It is tough to get excited about mature markets that grow at a steady rate unless it happens to be the most profitable part of the market. And when it comes to the global IT market, the portion of it that is consumed by enterprises – meaning everything smaller than a hyperscaler and large cloud builder or outside of an HPC center or telco/service provider and in this case including government agencies and educational institutions – is by far the most profitable.

It is also one that is notoriously proactive to economic downturns and cautious about economic rebounds, reflecting the conservative nature of the top 20,000 companies worldwide and the many millions of other companies that either supply them or attempt to compete against them.

It is with this in mind that we consider IT supplier Dell, which among the big original equipment manufacturers is among the few that still sells datacenter gear and client gear alike. (Lenovo does as well, but Hewlett Packard Enterprise, Inspur, Cisco Systems, and others do not.)

As part of its financial results for its third quarter of fiscal 2023 ended in October, the top brass at Dell characterized the total addressable market that Dell is chasing, and then even offered a forecast for the datacenter TAM out through 2025. This data was, to be frank, among the more interesting things that Dell talked about because we don’t often get such a view from the major IT suppliers. How Dell is managing its datacenter business during these weird times of jittery economics and fragile supply chains, and what Dell’s infrastructure customers are spending on, is also interesting and perhaps a good indicator of how the enterprise is behaving given all of the uncertainties.

The thing to always remember is that IT organizations have to spend. Budgets never go to zero and things still need to get done, even if no one is in a mood to be extravagant. Dell certainly was not in the October quarter.

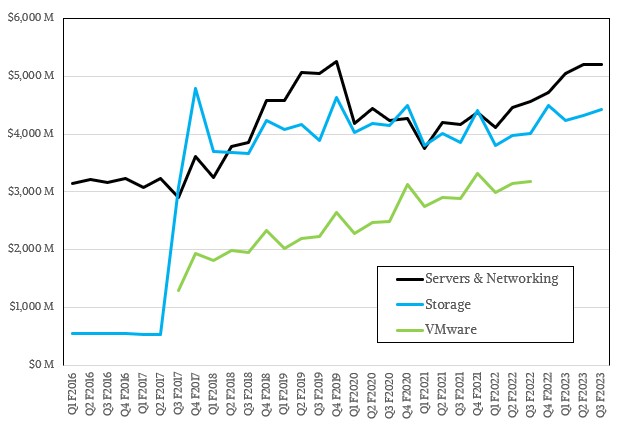

Chuck Witten, who is co-chief operating officer with Jeff Clarke at the company, said on a conference call with Wall Street analysts going over the numbers that Dell did indeed see slowing infrastructure demand, but added a caveat that storage sales “did hold up pretty well relative to servers, with growth in multiple storage types, including high-end and PowerStore.”

Witten added that with its direct sales model, Dell has immediate feedback from IT customers across geographies and industry sectors and can see the demand environment shift faster than the rest of the industry, and given this, Dell tightened the purse strings and cut operating costs by 3 percent sequentially in fiscal Q2 and by another 6 percent sequentially in fiscal Q3, trimming out $300 million in costs and contributing to the profitability of its Infrastructure Services Group and its Client Services Group. Dell was also, said Witten, able to capitalize on dropping component costs faster than its peers and therefore boost its profitability. This presumes that Dell did not pass cost savings onto customers, and given the backlogs for server, storage, and networking products, we believe Dell did not have to pass on those component cost savings as price reductions. Witten also said that Dell was able to reduce its server backlog, which has been growing throughout the pandemic because of component supply issues. When it is all said and done, Dell expects to increase its market share (based on the data that will come out of IDC next month) in both servers and storage.

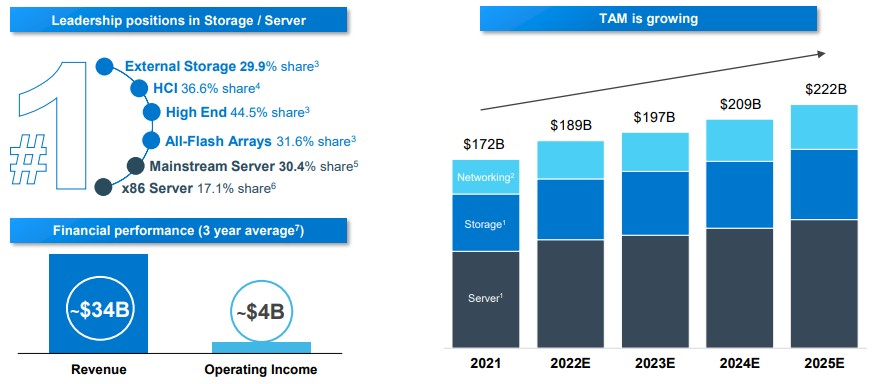

And that is the patient game that Dell has played to become the most dominant OEM on the planet, far surpassing HPE, Inspur, and Lenovo and well ahead of Cisco Systems and an enlittled Big Blue since it spun off its System x X86 server business back in 2014. Dell just keeps winning new customers and new business, using its volume component purchasing power across the client and server supply chains to wring whatever meager profits it can from the IT sector.

