There is no question that Taiwan Semiconductor Manufacturing Co is one of the best bellwethers of the IT industry. But it is important to not take it too far.

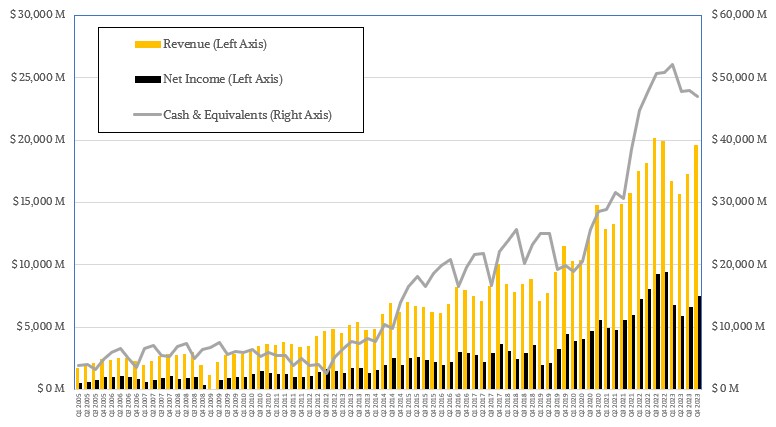

Everybody likes good news, especially at the beginning of the corporate year, and we are happy to report that TSMC’s revenues in the fourth quarter ended in December 2023 were only down 1.5 percent year on year to $19.62 billion, and were up 13.6 sequentially from the third quarter. That last bit is the good bit, and it shows that there is a recovery underway in PCs and smartphones and we can start hoping one might come to general purpose servers and their CPUs as 2024 rolls along. We have no doubt that sales of GPU-based AI servers are going to break records this year, and that will help cushion the blow a bit for the OEMs and ODMs who have been hurt in 2023 by the server recession outside of AI machinery.

Thanks to the costs of ramping its 3N process, which etches in 3 nanometers as the name suggests, as well as the high costs of building fabs outside of Taiwan, TSMC saw a 20.7 percent decline in net income in the final quarter of 2023, to $7.48 billion. That was less of a decline than it saw in net income for Q2 and Q3 of last year, so that is progress.

That said, TSMC outperformed its peers in the foundry business, and the company is cautiously optimistic about this year.

