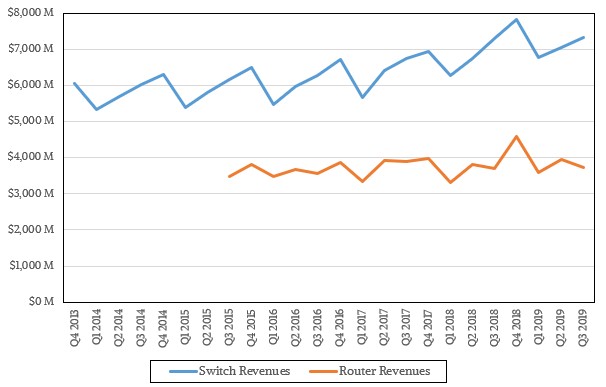

With the dividing line between switching and routing blurring among the hyperscalers and cloud builders, it is no wonder to us that switching is growing as Ethernet switch ASICs get more and more routing functions and true Ethernet routing has remained more or less flat in the past five years.

That’s the overall picture that we see emerging from the statistics released by market researcher IDC, which does a quarterly ranking of switching and routing, including a detailed breakdown of switching by bandwidth type and vendor that is extremely useful in analyzing trends.

In the third quarter, the data from IDC certainly gives the impression that switching is growing and routing has been more or less flat since data was released publicly on it starting in 2015. Take a look at the data:

In the period ended in September, sales of all bandwidths of Layer 2 and Layer 3 Ethernet switching devices, including fixed port and modular machinery, rose by a mere one-tenth of one percent to $7.32 billion year on year, but continued on what looks like that regular sawtooth pattern. Enterprise and service provider routing, which is done at Layer 3 and higher in the network, had eight-tenths of one percent revenue growth, year on year, to $3.74 billion. Neither is the kind of growth that gets people excited, but it is a lot better than the declines in revenues and shipments we have seen for servers in the same period. So there is that.

The good news is that behind these tepid revenue trends, we see that the shift to 100 Gb/sec Ethernet switching is well under way – and we think part of the reason is that high-end Ethernet ASICs include routing functions that obviate the need for routers in many cases at hyperscalers, cloud builders, and other service providers. It is hard to say how much of the Ethernet switching revenue is attributable to routing functions, but what we can tell you is that it is growing. (See The Switch-Router War Is Over, And The Hyperscalers Won for more on that.)

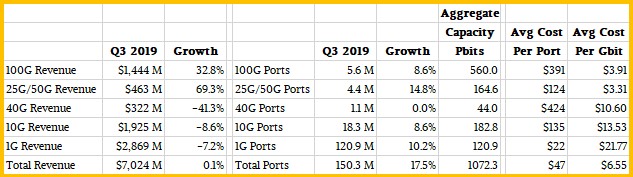

That 100 Gb/sec ramp has been a long, long time coming, and it has taken years to being the cost of the switches and the optics for transceivers for long-range cables down enough for the insatiable appetite for bandwidth to be released. In the quarter, the overall Ethernet switching market might have been flat, but the port count for 100 Gb/sec devices rose by 57.2 percent to 5.6 million ports and the revenues that these switches generated rose by 32.8 percent to $1.44 billion, comprising nearly a fifth of aggregate Ethernet switching revenues. Sales of switches that support 25 Gb/sec and 50 Gb/sec speeds were up 69.3 percent to $463.4 million and port counts here grew by 68 percent to 4.4 million ports. Sales of 40 Gb/sec devices are on the wane, finally, and 10 Gb/sec Ethernet switches had an 8.7 percent decline to $1.93 billion, but port counts here rose – thanks in large part to enterprise datacenters – by 8.7 percent to 18.3 million ports, and thus the average port cost a bit less sequentially and about 15 percent year on year.

Here is the breakdown of the third quarter Ethernet switch sales by bandwidth and by the aggregate Pb/sec of capacity sold by each bandwidth band:

If you do all of this math on the IDC data, as we have done, then you can reckon the average cost per Gb/sec of peak bandwidth that each port delivers by those bands, which shows some interesting things. For one thing, and this is no surprise, the cost per bit for 100 Gb/sec and 25/50 Gb/sec devices is much, much lower than the cost per bit of slower devices. Once again, the modest needs of the enterprise are subsidizing the tremendous needs of the hyperscalers, cloud builders, service providers, and HPC centers that employ Ethernet technology. The 1 Gb/sec Ethernet market is largely small and medium business and campus stuff, and is not particularly interesting in the datacenter – and it is nearly 5X more expensive per bit that 100 Gb/sec devices. That said, you can get a 1 Gb/sec port for the cost of a lunch for four at McDonalds, but a 100 Gb/sec port costs as much as a monthly payment on a muscle car or heavy duty truck.

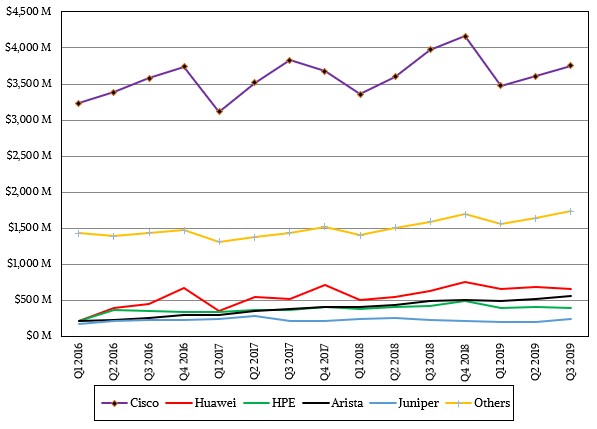

In terms of vendor market share, companies are pretty loyal to their one and sometimes two switch vendors, and this market changes very fast. It has taken a decade for Arista Networks and Huawei Technology to usurp Juniper Networks as the number two revenue maker after Cisco Systems, and Cisco has been diminished somewhat in recent quarters but is still overwhelming dominant because of the inertia of buying patters among service providers and enterprises. Hewlett Packard Enterprise and Arista have basically switched positions in the market. IDC did not make vendor breakdowns available until recently, so we cannot see the slide of Juniper and the rise of Huawei and Arista as we would like.

There are still many other and much smaller suppliers than the top five, and their revenues are growing, on average, testifying somewhat to the diversity of the Ethernet switch market. We suspect that the ODMs have a fair portion of that Others category, but we don’t know how much.

All of this data just goes to show that the only thing stickier than a switch in the datacenter is a database.

Be the first to comment