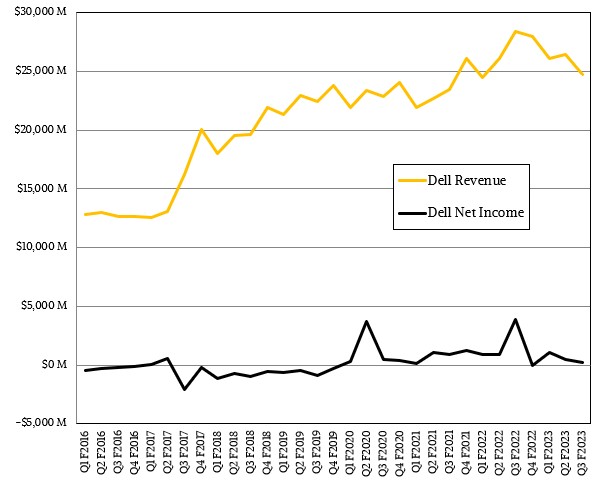

It ain’t much in terms of profits for Dell, particularly a year after VMware was spun off:

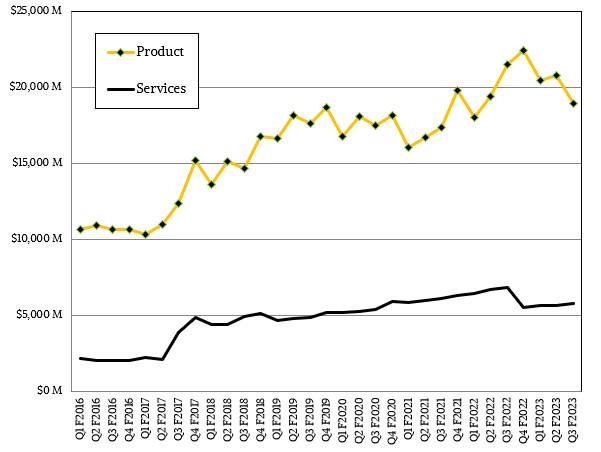

In the third quarter, Dell’s overall product sales were down 12.1 percent to $18.94 billion and its services sales were down 15.6 percent to $5.78 billion. Overall revenues fell by 12.9 percent to $24.72 billion, and its net income was slashed by a stunning 93.6 percent to $245 million, but that was against a very tough compare as some profits on the spinout of VMware were booked in the year ago period. Since then, Dell’s profits have been sinking faster than its revenues, and you can blame a lot of that on PCs, not servers, storage, and switching.

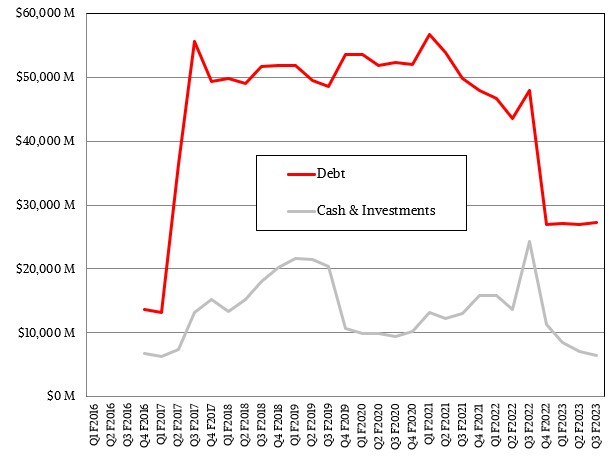

Dell has reduced its debt load by spinning off VMware – it is down by 43 percent to $27.33 billion – but the sharp tightening of PC market and the slowing in the datacenter infrastructure market has caused Dell to burn some cash, which is down 73.4 percent year on year to $6.44 billion.

Because of improving component supplies and dropping component prices, Dell’s Infrastructure Services Group – which makes and sells servers, storage, and switching – had sales of $9.63 billion, up a very nice 12.4 percent, and posted an operating income of $1.37 billion, which is 14.3 percent of revenue and which was up a very good 53.7 percent.

Within ISG, sales of servers and networking hardware rose by 14 percent to $5.2 billion and sales of storage rose by 10.6 percent to $4.43 billion. In general, Witten said that Q3 was about the same as Q2 in terms of customer sentiment and attitudes. The sales slump in China was more pronounced than planned, but spending by the energy sector, the US federal government, and by mid-sized businesses in general were higher than the overall spending across all of Dell’s customers.