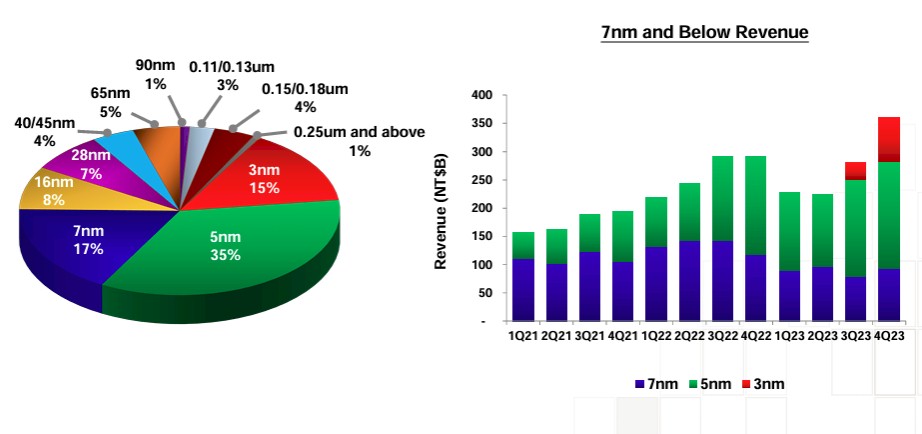

“Entering 2024, we forecast fabless semiconductor inventory to have returned to a healthier level exiting 2023,” CC Wei, TSMC’s chief executive officer, explained on a call with Wall Street analysts going over the Q4 numbers. “However, macroeconomic weakness and geopolitical uncertainties persist, potentially further weighing on consumer sentiment and the market demand. Having said that, our business has bottomed out on a year-over-year basis, and we expect 2024 to be a healthy growth year for TSMC, supported by continued strong ramp of our industry leading 3 nanometer technologies, strong demand for the 5 nanometer technologies and robust AI-related demand. Coming off the steep inventory correction and low base of 2023, for the full year of 2024, we forecast the overall semiconductor market excluding memory to increase by more than 10 percent year-over-year, while foundry industry growth is forecast to be approximately 20 percent. For TSMC, supported by our technology leadership and broader customer base, we are confident to outperform the foundry industry growth. We expect our business to grow quarter-over-quarter throughout 2024, and our full year revenue is expected to increase by low to mid-20 percent in US dollar terms.”

But don’t pop the champagne at the fab equipment manufacturers quite yet.

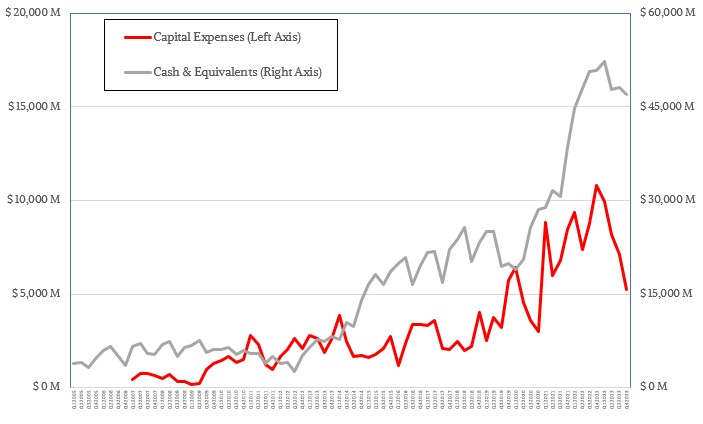

With a secular decline in the PC market and what appears to be a temporary decline in the smartphone market, it was no surprise that TSMC would tap the brakes a bit in 2023 when it came to capital expenses, and indeed it did. This time last year, TSMC cut its capital expense budget down to $32 billion, and even with increasing costs for its fab in Arizona, it managed to chop it all the way down to $30.4 billion last year. With both PC and smartphone sales on the mend a bit, but still not booming as they were during the coronavirus pandemic, TSMC is playing it conservative and expects for capex to be somewhere between $28 billion and $32 billion in 2024. Somewhere between 70 percent and 80 percent of that money will be spent on equipment for advanced processes (7 nanometer and below at this point in the Moore’s Law process curve), with somewhere between 10 percent and 20 percent being spent on “specialty technologies” and 10 percent on advanced packaging, mask making, and testing equipment.

TSMC capex spending is definitely a leading indicator for the IT industry at this point, and chief financial officer Wendell Huang explained why. But the coupling between what is happening at TSMC and what is happening across the broad swatch of the IT industry is not as tight as you might think.

“At TSMC, a higher level of capital expenditures is always correlated with higher growth opportunities in the following years,” Huang said. “In the past few years, we have sharply increased our capex spending in preparation to capture or harvest the growth opportunities from HPC, AI and 5G megatrends. Despite a challenging 2023, our revenue remains well on track to grow between 15 percent and 20 percent CAGR over the next several years in US dollar terms, which is the target we communicated back in our January 2022 Investor Conference. With our 2024 CapEx guidance of US $28 billion to US $32 billion, the rate of increase of our capital spending has begun to level off as we capture and harvest the growth. The objectives of TSMC’s capital management are to fund the company’s growth organically, generate good profitability, preserve financial flexibility and distribute a sustainable and steadily increasing cash dividend to shareholders.”

Such an increase in the dividend was just authorized by the board, which is a kind of profit taking. But you will note that TSMC is not seeing such a demand for chips that it thinks it needs to spend $35 billion or even $40 billion on capex this year or into the future.

