend a lot of dough on networking software, either. The Big Switch Networks acquisition made sense, but it already has telemetry and AI stuff in its new NetDL software stack announced this week. (We will circle back and see what this is all about.)

Giving the employees more stock options makes sense, given all this. And frankly, this is the first time we have ever thought it was a good idea. Building out an enterprise sales team and enterprise channel is probably a good place to spend a lot of dough, but that may or may not be fruitful. Being known as the vendor chasing Cisco’s heels in routing and running alongside it in switching is the best marketing that Arista Networks can do.

Riding up the 400 Gb/sec Ethernet wave in the cloud titans is the other thing it can do. A year ago, there were about 75 customers looking at 400 Gb/sec networks, and as June ended, it grew to 150 customers, and now at the end of September, it has doubled again to around 300 customers. No one wants to talk about the 200 Gb/sec generation. So we will just move along now. . . .

Be the first to comment