“The customer feedback is very similar to what we described in Q2, very cautious and deliberate behavior in the face of what is a lot of macroeconomic dynamics out there,” Witten explained. “So, we are hearing reassessment of budgets, reprioritization of spending, and customers buying effectively for just their immediate needs.”

And thus, new server demand was lower than expected, Dell fulfilled a bunch of its backlog, and now says that the server backlog is now at what it calls normal levels. And with a more predictable supply chain, that has secondary effects that increase profitability because freight can be bundled and shipped at volume and there is a much lower rate of expedited shipping, both of which help the profitability of the infrastructure group. As Clarke put it, “as supply is ahead of demand, we are able to put things on the ocean and we don’t have to expedite as much” with air freight.

Where there are constraints, it is in server power supplies, power integrated circuits, and high performance network cards, according to Clarke. For storage, custom ASICs and FPGAs are constrained. But the PC part of the Dell factory is on standard lead time – a demand crash will do that! – and the server part of the factory is mostly on standard lead time – as a softening in server sales will do.

Looking ahead, Dell is projecting that ISG sales will be flat sequentially – which means it will be up about 4.5 percent year on year – and that CSG sales will be down in the mid-20s percent year over year, which works out to about a 5.5 percent decline sequentially. Given the current economy and the fact that people don’t want to spend on PCs because they just did in droves during the pandemic, this is about as good as the world’s largest OEM can expect.

Surfing On The Rising TAM

Since fiscal 2020, Dell has grown its PowerEdge and APEX server business by a 3 percent compound annual growth rate, and in the past five years, it has gained 5.3 points of revenue market share in the mainstream server segment, according to IDC data cited by Witten.

Looking ahead, Dell thinks it can do 3 percent to 4 percent compound annual growth (presumably out to fiscal 2025), which while less than the 8 percent CAGR it had between fiscal 2020 and fiscal 2023 is still growing at the rate of the IT market growth in general in the sectors where Dell plays.

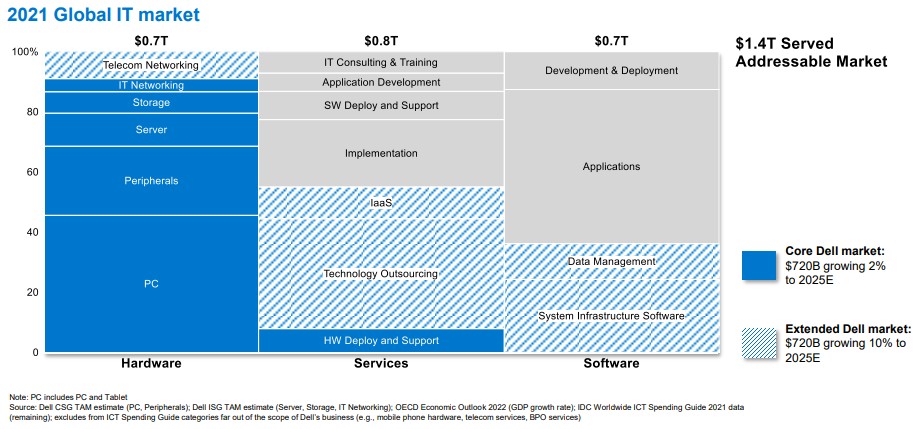

Here is the total addressable market that Dell chased in calendar 2021, broken by segments:

There was a $720 billion TAM for 2021 in the core PC and datacenter hardware businesses that Dell is after, which Dell expects to grow at a 2 percent CAGR out between 2021 and 2025. There is another $720 billion TAM in adjacent markets where it is starting to play, such as in infrastructure as a service (APEX utility priced machinery), technology outsourcing, data management, and system infrastructure software.

Yeah, we know what you are thinking: Didn’t Dell sell all of that stuff off? With this second $720 billion TAM having a 10 percent CAGR, Dell can’t afford to not chase it. It remains to be seen how it will do this, and how well it will do this.

With about $38 billion in sales for ISG in calendar 2022, Dell should get about a 20 percent share of the $189 billion server, storage, and switching TAM in the datacenter in 2022. If it just maintains share going out to 2025, it will have a $44.5 billion ISG business. That would be a 5.4 percent CAGR for ISG between 2022 and 2025 (calendar years). And if it can grow its share by 1 point per year – as it has done – that would be a $51.2 billion ISG business with a 10.4 percent CAGR over that same time.

Those, we think, are the brackets Dell’s ISG will fall between. But that is just numbers. It will take a lot of work to make that happen, and a recession – a real and prolonged recession, not just the defibrulator shock we are getting from the Fed – will toss that model into the garbage.

Be the first to comment