The point is this: That TSMC’s capex is going to be relatively flat doesn’t mean the chip business will not get back to booming. It is that it has the right balance of chip manufacturing and packaging capacity to meet the current boom, especially when it does things like make 3 nanometer chips with rejiggered 5 nanometer equipment, as it is doing.

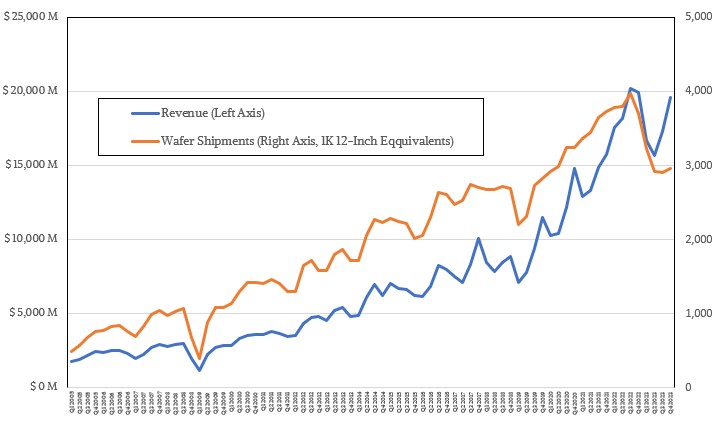

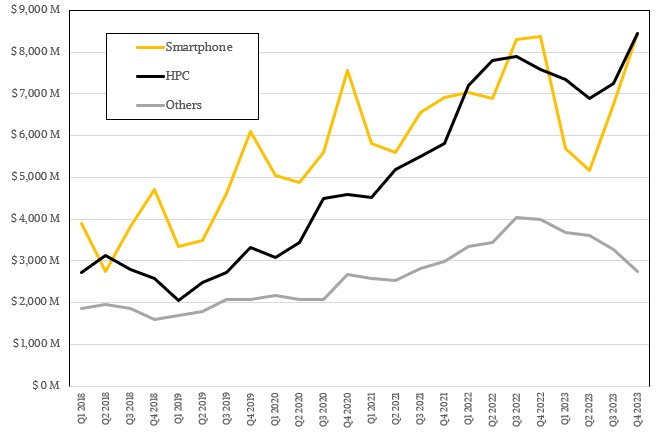

The interesting thing to watch over the long term is how much money TSMC extracts from a wafer each quarter. Back in 2005, when the company was still young, it brought in somewhere around $3,000 per wafer. (This data is normalized to 12-inch wafer equivalents.) Starting in late 2018, that revenue per wafer started creeping up and within a few short years has approached $6,000 per wafer. In the most recent quarter, the company etched 2.957 million 12-inch wafer equivalents and the average revenue per wafer was $6,636. As more complex and more valuable CPUs, GPUs, NNPs, DPUs, and switch ASICs come out of the TSMC foundries, that number can only rise in the years ahead.

Some of that is die to advanced processes and packaging, which cost more than prior technologies and which are absolutely necessary to advance the state of the art in compute and networking (and therefore storage).

It is important to realize that as each node gets more expensive, there will be tremendous pressure on TSMC’s profits and on that nearly $47 billion cash pile it has accumulated.

But for now, let’s enjoy the moment. In the December quarter, the smartphone business that drove 43 percent of TSMC’s revenues was up 25.2 percent sequentially to $8.44 billion, and the so-called HPC business – which is high end compute and switching devices used in client devices and datacenter infrastructure – was up 16.3 percent sequentially to that same $8.44 billion.

This is a good sign for the semiconductor industry, which has had a tough 2023. Excepting Nvidia and AMD, of course.

We look forward to seeing how the Thundering Thirteen do as they roll out their financial results for the last quarter of 2023.

Be the first to comment